Payroll software for Australian businesses

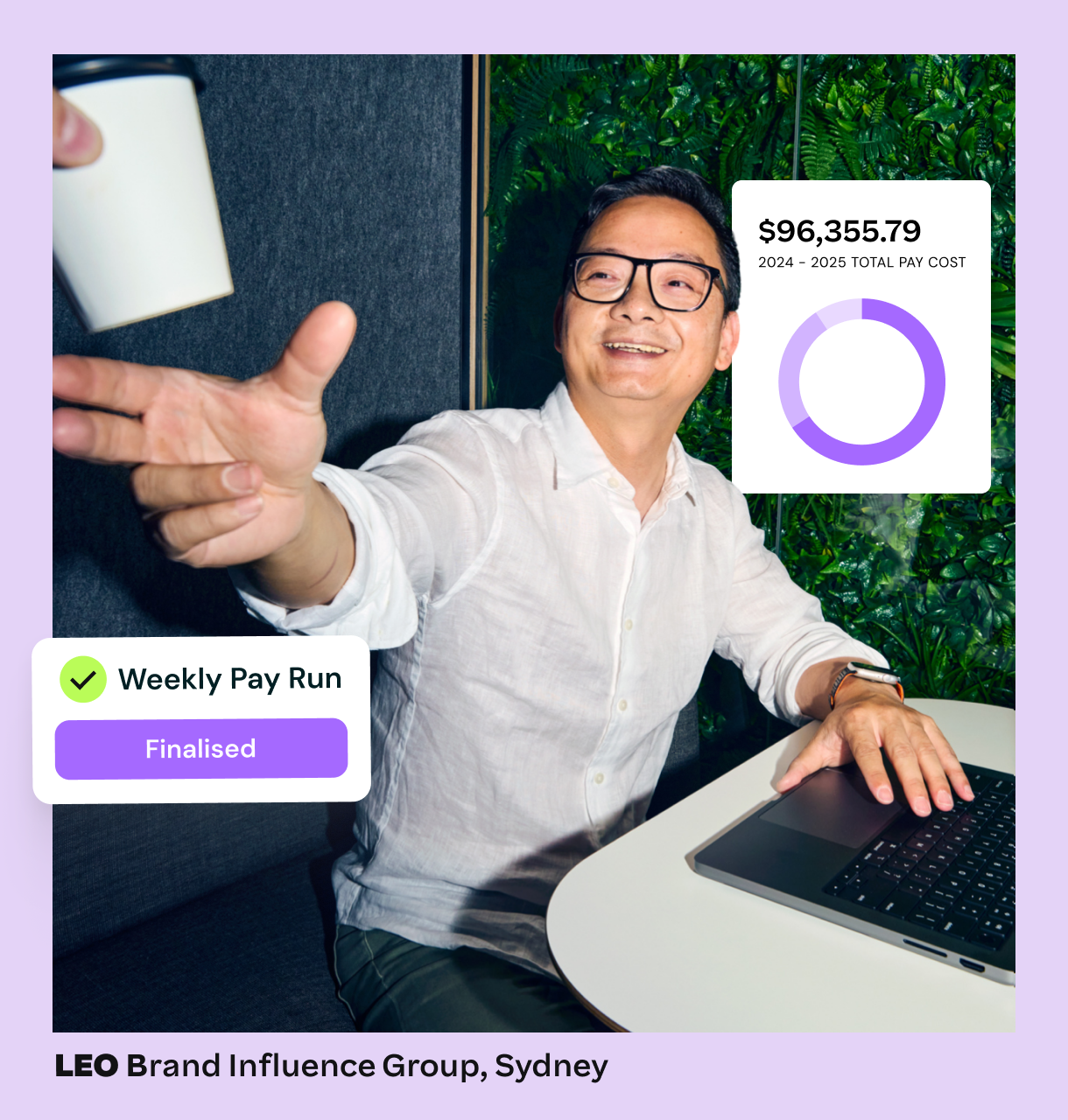

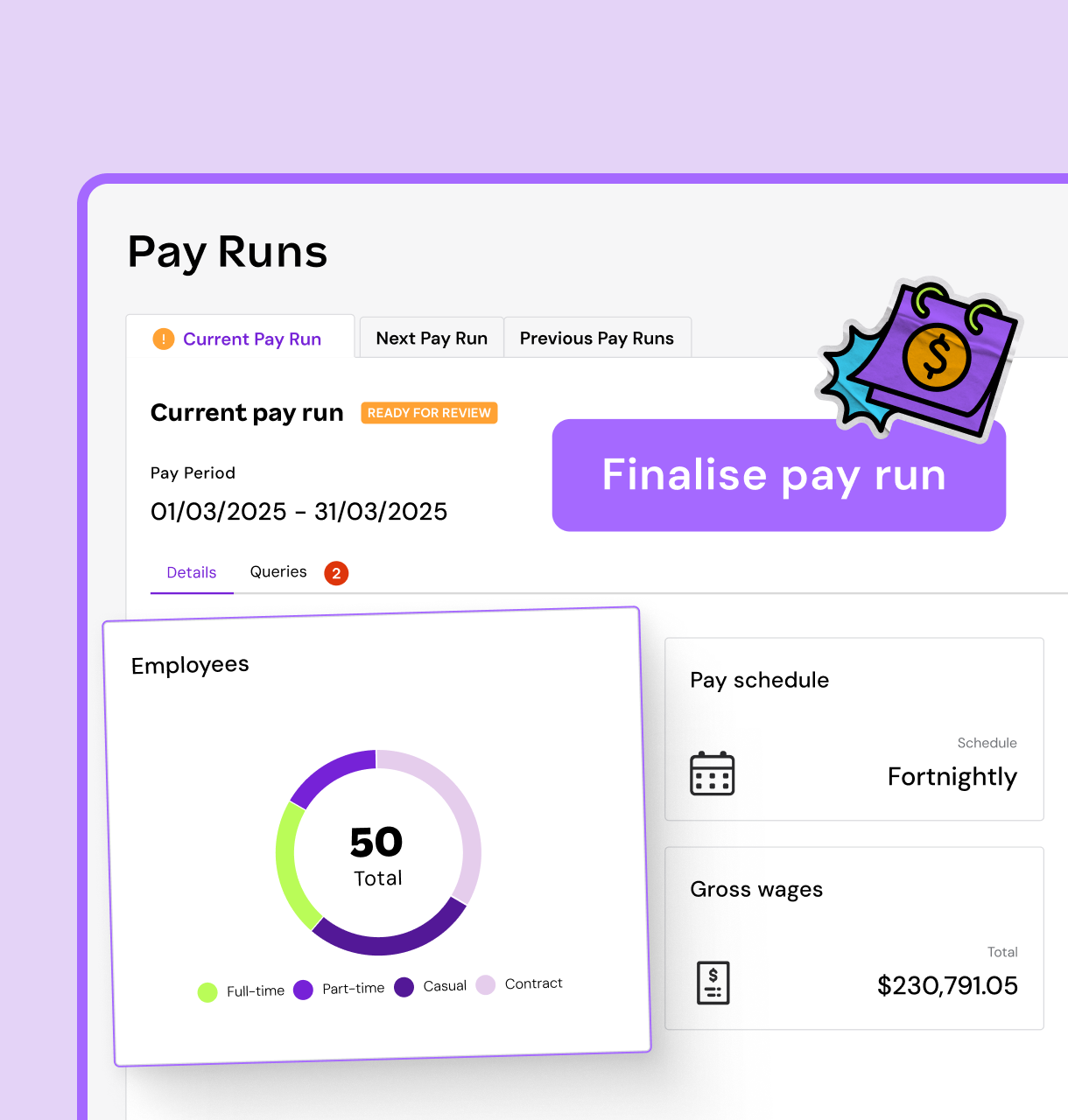

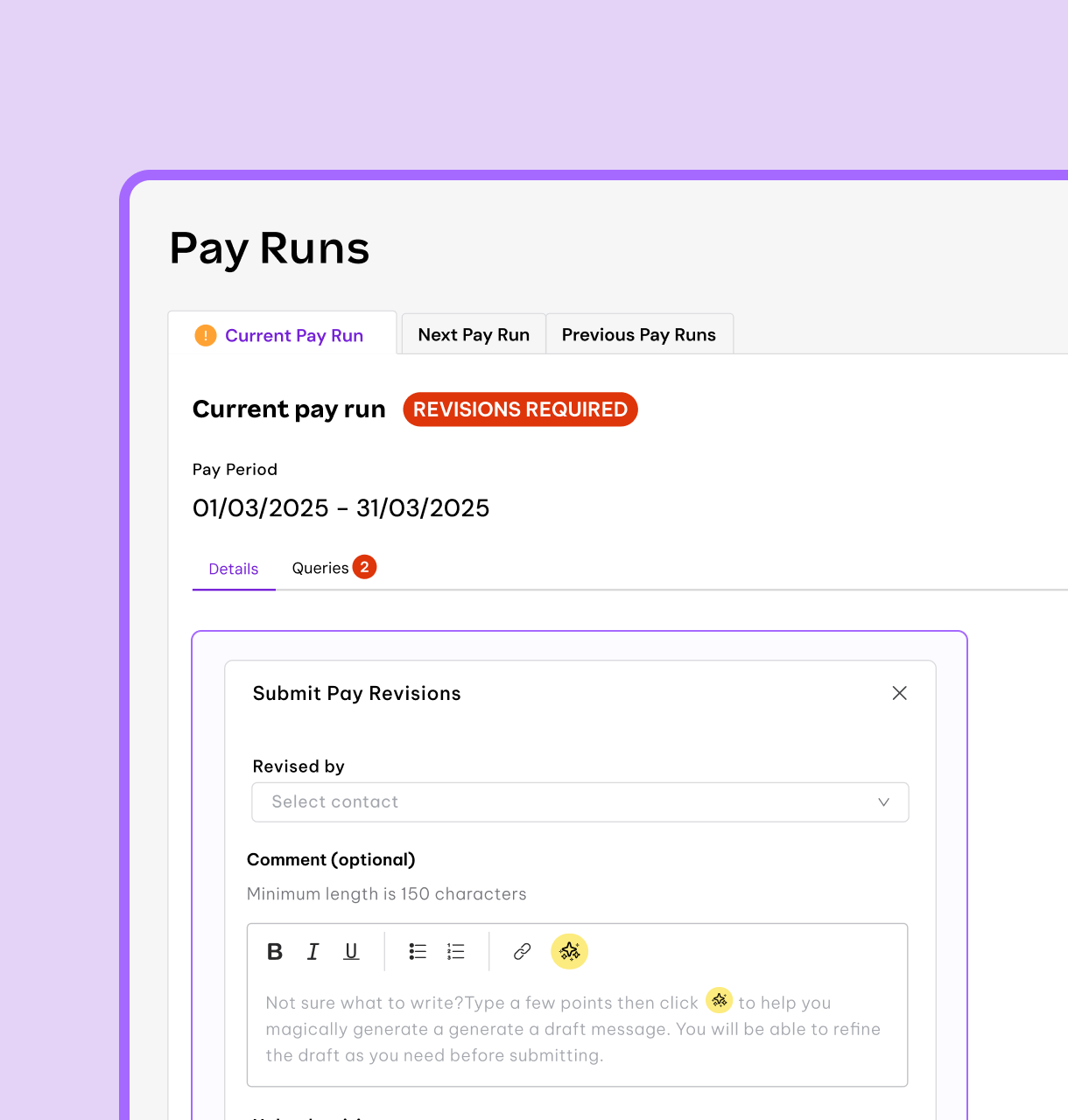

Employment Hero’s AI Employment Operating System automates, orchestrates, and runs payroll for you – freeing your team from repetitive admin and compliance uncertainty. Not just payroll software. A payroll system of action that helps you get pay runs done accurately and on time, every time.

Payroll compliance you can count on

Payroll that just works, without the busywork: Instead of managing data across disconnected systems, EmploymentOS takes action for you – automating