Earned Wage Access

Giving your team a flexible, on-demand access to their earned wages? That’s a forward thinking approach to employment benefits.

What is Earned Wage Access?

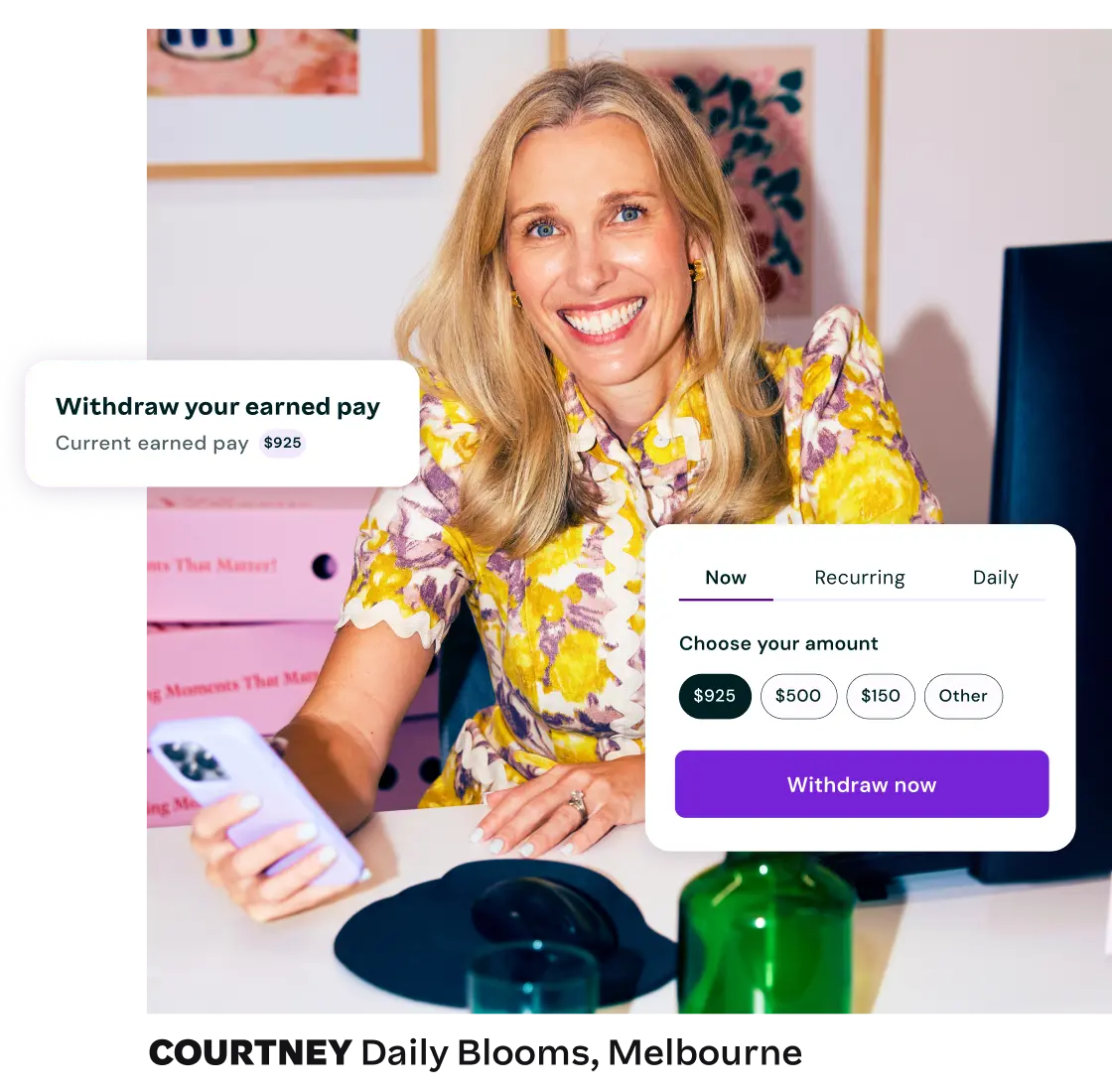

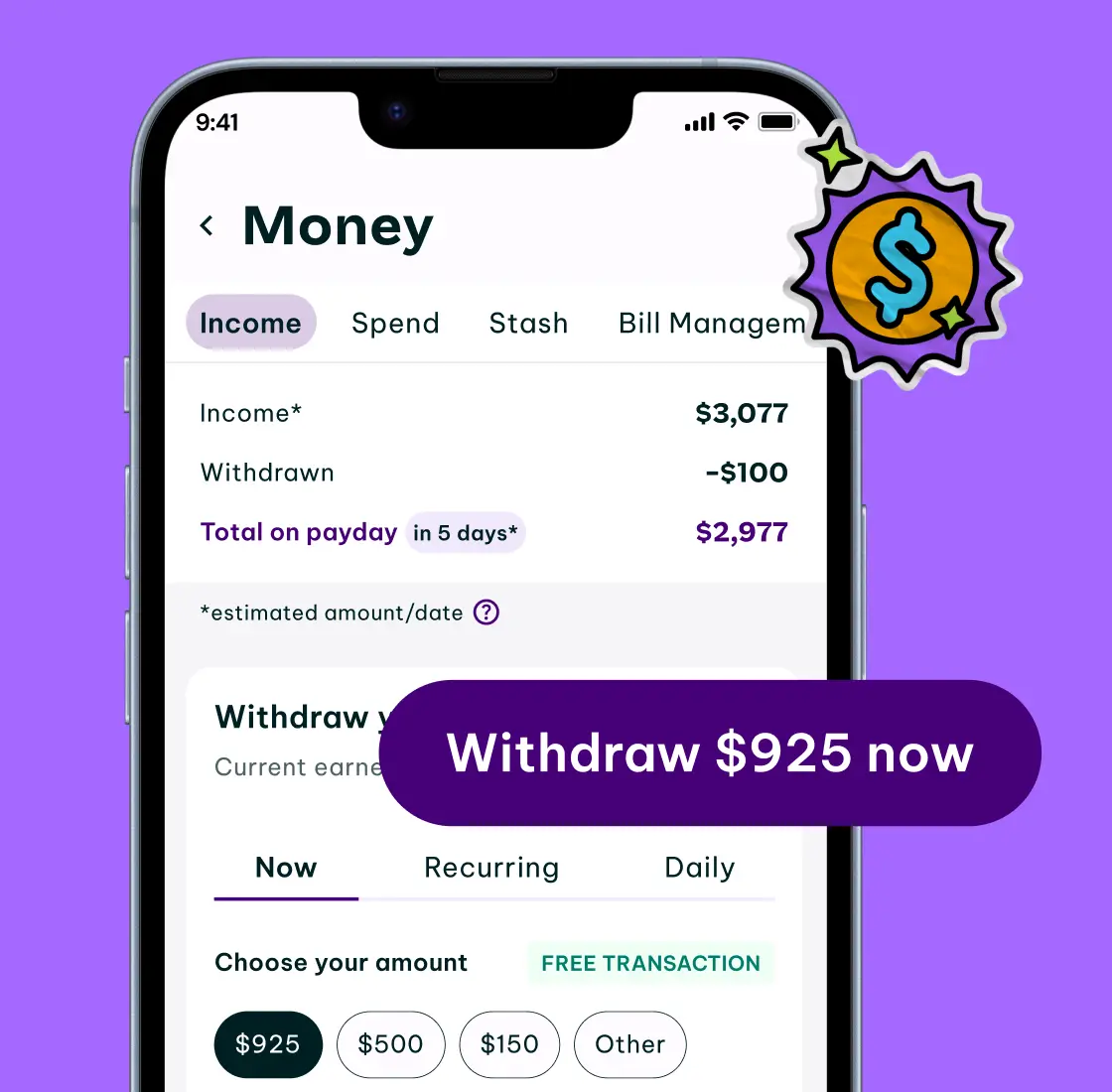

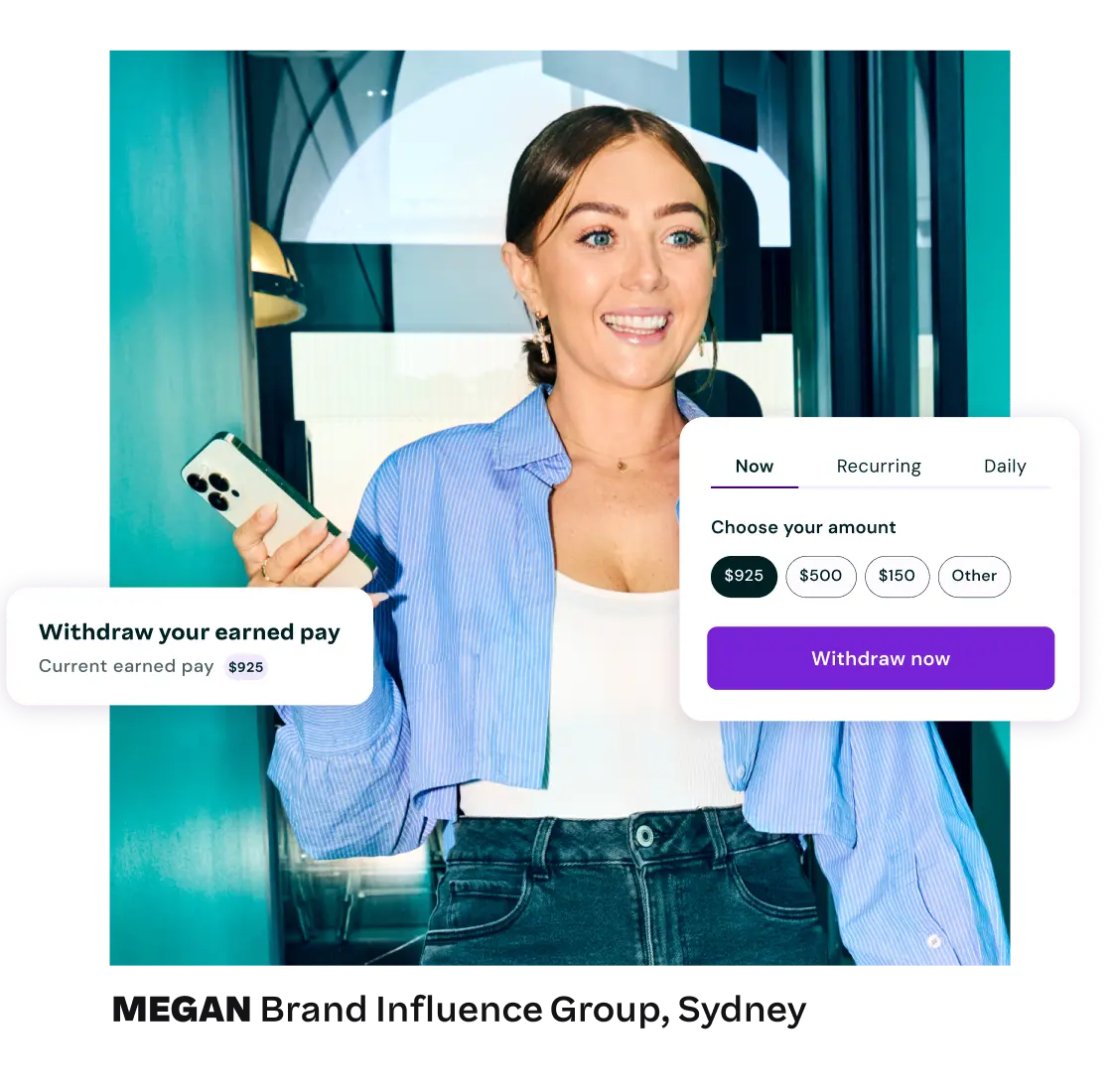

Earned Wage Access is available via Employment Hero Work, our mobile app, and is available to employees of organisations using Employment Hero HR and connected Payroll. Giving your team a flexible, on-demand way to access their pay as soon as they’ve earned it.

For a 1.3-1.5% fee per transaction,* your employees can request up to 50% of their earned wages, which is capped at a maximum of $1000 per week.

Supporting financial flexibility

EWA is a straightforward concept: it lets employees access their earned wages before their regular payday.

This isn’t like outdated payday loans or Buy Now, Pay Later schemes — it provides your team a safety net without the debt trap or interest risk.

Provide meaningful employee benefits with EWA

“If I can access my pay early… that’s going to provide us with a point of difference to other businesses out in the marketplace, especially during recruitment and wage review periods.” – Tanya McCombe, HR Manager, Macadamia Farm Management

