Super Funds: The Problem With Direct Marketing and Rethinking ROIs

Curious to learn how members benefit from super fund advertising? We’ve shared our thoughts here.

Contents

Super Funds need to find ways to engage and grow their members.

Marketing teams are constantly looking for the best way to achieve an ROI on their efforts.

Historically, funds would focus on promoting their corporate super offering under an employer-led strategy or choose to advertisin the right place, at the right time.e directly to individuals.

Both have pros and cons, but neither strategy offers a clear way to measure the ROI from your efforts. That is to say, how do you measure the success of your strategy?

Let’s say you run a TV campaign while the market rallies by 10%, and member engagement increases. What’s the root cause? The TV campaign? The market? Something else? It’s hard to know.

I would like to propose an alternative choice – strategic partnerships. Specifically with an HR platform like Employment Hero because of our unique ability to deliver funds with a clear ROI on their investment.

Let’s look at how this works in practice.

Creating a path to clear ROIs

Below we will use a fiction super fund, Super Dooper Fund and compare two marketing strategies: Direct advertising vs partnering with us, Employment Hero.

As we say in the super industry, time to compare the pair!

Scenario 1: Direct advertising

The opportunity: So the board has tasked you with engaging your members? Awesome, I can already feel the creative juices flowing on all of your ideas. But first, aren’t there specific requirements we have as a fund to ensure the money we spend links to member outcomes directly? Interesting. Let’s pretend we’re at a mythical fund called the ‘Super Dooper Fund’ to play this out.

The scenario: Super Dooper’s growth team’s job is to build a campaign to engage their existing members. The plan to do this is by investing $1m in a month-long campaign to advertise at every bus stop in the city. It’s tried, tested…and our competitors are doing it. No brainer.

The idea: Increase brand presence to members as they commute from the city

The idea: Increase brand presence to members as they commute from the city

The outcome: Super Dooper reports member engagement has increased by 5% for the month. Not bad, hey?

The question: How does the fund link the $1m investment to a 5% increase in member engagement?

In our mock-up scenario, we’ve had a bit happening behind the scenes while the campaign was live. The market went up 5%, an employer SG quarter and of tax time, so members made more contributions after meeting their adviser. All these factors would have played a role in our increased engagement.

Which factor was the root cause of the great outcome we achieved?

Would we see the same outcome with a $500k advertising spend?

How about a $250k spend?

Or what if the fund didn’t do any marketing at all?

The dilemma: Direct advertising is great for building brand presence. It falls short when translating the ROI to member outcomes. We can only infer, hypothesise or gut-feel how the campaign influenced member behaviour. You won’t find a straight-line formula P+L for direct advertising expenses.

Trustees should assess the costs and benefits of actions, which will commonly include quantifiable metrics to demonstrate what the anticipated financial outcome is and the reasonable basis for that expectation.The Best Financial Interests Duty – What does the new super duty actually require?

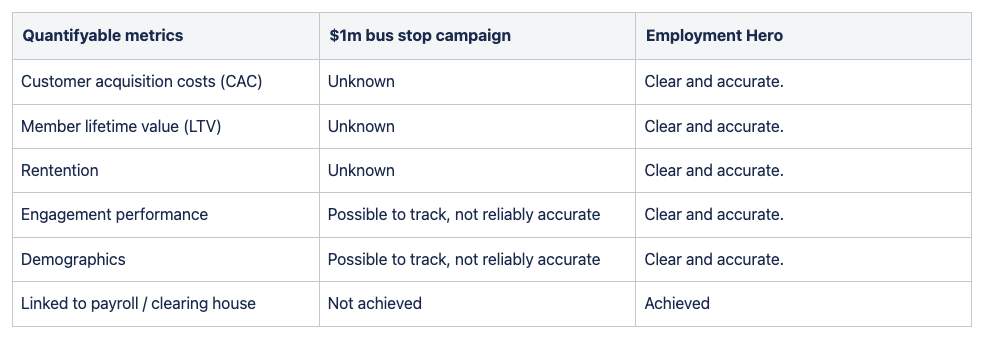

Now, we’re not lawyers or anything. But there are helpful metrics funds should understand to determine their ROI.

- Customer acquisition costs (CAC): What was the cost of acquiring new customers through the campaign? How does this compare to alternative sources of new member growth?

- Member lifetime value (LTV): How did the campaign positively influence member lifetime value (i.e. average time with funds and us under management)?

