Everything employers need to know about Earned Wage Access

Learn more about Earned Wage Access – the flexible, credit-free way to get paid.

Giving your employees on-demand access to their pay. It’s a huge change. And it’s a big ask for employers to re-think the way payroll has been done for centuries.

But here at Employment Hero, we believe Earned Wage Access is part of the future of payroll —and the key to employee engagement. It’s a faster, more flexible way to manage pay. With Earned Wage Access, employees can access their wages as they earn them, maintain financial wellbeing, and avoid high-cost credit. When people aren’t stressed about money and pay, they can bring their best selves to work each day.

To understand the broader implications of employee financial wellbeing and how it affects your business, check out our insights on our article on the secret struggle hurting your business.

What is Earned Wage Access?

Earned Wage Access is an Employment Hero feature that gives employees early access to their earned wages before payday. For a 1.3%-1.5% fee per transaction employees can request up to $1000 of their earned wages each week (or up to a maximum of 50% of their owed pay) before their allocated payrun.

Employment Hero pays the Earned Wage Access amount to the employee in advance of the payrun, and the Earned Wage Access amount is automatically included in their payslip as part of the next payrun as a post-tax deduction. Your team simply has to process the payrun as normal, with no extra admin or effort required. You will see the Earned Wage Access amount as a line item under ‘Deductions’ on the payslip.

Employment Hero first launched Earned Wage Access as a feature to users in 2018, and it has been helping employees manage their finances, handle unexpected expenses, and avoid high-cost credit ever since. For an overview of our latest product updates including Earned Wage Access, take a look at our November 2023 product update.

In 2022, Earned Wage Access was recognised as a finalist in Finder’s Early Wage Access Awards.

How does Earned Wage Access work?

- An employee requests an Earned Wage Access amount of up to $1000 per week.

- Employment Hero pays that amount to the employee when requested in advance of their regular payrun.

- The employee pays Employment Hero a fixed fee per transaction of 1.3% fee per transaction to deposit the Earned Wage Access amount into a Swag Spend account, or 1.5% fee per transaction into an external bank account.

- The Earned Wage Access amount is automatically added to your payrun as a post-tax deduction.

- Your team processes the payrun as normal, automatically repaying the Earned Wage Access amount to Employment Hero (which includes an employee fee of 1.3% fee per transaction to a Swag Spend account, or 1.5% fee per transaction into an external bank account).

