The Ultimate Guide to Single Touch Payroll

By now you’ve probably heard about Single Touch Payroll (STP). Many of you have already hopped aboard the Automation Train, destination: Compliance. But just to be sure, let’s refresh our memory.

Update: ATO has announced the delayed start date of STP phase 2.

The ATO released a great article that breaks down exactly how STP works. Basically, it works by sending tax and super information from your payroll or accounting software to the ATO as you run your payroll.

Wait, what… I’m going to have to change the entire way I do my payroll? Panic stations people! Don’t worry. You will run your payroll or accounting software as normal, still give your employees a payslip, and your pay cycle won’t be affected either.

Once you’ve paid your staff, your STP-enabled payroll software will send the ATO a report which includes all the information they need from your business automatically. Salaries, wages, PAYG, and super information will all be included in this report. Good times, right?

Once the ATO receives this information, they will match the STP information to their employer and employee records. This means that your employees will be able to see their year-to-date tax and super information in ATO online services.

Making it a much easier way to allow your employees to self-serve and have a better insight into their payments.

They can access this at any time, and it’s updated every time you send the ATO a report (so every pay cycle). Before this, employee payment data was only reported on at the EOFY. We know, we know. It’s all pretty complicated.

For those of you who are still a little unsure about the whole thing, we pulled together this ultimate guide with all the information you need to know about STP!

What is Single Touch Payroll?

Single Touch Payroll (STP) legislation requires employers to report wages, PAYG withholding, and superannuation information directly to the ATO using an online payroll system.

It was introduced by the Australian government in 2018 as a way to encourage small businesses to be more compliant in the way they report superannuation or PAYG instalments to employees. While it might seem annoying, STP is great for Australians.

It helps to keep black market criminal activity at bay, making Australia a stronger and fairer place for all.

When Did Single Touch Payroll Start?

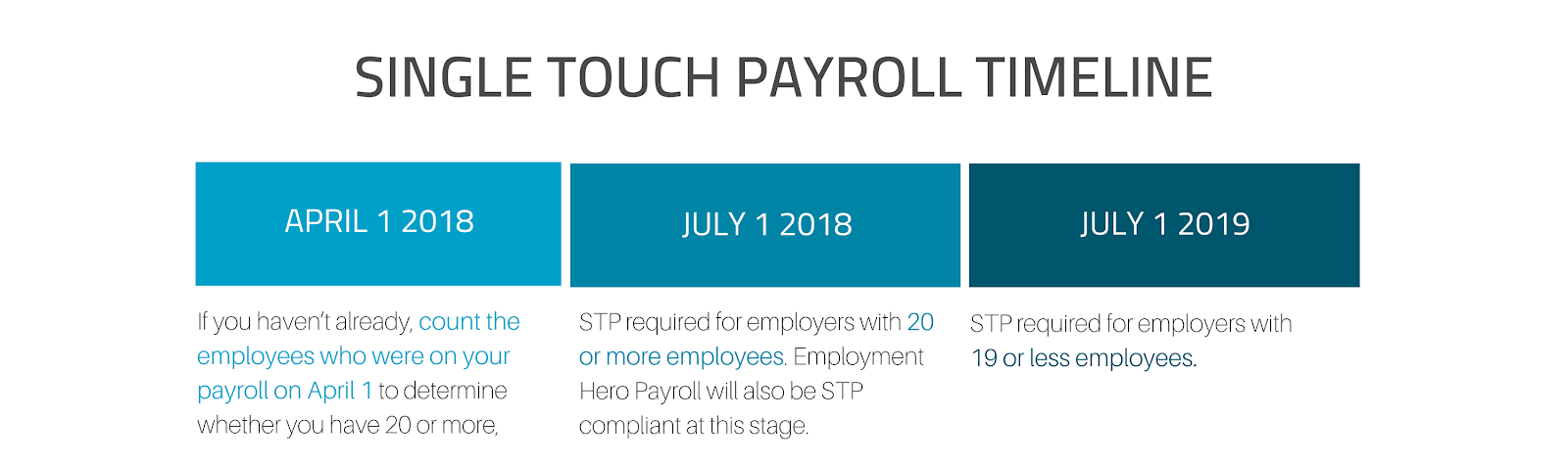

Here is a Single Touch Payroll Timeline we produced back in April 2018 when STP rules and regulations first started rolling out for companies with 20+ employees.