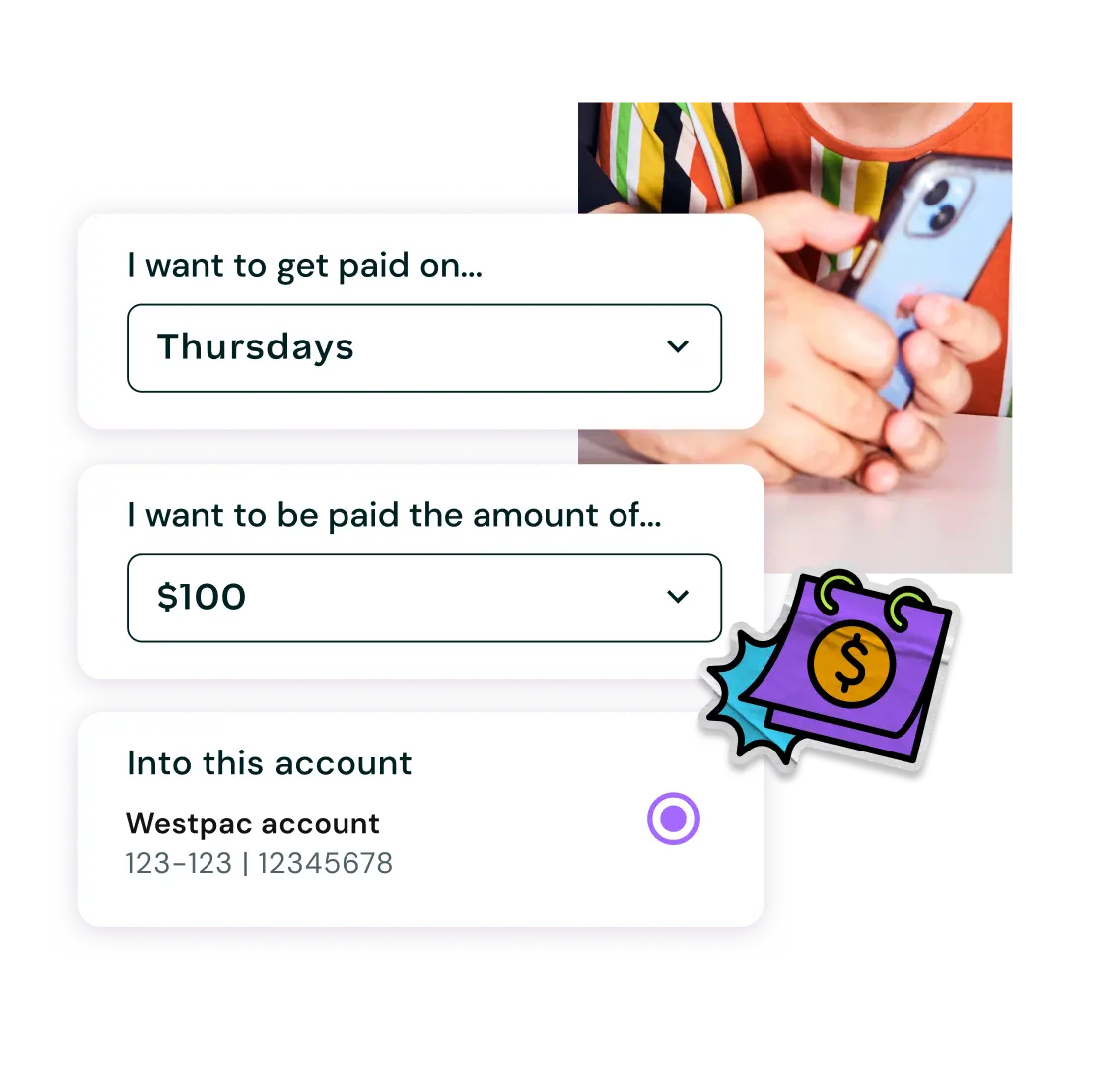

How do employees access it??

- Log into the Employment Hero Work app.

- Tap Money.

- Tap income.

- Enter the amount you want and where you’d like to send it.

- Follow the prompts to finalise.