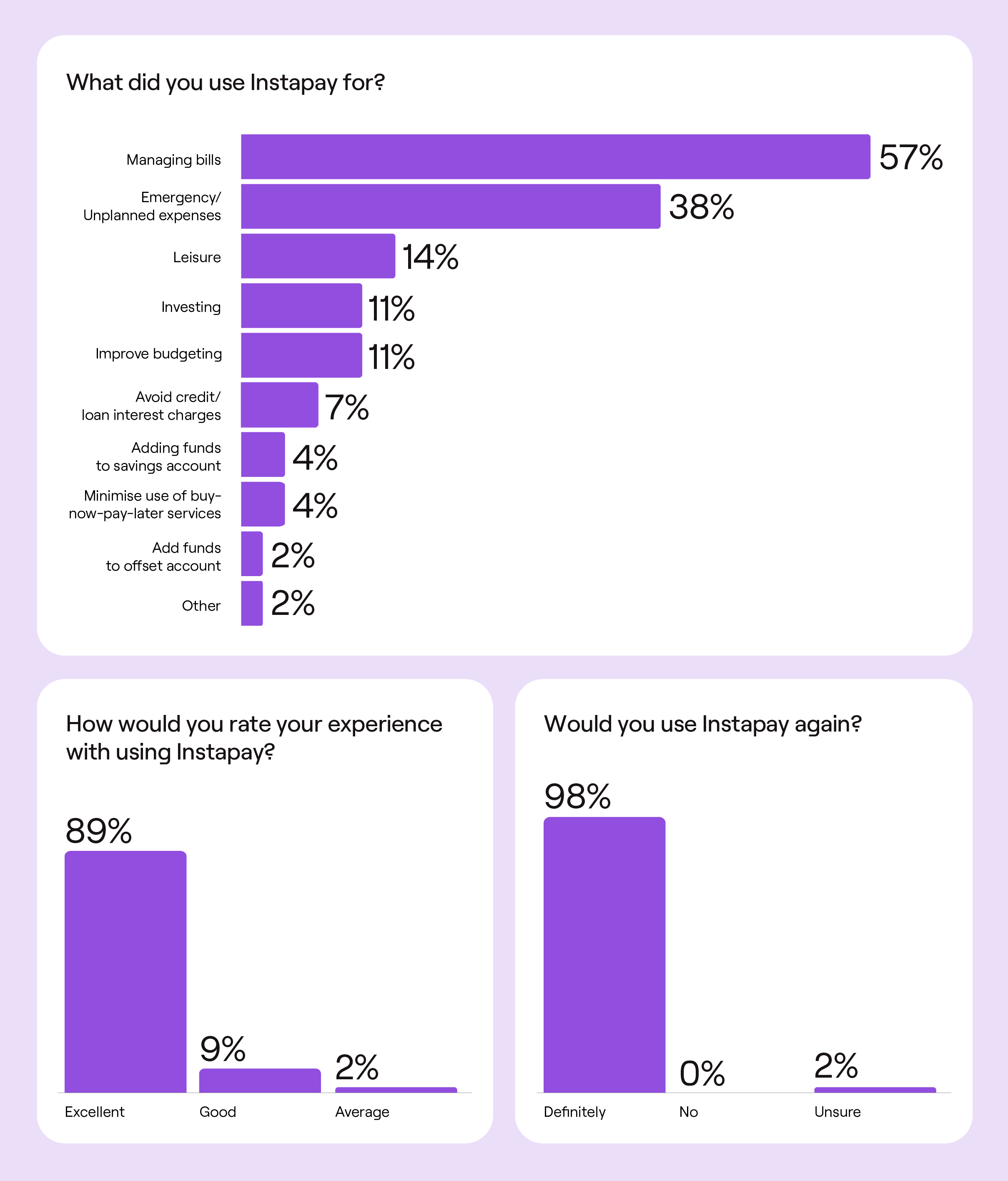

How do employees use Earned Wage Access?

Employees use Earned Wage Access for: managing bills when they fall on an ‘off’ week, offsetting mortgage repayments, tackling unplanned expenses like emergency vet visits or medical bills, managing funds between monthly pay cycles and much more.

Previously, employees would have turned to credit products or Buy Now Pay Later schemes (BNPLS) to find these funds. Research suggests that in the most extreme example, the fees for missing BNPL payments would equate to a 276.12% effective interest rate.

Earned Wage Access is a no-interest alternative that gives employees early access to their own money as they earn it. There’s absolutely no interest, late fees or credit involved (and no stress needed).

If you’re interested in understanding how you can leverage payroll data for better business decisions, consider joining our payroll metrics and analytics webinar.

What do real people think of Earned Wage Access?