calculations, compliance checks, reporting, and pay runs. We’re an ATO-recognised platform that handles STP Phase 2 reporting, SuperStream compliance, and we are Payday Super compliant. We automatically apply the latest PAYG and superannuation rates, and even handle changes to modern awards and penalty rates for you.

Smart automation that saves you time

AI-assisted workflows pull in the right data, calculate earnings and deductions, and help you finalise pay runs with confidence — with far fewer clicks and errors than traditional systems.

Payroll in one easy-to-use platform

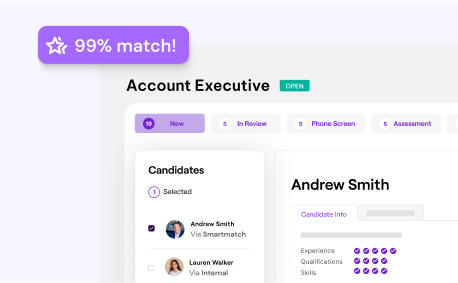

Tired of using multiple platforms to manage your team? Our payroll seamlessly integrates with HR management, recruitment, and employee experience in one easy-to-use platform.

Everything from timesheets, leave requests, payslips, to employee contracts and performance reviews is connected, so you have a single source of truth for all your employee data.

More time, less admin with employee self-service

Empower your team and win back your time. Through the Employment Hero Work App, employees can securely access their payslips, manage personal details, and apply for leave directly from their phone. That means fewer emails in your inbox and more time in your day.

