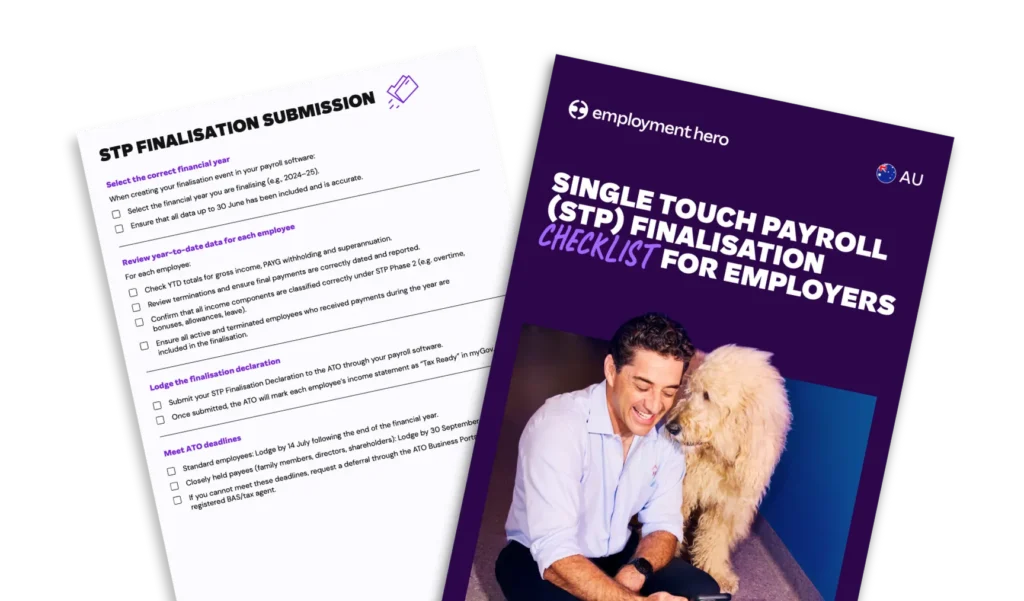

Single Touch Payroll (STP) finalisation checklist for employers

Published

Single Touch Payroll (STP) finalisation checklist for employers

Published

The end of the financial year brings a unique set of challenges for anyone managing payroll. One of the biggest tasks on the to-do list is Single Touch Payroll (STP) finalisation.

STP finalisation is a critical compliance process that requires accuracy and strong attention to detail. This guide gives you a clear, actionable checklist to complete your STP finalisation confidently and on time.

This checklist guides you step-by-step through the entire STP finalisation process, including:

- Preparing your payroll data and employee information.

- Reconciling wages, PAYG withholding and superannuation.

- Submitting your STP Finalisation Declaration to the ATO.

- Notifying employees and maintaining compliant records.

Download the STP finalisation checklist now by filling out the form.

What is Single Touch Payroll (STP) finalisation?

STP finalisation is the process where you, as an employer, formally declare to the Australian Taxation Office (ATO) that you have provided complete and accurate payroll data for the financial year. This is done for every employee you’ve paid through Single Touch Payroll.

Think of it as the final handshake with the ATO for the year. Each time you run payroll, you send them real-time data. Finalisation confirms that all the information sent throughout the year is correct, and no further regular payments will be made.

Why STP finalisation is required

STP finalisation is a legal requirement for businesses in Australia. The ATO uses this finalised data to pre-fill your employees’ income tax returns, making tax time simpler for them.

Once you’ve finalised, your employees can see their completed income statement in their myGov account, marked as ‘Tax ready’. This empowers them to lodge their tax returns accurately.

When is the STP finalisation deadline?

The deadline for making your STP finalisation declaration is 14 July each year.

This deadline applies to all employers, regardless of business size. Failing to meet this date can result in penalties from the ATO and cause unnecessary stress for your employees who are waiting to complete their tax returns.

Who needs to complete STP finalisation?

Every employer using STP must complete a finalisation declaration.

While the requirement is universal, the process might feel different depending on your business size. Growing businesses, in particular, face increasing complexity as their team expands. Managing payroll and compliance for 15, 50 or 150 employees requires robust systems to avoid errors and stay on top of obligations. This is where Employment Hero’s payroll software can help take off some pressure at EOFY.

Looking for a complete checklist for EOFY? Download our EOFY checklist here.