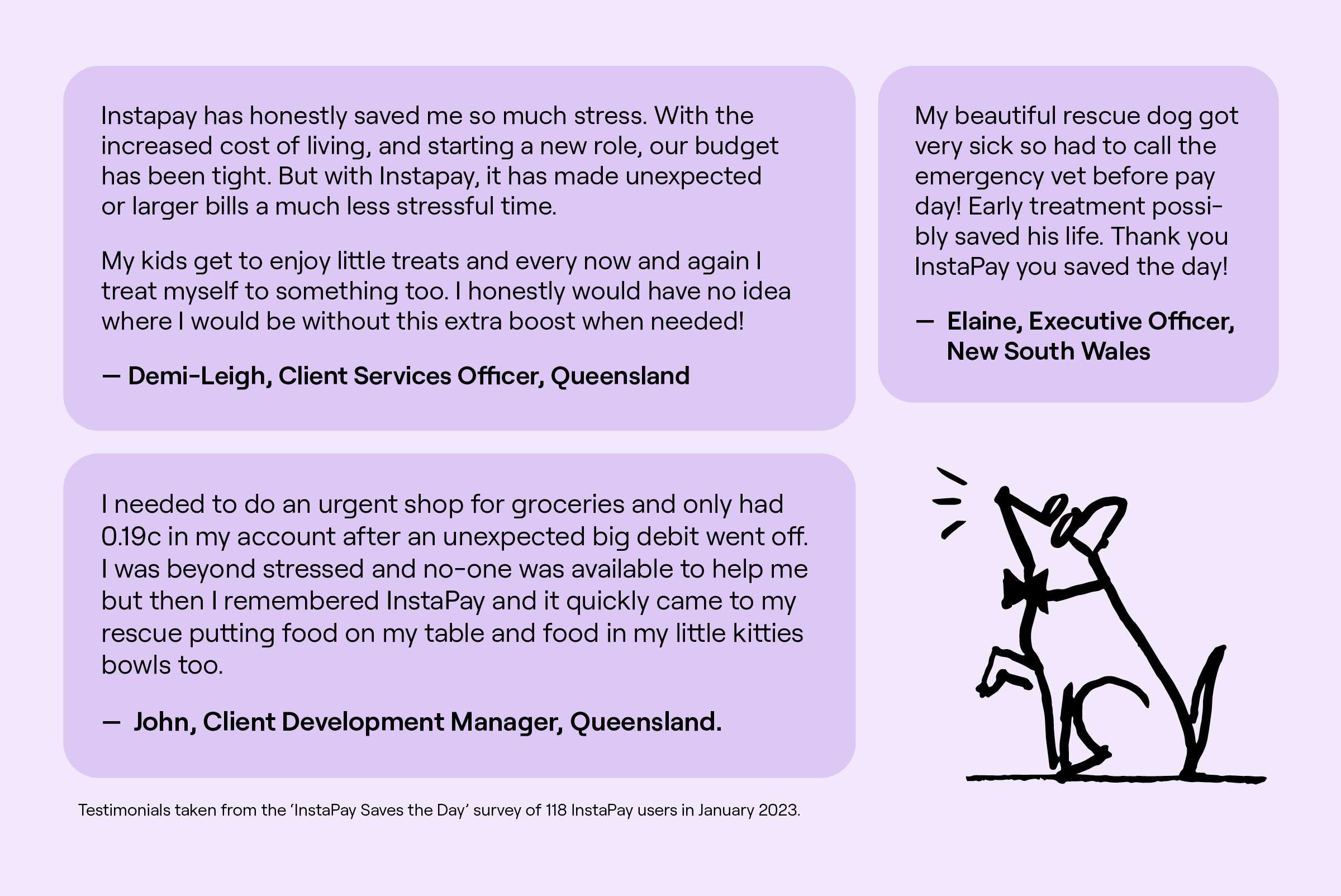

We invited Earned Wage Access users to complete a quick survey in January this year about their experience using the feature. We received 118 responses from employees who use Earned Wage Access to cover emergency expenses, manage bills, and avoid relying on credit. Here’s what a few had to say:

Earned Wage Access is not a payday loan or credit product

Because Earned Wage Access gives employees early access to their wages, it’s often confused with a payday loan or a credit product. It is neither of these — it is money that an employee has already earned. Earned Wage Access is not a loan or credit.

Employees often find it easier and less stressful to request an advance through Earned Wage Access rather than approaching payroll with a request for a pay advance.

To explore more about how Earned Wage Access fits into the larger payroll services market, our article on how to compete in the growing payroll services market offers valuable strategies and insights.

Why did Employment Hero create Earned Wage Access?

Payroll hasn’t changed to match our modern lifestyles. For centuries, people have been locked into rigid pay cycles and forced to rely on savings and credit to bridge the payday gap.

Earned Wage Access was created to challenge that status quo. It started when we asked a simple question:

Why shouldn’t you have access to the pay you’ve earned, for the work you’ve done each day?

In a world where everything is becoming faster and more efficient, why shouldn’t payroll be the same? We stream movies, podcasts, and music on-demand, we pay for purchases in real-time, and we can get almost anything delivered within hours. So why shouldn’t people get access to a portion of their wages as soon as they’ve earned them?

Think of it this way: if you ordered a cappuccino from a coffee shop, you wouldn’t tell the barista that you’d pay them next week. So why should we make employees wait weeks or months to be paid for the work they did that day?

Historically, the reason we got paid weekly, fortnightly or monthly was because of the time and administration it took to process pay. Payroll tax and compliance concerns, paper-based processes, managing banks and conferring with accountants all stretched the process out.

Today, payroll should be facilitated in a much faster and more efficient way, thanks to digitisation. Advances in HR and payroll tech mean there’s no need for time-consuming processes. So why can’t pay be on-demand?

Cashflow is another reason for spaced-out paydays. Small business owners often use delayed pay cycles to protect their liquidity, and will typically request instant payment from their customers. These earnings are then used to pay for labour and invoices in arrears. The reasons for this are clear: if every employee demanded to be paid at the end of a day’s work, businesses wouldn’t have enough liquidity for this to be financially viable. Paying employees on-demand could put organisations out of business, making it difficult to pay their regular costs, invoices and rent.