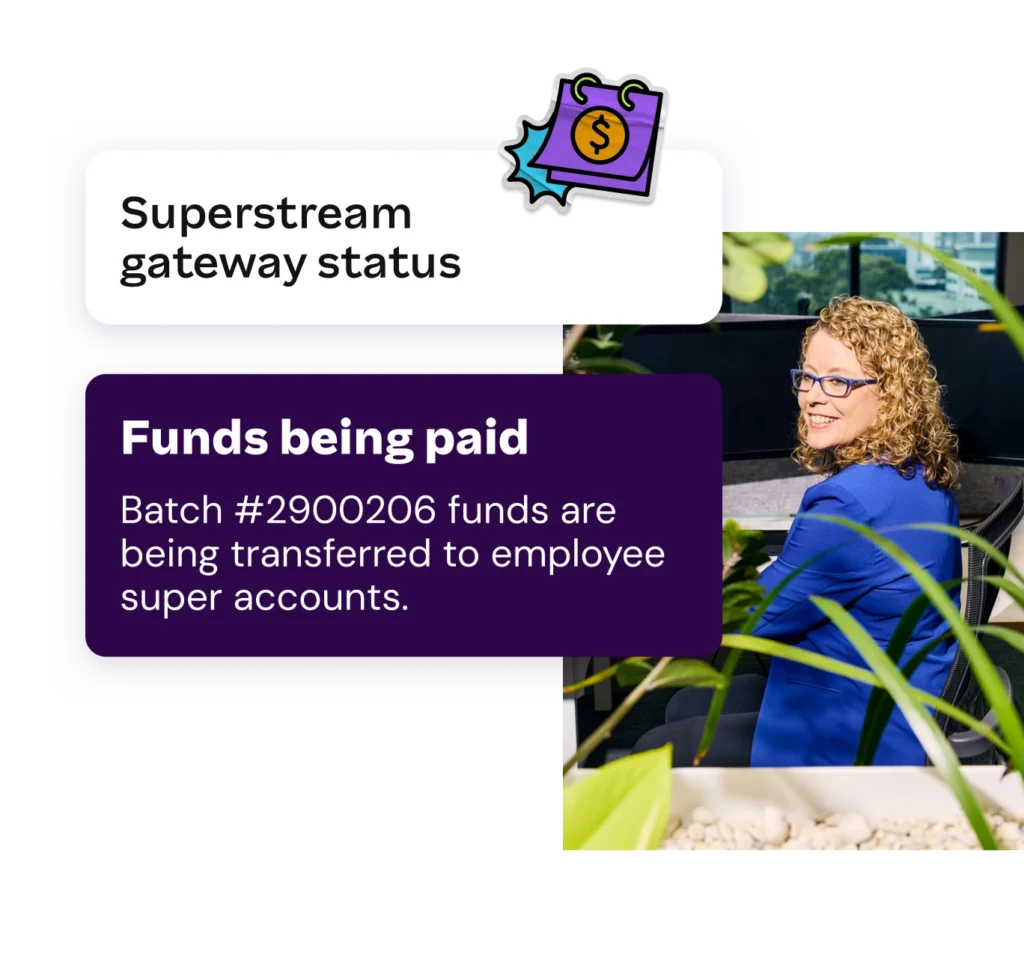

Payday Super Compliant with HeroClear

HeroClear is an embedded, end-to-end payment processing solution in Employment Hero Payroll. It automatically validates, pays, and tracks super contributions directly from payroll – helping you stay compliant, reduce admin, and protect your business from costly errors.

Real-Time Compliance

Stay compliant every pay cycle with automated award interpretation, tax and super calculations, and up-to-date regulation checks built into the system.

TRUSTED BY 300k+ HAPPY CUSTOMERS

Payroll that just works without the busywork.

Rather than a static interface for data entry, EmploymentOS continuously coordinates the work that payroll requires.

Automated timesheets & rostering

Say goodbye to manual timesheets and data entry errors. Our software automatically syncs your employee time and attendance and rostering data to calculate pay accurately. It effortlessly handles different pay rates, penalties, and allowances for full-time, part-time, and casual workers.

End-to-end leave management

Remove the administrative burden of managing leave with a fully integrated leave management software. Your employees can apply for leave through their self-service portal or the mobile app, and the system automatically updates leave balances.

Effortless onboarding & offboarding

Our platform streamlines the entire employee journey. It simplifies new employee onboarding by automatically capturing and storing their payroll details, and ensures all final payments and tax documentation are handled correctly during offboarding.

