Payroll Questions: 14 Common Payroll FAQs answered

Have you been affected by the latest payroll update? We answer common payroll questions by businesses surrounding STP, minimum wage, and payroll compliance.

There’s been a lot happening in the world of payroll lately. The ATO introduced Single Touch Payroll (STP), the national minimum wage increased by 3.5 percent and Fair Work has very publicly audited businesses of all sizes and caught out many for underpaying staff and misinterpreting awards.

As a result, we’ve had a lot of payroll questions come our way.

The interest in this topic inspired us to answer frequently asked questions about 2018’s payroll changes.

Single Touch Payroll FAQ

1. What is Single Touch Payroll (STP)?

On July 1, 2018, the Australian government enacted Single Touch Payroll legislation. STP requires employers to submit payroll and superannuation data to the ATO each time they run payroll.

These new changes allow the ATO to have greater visibility into a business, allowing them to ensure compliance with tax laws and regulations.

It also provides a means of streamlining the end-of-financial year process. Thanks to STP, employers will not have to produce payment summaries or conduct other admin tasks related to the EOFY process.

For more information, we strongly recommend that employers refer to the ATO website. There’s lots of good clear information where employers can be further educated on STP.

Click here to learn more about how to make sure your business is Single Touch Payroll ready.

2. Two months into STP, what actions should businesses be taking?

It’s all about educating yourself and taking action. If businesses haven’t already, they need to sit up and pay attention and educate themselves on STP. If a business isn’t already lodging STP data, they should at least be preparing to do so.

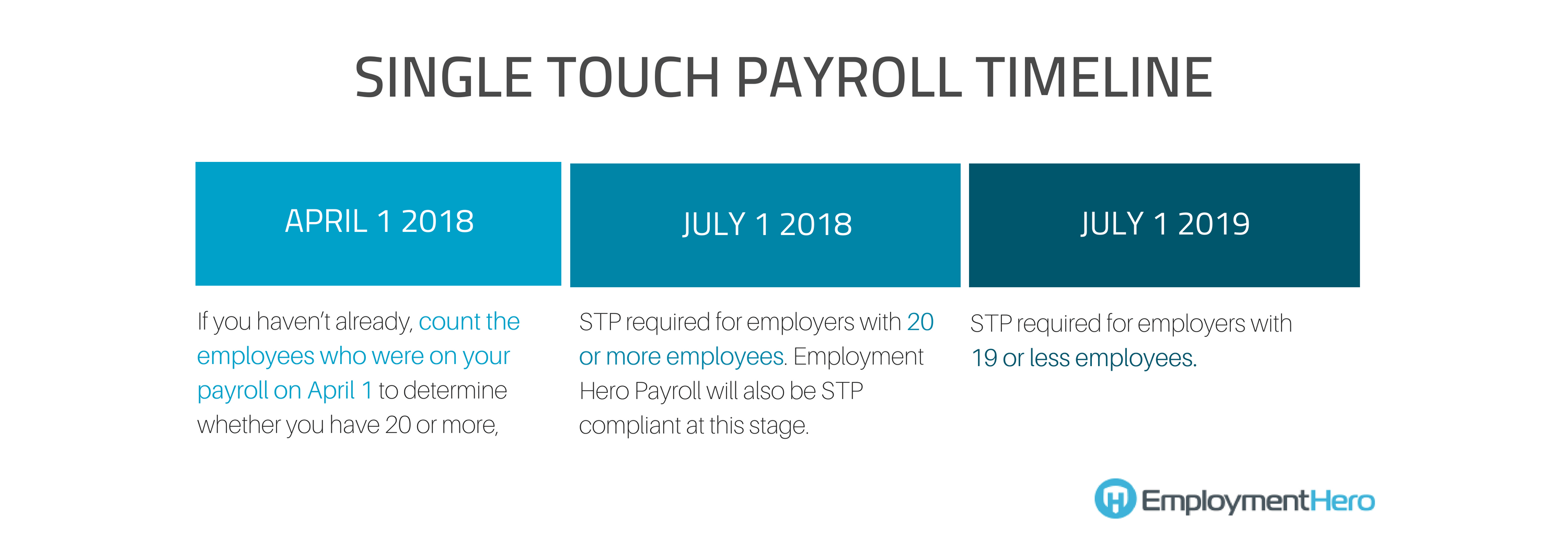

Currently, businesses with 20 or more employees on 1 April 2018 are required to report under STP from 1 July 2018. By the next financial year (1 July 2019), STP should become a requirement for businesses with 19 employees or less.

This is subject to legislation being passed in parliament, but essentially everyone is going to have to fall into line with the ATO reporting requirements regardless of the size of their business.

Here is a rough STP timeline.

3. How do I prepare to report STP data?

Employment Hero’s payroll software, Hero Pay, is already set up to report STP data.

If you use Hero Pay, you are likely already reporting STP data to the ATO.

