Free up time with payroll automation. Made for accountants.

Streamline your practice’s entire payroll journey in the cloud. Earn more time to shift your focus from compliance to advisory.

All in one place

Managing paperwork and spreadsheets can be hard to keep track of. Store all important client information digitally in one location. It’s secure and you can access it from wherever you are – via mobile or desktop.

Stay up to date

Enjoy product innovation, development, integrations, feature testing and legislation updates – all designed with you in mind.

Expand globally

Available in Australia, New Zealand, Singapore, Malaysia and the UK, our global offering streamlines payroll for your clients across multiple countries. Have as many clients as you like on the system.

Drive profit through payroll services.

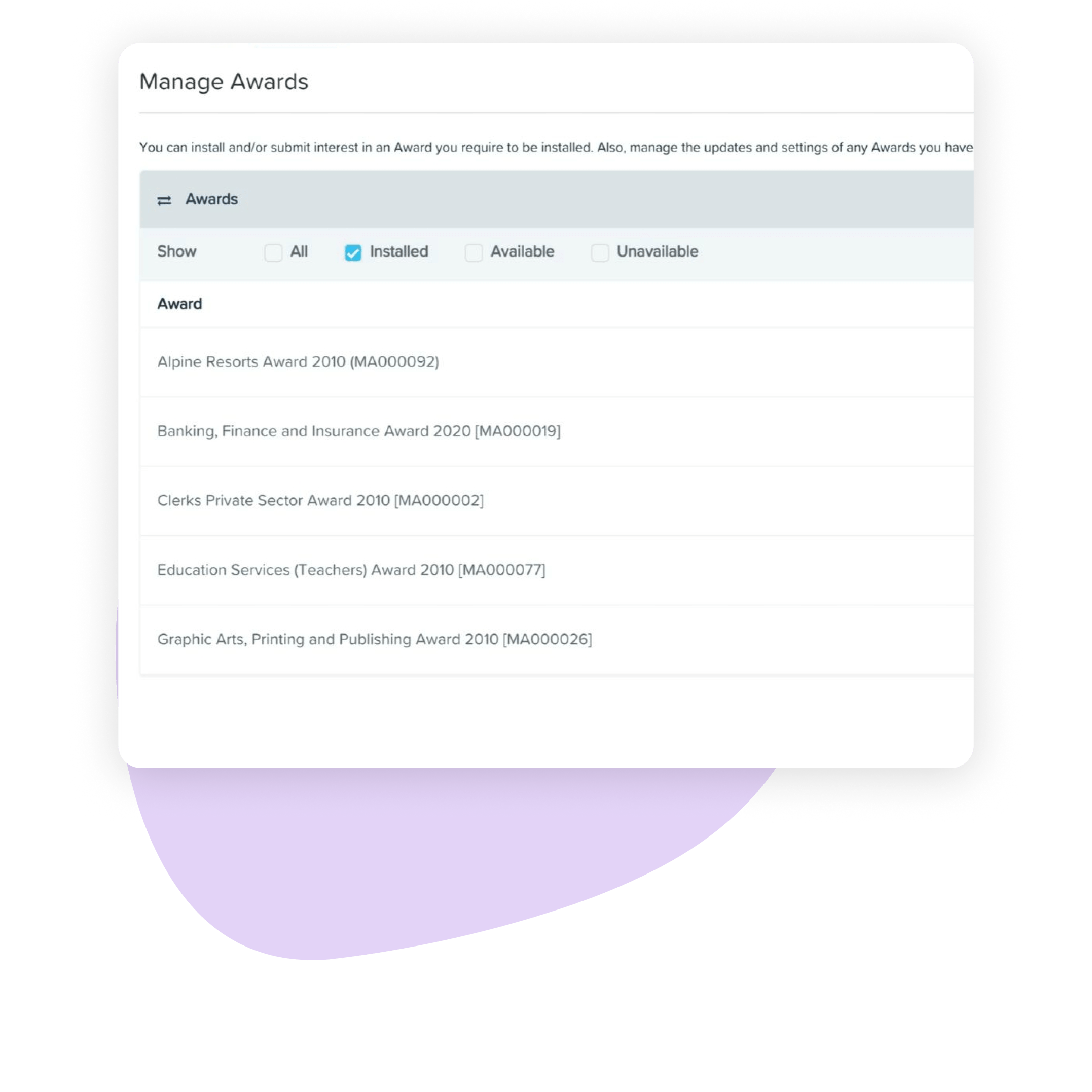

Support with award and payroll compliance

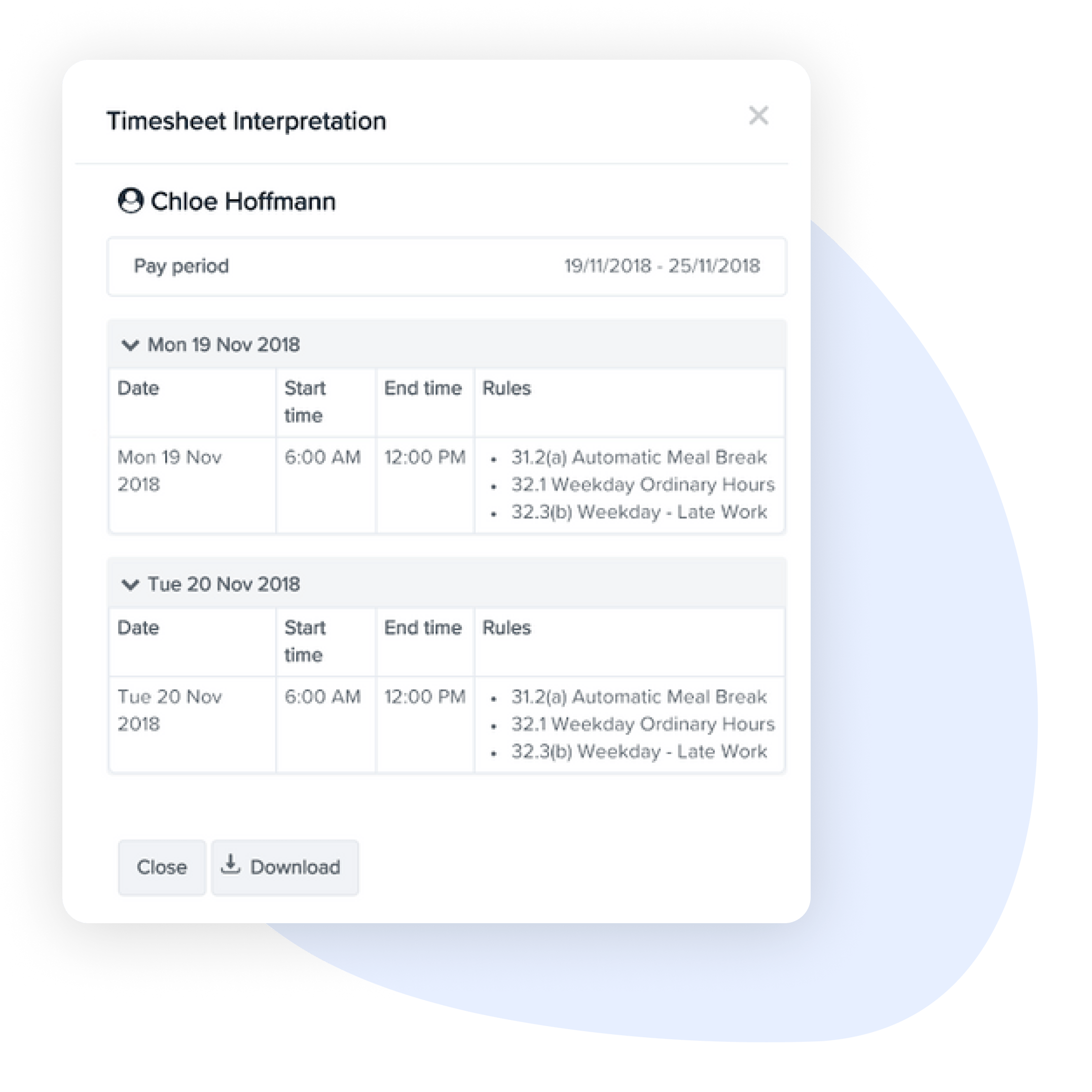

Payroll compliance is ever evolving and complex. Remove the need for manual calculations, spreadsheets, or multiple apps for the interpretation of Australia’s modern awards and leading ATO-certified STP reporting feature. Our modern award interpretation engine can automate employee award calculations – always updated in real time with scheduled legislation changes.