Here’s where Earned Wage Access comes in. Because of our unique position as one of Australia’s largest HR tech providers, we can help businesses preserve their liquidity by enabling on-demand pay using our funds to advance employees ahead of payday. The business then pays the advanced amount back to Employment Hero in the form of a deduction when it comes time for the regular payrun.

Access to earned wages is relatively new in Australia, but it’s a concept that has taken off in the US. 80% of the Fortune 200 companies now offer earned wage access, and leading companies like PayPal, Unilever, Uber, Walmart and McDonalds provide access to earned wages as a benefit for their employees.

Testimonials taken from the ‘InstaPay Now Saves the Day’ survey of 118 Earned Wage Access users in January 2023.

Testimonials taken from the ‘InstaPay Now Saves the Day’ survey of 118 Earned Wage Access users in January 2023.

For those considering how Employment Hero can streamline your payroll processes and adapt to modern needs, our article on why choose Employment Hero? provides a comprehensive overview.

Are there any hidden fees or interest charges involved?

There are no hidden late payment fees, or interest charges for using Earned Wage Access. Since it’s money that’s already been earned, there’s no credit, interest or hidden costs involved: just a 1.3% fee per transaction when an employee deposits an Earned Wage Access amount into their Swag Spend account. Deposits into an external bank account incur a 1.5% fee.