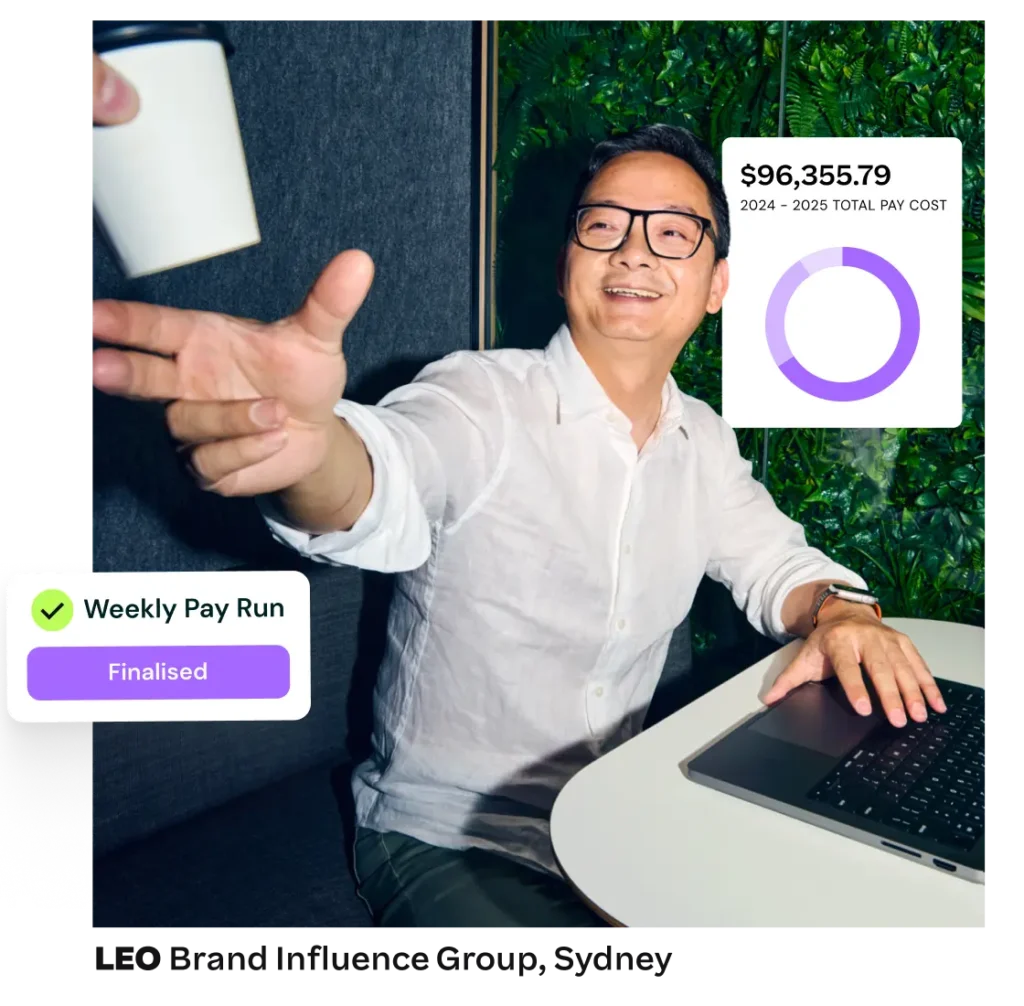

What does my payroll team need to know?

There’s no extra admin. When a user requests access to their earned wages, Employment Hero funds that request to the users nominated account.

The withdrawals are then automatically recorded as a deduction in the payroll system in the next pay cycle.

For more details, check out the below guide.

What are the fees and charges?

Users pay a 1.3% per transaction into a Swag Spend account and 1.5% per transaction into an external bank account.

Why do we offer Earned Wage Access?