Accounting software integration

Eliminate the need for journal spreadsheet exports and uploads. Integrate seamlessly with a range of accounting platforms including Xero, QuickBooks Online, NetSuite and Saasu. Automate journal entries after each pay run, provision leave liabilities in journals, and map GL accounts with the ability to split by location.

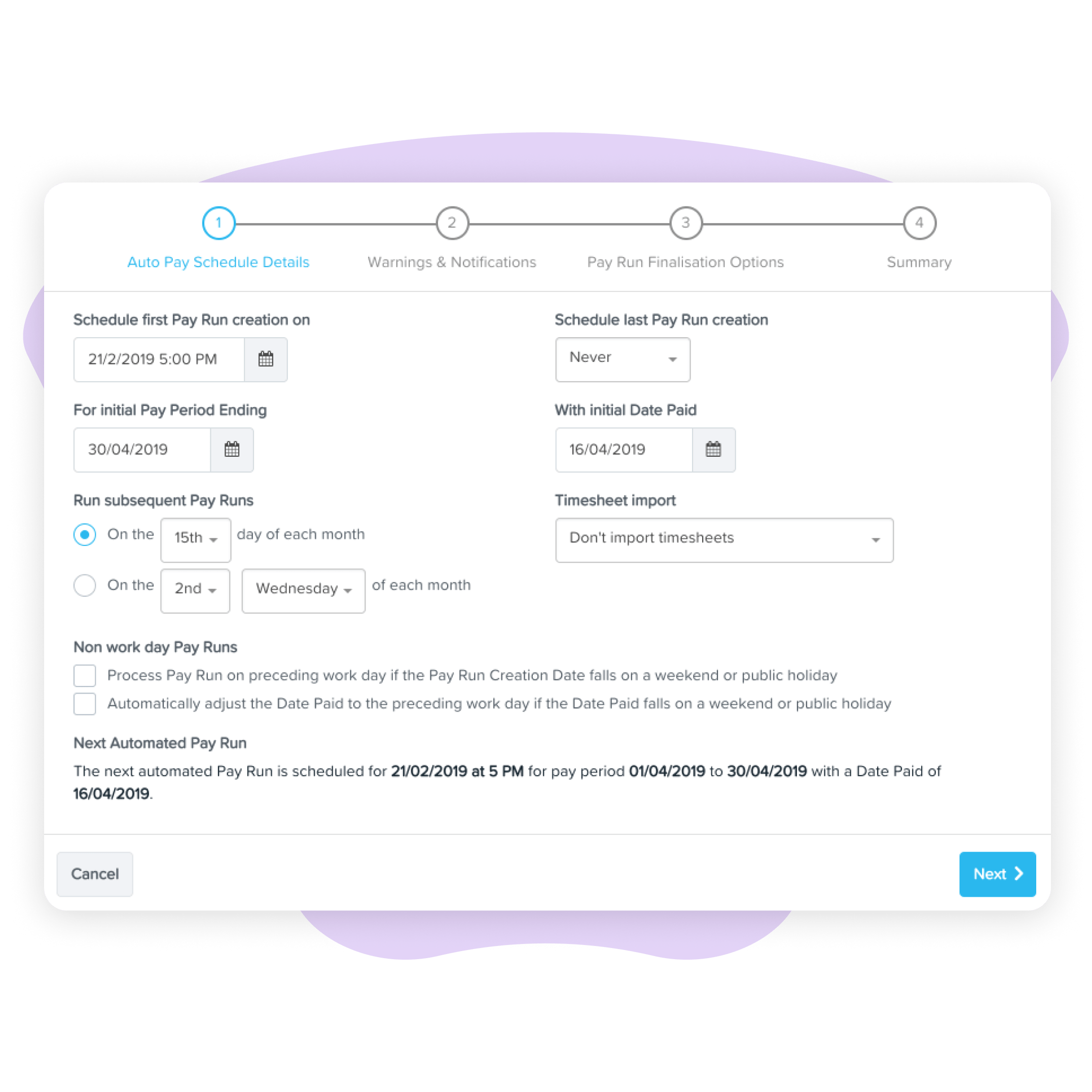

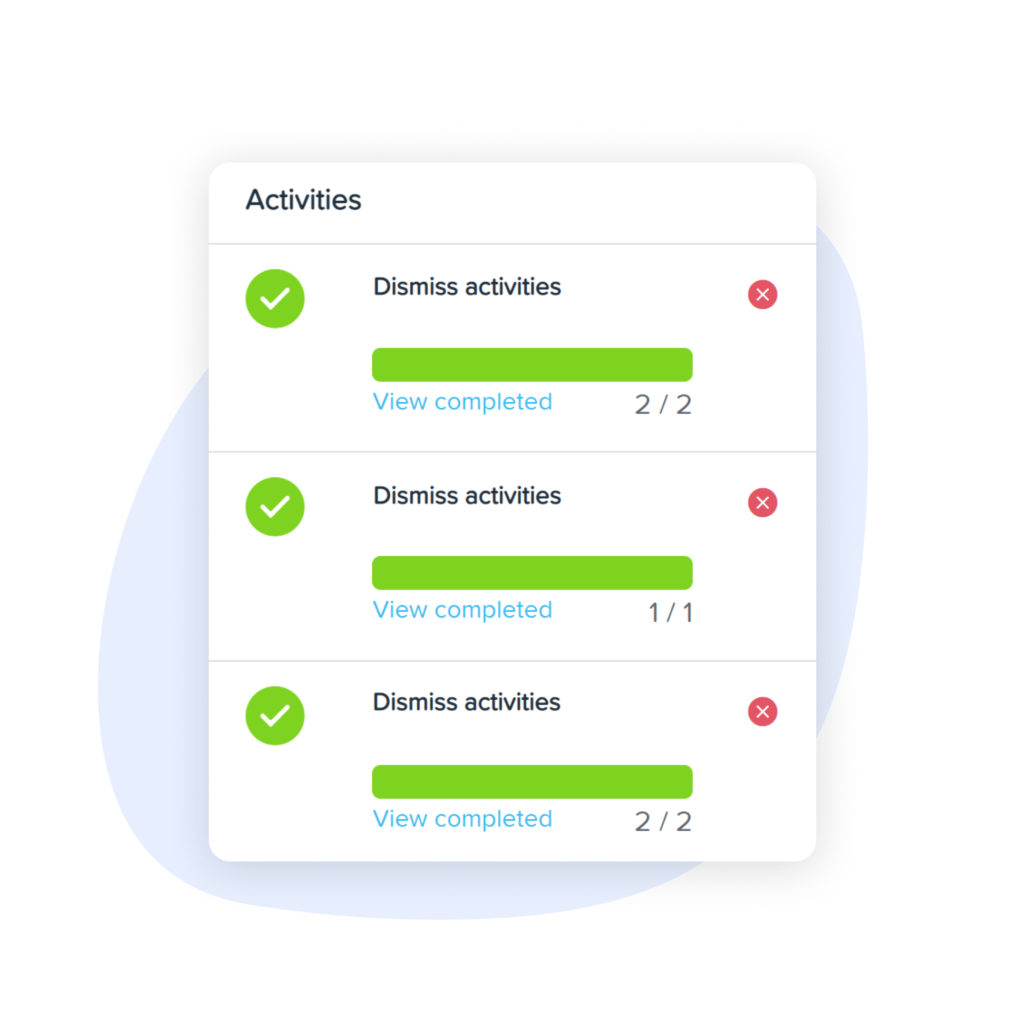

Automate pay runs

Remove all the mundane parts of payroll processing, freeing up time while keeping you firmly in charge. Let pay runs run in the background from start to finish and choose warnings that will stop the automation. Set and forget.