It started affecting businesses with twenty employees or more who had to be ready to implement the new processes by 1 July 2018. If you had less than 20 employees, then companies had until 2019 to get ready.

Is Single Touch Payroll Compulsory?

Single Touch Payroll (STP) reporting has been compulsory for small businesses(those with 20 employees or less) since July 1, 2019. As we’ve covered, STP has been compulsory for employers with over 20 employees since July 1, 2018 – but by now everyone should be involved.

July 1 2019, was always the date earmarked for compulsory STP reporting by small businesses, a timeline that was made a reality earlier that year when the government passed supporting legislation. There are caveats in place to help small businesses make the transition so don’t panic if you’re still not quite STP-ready!

What you need to know about Single Touch Payroll

1. Single Touch Payroll deadlines differ depending on the employer

By now, small, medium and large businesses should already be reporting through STP or have applied to the ATO to start reporting at a later date. For companies with four or fewer employees, you can choose a no-cost or low-cost solution when one is available.

These solutions have been made for micro employers who need to report through STP but do not currently have Single Touch Payroll ready software. Micro-employers can choose to report quarterly through your registered tax or BAS agent until 30 June 2021.

More information on this is available on the ATO’s Single Touch Payroll Factsheets.

2. There are no penalties for mistakes, missed or late reports for the first year

This one is pretty self-explanatory, but the ATO understands that there’s a required adjustment period. The most important thing is that businesses simply start reporting through STP. For businesses that have applied to start reporting through STP later than 1 July 2019, this means you may still be in this grace period.

Commissioner Chris Jordan made a statement regarding this, “I want to reassure small business and give my personal guarantee that our approach to extending Single Touch Payroll will be flexible, reasonable and pragmatic…There will be no penalties for mistakes, missed or late reports for the first year.”

3. You are required to report a pay event to the ATO on or before the employees’ payday

Something to note is that you’ll be required to report a pay event to the ATO on or before the employees’ payday. Additionally, you must report the year-to-date values of gross salary or wages, allowances or other payments (as relevant) deductions and PAYG withholding for each employee included in that pay event.

Some other hot tips:

- All payees must have either a Tax File Number (TFN) or Australian business number (ABN)

- You’re allowed to lodge multiple pay event files for the same day

- If you make an employment termination payment (ETP) you must report it in a pay event on or before the day you make the payment

Single Touch Payroll Penalties Moving Forward

There is a $210 fine every 28 days that a Single Touch Payroll report is overdue. This can accumulate up to a maximum value depending on the size of the business.

These are:

- $1,050 for small businesses

- $2,100 for medium businesses

- $5,250 for large businesses

- $525,000 for significant global entities

Single Touch Payroll Requirements for the Self-Employed

The ATO classifies self-employed individuals, or family members working for a family business, as Closely Held Payees. As of April 2020, small businesses with 19 or less employees do not need to report closely held payees under Single Touch Payroll until the 1st July.

Other closely held payees include shareholders of a company or beneficiaries of a trust.

How Employment Hero Payroll Can Help

We know STP has been a tense long journey over the last few years, especially to payroll managers and accountants, but we’re nearly there. Stay strong guys.

Of course, we believe Employment Hero Payroll is the best STP solution for medium and small businesses. If you’re using Employment Hero Payroll, then STP compliance will be automatically rolled out for you.

At Employment Hero, we’ve been working hard to implement STP to meet ATO’s specifications, and this blog will give you all the insights you need on how it works.