- Retention: How did the campaign influence the probability of existing members staying with us?

- Engagement: Did members engage with us as a result of the campaign (i.e. with enquiries, updates to contact details, downloads of mobile app or investment/insurance updates)?

- Demographics: Who were the members that engaged due to the campaign? How do they fit within our target market determination (TMD)?

There are gaps in this scenario. Now let’s look at an alternative approach to achieving fund outcomes through partnering with HR, payroll and benefits platform – Employment Hero.

Scenario 2: Partnering with Employment Hero

The opportunity: Same scenario as before; Super Dooper needs to increase member engagement and provide a transparent ROI.

The scenario: Putting bus stop ads to one side, Super Dooper partners with Employment Hero. The partnership provides an opportunity to engage members throughout their employment.

The idea: Employment Hero onboard over 35,000 employees a month. Super Dooper is displayed when existing members secure a new role and need to provide a Choice of Fund.

This results in a proactive brand presence and engages with members at a critical stage.

Super Dooper also engages members throughout the employment lifecycle, prompting consolidation and reminding members to provide up-to-date contact details.

The importance of daily engagement cannot be overstated, as it plays a critical role in member satisfaction. For insights on how to effectively engage super members in their daily routine, take a look at our blog on Engaging Super Members in their Daily Routine.

The outcome: Member engagement increases by 10% in the first month. Super Dooper starts to see a clear report on engagement, from retention to the number of members consolidating their super.

Because employment is linked to payroll (and Clearing Houses), the digital onboarding flow means the member doesn’t need to manually fill in any paperwork to ensure their nomination is honoured when their employer next makes their super payments. It’s all centralised and means Super Dooper enjoys the best chance of their members SG being paid in the right place, at the right time. This is a model that aligns perfectly with the future compliance requirements of Payday Super. Favourable for CAC payback and LTV metrics must be considered part of the overall ROI.

Super Dooper can also see the demographics of which members are engaging via the partnership to directly translate how the overall investment in the partnership is translating to ROI for the fund, or in other words, achieving members’ best financial interest.

For more strategies on building member loyalty through value-driven propositions, check out our guide on Increasing Super Member Loyalty.

The wrap up

Direct marketing has its time and place. It helps build brand awareness and gets your message out there. Where it falls short is providing a clear ROI on outcomes. It doesn’t tell you who made a decision based on your efforts or who those members are.

That’s where we fit in.

Partnering with Employment Hero delivers a transparent ROI, directly translating your investment into engagement and growth metrics to make sure the desired outcome is being achieved.

Understanding the history of superannuation can also provide valuable insights into how the industry has evolved and where it’s headed. Learn more in our article on The History of Super in Australia.

To learn more get in touch at ray.jaramis@employmenthero.com

Do you work for a Super Fund? Have a read and let me know your thoughts. We already help several industry and retail funds and would love to learn more about how Employment Hero can help achieve your engagement and growth objectives.

Disclaimer: The information in this article has been prepared by Employment Hero Pty Ltd (ABN 11 160 047 709) and its related bodies corporate (Employment Hero). The views expressed in this article are general information only about our products and services, are provided in good faith and should not be relied on as professional advice. Employment Hero does not accept any liability for any loss or damages arising directly or indirectly as a result of reliance on, use of or inability to use any information provided in this article. You should undertake your own research and seek professional advice before making any decisions or relying on the information in this article.

Related Resources

-

Read more: OKR examples for Australian workplaces

Read more: OKR examples for Australian workplacesOKR examples for Australian workplaces

Discover practical OKR examples for Australian businesses. Learn how to set effective objectives and key results to boost alignment and…

-

Read more: Cash flow management: The guide to financial health for Australian businesses

Read more: Cash flow management: The guide to financial health for Australian businessesCash flow management: The guide to financial health for Australian businesses

Discover effective cash flow management strategies for employers. Learn how to forecast cash flows, manage inflows and outflows, and ensure…

-

Read more: The rise of ‘benefitsmaxxing’: UK workers look beyond pay during period of slowing wage growth

Read more: The rise of ‘benefitsmaxxing’: UK workers look beyond pay during period of slowing wage growthThe rise of ‘benefitsmaxxing’: UK workers look beyond pay during period of slowing wage growth

26 February 2026 – New research commissioned by Employment Hero reveals 53% of UK workers say better benefits are a…