Automated payroll system.

Leave payroll tasks in the background and free yourself from manual admin. Smarter payroll from start to finish.

Save time on payroll processing

Save up to 90% of time spent on payroll admin. Automate payroll processing tasks such as payroll reports and timesheets, downloading and applying tax codes, super deductions, applying leave calculations and more.

Stay in control

Implement payroll automation and free yourself from day-to-day manual admin while still allowing complete control of the pay run. You determine what components of the pay run to automate and process manually.

Quality assurance

Ensure employee wages are always accurate. Our payroll automation software utilises built-in warnings that users can pre-select to pause the payroll automation process if an action is required prior to finalising the pay run.

Payroll processing is now fully automated. From start to finish.

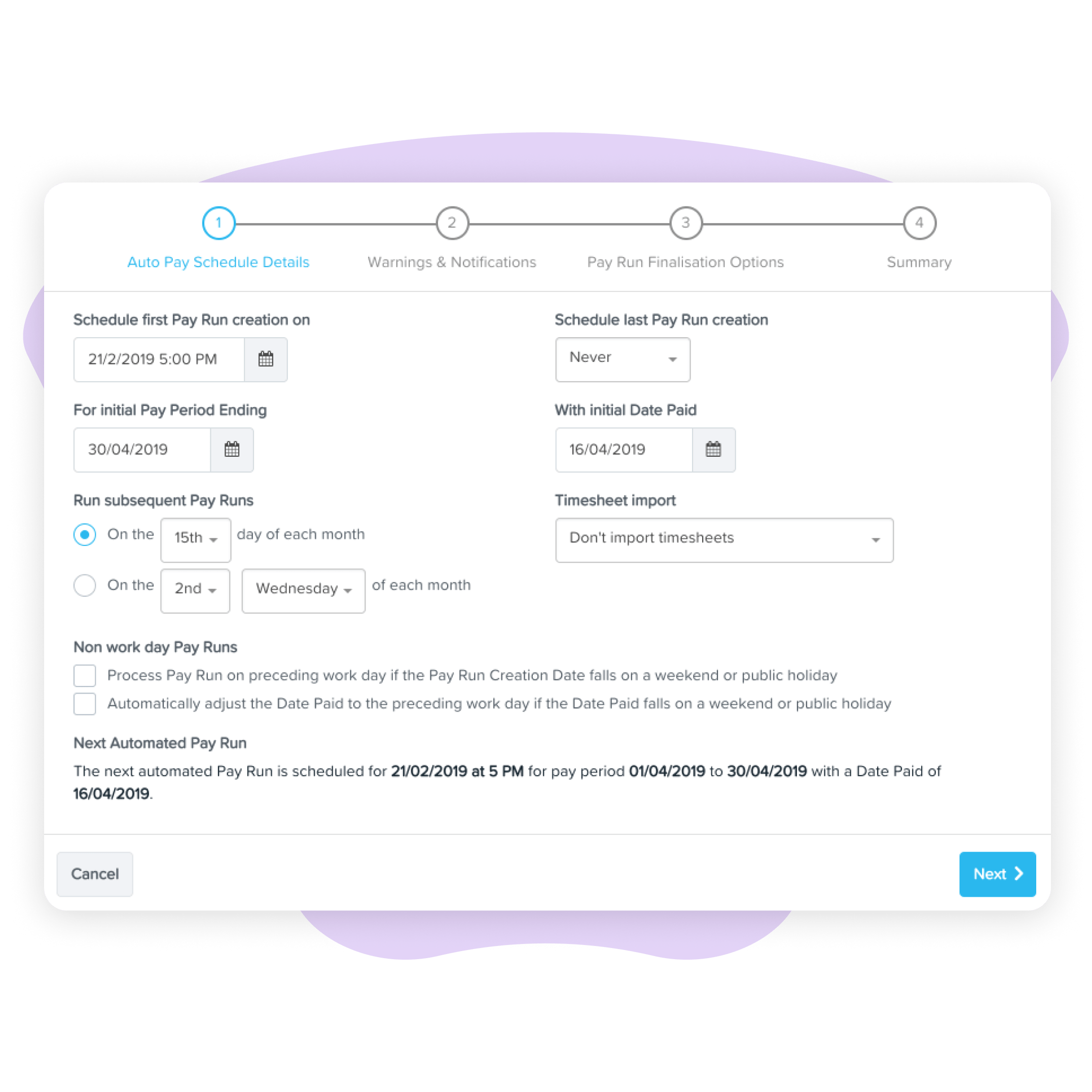

Auto pay schedule

Run multiple pay runs in the background at the same time. Choose which pay run processes to automate, and enjoy greater control by choosing specific dates and times to automate certain tasks.