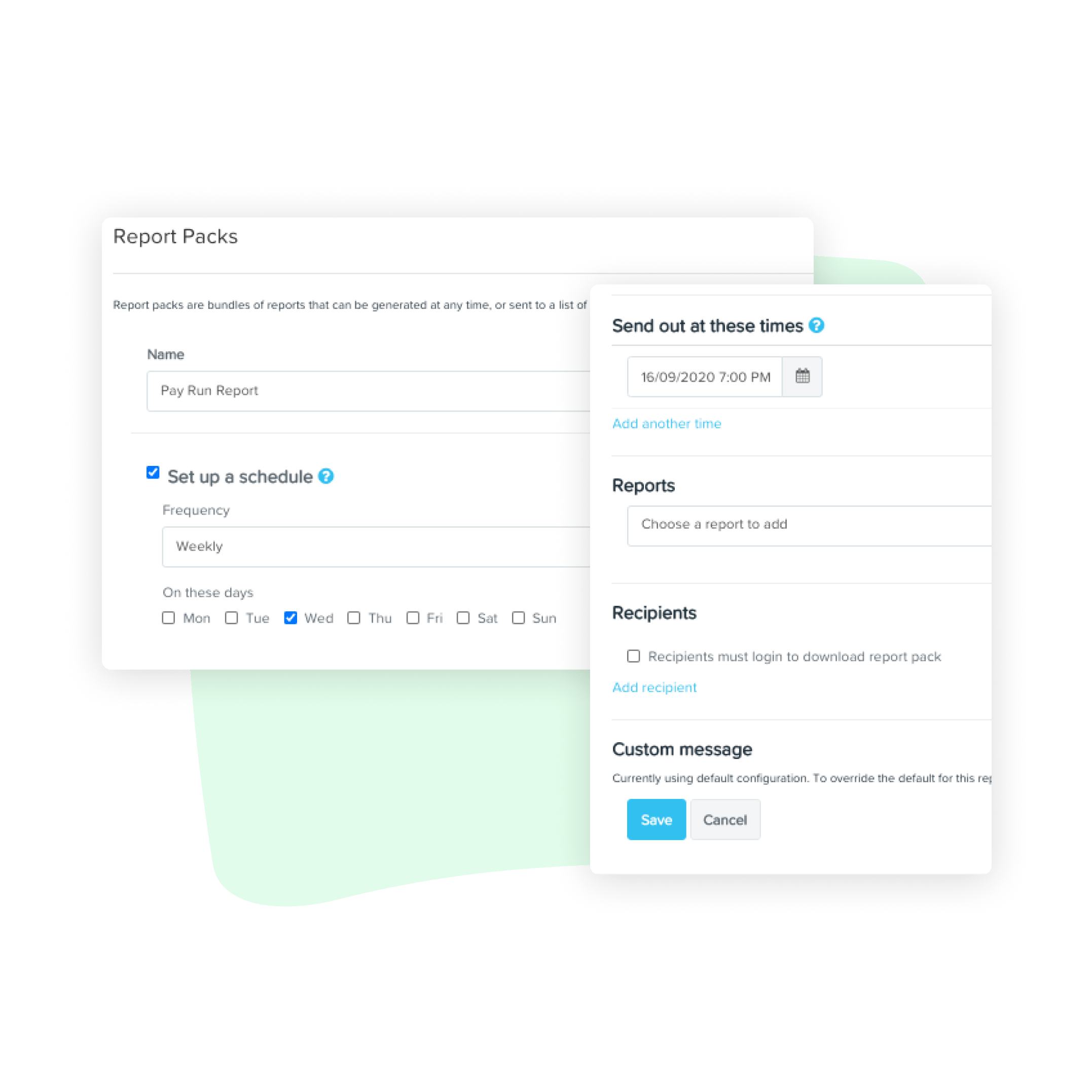

Automate reporting

Add value beyond payroll. Automate the generation and distribution of key reports such as Gross to Net, Leave Liabilities, pay run, super and PAYG.

