Payroll software without the pressure.

Employment Hero takes care of the hard stuff so that you don’t have to. Whether you’re an owner managing payroll software yourself or a growing business looking to streamline processes, Intelligent Payroll adapts to your needs and takes payroll off your plate.

Employment Hero’s payroll isn’t a standalone tool. That means time and attendance, leave management, salaries and employee data flow seamlessly together, eliminating double-handling, spreadsheets and siloes.

Whether you’re in HR, ops or finance, payroll might not be your job title: but it’s on your plate. Intelligent Payroll is built to be intuitive, reliable and stress-free. Non-specialists can run compliant payroll with confidence, and experts can go further, faster.

From built-in award interpretation software, Single Touch Payroll (STP) reporting, to ATO-aligned workflows, Employment Hero takes the guesswork out of compliance.

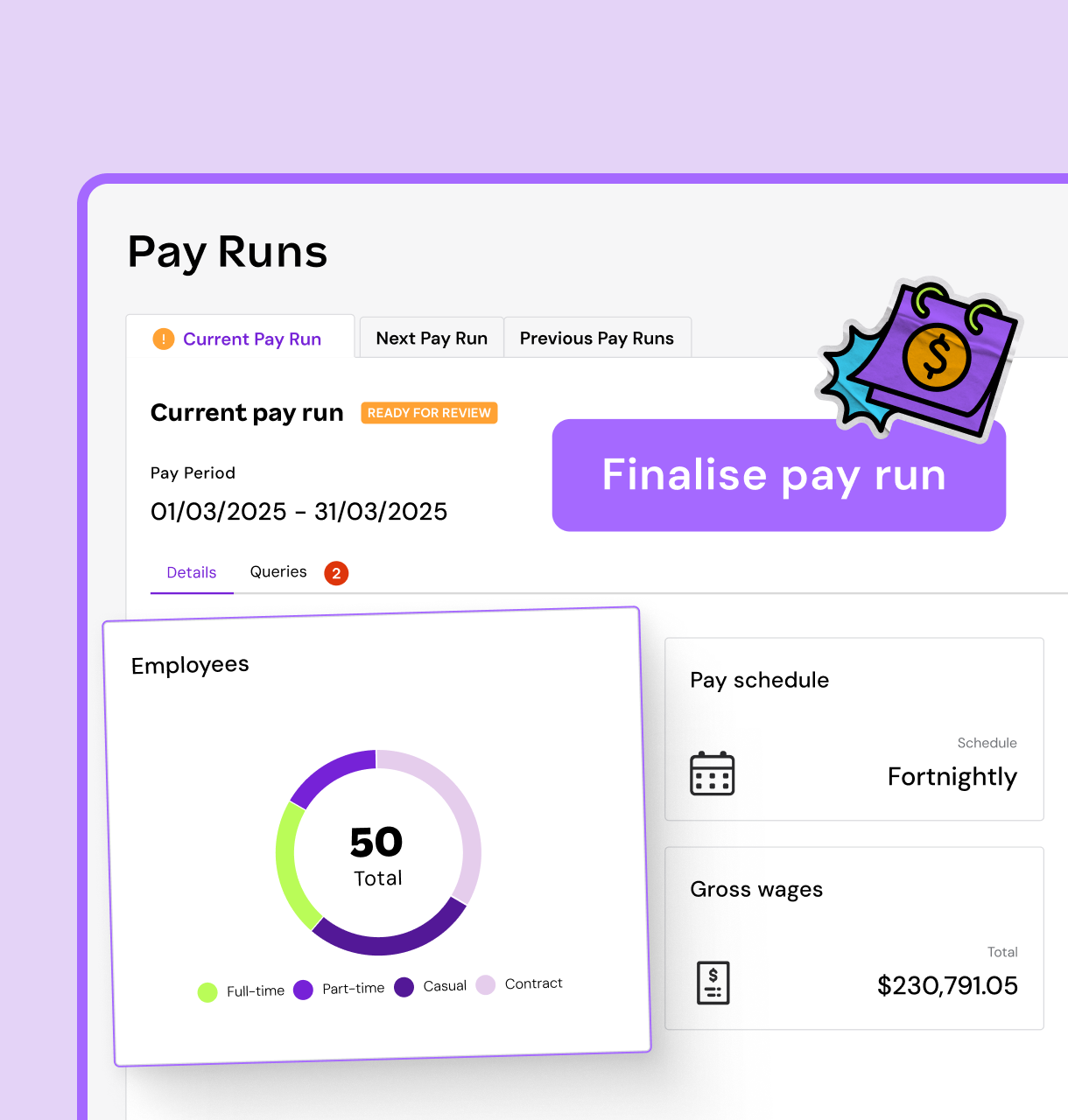

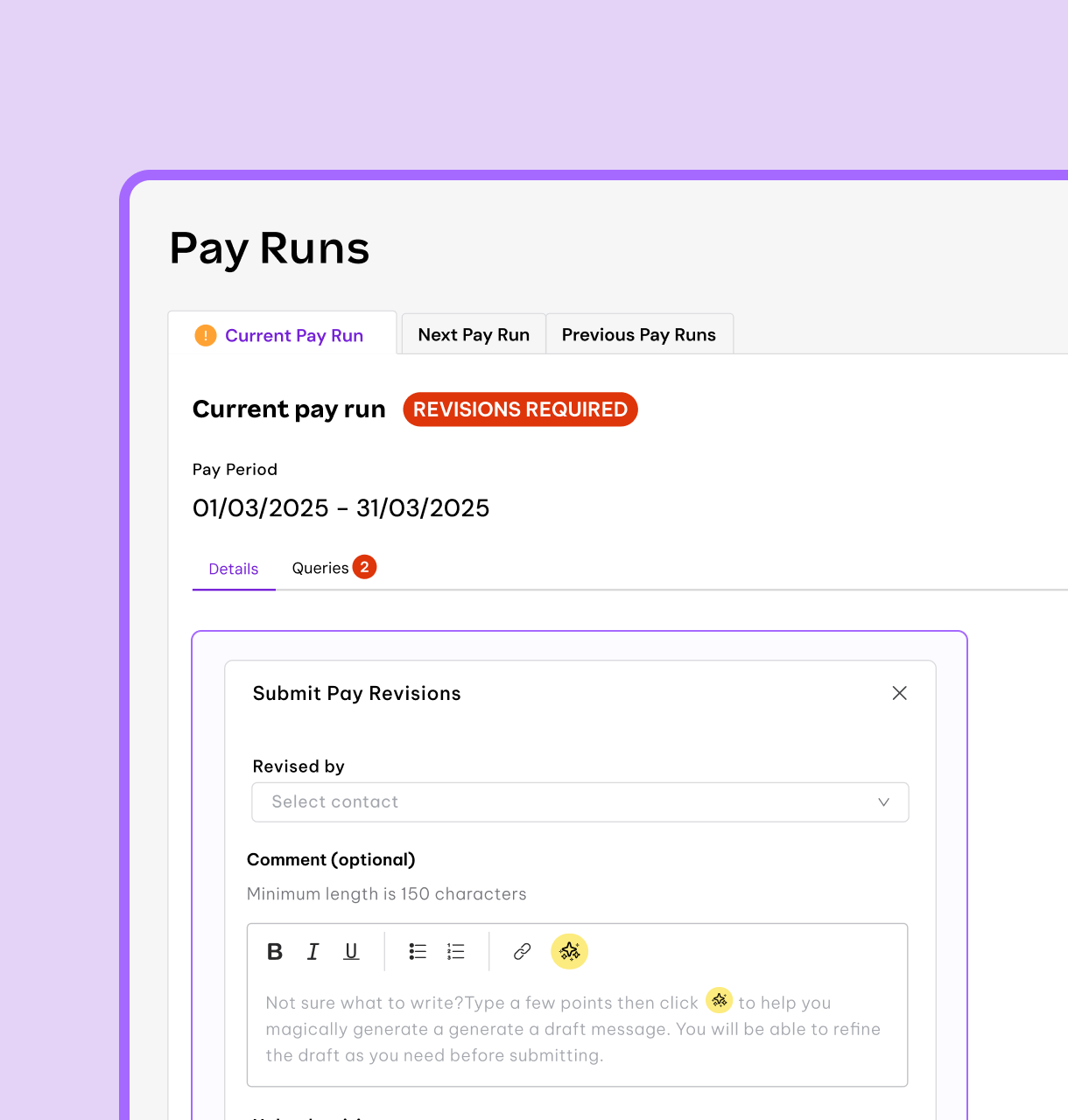

Run payroll in minutes, not days with AI automation. Our tech flags anomalies before they become big issues, and cuts out busy work and manual handling. And if things get tricky, our local experts have your back.

TRUSTED BY 300k+ HAPPY CUSTOMERS

Automated payroll. But smarter.

Unlike traditional payroll solutions, Intelligent Payroll isn’t just automation: it’s smarter. By combining machine learning with expert support, we ensure the highest level of compliance and accuracy.

Built-in payroll

One system. One source of truth. One smarter way to run payroll.

Less admin, more control

Made for the unsung heroes who make payday happen.

Compliant, not complex

Running a business is stressful. Compliance shouldn’t be.

Support when you need it

Power, not paperwork. With real people to help when you need them.