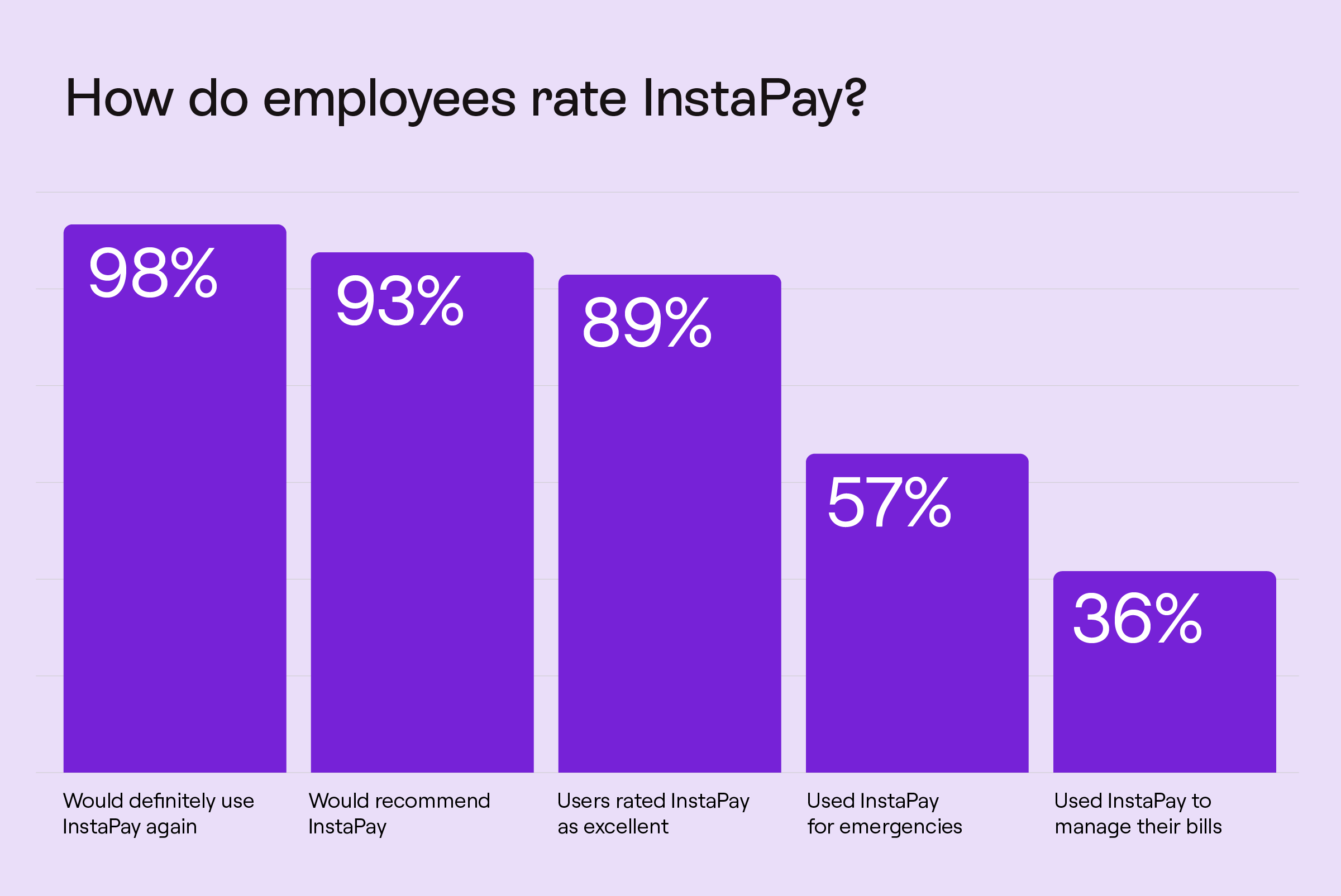

How do employees rate Earned Wage Access?

In January 2023 we conducted an ‘InstaPay Now Saves the Day’ survey where we spoke to Earned Wage Access users and asked them how the feature has helped them manage their finances. We received 118 responses and were amazed by the results.

- 93% would recommend (9-10) Earned Wage Access

- 98% would definitely use Earned Wage Access again

- 89% of users rated Earned Wage Access as excellent

- 57% used Earned Wage Access for emergencies

- 36% used Earned Wage Access to manage their bills

Earned Wage Access has helped with medical bills, saving animals, helping single parents manage the holidays, helping families move house and much more.

What is the business case for Earned Wage Access?

Financial stress has a hidden effect on productivity at work: and it can cost businesses big time. A staggering 31% of Australians are struggling to make ends meet week to week, and $31B in Australian business revenue is lost each year as a result of employee financial stress. Absenteeism, lost productivity and poor engagement can contribute to this lost revenue.

Reducing financial stress for employees increases engagement at work and boosts your employer brand in a competitive talent market.60% of employees would view a potential employer favourably if they offered on-demand pay.

Here’s how Earned Wage Access benefits businesses:

Earned Wage Access lets you gain the competitive advantage

Earned Wage Access makes it easy to attract great talent by offering a modern way to get paid. By empowering people to break free of credit cycles and take control of their finances, you’re proving you’re invested in your employees’ wellbeing. This not only boosts your employer brand, it also keeps your team engaged and motivated. It’s the way payroll should’ve been from the start.

Learn more about how Employment Hero can enhance your payroll services by exploring our insights on competing in the payroll services market in how to compete in the growing payroll services market.

Earned Wage Access encourages financial wellbeing

Earned Wage Access bridges the payday gap, providing a crucial alternative to high-cost credit products. Employees use Earned Wage Access to pay bills, contribute to mortgage repayments, and manage unplanned expenses —all of which lead to better financial health and reduced stress.

Earned Wage Access is an alternative to high-cost credit

Give your employees an option to avoid high-cost credit. Earned Wage Access gives employees who need access to their salary between payruns, early access to their own earned pay without the need to use credit cards, Buy Now Pay Later (BNPL), or loans.

Earned Wage Access gives employees autonomy

With Earned Wage Access, you can encourage employees to build budgets around their life — not their pay cycles. With easy, real-time access to their earned wages, employees can plan ahead and prevent financial shortfalls.

Learn more

If you’d like to learn more about the value Earned Wage Access can bring to your business, read our Earned Wage Access Factsheet here.

Related Resources

-

Read more: New research reveals Australians remain unprepared for Payday Super, now mere months away

Read more: New research reveals Australians remain unprepared for Payday Super, now mere months awayNew research reveals Australians remain unprepared for Payday Super, now mere months away

February 23, 2026: Employment Hero’s Inside the Future of Super: 2026 Report reveals a national readiness crisis as businesses and…

-

Read more: Product Update: January 2026

Read more: Product Update: January 2026Product Update: January 2026

Welcome to the January 2026 product update from the Employment Hero team. We’ve got lots to share around Custom Forms,…

-

Read more: At A$300M ARR, AI-Powered Employment Hero Enters Next Phase as SEEK Growth Fund Launches Stake Sale

Read more: At A$300M ARR, AI-Powered Employment Hero Enters Next Phase as SEEK Growth Fund Launches Stake SaleAt A$300M ARR, AI-Powered Employment Hero Enters Next Phase as SEEK Growth Fund Launches Stake Sale

Employment Hero, a global AI-powered employment operating system, and SEEK Investments, manager of the SEEK Growth Fund, today announced that…