Timesheet app and time clocking

Accountants often spend hours each month chasing and managing timesheets. Our timesheet calculator automatically interprets timesheet hours for each employee and feeds the data straight into payroll, so you don’t have to.

Trusted by over 750 partners. Here’s why our payroll partners love us.

Partner dashboard

Our partner dashboard enables you to provide more tailored services to each client, extract insights into client activity and generate new business streams.

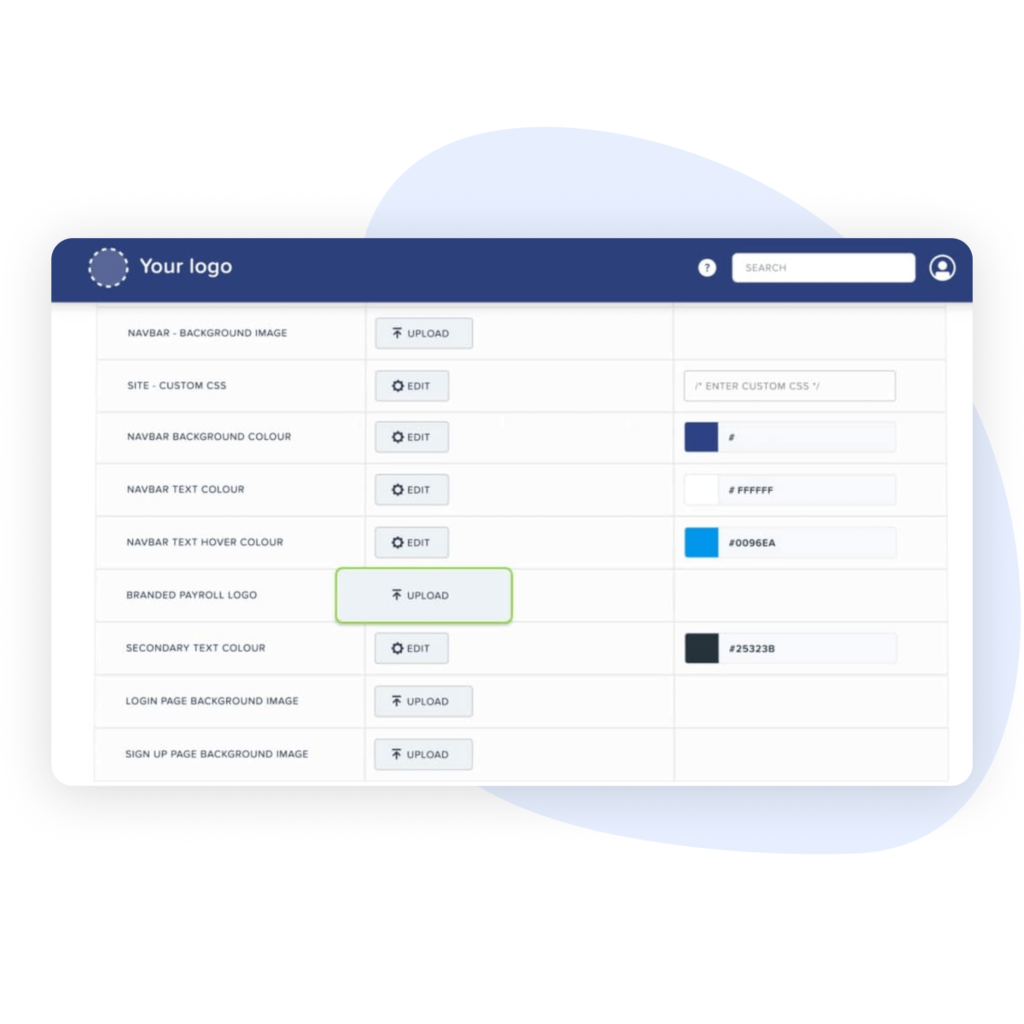

Branded payroll

Manage customers from one branded interface, boosting your brand amongst clientele.