STP Phase 2 finalisation requirements

STP Phase 2 expanded the payroll data you report to the ATO. The goal was to reduce the reporting burden for employers by sharing more information with other government agencies. This means your finalisation now includes more detailed information than ever before.

What’s changed with STP Phase 2?

Under Phase 2, reporting has been broken down to provide greater clarity. Instead of a single gross payment figure, you now report specific components separately. This includes:

- Paid leave

- Allowances (broken down by type)

- Overtime

- Bonuses and commissions

- Directors’ fees

- Lump-sum payments

This disaggregation gives the ATO a clearer picture of an employee’s earnings. It also means your payroll setup must be precise to capture and report these details correctly.

Step-by-step guide to STP finalisation with Employment Hero

Using an integrated system like Employment Hero Payroll transforms STP finalisation from a daunting task into a streamlined process. Our platform is designed to automate your obligations and minimise manual work.

Here’s how you can manage it seamlessly with our Employment Operating System:

- Reconcile your payroll data: You can reconcile your payroll data at any time before the end of the financial year or your final pay run. We recommend doing this earlier rather than later. That way, any errors or data mismatches can be identified and corrected ahead of time. Once everything is accurate, you can do a quick check again before lodging your finalisation event. Remember to run an update event, not a pay run, when reconciling your data.

- Generate reports: Use our pre-built reports to cross-check totals and identify discrepancies. Verify allowances, deductions and leave payments against your records.

- Navigate to the STP Finalisation Wizard: Our platform guides you through the process step-by-step, flagging any potential employee errors which are not ATO compliant before you submit.

- Review employee data: Check that all employee details are correct, especially for those who terminated during the year.

- Make your finalisation declaration: With a few clicks, you can submit your finalised data directly to the ATO. The platform will automatically generate the required reports and send them securely.

What is a finalisation declaration?

A finalisation declaration is your official statement to the ATO, confirming that you have fully reported all employee payments for the financial year. By making this declaration, you’re taking responsibility for the accuracy of the information provided.

Finalising STP for terminated employees

You don’t have to wait until the end of the financial year to finalise terminated employees. You can finalise their records as part of their final pay run. This gives them immediate access to their ‘Tax ready’ income statement, which is a supportive action for a departing team member. If you don’t finalise them upon termination, they must be included in your bulk end-of-year finalisation.

Finalising STP for casual employees

Casual employees are included in your STP finalisation just like any other employee. You must report all payments made to them throughout the financial year. If you have casuals who worked intermittently, make sure all payments are accounted for, even if they haven’t worked for several pay cycles leading up to year-end.

Finalising STP for contractors vs. employees

It’s crucial to correctly classify your workers. STP reporting applies only to employees. Payments to independent contractors are generally not reported through STP, unless you have a voluntary agreement to withhold PAYG from their payments. Misclassifying an employee as a contractor can lead to significant penalties and backpayments, so review these arrangements carefully.

Common STP finalisation errors

We’re all human and mistakes happen, but they can be costly. Here are common errors and how to avoid them:

- Incorrect PAYG withholding: Mismatch between reported tax and actual amounts withheld.

- Misclassified allowances: Under STP Phase 2, allowances must be itemised.

- Forgetting terminated employees: Overlooking employees who left during the year.

- Duplicate reporting: Creating a new employee record for a re-hired employee instead of reactivating their old one.

For a deeper dive into payroll best practices, explore our comprehensive Payroll Guide.

What is included in your STP finalisation

Your finalisation report is a summary of all payments and contributions. Key components include:

Gross payments and allowances

This is the total taxable income, now broken down into specific payment types like salary, wages, bonuses, overtime and specific allowances under STP Phase 2.

PAYG withholding amounts

The total amount of Pay As You Go (PAYG) tax you have withheld from employees’ pay throughout the year.

Superannuation information

This includes both compulsory superannuation guarantee contributions and any reportable employer super contributions (RESC).

Reportable fringe benefits

If an employee receives fringe benefits exceeding $2,000 in a year, the grossed-up taxable value must be reported.

Reportable Employer Super Contributions (RESC)

These are extra super contributions made on behalf of an employee, such as salary sacrifice amounts. They are reported separately from the super guarantee.

Employment Termination Payments (ETPs)

Payments made to an employee upon termination, like payments in lieu of notice or unused sick leave, have their own specific reporting category.

Download our power of automated payroll to learn more about the power of automating these complex requirements.

What happens after you finalise STP?