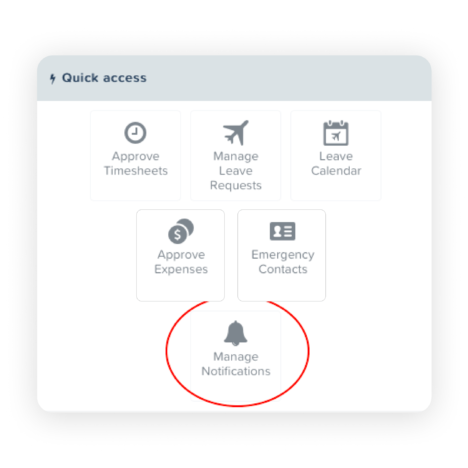

Warnings and notifications

Run payroll on your terms. Choose what you want to get notified about to stop the automation, and who needs to be informed.

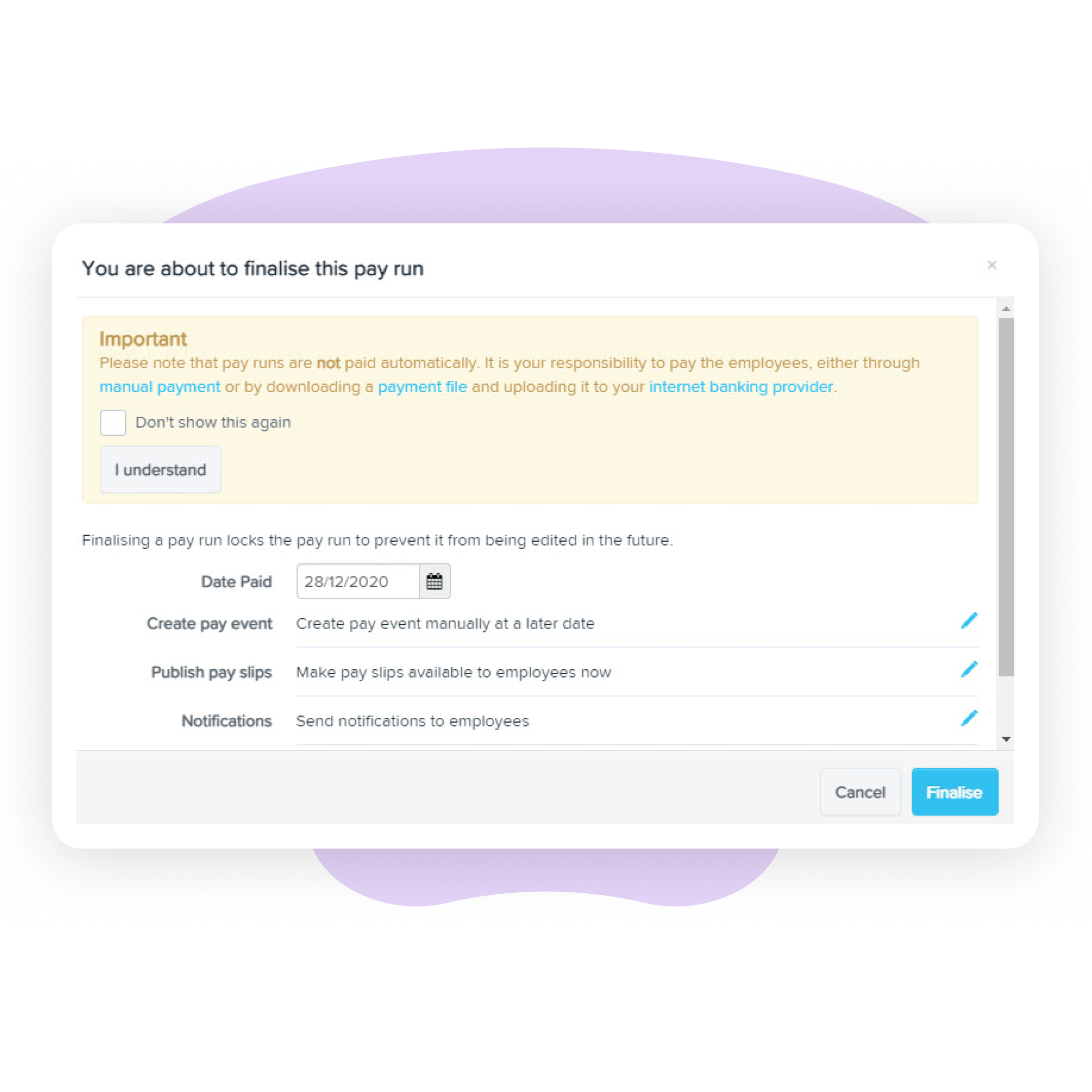

Pay run finalisation

Choose how to finalise the pay run, and automatically build and send reports on a recurring basis, based on the schedule set.

What can you automate?

Payroll, leave and super calculations

Leave the math to us – build the rules of unique employment agreements to automate calculation of wages, overtime, super, allowances and more. Calculation panels allow you to understand exactly what’s been applied, providing total transparency to assist with legislative compliance.

Award interpretation

Automate calculations using an extensive list of in-built awards. Changes to awards are also managed and automatically updated, saving hours of auditing.

Leave requests

Cater to different leave entitlement scenarios down to a per-hour worked or per-pay run basis with ease. Our personal/carer’s leave category is also compliant to the Fair Work Commission’s decision on the accrual of this leave.

Termination calculations

Whether it be a resignation or a redundancy, automatically process all leave types to be paid out, determine taxable and tax free amounts, and calculate the PAYG according to the ATO’s specifications.

Reporting

Select specific dates and times to automate payroll reports and journals. Once configured, our automated payroll system handles everything. Say goodbye to Excel spreadsheets.

Split earnings by location

Need to split employee earnings across various locations or cost centres for reasons such as government funding or budget management? Automate the distribution of earnings for auto pay salaried employees as a set percentage – no manual calculations required.

For effortless, full transparency over your business.