Bureau dashboard

Get overall insights into how pay runs are processed, the state of those pay runs and make informed decisions.

Partner support

Get extensive product support articles, training videos, bite-sized webinars, tools for growth, and much more.

Why partner with us?

What are the benefits?

By becoming a part of the Employment Hero Partner Network, you can access:

- Tiered pricing

- Comprehensive support

- Dedicated Account Manager

- Guided onboarding options

- Support articles, product training videos, and webinars

- Updates on the latest features

- Technical support

- Resources to help you grow your practice

- Exclusive partner benefits such as industry training discounts

- Brand exposure to 200,000+ SMBs globally, with your listing in the partner directory

- Ongoing value, in conjunction with your products and services, to increase lifetime value

- Partner-specific tools designed to better manage the client experience

- Brand our software with your logo using our branded payroll solution

- Gain valuable insights about your client using the Partner Dashboard

What does it cost?

We offer different plans to help deliver a valuable payroll service to your clients. Tell us about your business and we’ll direct you to the most appropriate plan based on your requirements.

What to consider when choosing a payroll software?

Here’s what accountants and outsourced payroll providers should consider when choosing a payroll software:

- → Scalability and flexibility – Ensure the software can handle the varying needs of your clients, whether you’re dealing with small businesses or larger enterprises. It should be scalable to accommodate changes in the number of employees or clients you’re managing.

- → Compliance and tax regulations – Your payroll software should constantly stay up-to-date with the latest payroll and tax laws and regulations in your region. This will lift a huge burden off your shoulders because you no longer need to worry about compliance — they’ve got you covered.

- → Automation features – Look for software that enables you to automate tasks such as payroll and tax calculations, report generation and more. Leveraging on automation reduces the chance of human error and saves you so much time.

- → Integration capabilities – Choose software that can integrate with other accounting and HR systems that you or your clients might be using. This streamlines data sharing and minimises duplicate data entry.

- → User-friendly interface – A user-friendly (and mobile-friendly) interface is essential, especially if multiple employees and clients will be using the software. Intuitive navigation and clear layouts can help to reduce the training time needed, and speed up the implementations process.

- → Security and data privacy – Payroll involves sensitive financial and personal information. Make sure the software employs strong security measures, like encryption and multi-factor authentication, to protect this data.

- → Customer support and training – Check if the software provider offers reliable customer support and extensive training resources. A dedicated support team can help to assist you quickly when issues arise or when you need guidance. This is crucial in maintaining client satisfaction.

- → Customisation options – Each client might have specific payroll requirements. A software that allows the customisation of pay structures, deductions, and benefits can better accommodate these unique needs.

- → Reporting functionality – Robust reporting capabilities help to generate essential financial reports, payslips, and tax documents. Make sure the software can generate the reports you and your clients require for statutory reporting. These reports will also provide you with invaluable insights you can use to better advise your clients.

- → Cost considerations – Compare the software’s pricing structure and ensure it aligns with your budget. Some software providers offer tiered pricing based on the number of employees or clients you onboard.

- → Cloud-based accessibility – Cloud-based software allows you and your clients to access payroll data from anywhere, which can be particularly helpful for remote work scenarios or flexible work arrangements. It facilitates efficiency and everything can be accessed either via desktop or mobile.

- → Reviews and recommendations – Research online reviews and seek recommendations from fellow accountants and payroll providers who have experience with using the software. Their insights can be invaluable in helping you make an informed decision.

- → Upgrades and future developments – Check if the software provider regularly updates the software with new features, legislative changes, and improvements. This ensures that the software you use will stay relevant in the long term, plus you get more bang for your buck with an ever-growing suite of features.

- → Data migration – If you’re transitioning from an existing system, enquire about the ease of data migration and what it will entail. What are the steps required, the resources needed, and the estimated timeline for it? A smooth transition can save time and reduce disruptions.

How do i join?

You must be an accountant, bookkeeper or outsourced payroll provider to join. Simply fill and submit the form located on the partner network page and we’ll be in touch. Make sure to select the ‘partner type’ you most align with, so our team can progress your application.