How to be ready for STP if you are not using Employment Hero

If you’re unfortunate enough not to be fully integrated with Employment Hero and Employment Hero Payroll (if you’re not, then why not?) here are some other things to consider to get Single Touch Payroll ready:

1. Select your Single Touch Payroll Champion

Choose someone to be the STP expert in your business. They can help by being responsible for managing the change and ensuring the business is up-to-date. (plug: Employment Hero Payroll!)

2. Start to put the key ATO processes in place

Visit the ATO website and make sure your business has:

- Registered for an ATO AUSkey

- A login to the ATO Business Portal

- A login to the ATO Access Manager

3. Check your data

Now is a great time to check your data is correct in the following areas:

- Payroll – Check PAYG withholding is calculating correctly and all the information captured is correct.

- Superannuation – Check your superannuation contributions are calculating correctly, your SuperStream solution is compliant and you have the correct employee and superannuation funds set up.

- Employee master files – It’s crucial that payroll records match the ATO. Ensure employee data is up to date and correct (such as full name, address, tax file number and date of birth). For a detailed guide on superannuation changes, check out Superannuation Changes 2022: Key Takeaways.

4. Review your business processes

As well as double-checking your data, it’s also a good time to double-check your processes.

- Make sure the right people in your business know about STP – especially your payroll staff.

- Check if you are paying your employees correctly.

- Check if you are addressing overpayments correctly.

TIP: You will not need to provide payment summaries to your employees for the payments you report through STP. Employees will be able to view their payment information in ATO online services, which they will access through their myGov. Your employees can also request a copy of this information from the ATO. To be exempt from giving payment summaries, you will need to make a finalisation declaration.

Under STP, there are a number of withholding payments that are either mandatory, voluntary or that cannot be reported. Visit the ATO website, so you know how to handle these types of payments and ensure that you have processes in place to deal with these obligations.

5. Communicate these changes to your employees

STP has been designed to help create transparency and make life easier for your employees. To unlock the full potential of STP, they will need to take a few steps too. Talk to your employees about:

- Registering on myGov. Step-by-step instructions can be found on the Department of Human Services website and they can access a range of government services.

- Provide helpful hints of what they’ll need to set up on myGov like their TFN and bank account details. This can add real value to their experience and help speed up the process.

- Put managers through the process first so they can help their teams and reduce the effort involved.

Have more questions about Single Touch Payroll?

There’s no doubt that Single Touch Payroll will change the payroll software landscape in Australia. As illustrated in this article by the SMH, more businesses are going to move to digital solutions due to STP requirements.

While this might require a small time investment at first, digital payroll solutions ultimately reduce administration time and greatly reduce the chances of error. Systems like our very own Employment Hero Payroll also automatically interpret modern awards.

The Australian payroll system is incredibly complex. With more businesses using smarter solutions, we hope to see a decrease in the payroll scandals that regularly feature in our news feeds. For a comprehensive understanding of Australian payroll, including FAQs and guides, explore our : 14 common payroll FAQs answered and understanding Australian payroll accountants, bookkeepers, and payroll providers.

Related Resources

-

Read more: The ‘work-life balance’ trap: Why promising it is hurting your SME recruitment (and what to promise instead)

Read more: The ‘work-life balance’ trap: Why promising it is hurting your SME recruitment (and what to promise instead)The ‘work-life balance’ trap: Why promising it is hurting your SME recruitment (and what to promise instead)

For growing SMEs, work-life integration is a sustainable way to support your team and attract top talent. Explore how your…

-

Read more: Job ad guide: How to attract top candidates

Read more: Job ad guide: How to attract top candidatesJob ad guide: How to attract top candidates

Looking to hire your perfect match? The way you pitch your open role can be the difference between landing or…

-

Read more: Employment Hero and CommBank to provide businesses with discounted HR, payroll and benefits support following EOFY

Read more: Employment Hero and CommBank to provide businesses with discounted HR, payroll and benefits support following EOFYEmployment Hero and CommBank to provide businesses with discounted HR, payroll and benefits support following EOFY

Eligible CommBank Yello for Business customers will get the first 3 months free on any Employment Operating System subscription with…