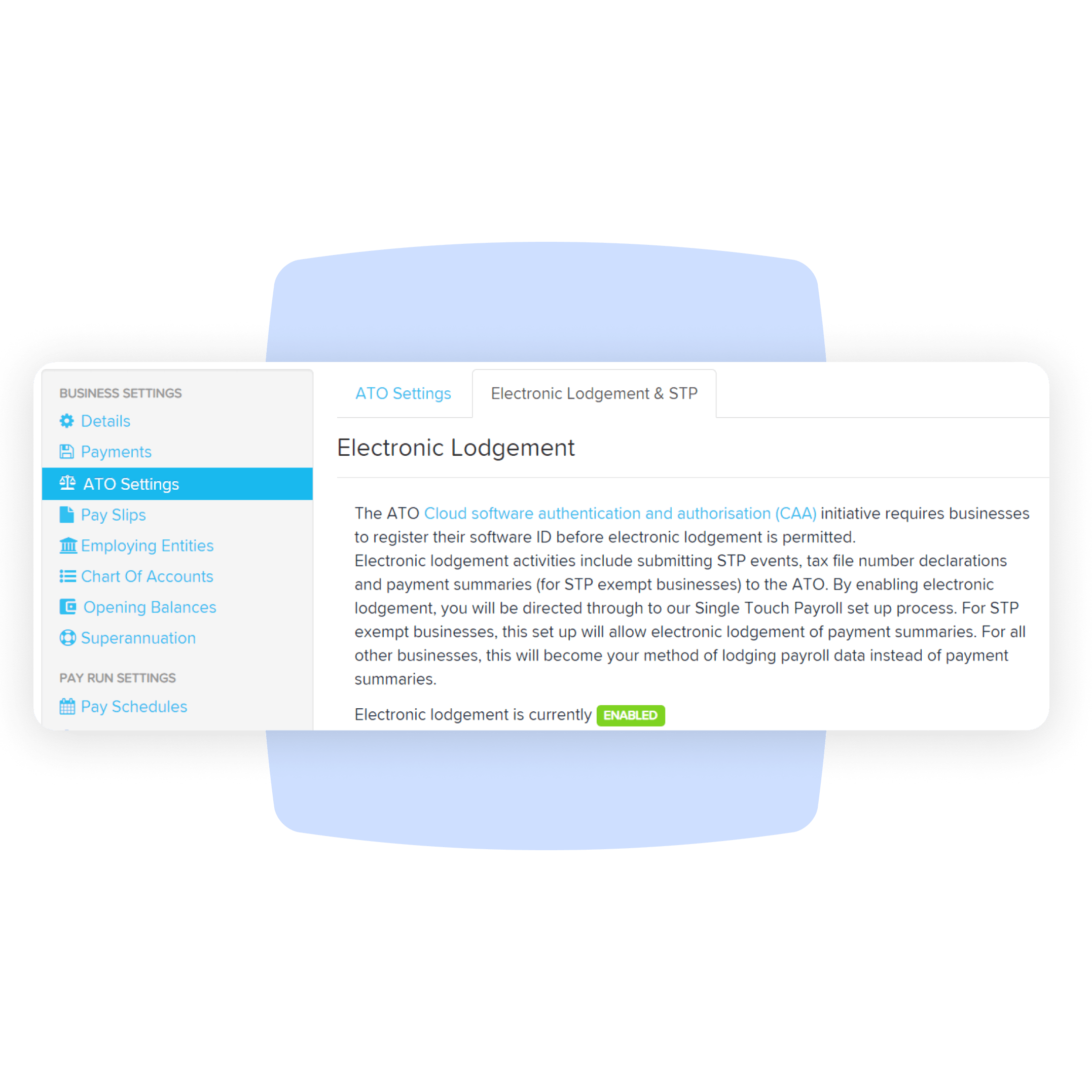

ATO reports

Easily provide Single Touch Payroll reporting. Automatically report payroll information to the ATO. Available for businesses of all sizes.

