Single Touch Payroll (STP) Software

STP Phase 2 reporting? It’s effortless with our ATO-certified payroll software. Support payroll compliance with smart automations and built-in award rates.

We take STP payroll off your plate

Tax/BAS agents can now easily manage client pay events directly on the platform: no need to send emails back and forth.

All client approvals and actions are securely recorded within the STP event itself, providing a clear audit trail. For agents who have Standing Authority, approvals are even smoother: just action events without needing to request approval each time.

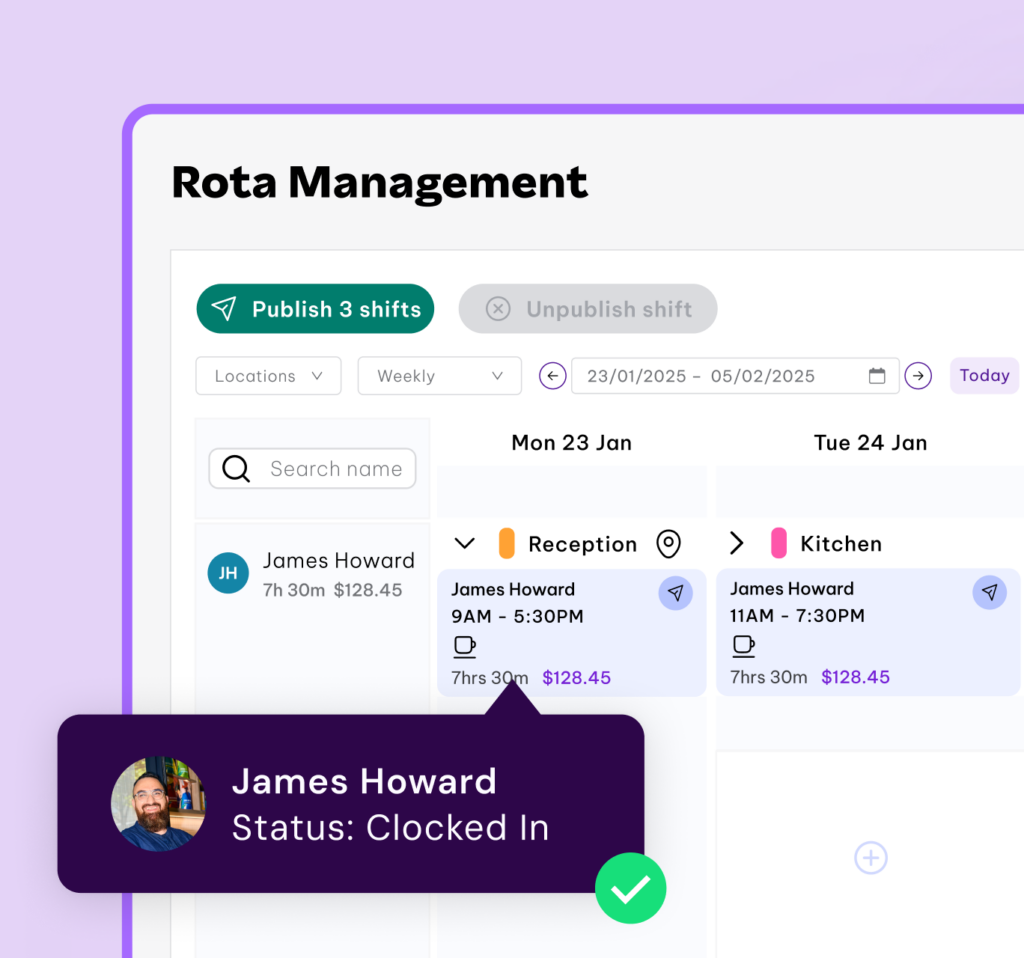

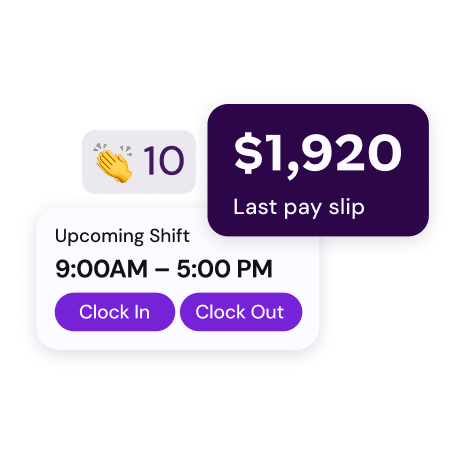

Minimise rostering mistakes and stay in control. Easily assign shifts to your team and feel confident knowing your workforce is ready to handle busy periods.

