Payroll software for small businesses.

Payroll doesn’t need to be a headache. Employment Hero’s Intelligent payroll software automates tax, super and compliance so you can run pay in minutes. Prefer to take payroll off your plate? You can outsource payroll to our managed payroll experts.

We’ve designed payroll to be easier for small businesses

Automated payroll that saves time

Spend less time on spreadsheets and run payroll faster with payroll automation. Review, approve and pay staff in just a few clicks.

Simple for anyone to use

No finance team? No problem. Our software is designed for busy business owners, not payroll experts.

Staff paid right, every time

Automate awards, deductions and entitlements so you never worry about errors or underpayments.

Everything you need to run payroll with confidence

Automated compliance

From STP Phase 2 to PAYG, super, deductions and award interpretation, compliance is built ATO-certified reports and secure records give you peace of mind.

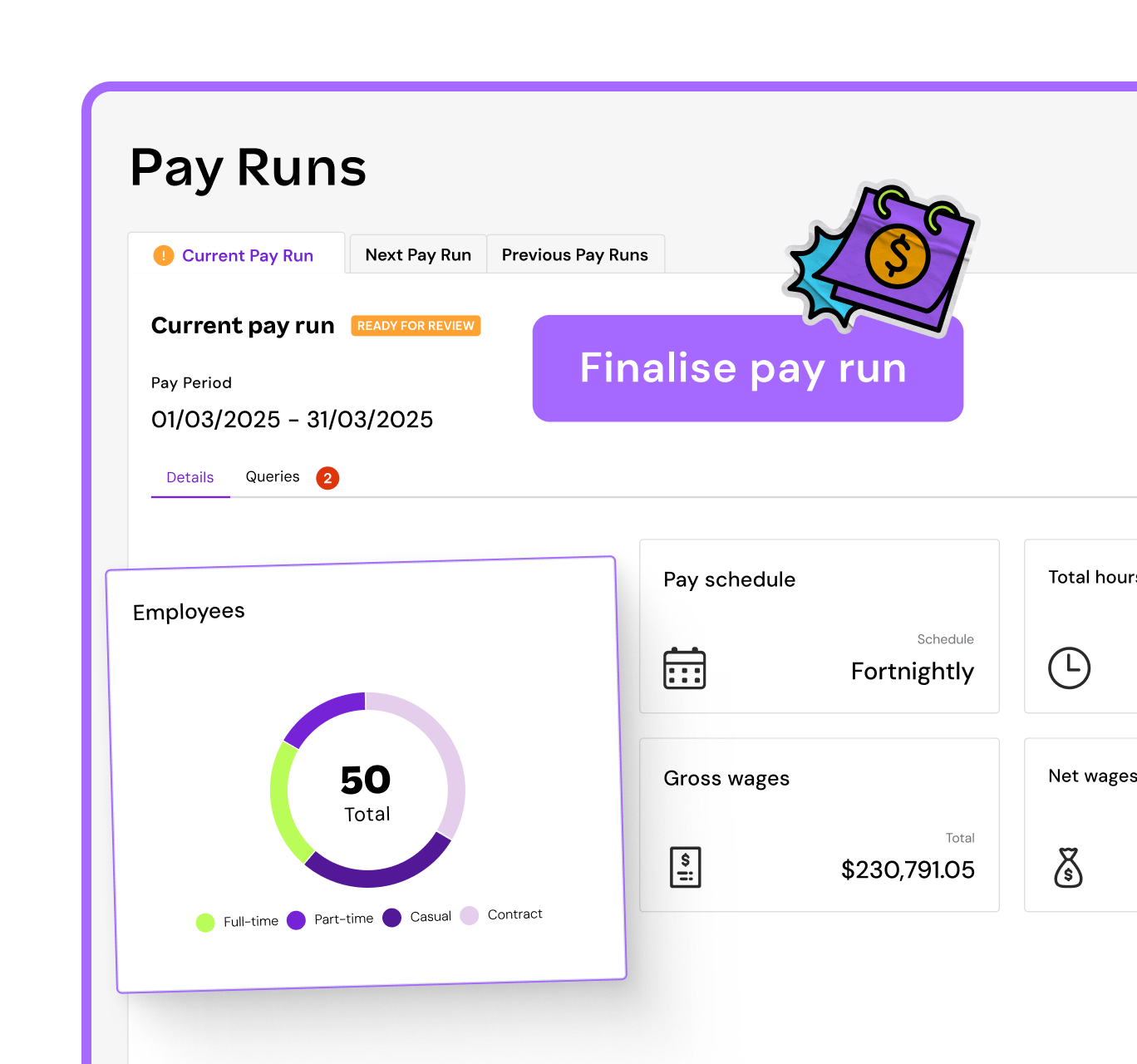

Pay cycles that fit your team

Run payroll weekly, fortnightly or monthly – the software adapts to your business, not the other way around. Generate payslips in seconds.