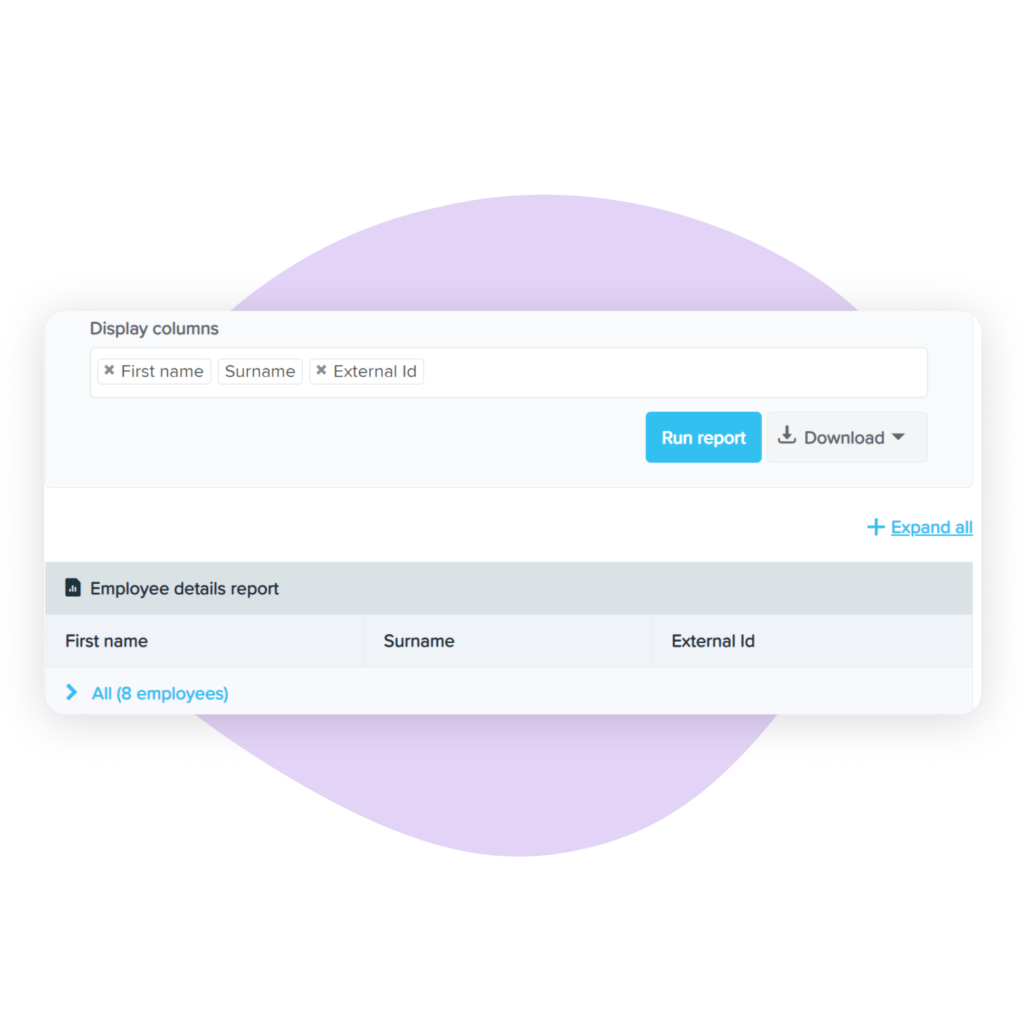

Employee details report

Access a detailed view of your employee data and an audit log of changes made to employee profiles. Tailor reports by start date, location and more, and export them in Excel, CSV or PDF formats.