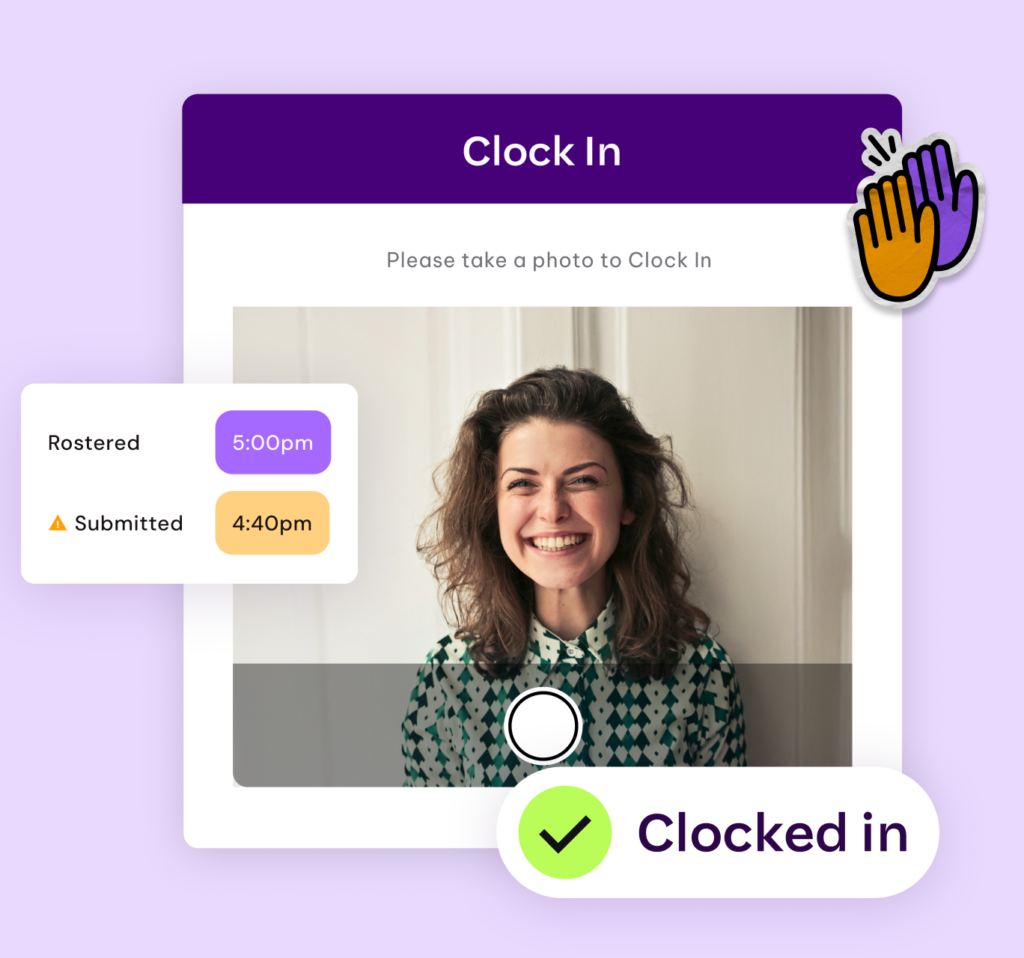

Make it easier than ever to clock in and out for a shift. Use dynamic rostering, templates and shift bidding to get a full view of your team’s availability.