If you aren’t using Hero Pay or another payroll software you know is already configured to report STP data, there are a few steps you can take to prepare.

The first thing to do is to review your current payroll process and setup.

Is the software package you are using STP compliant? Ask your payroll software provider and find out!

A good payroll software will help achieve the intended outcomes of STP and will also ensure an employer is meeting their reporting obligations

If you are reading this right now and are not STP compliant, get in touch with our team, and we can help you out.

It’s also worth noting the ATO is granting deferrals to employers whose payroll software is not ready to lodge STP and those who need more time to implement the right software.

4. Will STP make it harder to run payroll?

Absolutely not. The ATO, in conjunction with payroll software providers, has designed the STP lodgement process to be as simple and seamless as possible.

In short, your payroll software should be doing all the heavy lifting for you. Not much has changed in the actual payroll process, only the reporting requirements have changed.

Payroll is a very task-heavy process. There are a lot of checks and balances, and often payroll officers need to be across a range of things associated with running their payroll.

The ATO is aware of this and that’s why, along with payroll software providers, they have designed STP lodgement to be quick and simple.

5. How can I be sure that my outsourced payroll provider is STP compliant?

This is a matter of engaging with your payroll provider and asking the right questions. Ideally, you have a great relationship with constant and open communication from both sides.

Most outsourced payroll providers will have already moved across to STP-compliant systems or will be in the process of doing so. That being said, this really comes down to an employer owning their payroll process and ensuring they are safe from any liability.

This means having strong knowledge of your outsourced payroll providers processes and systems.

If you don’t feel like you have that assurance from your outsourced payroll provider, don’t hesitate to ask!

They will be happy to answer any queries you may have.

6. If I’m a small business at the moment but I expect to be have more than 20 staff before July 2019, what should I change now to ensure I am STP compliant?

Get ready by implementing a software package that is STP compliant!

Get your ear to the ground so that you can be fully prepared when it’s go time. In fact, we would do one better and begin reporting STP data from now.

While it is still subject to legislation being passed in parliament, smaller employers with 19 employees or less can voluntarily opt into STP before 1 July 2019.

There’s a huge advantage of starting STP reporting early as it gives you time to become completely familiar with your payroll software’s STP lodgement process before you are obligated to begin reporting data.

Save yourself the anguish and don’t leave it to the last minute!

2018 Minimum Wage Increase FAQ

7. What is the minimum wage increase all about?

The Fair Work Commission (FWC) handed down a decision to increase minimum wages by 3.5%, effective from July 1, 2018. It’s been the largest increase prescribed by the FWC (click here to read our guide to HR acronyms).

There have been a lot of considerations taken into the wage increase, but essentially what it means is that employees who are paid under a Modern Award are to have their rate of pay increased by 3.5% This has been done to provide a fair and relevant minimum wage.

A wage that addresses the needs of lower-paid workers and properly remunerates employees working overtime, on public holidays or on weekends.

Employers have a huge responsibility to pay their employees in accordance to the new minimum wage otherwise they are at risk of underpaying their employees.

Decisions around minimum wage increases are usually made by mid-June, sometimes by the end of May.

There is a lot of pressure on small to medium businesses during this time given increases happen right in the midst of end-of-financial year activities.

Therefore there is a high risk of employers neglecting to pay enough attention to wage increases.

It’s really important employers stay up to date and make any amendments required of them. In this case, two months into the new financial year, employers should have already adjusted their pay to reflect the new minimum wage.

8. What awards were affected by the minimum wage increase?

The minimum wage increase applies to all awards. Any employee that is paid under a modern award is to have their rate of pay increased by 3.5%. This also applies to juniors, apprentices and trainees.

The FWC estimates that the number of employees in Australia that have their rate of pay set by a modern award is around 20%. That amounts to a lot of Australian employers having to manage award updates.

For more detailed guidance, you can navigate the complexities of payroll legislation in Australia with our free guide for accountants, bookkeepers, and outsourced payroll providers.

9. Does the minimum wage increase apply to hourly rates only? Or does it also affect things like penalty rates?

Penalty rates will be affected by the award increase. It should be noted that penalty rates for the retail, fast food, hospitality and pharmacy sectors have been subjected to other changes from July 1, 2018.

There is a lot of change and moving parts in the world of payroll which makes it very difficult for employers to keep on top of everything and remain compliant.

10. I am not using automated payroll software. How should I update my payroll?

If you are using our payroll software, you won’t have to update anything. Our platform will have made amendments based on the minimum wage increase from July 1, 2018.

For those who don’t use automated payroll software, you will need to review your current payroll and the specific award you are paying employees under. Compare the pay rates as they are made available by the FWC and then implement those changes into your payroll system.

You will also need to update things like allowances, annual leave and personal leave rates or any pay rates that use the base rate of pay in a modern award for calculation.

This task becomes more and more complex the more employees an organisation manages. This is why we’d like to reiterate the importance of an automated payroll system whereby the pay rates are updated automatically, making these admin tasks much simpler.