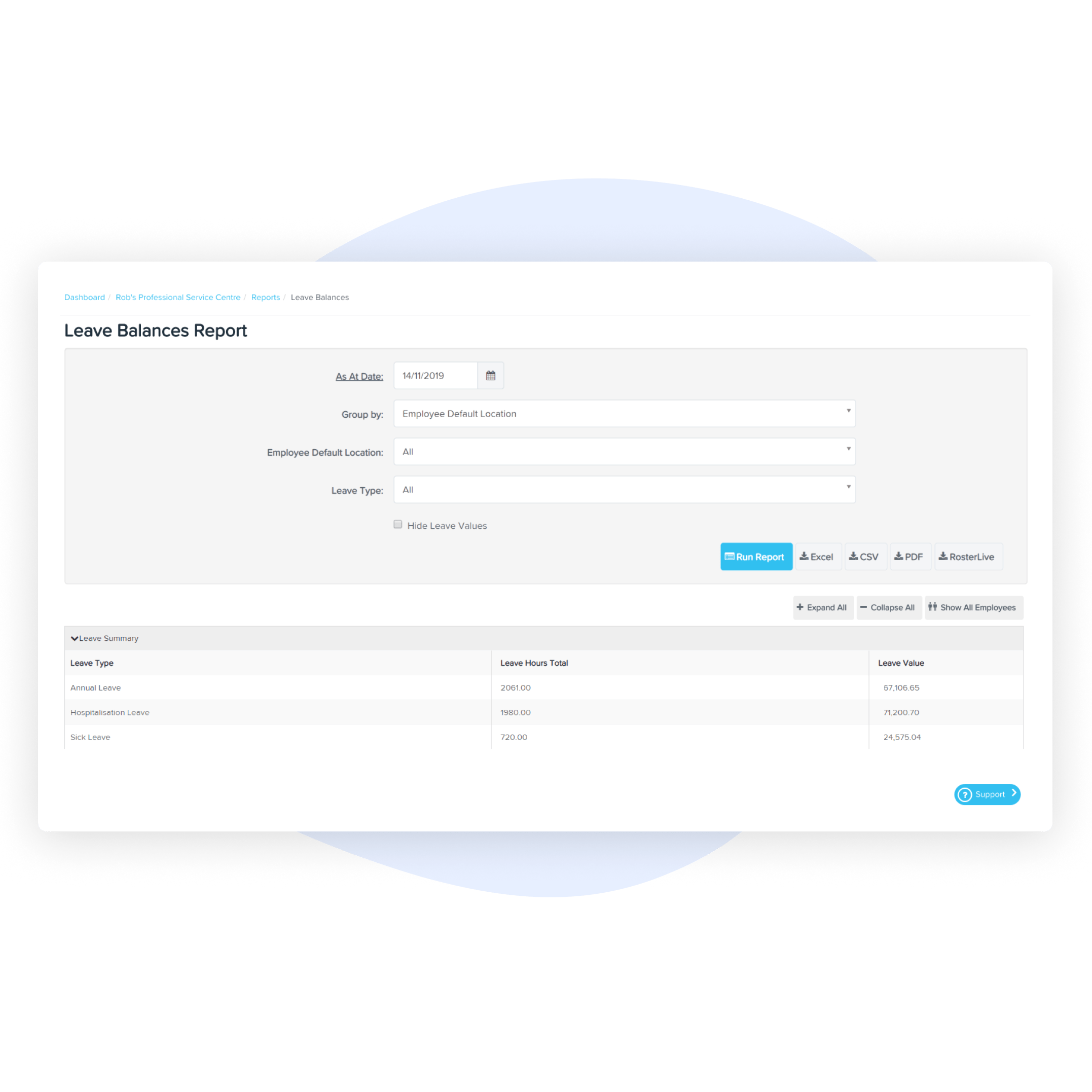

Leave balances report

Easily generate reports to show a summary of the leave type, approved requested hours, total leave hours, leave balance and more. View breakdowns of employees’ holiday pay calculations, for total transparency on how leave liabilities have been calculated.

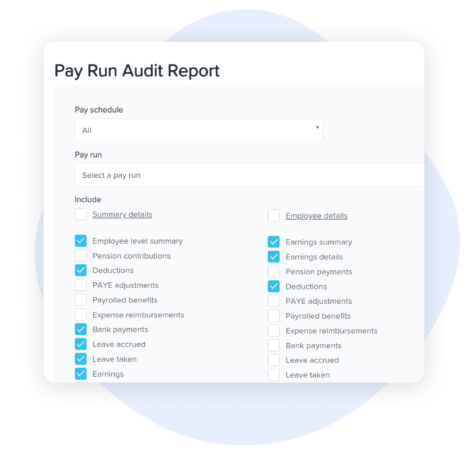

Pay run audit report

Need a report that lists all pay run details at a glance? Our report can be personalised to include earnings, super payments, bank payments, leave, and deductions.

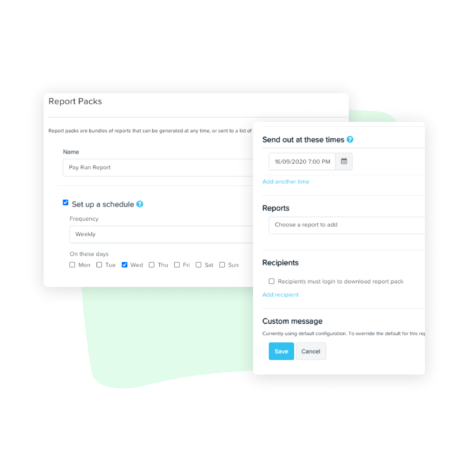

Report packs

Say goodbye to manually downloading a report to save, attach and forward via email to relevant recipients! Configure multiple reports with all of the information you need and automatically send them to recipients on a recurring basis, according to the schedule you want.

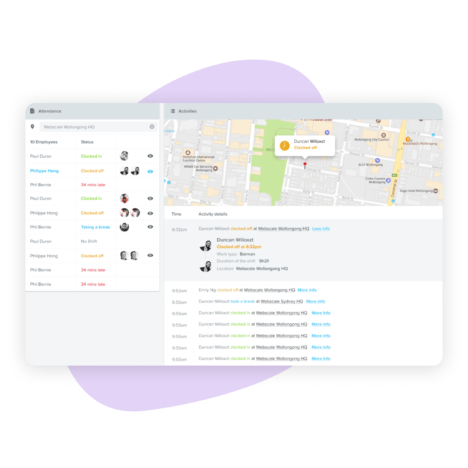

Attendance reports

View dates, times, locations and images of each attendance activity recorded via Clock Me In. Cross reference activities against timesheets and rosters to eliminate uncertainty around shifts worked. You can even filter according to different locations, for businesses that operate across multiple venues.

Made by payroll experts. For payroll experts.

We’re the all-in-one employment solution for businesses with big ambitions.

Automated payroll systems FAQs

What is automated payroll?

