Fringe Benefits Tax Guide For Employers [Free Employee Gifting eBook]

Published

Fringe Benefits Tax Guide For Employers [Free Employee Gifting eBook]

With the holiday season quickly approaching, you’re probably thinking about how you can best reward and recognise your employee’s hard work.

We know that the fringe benefits tax can sometimes make this hard depending on how you approach your end-of-year reward and recognition program.

Fringe benefits are an important part of any business and can be a useful way of attracting and retaining quality employees.

However, if you’re going to provide fringe benefits to your staff, there’s vital information you need to know about the taxation obligations.

Learn how to streamline HR processes and reduce admin in our free guide here.

What will you learn about Fringe Benefits Tax with our guide?

There’s more to employee gifting than simply giving a gift to your team. There are regulations and tax obligations in place that all businesses must abide by.

This guide has the information you need to help understand employee gifting and the fringe benefits tax (FBT).

The Guide to Employee Gifting and the Fringe Benefits Tax (FBT) will cover:

- What are fringe benefits

- Things to consider when giving gifts

- Employee Christmas gift ideas

Download the guide now.

Find out more about the Small Business Technology Investment Boost announced in the Federal Budget here.

What are Fringe Benefits?

While it might seem confusing at first, a fringe benefit can simply be defined as a: ‘payment’ to an employee, but in a different form than salary or wage.

Who pays Fringe Benefits Tax (FBT)?

Fringe Benefits Tax (FBT) is paid by employers on certain benefits they provide to their employees.

Read more: Is it time to hire an accountant?

What is Fringe Benefits Tax (FBT)?

How does Fringe Benefits Tax work? FBT is separate from income tax and is calculated on the taxable value of the benefits that you provide your employees.

Some common examples of fringe benefits include:

- Allowing an employee to use a work car for private purposes

- Giving an employee a discounted loan

- Paying an employee’s gym membership

- Providing entertainment by way of free tickets to concerts

- Reimbursing an expense incurred by an employee, such as school fees

- Giving benefits under a salary sacrifice arrangement with an employee.

Note: This information and these examples were provided by the ATO and current as of August 2020.

What constitutes a fringe benefit can be complex and change at any time, you should consider getting professional advice on the specific requirements for your business.

Although we won’t go into all the ins and outs of fringe benefits tax, there is one area of fringe benefits we’d like to explore today, the minor fringe benefits exception.

Read more: Why bookkeeping is important for businesses

Minor benefits exemptions

Rewarding your staff doesn’t have to have to be a big affair. Sometimes a small gift is just the perfect thing to give staff that little holiday ‘boost’. They’ll go into the new year feeling appreciated and who doesn’t want that?

Many small gifts are exempt from tax, and you may already be exempt from paying fringe benefits tax on certain items. Keep reading to find out what defines a minor benefits exemption.

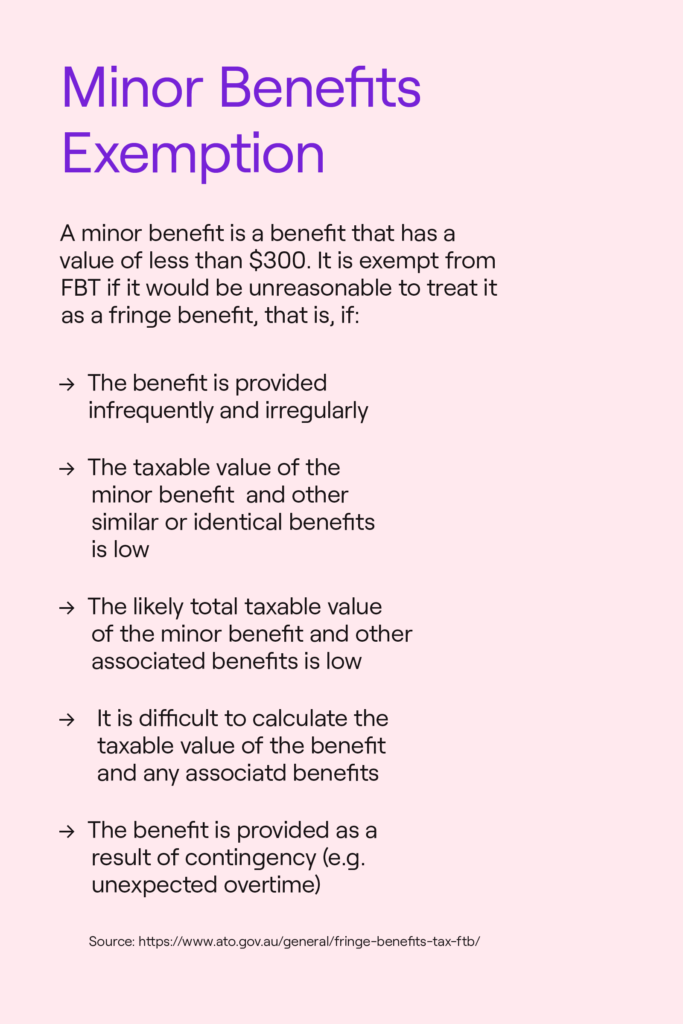

A minor benefit is a benefit that:

- Has a value of less than $300;

And it would be unreasonable to treat it as a fringe benefit if:

- The benefit is provided infrequently and irregularly

- The taxable value of the minor benefit and other similar or identical benefits (if they were treated as fringe benefits) is low

- The likely total taxable value of the minor benefit and other associated benefits is low (associated benefits are those provided in conjunction with the minor benefit, for example, electricity and telephone benefits provided as part of an accommodation package)

- It is difficult to calculate the taxable value of the benefit and any associated benefits

- The benefit is provided as a result of a contingency (for example, unexpected overtime)

Source: Minor benefits exemption, ATO, January 2023

Essentially, this exemption means that items of less than $300 delivered as part of employee reward and recognition would typically be exempt from FBT.

There are a few ifs, buts and maybes so you should check out the details here. But the one to look out for is that you’re not providing a bunch of similar benefits on a regular recurring basis in a year.

Keep in mind that this exemption isn’t meant to be a way for employers to deliver meaningful remuneration to employees on a tax-exempt basis.

But if you’re simply providing a small recognition of an employee’s extra effort or an anniversary or birthday gift, it’s worth considering if this exemption could apply to you.

Looking for ways to power-up employee engagement on a budget? Check out these effective, low-cost strategies here.

Fringe Benefits Tax and Christmas

Tis’ the season to be jolly and it can be hard to know what things qualify for fringe benefits tax and what falls under the minor benefits exemption.

Thankfully, the ATO have a handy blog around this topic which you can read here: Work Christmas parties and FBT

It’s important to understand that depending on how you choose to celebrate Christmas, there’ll be multiple variables for your business to consider come tax time.

To understand the priorities of Australian SMEs and their views on the Federal Budget and election, download our factsheet here.

What Qualifies as a Fringe Benefit?

Fringe benefits are non-wage perks employers offer, going beyond legally required benefits. These packages vary widely among organisations.

Tax-Exempt Fringe Benefits

Certain fringe benefits are tax-exempt, including:

- Travel and transportation expenses

- Stock options

- Health, life, and disability insurance

- Education assistance

Examples of Fringe Benefits

- Employee Stock Options – Discounted company shares with growth potential.

- Transportation Assistance – Coverage for commuting costs like fuel, parking, or transit.

- Free or Discounted Meals – Complimentary or subsidised food and snacks.

- Gym Memberships – Access to fitness facilities or memberships.

- Tuition Assistance – Financial help for further education or certifications.

- Insurance Plans – Affordable health, dental, or vision coverage.

- Childcare Reimbursement – Help with childcare costs or onsite daycare.

- Company Vehicle – For roles involving frequent travel.

- Unlimited PTO – Flexible leave policies tied to performance.

- Employee Discounts – Reduced prices on company products or services.

- Discounted Amusement Park Tickets – Encourages work-life balance.

- Retirement Contributions – Employer-matched or funded savings plans.

- Company Cell Phone – Covers work-related communication expenses.

- Relocation Assistance – Help with moving expenses for job relocations.

- Lodging Benefits – Subsidised stays for work-related travel.

- Paid Sick Days – Additional leave for health-related absences.

Fringe benefits not only attract and retain talent but also boost employee satisfaction and loyalty, making them an essential part of competitive compensation.

The Wrap Up

When dealing with employment tax requirements such as FBT, it’s always best to consult an expert.

Make sure you have all the right information before you start and always consult the ATO for any questions or queries.

For a comprehensive overview on transforming your practice from compliance to advisory, check out our guide here.

If you’re looking at end-of-year rewards and recognition for your employees, using a payroll platform such as Employment Hero can help you.

Disclaimer: While due care has been taken in preparing the resource, no responsibility is accepted by the author for the accuracy or suitability of the information contained. All liability is expressly disclaimed for any loss or damage which may arise from any person relying on, using or acting on any information contained therein. If you are unsure about how this information applies to your specific situation please seek expert advice.

And if you need further advice on how to do right by your business, download our Guide To Employee Gifting and Fringe Benefits Tax today.

To download the guide, we just need a few quick details:

Related Resources

-

![Manufacturing and Associated Industries and Occupations

Award Summary [MA000010]](https://employmenthero.com/wp-content/uploads/2026/01/Award-Summary_Manufacturing-Industry.webp) Read more: Manufacturing and Associated Industries and Occupations Award Summary [MA000010]

Read more: Manufacturing and Associated Industries and Occupations Award Summary [MA000010]Manufacturing and Associated Industries and Occupations Award Summary [MA000010]

The Manufacturing Industry Award covers employers and employees who work in manufacturing or associated industries.