Comprehensive compliance & expert support

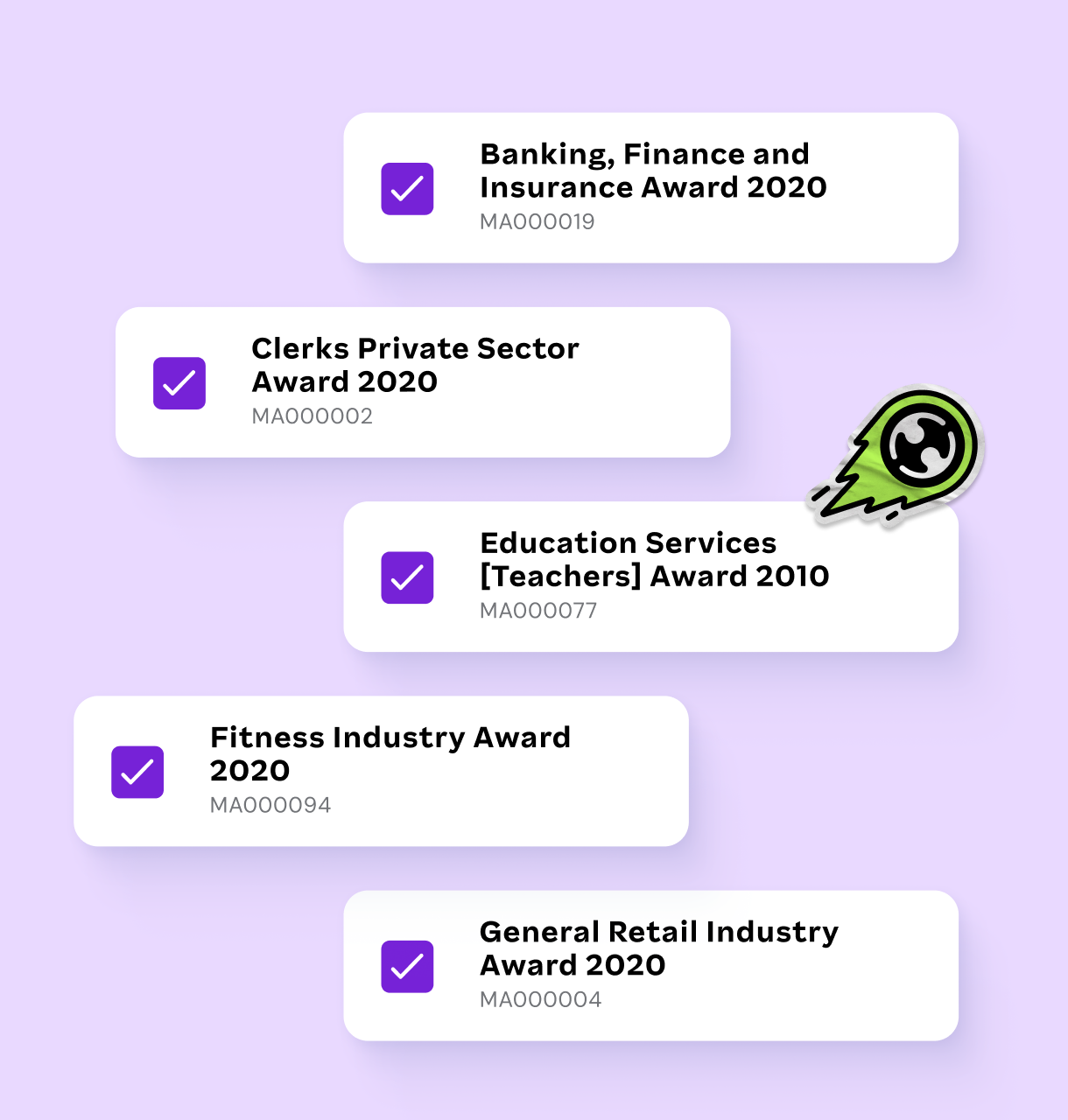

Advanced award & super compliance

Stop worrying about complex awards and penalty rates. Our payroll software includes built-in tools for award interpretation that automatically apply the correct rates for your industry, as well as manage Payday Super obligations for every employee. Our system manages all the updates for you, so your payroll is always fair and compliant.

End-to-end STP Phase 2

Our platform is an ATO-recognised software that automatically handles all aspects of Single Touch Payroll (STP) Phase 2 reporting. This ensures your business meets all legislative requirements without the hassle of manual data transfers.

Local expert support & managed payroll

Get dedicated support from a local team that truly understands Australian small business. Need a completely hands-off approach? Our in-house payroll experts can handle your entire process from start to finish with our Managed Payroll Service, giving you complete peace of mind.