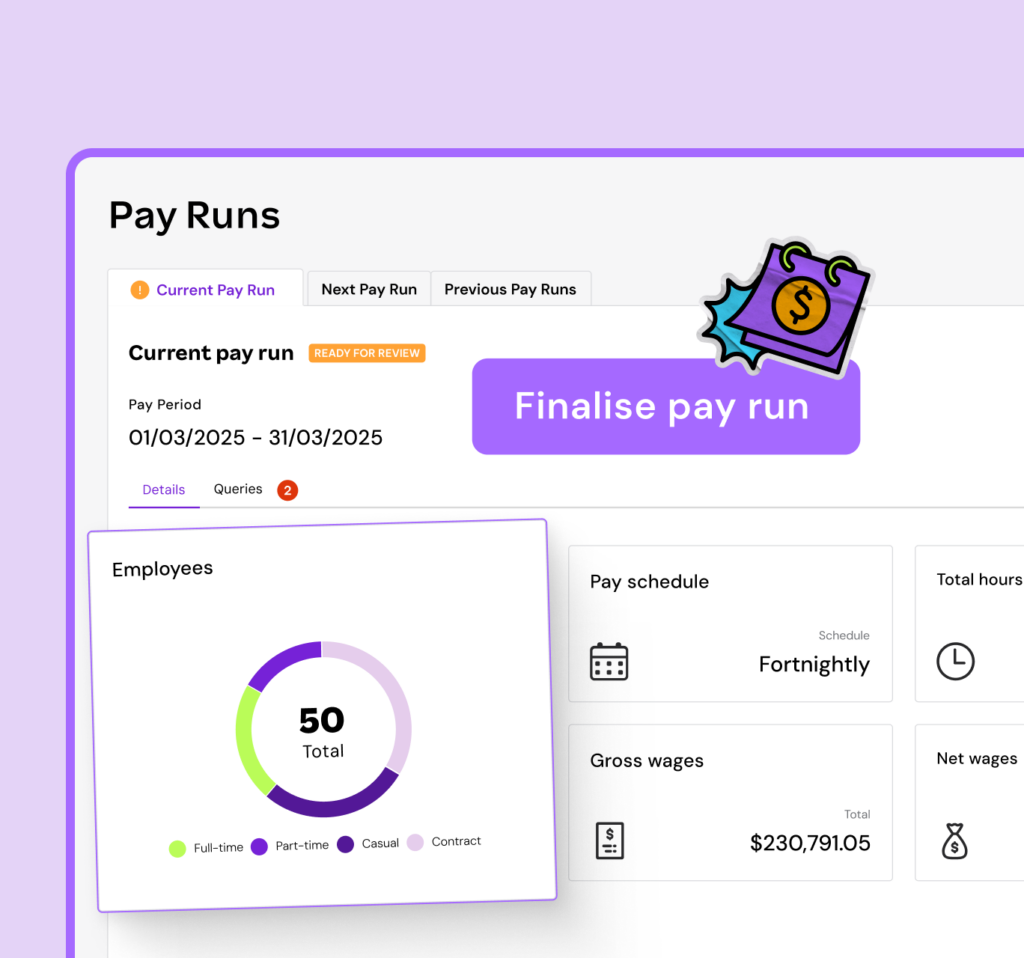

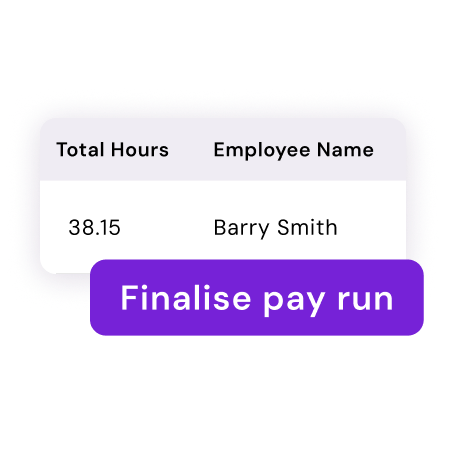

A smarter way to pay your people. Automate your payroll and give yourself hours back to focus on more strategic work. In a few simple clicks, you can process, finalise and publish your payroll.

TRUSTED BY 300k+ HAPPY CUSTOMERS

STP: it’s payroll. Just faster.

Handle STP Phase 2 reporting requirements without breaking a sweat. It’s easy with Employment Hero.

ATO compliance has never been easier

Our STP feature is housed in the same software as your payroll data, meaning no manual exporting of data is required to complete the report. Never worry about reporting errors or corruption of data again.

Minimise STP errors

Any issues relating to payroll data or employee/business details will be displayed as required to be corrected before lodging. The pre-lodgement validation ensures you are significantly more likely to lodge an event successfully.

Enjoy peace of mind over STP Phase 2

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Made by STP payroll experts.

Join 300k+ successful businesses who trust employment hero to take STP & payroll off their plate

Frequently Asked Questions

Employment Hero’s Single Touch Payroll software is an ATO-certified solution integrated within its payroll platform, designed to simplify STP Phase 2 reporting for Australian businesses. It streamlines the process of reporting payroll information directly to the ATO, supporting businesses with compliance.

The software is ATO-certified and integrates STP reporting directly into the payroll process, eliminating the need for manual data export and reducing the risk of errors. It also identifies potential payroll data or employee/business detail issues before lodgement, increasing the likelihood of successful and compliant event reporting.