Give yourself the peace of mind that you are compliant and paying your employees correctly.

If you are experiencing challenges with your current payroll software, it might be time to consider a change. Explore our guide on five simple steps to changing payroll software.

Payroll compliance FAQ

11. The media has reported quite a few Fair Work crackdowns recently. What’s been happening?

In recent months there have been a lot of big brands exposed for underpaying their employees. From Lush Cosmetics to Supercheap Auto to popular restaurant groups like Rockpool Dining Group. Groups like these have dedicated HR and payroll staff at their disposal, and even with the resources available to them, they have still ended up in the red.

We don’t believe these businesses intended to get their payroll wrong. Mistakes easily occur because of the complexity of payroll and modern award interpretation in Australia.

Failure to comply with the modern award rates can result in severe penalties of up to $630,000 per offence for a business and $126,000 per offence for an individual. Claims for underpayment can be made retrospectively for up to 6 years.

Ignorance is not an acceptable excuse in these situations.

12. How can employers ensure they are compliant?

With the increased media coverage about compliance mishandling, added attention and pressure have been placed on employers who are rushing to ensure they are compliant with current employment standards.

Running a small to medium business is tough, there are so many bits and pieces of legislation to deal with (i.e. the Fair Work Act, Modern Awards, Workplace Health and Safety, industry-specific legislation and more!). Employers are up their armpits with tasks related to running their business.

With so much going on it’s easy to see how things can get overlooked particularly if you don’t have a dedicated HR or payroll function.

From an employee management and payroll perspective, it’s imperative that you invest in a tool that will streamline and automate the tasks surrounding employee onboarding, day-to-day record keeping, accurate award and wage interpretation and payroll processing.

Something like this will not only add value to your business but ensure you are achieving compliance and will not have the Fair Work Ombudsman knocking on your door.

13. What immediate steps can employers take to make sure they’re compliant?

Employers need to make sure they are educated and remain up to date with changes in compliance. Review your employee management tools and your payroll software.

If you are using paper-based systems, I’d seriously begin to consider different management solutions like HRIS (such as Employment Hero).

Ask yourself, how you are capturing employee data when onboarding? How are processes like leave requests or terminations are being actioned? How does my business keep up to date with modern awards and compliance?

We recommend that small to medium employers take the time to engage with experts on these matters. Reach out to people in know, people who specialise in providing these systems and processes, there is a wealth of information out there.

The FWC and ATO website are great places to start!

Costs may be involved during this process, but ultimately it would be much more costly in the long run if you were to be found to be in breach of any legislation surrounding employment.

Not only would there be a financial penalty, but the negative attention it would bring could really hurt your business in the long run.

14. When it comes to remaining compliant, what are the advantages of using an employee management tool and automated payroll solution?

An employee management tool or HRIS will help capture the right information from the employee onboarding phase.

They provide full transparency to all your information, create audit trails and system-generated reports, all things that help you ensure you are compliant, and assist in auditing your own processes.

When it comes to payroll, a good automated payroll solution will update legislative, and award changes as soon as they occur. Requiring a simple click of a button for employers to install and enact changes.

Choose a payroll software you know will stay on top of modern awards and changes, so you can have peace of mind.

Ultimately, HRIS and automated payroll software help streamline your admin tasks and achieve compliance with inbuilt processes.

Another huge benefit is that there’s a team of professionals who work on the other end of the software, constantly innovating and ensuring it’s up to date and fit for purpose.

Want to learn more about payroll? Check out our other articles below:

- Why small businesses should start bookkeeping

- When a business should hire accountants

- Payroll tax for interstate employees in Australia

- How to pay staff correctly

- What is fringe benefits tax

Employment Hero is the easiest way for small to medium businesses to manage HR, payroll and employee engagement and benefits in Australia. Request a demo today.

Related Resources

-

Read more: The ‘work-life balance’ trap: Why promising it is hurting your SME recruitment (and what to promise instead)

Read more: The ‘work-life balance’ trap: Why promising it is hurting your SME recruitment (and what to promise instead)The ‘work-life balance’ trap: Why promising it is hurting your SME recruitment (and what to promise instead)

For growing SMEs, work-life integration is a sustainable way to support your team and attract top talent. Explore how your…

-

Read more: Job ad guide: How to attract top candidates

Read more: Job ad guide: How to attract top candidatesJob ad guide: How to attract top candidates

Looking to hire your perfect match? The way you pitch your open role can be the difference between landing or…

-

Read more: Employment Hero and CommBank to provide businesses with discounted HR, payroll and benefits support following EOFY

Read more: Employment Hero and CommBank to provide businesses with discounted HR, payroll and benefits support following EOFYEmployment Hero and CommBank to provide businesses with discounted HR, payroll and benefits support following EOFY

Eligible CommBank Yello for Business customers will get the first 3 months free on any Employment Operating System subscription with…