Public holiday pay guide for Australian employers in 2026

Published

Public holiday pay guide for Australian employers in 2026

Published

Managing public holiday pay shouldn’t be a compliance nightmare. For growing businesses, navigating the web of rules, rates and exceptions can be an exhausting and overwhelming process. This guide provides clear, actionable information on your public holiday pay obligations for 2026, so you can pay your team correctly and confidently.

We’ll cover your employer obligations, how to calculate correct pay rates across different awards and how to manage entitlements seamlessly.

What’s in the guide?

In the public holiday pay guide, we’ll cover:

- What is public holiday pay?

- Public holiday rates for popular awards

- Public holiday entitlements

- How to calculate public holiday pay

What is public holiday pay?

Public holiday pay refers to the specific payment entitlements for employees on days declared as public holidays. Under Australia’s National Employment Standards (NES), which are a key part of the Fair Work Act 2009, employees have clear rights related to these days. These standards are designed to compensate employees for working on days typically reserved for rest or celebration.

For permanent full-time and part-time employees, this includes the right to a paid day off if the public holiday falls on a day they would normally work. As an employer, you can request an employee to work on a public holiday if the request is reasonable. An employee can also refuse a request to work if their refusal is reasonable. The Fair Work Ombudsman provides guidance on what determines “reasonable,” including the nature of your business, the employee’s personal circumstances and the notice given.

Correctly managing public holiday pay is a fundamental obligation. Non-compliance can result in substantial penalties and back-pay claims.

Public holiday rates for popular awards

Modern Awards are the primary source for industry-specific pay rates. Let’s look at the requirements under some common awards.

Hospitality Industry (General) Award [MA000009]

The hospitality industry operates around the clock, making public holiday management crucial.

- Full-time and part-time employees: If they work, they’re typically paid 225% (double time and a quarter) of their minimum hourly rate.

- Casual employees: If they work, they are paid 250% (double time and a half) of their minimum hourly rate, which includes their casual loading.

General Retail Industry Award [MA000004]

Retail often relies on public holiday trade, which comes with specific payroll obligations.

- Full-time and part-time employees: Employees working on a public holiday are generally paid 225% of their minimum hourly rate.

- Casual employees: Casuals working on a public holiday are generally paid 250% of their minimum hourly rate, inclusive of their casual loading.

Clerks – Private Sector Award [MA000002]

For office-based businesses, public holidays are usually non-working days. When employees are required to work, specific rates apply.

- Full-time and part-time employees: An employee who works is paid 250% (double time and a half) of their minimum hourly rate.

- Casual employees: A casual working on a public holiday must be paid 275% of their minimum hourly rate, including their casual loading.

Health Professionals and Support Services Award [MA000027]

Healthcare is an essential service that operates continuously. Pay rates reflect the need for staff availability.

- Full-time and part-time employees: Employees working on a public holiday are generally entitled to 250% of their minimum hourly rate.

- Casual employees: Casuals are typically paid 275% of their minimum hourly rate, inclusive of casual loading.

Public holiday entitlements

Understanding entitlements beyond pay rates is essential for compliant rostering.

Payment for absence on a public holiday

If a public holiday falls on a day a permanent employee would ordinarily work, they are entitled to a paid day off. This payment is for their ordinary hours at their base rate. You cannot require an employee to use annual leave for this.

Some awards provide that employees are entitled to be paid for being absent on a public holiday, even if it isn’t the employee’s normal work day, so it’s important you check your modern award carefully.

An effective leave management software can help track these entitlements accurately, ensuring your records are always up to date. For a deeper dive into managing leave, developing a clear leave policy is a great first step.

Entitlements for casual employees

Casual employees have different rules. They don’t have guaranteed hours and are not entitled to payment for public holidays they don’t work. However, they can reasonably refuse a shift on a public holiday. If they choose to work, they must be paid the correct penalty rate.

Substituting public holidays

The Fair Work Act allows for substituting public holidays. An employer and employee can agree in writing to substitute a public holiday for another day. This provides flexibility for businesses needing to operate and for employees who prefer a different day off. The substituted day is then treated as the public holiday.

Public holidays in Australia for 2026

Australia has national and state-based public holidays. Below are the key dates for 2026. Always check your state or territory government website for local and regional holidays.

National public holidays 2026

- New Year’s Day: Wednesday, 1 January

- Australia Day: Monday, 26 January

- Good Friday: Friday, 3 April

- Easter Monday: Monday, 6 April

- Anzac Day: Saturday, 25 April

- Christmas Day: Friday, 25 December

- Boxing Day: Saturday, 26 December (public holiday rolls over to Monday, 28 December in most states)

State/Territory public holidays or 2026

- King’s Birthday: Varies by state (typically June, but September for WA and October for QLD).

- Labour Day: Varies by state (e.g., March in VIC, May in QLD, October in ACT, New South Wales & SA).

- Canberra Day (ACT): Monday, 9 March

- Western Australia Day (WA): Monday, 1 June

- Melbourne Cup (VIC): Tuesday, 3 November (in some parts of Victoria).

- Holidays like Christmas Eve or New Year’s Eve may have special part-day provisions in certain awards or locations. When Anzac Day, Australia Day or Boxing Day fall on a weekend, an additional public holiday is often declared on the following Monday.