Less admin with connected tools

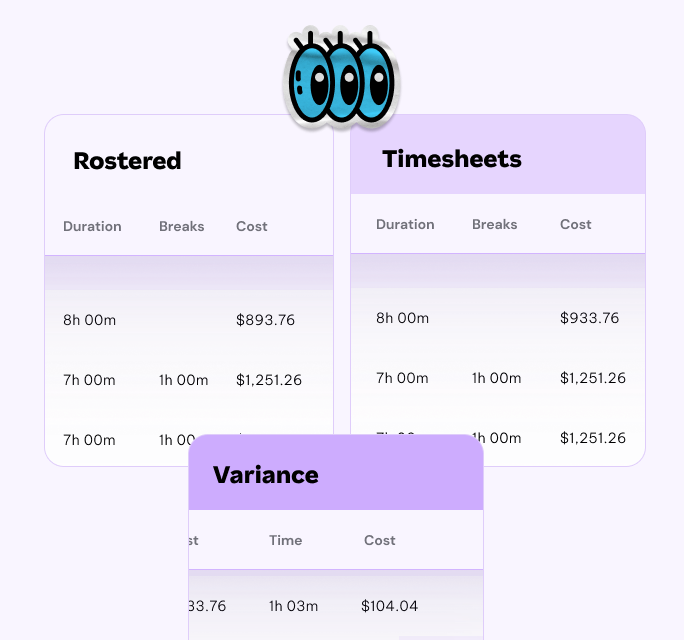

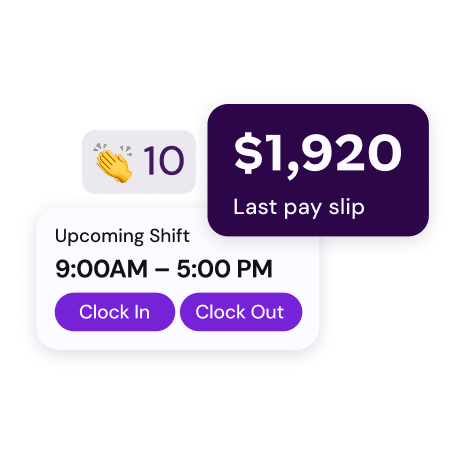

Cut out manual work. Staff can request leave, record hours with our integrated time and attendance software, and check their shifts with employee rostering. Everything connects seamlessly to payroll, so pay runs are fast and error-free.

Payroll that grows with your small business

Start with payroll, then add HR software, hiring tools and more as your team expands. Prefer a hands-off approach? Our Managed Payroll service can do it all for you.

TRUSTED BY 300k+ HAPPY CUSTOMERS

Small business payroll support you can rely on

Easy setup and migration

Switching systems doesn’t have to be stressful. Our team will guide you through importing employee data, setting up pay rules and getting everything ready for your first pay run – quickly and accurately.

Your data stays safe

Payroll involves sensitive information, and we take that seriously. All data is encrypted, backed up, and stored securely in the cloud, with strict access controls so only the right people can see it.

Expert help when you need it

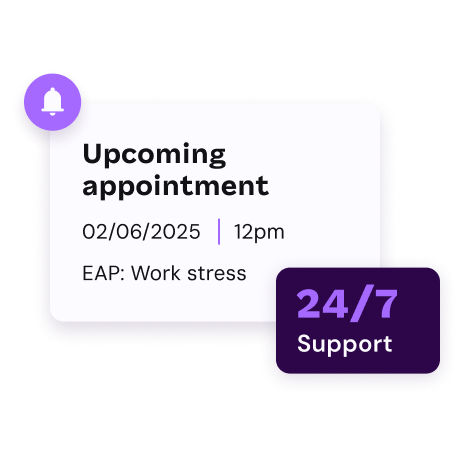

You’ll never be left on your own. Our local payroll specialists understand small business and are here to answer questions, troubleshoot issues and give you the confidence that everything’s running smoothly.

Payroll off your plate by experts

Don’t want to handle payroll yourself? With Managed Payroll, our in-house experts can take care of the entire process for you – from pay runs to ATO reporting – so you can focus on growing your business.

