New superannuation changes could put hundreds of dollars back in the pockets of a million low-income workers as the government addresses major inequity.

For over thirty years Australia’s compulsory superannuation system has been critical to the retirement financial security for Australians. But for too long many of the workers who keep the economy running, like casuals, part-timers, and carers, have missed out on a lot of the core benefits.

The Albanese Government’s recent reform to the Low Income Superannuation Tax Offset (LISTO) will see more than 1.3 million Australians get a boost under the government’s planned superannuation tax reforms, which aim to make the system fairer for lower-income earners.

Starting from 1 July 2027, the Low-Income Superannuation Tax Offset (LISTO) threshold will rise from $37,000 to $45,000. The maximum LISTO benefit will also rise from $500 to $810 which is a meaningful bump for employees who often live week to week.

For small business owners, contractors, retail managers, and anyone who employs casual or part-time staff, this news carries two big takeaways: your workers will keep more of what they earn, and the super system will work harder for them in the background.

Superannuation tax inequity for low income earners

Most employees know that compulsory super contributions are taxed at a flat rate of 15% on the way into your fund. For most middle and high-income earners, this is a pretty good deal, as it’s much lower than their marginal income tax rate.

However, anyone earning less than the tax-free threshold of $18,200 pays 0% income tax. Yet, when their employer paid their super guarantee, that money was immediately hit with a 15% tax. Basically, they pay a higher tax rate on their retirement savings than on their take-home pay, an equity that penalises the workers that need the most help.

The low‑income superannuation tax offset (LISTO) was created to refund this tax, but its income threshold of $37,000 hadn’t been updated since 2017. With wage growth and inflation, that limit has quietly excluded hundreds of thousands of people who should still qualify. Raising it to $45,000 does more than catch up with reality and lifts retirement fairness for a new generation of workers.

Who is eligible for the new superannuation tax offset?

The government projects that around 1.3 million additional Australians will now qualify for the offset. From shop assistants at Bunnings to teenagers working their first shifts at Coles, essential carers juggling part-time hours and employees in small businesses across Australia who earn below the new $45,000 threshold.

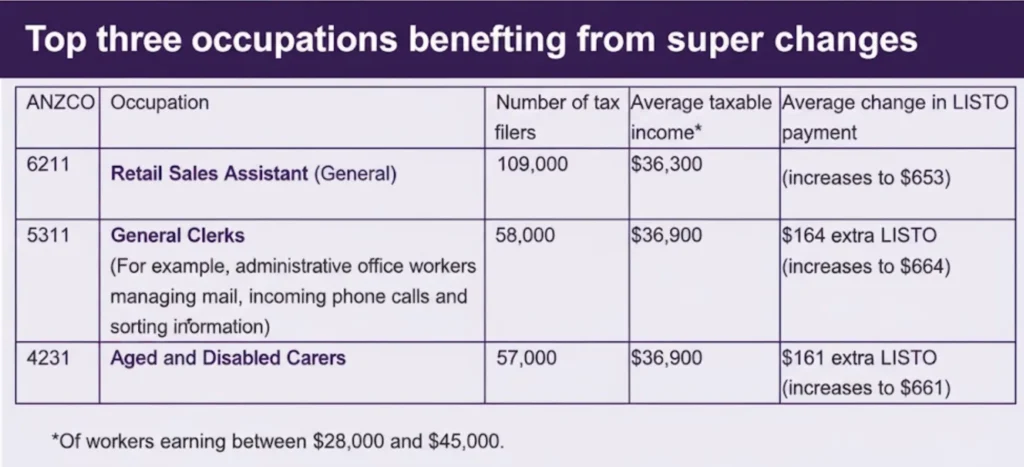

In his comment to the press, Treasurer Jim Chalmers framed the reform as a win for fairness: “We’re helping lower-income workers earn more, keep more of what they earn, and retire with more too. Clerks, carers and cashiers are some of the biggest beneficiaries of this change.”

The government’s reform addresses this with two clean strokes. Firstly, from 1 July 2027, the income eligibility threshold for LISTO will be lifted from $37,000 to $45,000. Secondly, the maximum annual payment will increase.

For your employees, the impact is tangible. A worker on $45,000 could receive an automatic bonus of up to $810 paid directly into their super account by the ATO, and the government estimates this could add around $15,000 to an individual’s retirement balance.

This will also help the 550,000 young people under 30 who will now be eligible. For a young person starting their career, every dollar in super is potent, supercharged by compound interest over a 40-year career.

A step towards a gender equity boost

All up, the change will bring total LISTO eligibility to 3.1 million Australians, of which 60 per cent are women. The average annual LISTO payment will jump from $280 to $375.

Currently, women retire with around 25 to 30 per cent less super than men on average. Structural issues like unpaid caregiving, part-time work, and time out of the workforce compound that gap. By extending LISTO and boosting its value by $310, the reforms deliver a tangible step toward closing that divide.

Approximately 450,000 women earning between $37,000 and $45,000 will benefit for the first time, while 500,000 more already inside the system will see their LISTO payment increase.

What new Superannuation laws mean for business owners

For the revised Low Income Superannuation Tax Offset (LISTO) specifically, the administrative lift for your business is zero. The Australian Taxation Office (ATO) automatically identifies eligible employees and pays the offset directly into their super accounts.

It’s crucial, however, to distinguish this from other significant reforms on the horizon. While the LISTO change is hands-off, the move to Payday Super could have a substantial impact. The upcoming requirement to pay super contributions alongside regular wages, shifting from the current quarterly schedule, will represent a major change to payroll administration and business cashflow management.

These reforms, along with the new super contributions to paid parental leave, are part of a broader shift towards strengthening the entire superannuation architecture.