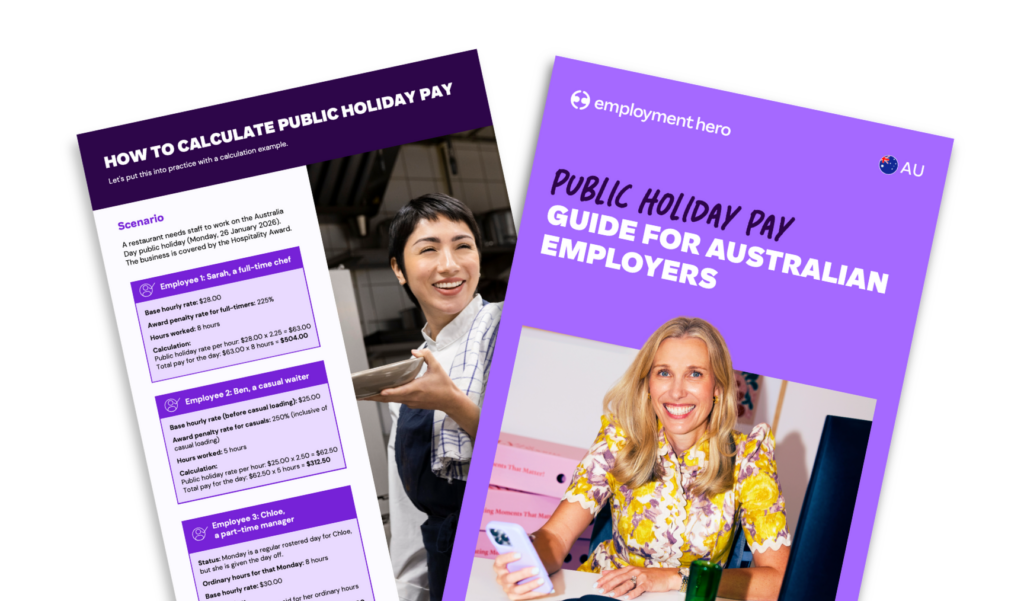

How to calculate public holiday pay

Calculating public holiday pay correctly is essential for staying compliant with the Fair Work Act 2009 and ensuring your employees are fairly compensated. The exact calculation depends on whether your employee works on the public holiday or takes the day off.

1. If the employee doesn’t work

Most full-time and part-time employees are entitled to take the public holiday off at their base pay rate for the ordinary hours they would normally have worked. This means you simply pay their regular daily rate (no penalties or loadings apply).

Casual employees generally don’t receive pay when they don’t work on a public holiday, unless their award or agreement says otherwise.

2. If the employee works on the public holiday

Employees who work are usually entitled to a public holiday penalty rate, which is higher than their standard rate of pay. The exact percentage (for example, double time or double time and a half) depends on the modern award or enterprise agreement covering their role. These rates compensate employees for working when most others are off.

3. Alternative arrangements

In some cases, an employee and employer may agree to take another paid day off (a substitute day) instead of receiving penalty rates.

This must be agreed in writing and in line with the applicable award or agreement.

4. Include leave considerations

If a public holiday falls during an employee’s period of annual leave, it must be treated as a public holiday, not as annual leave. Employees also can’t be required to work unreasonable hours on public holidays — they can refuse if the request isn’t reasonable.

Automating these calculations with payroll software can reduce the risk of errors and can support you meeting your obligations. For businesses wanting to offload this entirely, a managed payroll service can handle everything from calculations to reporting, including complex entitlements like long service leave.

Take control of your public holiday payroll

Managing public holiday pay doesn’t need to be a complex burden. With the right knowledge and tools, you can handle your payroll with confidence. For a more detailed breakdown, our complete payroll guide offers more handy information.

Stop letting complex rules slow you down. Build a payroll process that is seamless, easy and works for you. For an easy-to-use reference, download our complete guide.

Disclaimer: The information in this guide is current as at October 2025, and has been prepared by Employment Hero Pty Ltd (ABN 11 160 047 709) and its related bodies corporate (Employment Hero). The views expressed in this guide are general information only, are provided in good faith to assist employers and their employees, and should not be relied on as professional advice. The Information is based on data supplied by third parties. While such data is believed to be accurate, it has not been independently verified and no warranties are given that it is complete, accurate, up to date or fit for the purpose for which it is required. Employment Hero does not accept responsibility for any inaccuracy in such data and is not liable for any loss or damages arising either directly or indirectly as a result of reliance on, use of or inability to use any information provided in this guide. You should undertake your own research and to seek professional advice before making any decisions or relying on the information in this guide.

Register for the guide

Related Resources

-

Read more: Employee development plan: Examples and template

Read more: Employee development plan: Examples and templateEmployee development plan: Examples and template

Discover real employee development plan examples, strategic frameworks and a free template to empower growth in your team.

-

Read more: The Payday Super Shift: 2026 Employer Readiness Report

Read more: The Payday Super Shift: 2026 Employer Readiness ReportThe Payday Super Shift: 2026 Employer Readiness Report

New research on the cash flow risk and compliance gaps facing Australian employers. Download the report now and access industry…

-

![Restaurant Industry Award Summary [MA000119]](https://employmenthero.com/wp-content/uploads/2026/02/Award-Summary_Restaurant-Industry.webp) Read more: Restaurant Industry Award Summary [MA000119]

Read more: Restaurant Industry Award Summary [MA000119]Restaurant Industry Award Summary [MA000119]

This Award primarily applies to businesses operating restaurants, cafés and similar establishments, but also extends to employees performing similar roles.