Payroll FAQs for small businesses

Yes – our platform is designed for business owners without payroll experience. It’s simple, intuitive, and guides you through each pay run.

Absolutely. Our Implementation Hub and support team will help you import employee details and set up quickly, without stress.

Our pricing is small-business friendly, with flexible plans that scale as your team grows. See our pricing page for more details.

Yes. Employment Hero integrates with major accounting platforms so your payroll data flows straight into your books.

Most small businesses aren’t liable until total wages exceed state or territory thresholds. If your business does reach that point, Employment Hero can help you stay compliant.

Absolutely – if you’d rather not manage pay runs at all, you can outsource payroll or have it handled by our Managed Payroll team.

Refer your clients or business network to us and get rewarded for every successful referral.

Let us solve your clients HR & Payroll problems, making you look like the hero.

Small business payroll tools, tips & insights

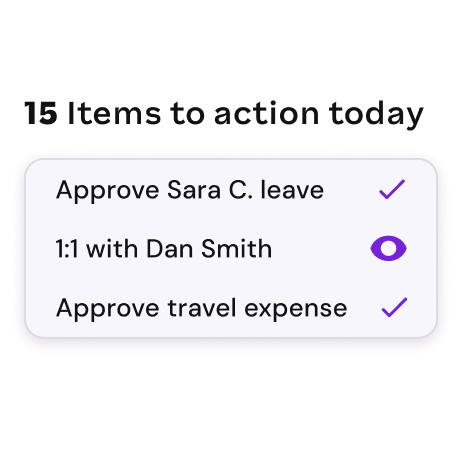

Never run another pay run again. We handle it all: you simply approve

Manage all payroll tasks from one place with automated data flows and error alerts., Make paying your people faster and worry-free.

AI-powered payroll automation and expert oversight for accuracy and compliance.

Centralised access to pre-payroll data like timesheets, leave, and rostering.

Automated bank transfers, compliance reporting, and more.

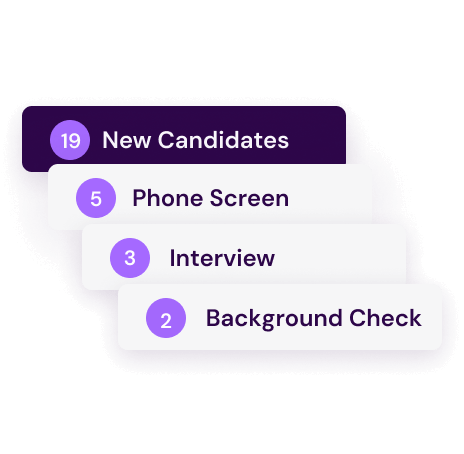

Hiring on autopilot.

Take people from Hi to Hired without switching tabs.

Get instant access to talent. Save time and cut costs

Curated talent shortlists, automation, and more

Manage open roles, interviews, and onboarding from one place

Hire smarter with salary insights and candidate matches for every role

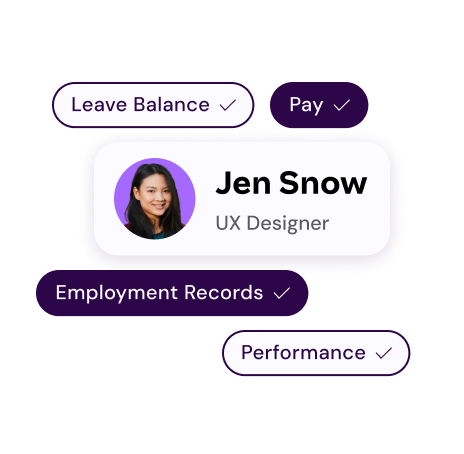

Make work feel less like work.

We’ve made work admin a breeze. Forget paper-based processes and lost leave requests: give your team self-service access to all their important HR and Payroll tasks.

All employee data is housed in a single, secure platform

Automate leave requests, performance reviews, and onboarding.