Helping address financial strain

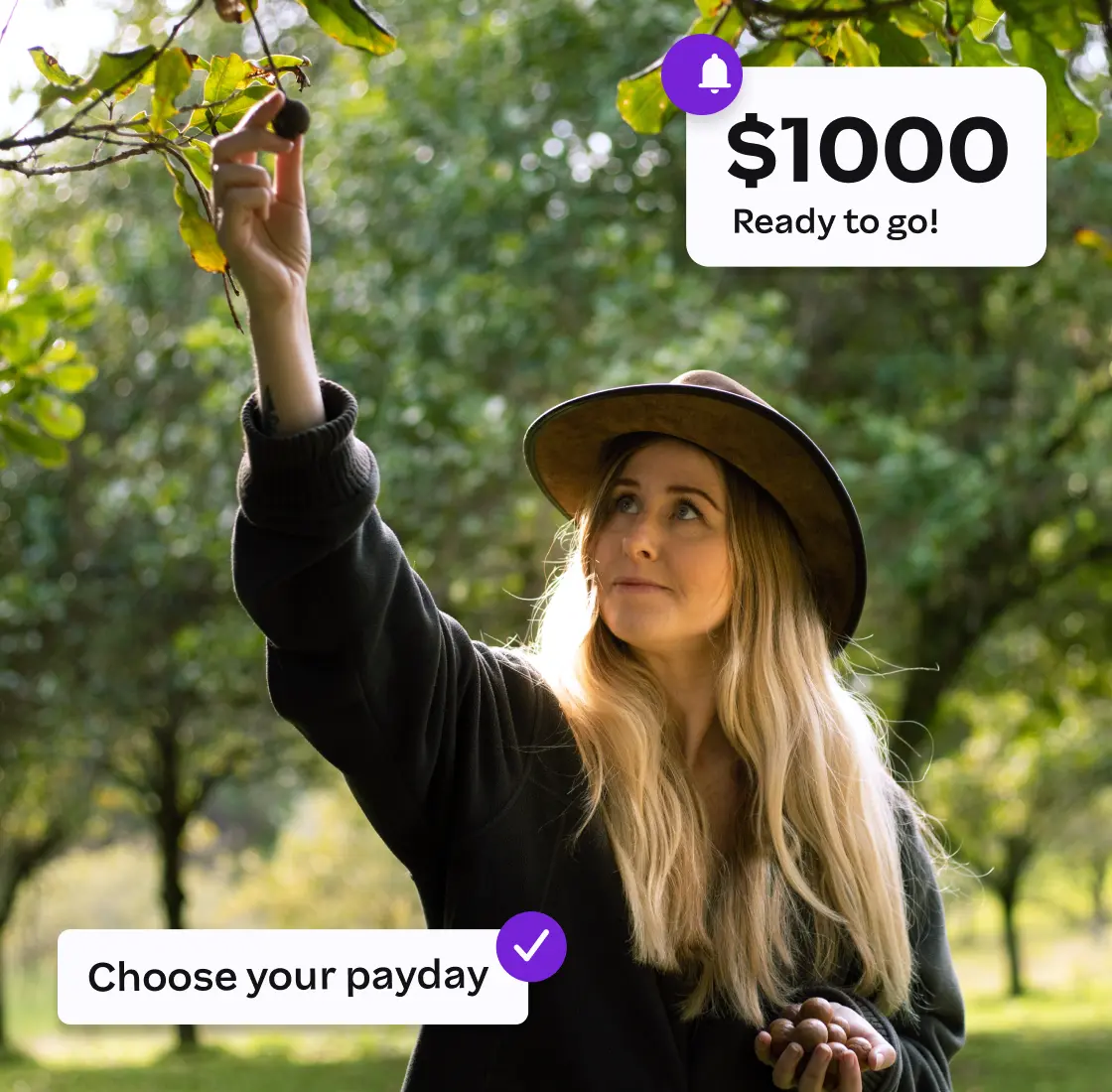

Employees get real-time payments for the work they’ve done, which promotes better budgeting and reduces reliance on short-term credit to bridge the payday gap.

Earned Wage Access is a 100% credit-free, interest-free option that gives employees access to their own earned wages.

No extra pay run effort

Access to earned wages integrates seamlessly with your existing payroll process, making it an easy benefit for your team without adding extra work for you.

Your team simply request access to a portion of their earned wages via our app.

The maximum withdrawal is $1000 per week, up to 50% of an employees owed pay.

Terms & Conditions

*Earned Wage Access is only available to employees that have an employer that uses Employment Hero payroll software. Access to Earned Wage Access for employees is via the Employment Hero Work app only. Earned Wage Access is not a credit product, and there are no related interest charges. Earned Wage Access fees are 1.3% per transaction into a Swag Spend account and 1.5% per transaction into an external bank account. Earned Wage Access terms and conditions are here.

If an employee has a termination date entered into the Employment Hero payroll system, Earned Wage Access will be disabled.

50% of your unpaid net pay owed is eligible for Earned Wage Access, with a weekly withdrawal limit of $1000. Earned Wage Access will show as a payslip deduction on your next payslip.

Earned Wage Access ‘Available funds’ is an estimated total amount of money eligible for withdrawal, based on the amount of time you have worked, but have not yet been paid for in the current pay period. For salaried employees, Earned Wage Access calculates as a proportion of your salary for the total number of days worked in the pay period.

Earned Wage Access terms and conditions are here.

Earned Wage Access FAQs for employees can be found here.

**Any general advice or factual information we provide has been prepared without taking into account your objectives, financial situation or needs. Before acting on any information, you should consider whether it is appropriate for you. Before making any decision about whether to acquire one of Employment Hero’s products, you should obtain and read the relevant terms and conditions relating to that product and also seek independent financial, legal and taxation advice.