Secure, smart & accessible payroll

Actionable financial insights

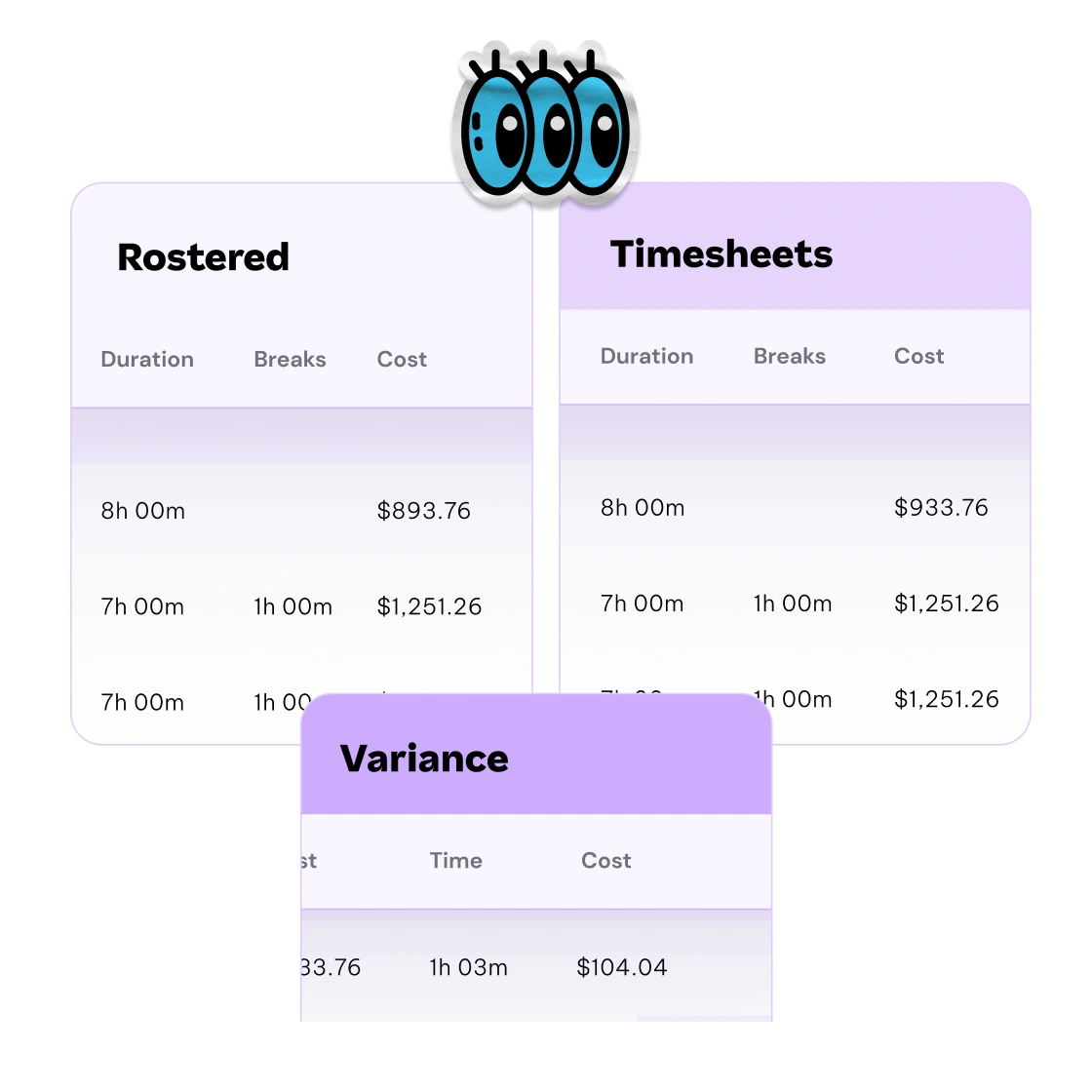

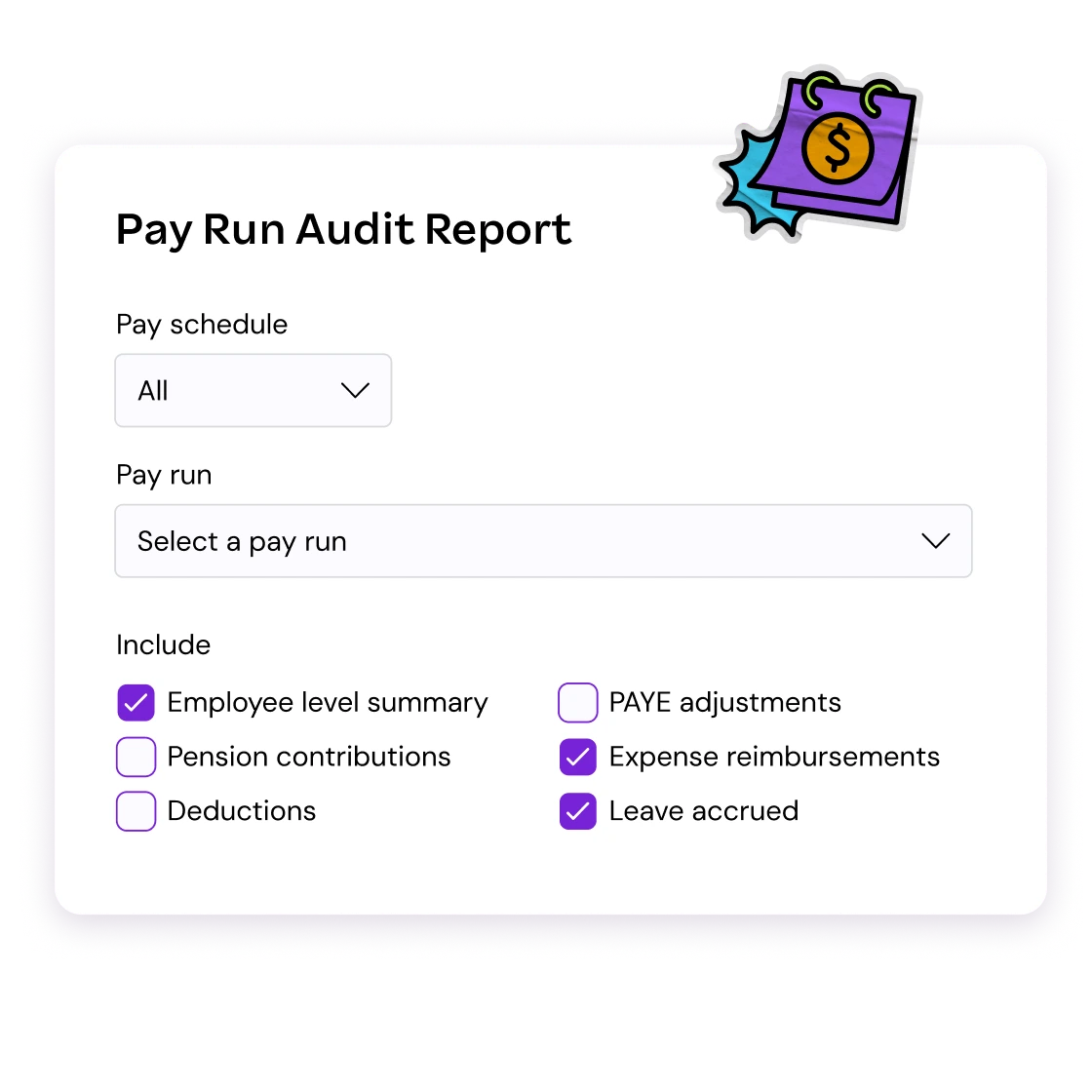

Don’t run your business in the dark. Our payroll software goes beyond simple reporting to give you valuable financial insights. You can easily access reports on pay run variances, budgets, and salary distribution to drive better, data-backed decisions for your business.

Your payroll data is always safe

Your employee’s sensitive data is our top priority. Our payroll platform is built with security at its core, with all data encrypted and stored on secure cloud servers. We also have access control, password protection, and disaster recovery plans to ensure your data is always safe.

The Employment Hero Work App

Empower your team and reduce administrative work with the Employment Hero mobile app. Your employees can access their payslips, manage personal details, and apply for leave directly from their phones. The app is a central hub for all employment needs, giving your team control and convenience.

Don’t just take it from us…

Future-Ready Payroll

Employment Hero isn’t just a tool; it’s the intelligent, all-in-one platform built for modern Australian businesses. You’ve seen how our seamless integration, smart automation, and uncompromising compliance take the stress out of payroll. We give you back time, protect your business from errors, and provide a partner who truly understands your needs. It’s time to find a smarter way to manage payroll.

Payroll in one smart system

Our powerful payroll is built into an all-in-one Employment Operating System, combining HR management, employee experience, and hiring in a single platform.

Less admin, more time

Our platform includes a mobile app where employees can access payslips and apply for leave, reducing your admin burden.

Compliant, not complex

We keep you compliant with Australian laws and automatically update for modern awards and pay rates.

Support when you need it

We give you local support and a team that truly gets small business, so you have real people to help when you need them.

Smart payroll integrations

Switch payroll solutions easily by importing employee time worked, leave taken and other employee details from your current payroll provider or accounting software into Employment Hero.

Payroll software FAQs

Payroll software is a smart way to automate and streamline your payroll processes. It takes care of calculating pay, managing taxes, leave management, generating payslips, and more – so you can focus on what matters most: growing your business.

Keeping up with changing legislation is tough -payroll software makes it easier. It helps you:

- Stay compliant with ATO rules and Single Touch Payroll (STP) reporting

- Automatically apply the latest PAYG and superannuation rates