Once you submit your finalisation declaration, the ATO will send a notification confirming its receipt. Within your STP-enabled software, you should see the status of your employees change to ‘Finalised’.

Your work is now done. The ATO takes over, using the data to pre-fill tax returns and cross-reference information with other government agencies.

How employees access their income statements

Employees no longer receive payment summaries. Instead, they can access their income statement through their personal myGov account linked to the ATO. The statement will be marked as ‘Tax ready’ once you complete your finalisation, signalling that they can proceed with their tax return.

Income statements vs payment summaries

The income statement is the digital equivalent of the old payment summary (or group certificate). With STP, payment summaries are now obsolete for all employers. The move to digital income statements provides employees with secure, real-time access to their payment information directly from the ATO.

Amending STP data after finalisation

If you discover an error after you’ve already completed and lodged your finalisation, you can still fix it. The ATO allows you to correct mistakes by submitting an amended finalisation event.

This process essentially updates the original submission with the correct information, ensuring your employees’ income statements reflect the accurate year-to-date figures in their myGov accounts.

Penalties for late STP finalisation

The ATO can apply penalties for failing to finalise by the 14 July deadline. Fines can be significant and repeated failures may trigger a deeper audit of your business.

Proactive compliance is the best way to avoid these unnecessary costs and distractions.

Extensions and deferrals: when are they available?

If you anticipate you won’t be able to finalise by the deadline, you can apply for a deferral from the ATO. You must have a valid reason, such as illness, natural disaster or complications with your systems. Applications should be submitted as early as possible.

Make EOFY easy with Employment Hero

As you can see, there’s a lot involved with STP finalisation. Thankfully, Employment Hero makes the time-consuming, complex parts easy.

Employment Hero’s Employment Operating System simplifies end of financial year processing with:

- Automated STP reporting that securely sends payroll data to the ATO.

- Built-in reconciliation tools to review and verify pay, tax and super totals before finalisation.

- Step-by-step EOFY workflows that guide you through every stage of the STP finalisation process.

- Automatic compliance updates for tax tables, superannuation rates and ATO requirements.

- Comprehensive reporting tools to ensure accuracy and transparency.

- Employee self-service access so staff can easily view payslips and income statements when they’re tax ready.

Get in touch with one of our business specialists today to learn how we can help your business streamline payroll, compliance and save time this financial year.

Download your STP finalisation checklist now.

Ready to take control of your end-of-financial-year compliance?

Download the STP finalisation checklist now by filling out the form.

Disclaimer: The information in this guide and checklist is current as at November 2025, and has been prepared by Employment Hero Pty Ltd (ABN 11 160 047 709) and its related bodies corporate (Employment Hero). The views expressed in this guide and checklist are general information only, are provided in good faith to assist employers and their employees, and should not be relied on as professional advice. The Information is based on data supplied by third parties. While such data is believed to be accurate, it has not been independently verified and no warranties are given that it is complete, accurate, up to date or fit for the purpose for which it is required. Employment Hero does not accept responsibility for any inaccuracy in such data and is not liable for any loss or damages arising either directly or indirectly as a result of reliance on, use of or inability to use any information provided in this guide and checklist. You should undertake your own research and seek professional advice before making any decisions or relying on the information in this guide and checklist.

Register for the checklist

Related Resources

-

Read more: Product Update: January 2026

Read more: Product Update: January 2026Product Update: January 2026

Welcome to the January 2026 product update from the Employment Hero team. We’ve got lots to share around Custom Forms,…

-

![Restaurant Industry Award Summary [MA000119]](https://employmenthero.com/wp-content/uploads/2026/02/Award-Summary_Restaurant-Industry.webp) Read more: Restaurant Industry Award Summary [MA000119]

Read more: Restaurant Industry Award Summary [MA000119]Restaurant Industry Award Summary [MA000119]

This Award primarily applies to businesses operating restaurants, cafés and similar establishments, but also extends to employees performing similar roles.

-

Read more: At A$300M ARR, AI-Powered Employment Hero Enters Next Phase as SEEK Growth Fund Launches Stake Sale

Read more: At A$300M ARR, AI-Powered Employment Hero Enters Next Phase as SEEK Growth Fund Launches Stake SaleAt A$300M ARR, AI-Powered Employment Hero Enters Next Phase as SEEK Growth Fund Launches Stake Sale

Employment Hero, a global AI-powered employment operating system, and SEEK Investments, manager of the SEEK Growth Fund, today announced that…