Centralise and share company policies and essential documents

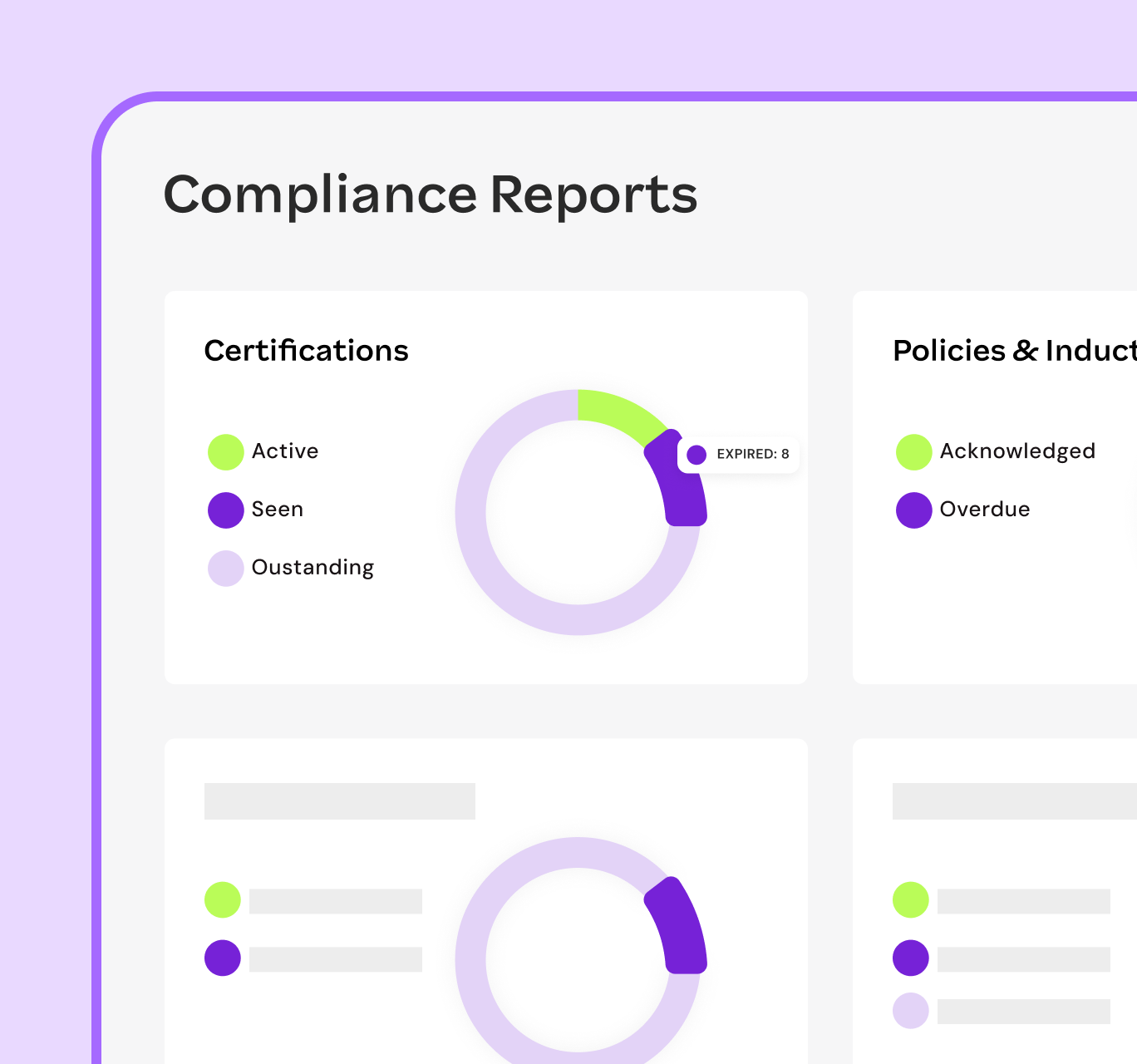

Workforce analytics and reports to help leaders make data-driven decisions.

Be the employer everyone wants to work for.

You offer the employment – we’ll bring the benefits

Employees can access everything they need through an intuitive self-service portal

Keep your team engaged and motivated with world-class benefits

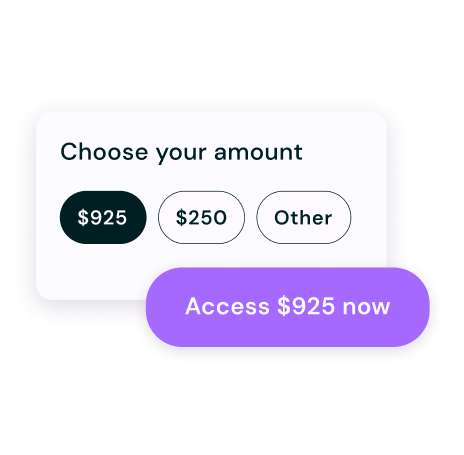

Give your team flexible, on-demand access to their earned wages

Increase morale, productivity, and loyalty with an employee assistance program.

Work made easy

Employment Hero is an all-in-one HR and payroll platform for Aussie businesses.