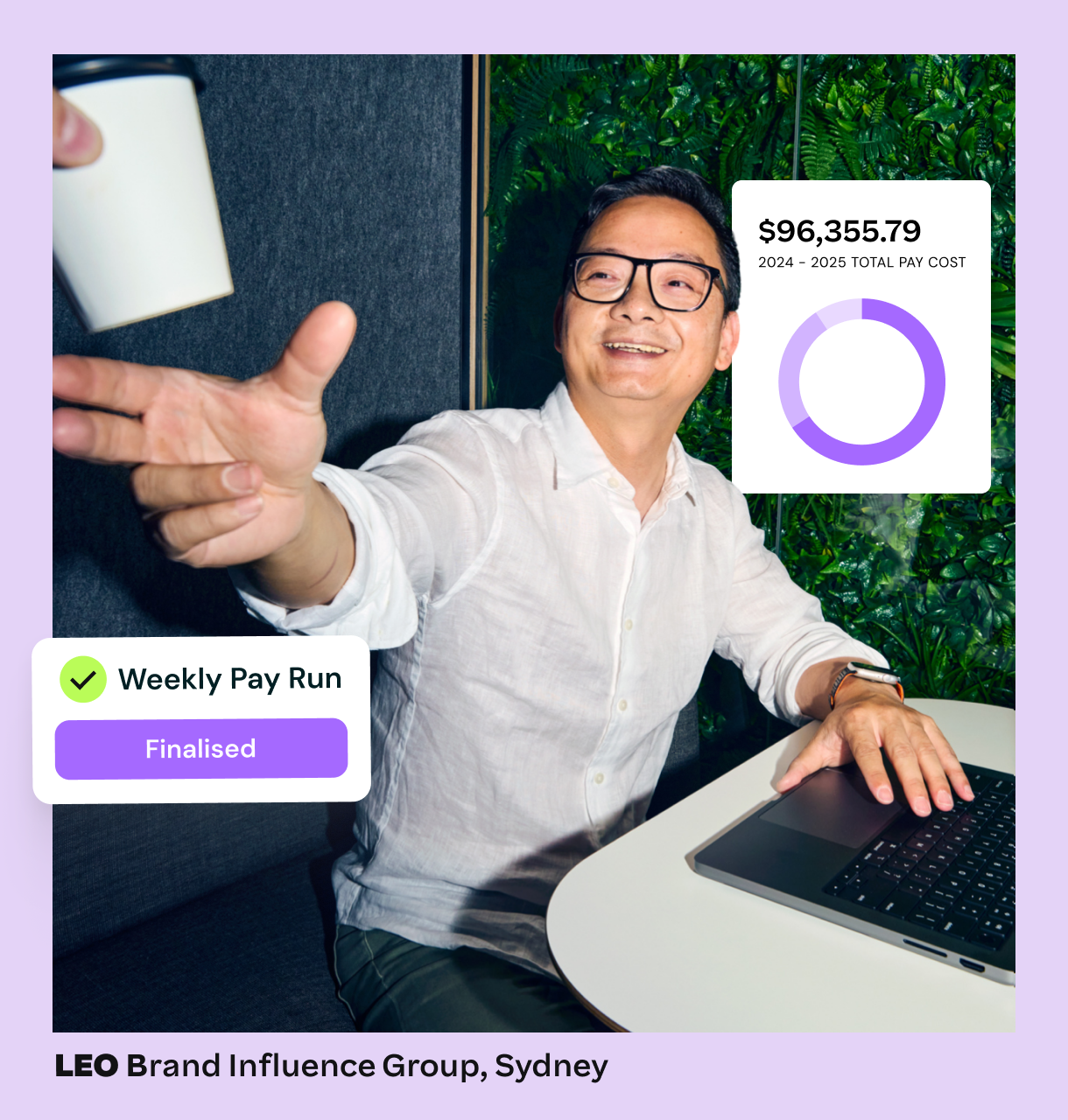

Don’t just take it from us…

Smart payroll integrations

Switch payroll solutions easily by importing employee time worked, leave taken and other employee details from your current payroll provider or accounting software into Employment Hero.

Payroll software FAQs

Payroll software helps businesses automate their payroll processes. This can include tasks like payroll processing, payroll calculation, tax filing, and detailed reports.

One of the significant benefits of using payroll software is that it can help businesses avoid penalties for non-compliance with payroll tax laws. These laws can be complicated and subject to change, which can make it challenging for businesses to stay on top of their obligations.

- Reduced administrative mistakes and improved accuracy – By adopting payroll software, small businesses can automate complex calculations and other payroll processes, minimising the risk of errors.

- Accurate time tracking for small businesses with shift workers – Payroll software can help provide accurate time tracking and reduce the risk of reputation loss with employees and customers alike.

- Ease and security of having data in the cloud – By utilising encrypted and password-protected cloud servers, payroll software ensures that you enjoy enhanced data security, and that all sensitive data remains safe from physical damage, theft, or loss.

- Scalable according to business needs – Payroll software offers flexible scalability, allowing businesses to adapt their payroll processes to changing needs.

- Comprehensive tracking and accountability – Rather than keeping files and stacks of paper in cupboards, payroll software enables you to maintain a detailed record of all payroll-related activities, including employee data, timesheet entries, earnings, deductions, tax withholdings, and payments.

- Record keeping according to legislative requirements – Payroll software eliminates all that hassle by providing secure data archiving and storage capabilities, which ensures that historical payroll data, including audit trails, are securely preserved for the required duration as mandated by local regulations.

Payroll tools, tips, templates.

-

Read more: End of Financial Year HR and Payroll Checklist

Read more: End of Financial Year HR and Payroll ChecklistEnd of Financial Year HR and Payroll Checklist

Get organised this EOFY with our complete checklist.

-

Read more: How will AI change the payroll industry?

Read more: How will AI change the payroll industry?How will AI change the payroll industry?

Learn how AI is being used in payroll – and how you can make the most of it in your…

-

Read more: Payroll Guide: The Basics of Payroll In Australia

Read more: Payroll Guide: The Basics of Payroll In AustraliaPayroll Guide: The Basics of Payroll In Australia

How can you ensure that you are running payroll correctly? Get the basics in our guide.

The real MVPs? The payroll heroes.

Power them with the only payroll built into an end to end Employment Operating System.