- Meet Fair Work and award requirements with built-in compliance tools

- Avoid penalties with accurate record keeping and audit trails

Payroll software levels the playing field for small businesses. It helps you:

- Cut down on manual admin and reduce errors

- Track time and attendance more accurately (especially with shift workers)

- Access payroll data anytime, anywhere with secure cloud storage

- Scale easily as your team grows

- Keep all your records in one place – ready for audits or reviews

Yes. Our payroll platform is built with data security at its core:

- All sensitive data is encrypted and stored on secure cloud servers

- Access is controlled with password protection and role-based permissions

- Backups and disaster recovery plans help protect your data, always

Employment Hero Payroll is built for Aussie businesses. We’ve got you covered with:

- Single Touch Payroll (STP) Phase 2 reporting

- SuperStream compliance

- Award interpretation for modern awards and penalty rates

- Built-in support for PAYG, tax declarations, and more.

Yes – our payroll software is designed for today’s flexible workforce. You can easily manage:

- Full-time and part-time employees

- Shift-based and casual workers

- Independent contractors with PAYG or ABN setups

We make it easy to track every shift and hour worked:

- Integrated timesheets for accurate pay runs

- Roster syncing to calculate penalties, allowances, and overtime

- Employee self-service for submitting hours and requesting leave.

Absolutely. Employment Hero Payroll is 100% cloud-based, so you can log in from anywhere – whether you’re at the office, working from home, or on the go.

Yes – whether you’re managing a team of less than 10 or 150+, we have payroll software for small businesses up to large enterprise companies. Our payroll software adapts to your needs:

- Add new team members in seconds

- Integrate with accounting, HR, and rostering tools

- Customise settings for different pay groups or locations.

Because we’re not just a software provider – we’re your partner in people management. With Employment Hero, you get:

- Powerful payroll, HR management and hiring in one platform

- Built-in compliance with Aussie laws

- Local support and a team that truly gets small business

We know that switching payroll software can be daunting. We have a dedicated, step-by-step process to help you easily import your existing employee data from your current provider. Our Implementation Hub and local support team are here to guide you through a smooth and stress-free transition.

Yes. Our platform is designed to seamlessly integrate with a wide range of accounting and business software. This ensures that your payroll data flows directly to your general ledger, eliminating double-handling and manual exports at the end of each pay run.