The software handles a range of mandatory and voluntary reporting requirements for STP Phase 2, including mandatory termination reporting, voluntary child support reporting, TFN declaration reporting, disaggregation of gross pay, and the correct application of income types and country codes.

Single touch payroll tools, tips, templates

-

Read more: How to Prepare for EOFY

Read more: How to Prepare for EOFYHow to Prepare for EOFY

With the End of Financial Year almost upon us, it’s time to ensure that you are prepared and ready to…

-

Read more: Transitioning STP records

Read more: Transitioning STP recordsTransitioning STP records

STP Phase 2 reporting is now mandatory for all businesses. Learn more about transitioning STP records between payroll softwares. Published…

-

Read more: Common STP Lodgement Errors

Read more: Common STP Lodgement ErrorsCommon STP Lodgement Errors

If you are an Employment Hero Payroll admin, this article is for you.

Never run another pay run again. We handle it all: you simply approve

Manage all payroll tasks from one place with automated data flows and error alerts., Make paying your people faster and worry-free.

AI-powered payroll automation and expert oversight for accuracy and compliance.

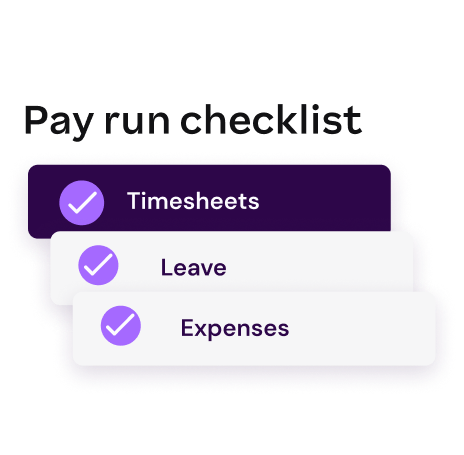

Centralised access to pre-payroll data like timesheets, leave, and rostering.

A dedicated payroll partner to handle complex tasks, from STP, awards, legislation changes to payroll anomalies.

Automated bank transfers, compliance reporting, and more.

More than just an ATS

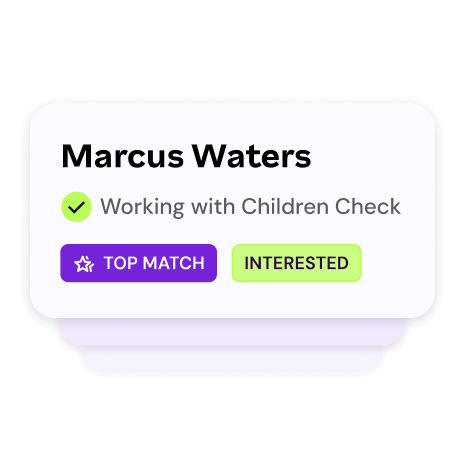

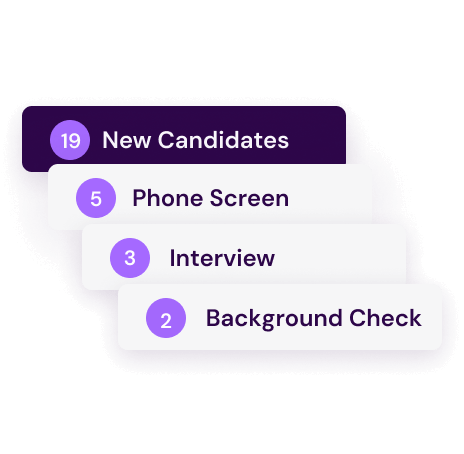

Take people from “Hi” to Hired without switching tabs.

Get instant access to talent. Save time and cut costs

Curated talent shortlists, automation, and more

Manage open roles, interviews, and onboarding from one place

Hire smarter with salary insights and candidate matches for every role

Make work feel less like work.

We’ve made work admin a breeze. Forget paper-based processes and lost leave requests: give your team self-service access to all their important HR and Payroll tasks.

All employee data is housed in a single, secure platform

Automate leave requests, performance reviews, and onboarding.

Centralise and share company policies and essential documents

Workforce analytics and reports to help leaders make data-driven decisions.

Be the employer everyone wants to work for.

You offer the employment – we’ll bring the benefits

Employees can access everything they need through an intuitive self-service portal

Keep your team engaged and motivated with world-class benefits

Give your team flexible, on-demand access to their earned wages

Increase morale, productivity, and loyalty with an employee assistance program.

Work easy.

Say goodbye to manual data exports and reporting errors with Employment Hero’s STP reporting.