An automated payroll solution uses software to help managers save time by automatically performing payroll tasks, such as payroll calculations, calculating tax withholdings, generating pay slips and paying employees in just a few clicks.

Are there different types of learning management systems?

- Compliance confidence for tax payments – Between payroll taxes, STP, Modern Awards, super stapling, and much more things can get complicated when it comes to staying compliant. When you use an HRIS to automate your payroll obligations, you can have confidence that you’re doing the right thing.

- Seamless integration of payroll services – Increase your business’s efficiency by using a payroll software that will will integrate seamlessly with your current HR software. So you can breeze through payroll with confidence and ease knowing that all your employee data and information is housed together.

- Reduce the chance of human error – Payroll is something you do not want to run the risk of getting wrong. We’re all human, and mistakes are bound to happen. However, using an HRIS (particularly one with AI integrations like Employment Hero) can help automate payroll obligations to help enhance your payroll accuracy and reduce human error.

- Save time on administrative tasks – When done manually, running payroll and bookkeeping can be a time-consuming and mundane task. Thankfully an HRIS can help save you time and allow you to focus on more strategic tasks for your business. Here’s how:

- Payroll automation – Easily calculate penalty rates, overtime rules, and a range of allowances

- Electronic timesheets – Employees can send these to management for approval

- Modern Awards – Payroll software like Employment Hero has built-in award interpretation (over 50 modern awards)

- Dynamic rostering – Allows businesses to allocate their team based on demand and peak times

- Single touch payroll (STP) compliance – Automatically report your tax and super to the ATO with minimal fuss

- Empower employees with an employee self-service portal – Whether it’s updating their personal information when changes happen, submitting their leave requests, checking timesheets on their phone or acknowledging important workplace policies, allowing your team to make changes when it suits them takes pressure and admin off payroll officers.

- Save money – When you use an HRIS to automate managing payroll obligations, not only will you save time and money, you can make your payroll process more dynamic and efficient for your business needs.

How does automated payroll work?

Automated payroll software collects and processes employee and payroll data from multiple platforms, such as integrated time-tracking systems, accounting software, and HR software. Once a one-off configuration is set, the software then uses this data to calculate employee salaries, wage deductions, and payroll taxes based on local payroll legislation changes, unique employee scenarios and the company’s payroll policies and regulations. Finally, employees are paid straight into their bank accounts, by pay schedule set.

Can payroll be fully automated?

Core payroll tasks such as importing timesheets, calculating pay or sharing payslips can be automated with the help of using cloud-based technology. Cloud-based payroll software like Employment Hero Payroll keeps all employee data in one centralised location and updates in real time. A payroll software with employee self-service also reduces the workload associated with payroll administration. By empowering employees to access and enter their own data and even view their wages, deductions, and benefits, managers will no longer have to chase for data. When using the right cloud payroll system, small business owners, managers and payroll and HR teams can fully automate payroll, as long as one-off configurations have been set.

What features should you look for in an automated payroll service provider?

When looking for an automated payroll service provider, it is important to make sure it is cloud based and has features such as shift management, local compliance with regulations, integration with existing software, employee self-service capability and scalability. Additionally, you should evaluate the security of the provider’s systems and the support they provide, to ensure that your data is secure and all issues can be addressed quickly.

When looking for an automated payroll service provider, it is important to make sure it is cloud based and has features such as shift management, local compliance with regulations, integration with existing software, employee self-service capability and scalability. Additionally, you should evaluate the security of the provider’s systems and the support they provide, to ensure that your data is secure and all issues can be addressed quickly.

Refer your clients or business network to us and get rewarded for every successful referral.

Let us solve your clients HR & Payroll problems, making you look like the hero.

Innovation, reliability, customer service. A tick, gold medal, five stars.

Resources. All for you.

Payroll Guide: The Basics of Payroll In Australia

How can you ensure that you are running payroll correctly? Get the basics in our guide.

The essential guide to HR compliance in Australia

Tick HR compliance tasks off your to-do list with our HR compliance guide. Download today!

In-house payroll vs outsourcing: Which is best for SMEs?

Using a payroll platform to bring payroll in-house can be transformational for your business.

Work easy.

Employment Hero is an all-in-one HR and payroll platform for Aussie businesses.