Your employees get instant access to everything they need on the go. Through the Employment Hero Work App, they can view their payslips, submit leave requests, manage their personal details, and securely access other important documents. This reduces the time you spend on administrative requests.

EmploymentOS doesn’t just store payroll data — it runs pay cycles for you. Intelligent automation coordinates your employee data, calculates entitlements and helps guide your team through compliance checks and pay runs.

Security and privacy are core to the platform. We use enterprise-grade encryption, role-based access and compliance protocols to protect your payroll data.

Payroll tools, tips, templates.

-

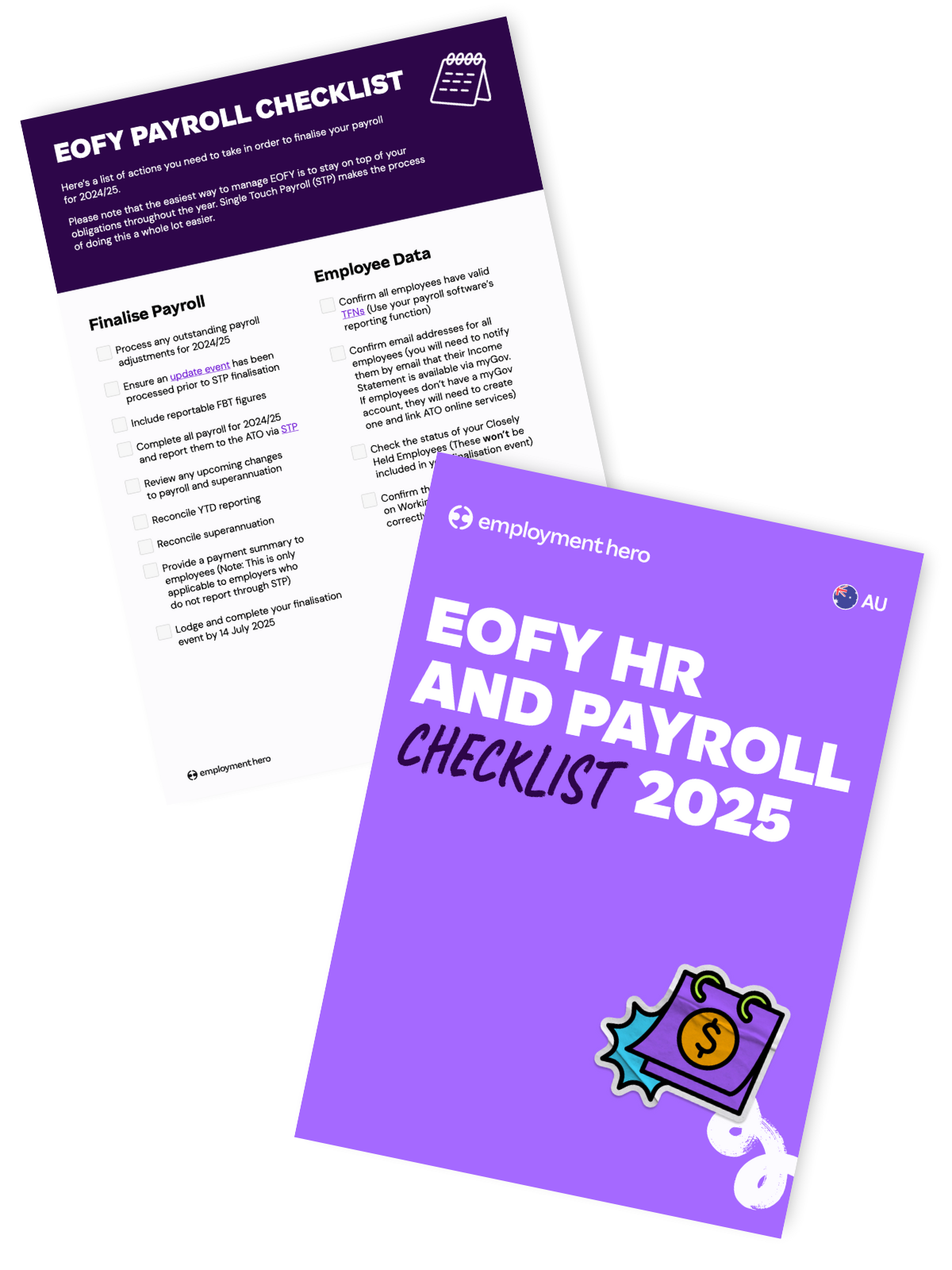

Read more: End of Financial Year HR and Payroll Checklist

Read more: End of Financial Year HR and Payroll ChecklistEnd of Financial Year HR and Payroll Checklist

Get organised this EOFY with our complete checklist.

-

Read more: How will AI change the payroll industry?

Read more: How will AI change the payroll industry?How will AI change the payroll industry?

Learn how AI is being used in payroll – and how you can make the most of it in your…

The real MVPs? The payroll heroes.

Power them with the only payroll built into an end to end Employment Operating System.