Payroll Essentials

Implementation: Singapore

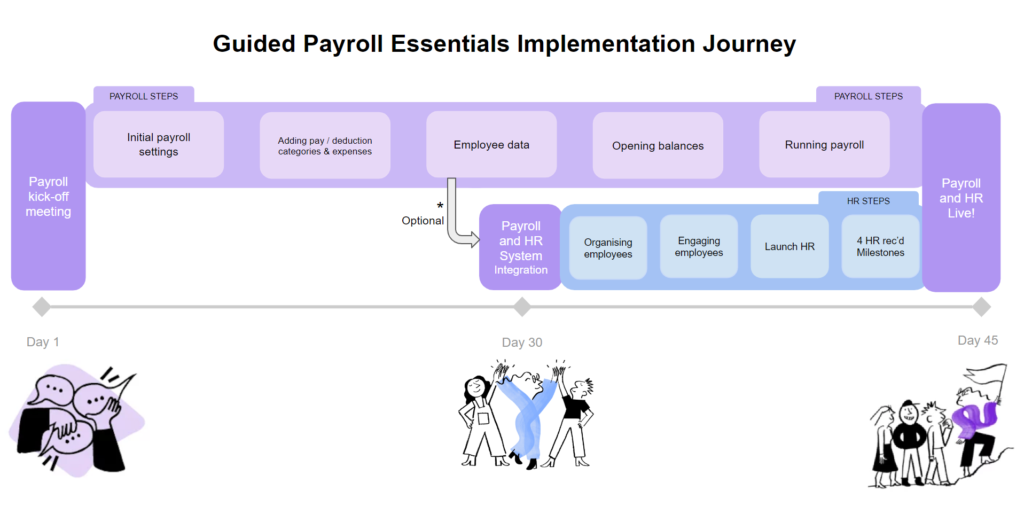

Our Payroll Essentials stream is the simplest way to get your employees onboarded and paid as quickly as possible. Your shortened implementation journey starts below.

The Guided Payroll Implementation provides you with the following support mechanisms:

- On-demand webinars for you to watch at a time that suits you

- Access to our weekly live Q&A webinar sessions, where our consultants will demonstrate the payroll platform and answer customer questions

- Support via email

This implementation service does not cover direct phone access to our consultants or 1:1 meetings with our consultants. If you need additional support, please reach out to our team via email. Don’t worry – we’ll be here from the setup of your system to your first live pay run.

Have questions? Our dedicated guided implementation team is here to help you any time during your journey at

implementations@employmenthero.com

To get started, sign up for your on-demand webinar or one of our live Q&A sessions by clicking the relevant link below.

Live Q&A

On-demand webinars

Live webinars

General Q&A

In this open live Q&A session the consultant will demonstrate any topics relating to configuration or pay run issues you have encountered during your implementation, or any questions you have from the on demand content.

On-demand webinars

Depending on your business needs, please access the appropriate on-demand workshops below.

Required 1: Initial Payroll Settings

Enter or check your company details, and setup your banking details so you can generate bank files

Core 2: Pay Categories, Deduction Categories & Expenses

In this core workshop you will learn how and why you need to manage and create pay and deduction categories and expense categories

Core 4A: Employee Data

Importing your employee data is a key part of working in the payroll system. This workshop will provide you with the knowledge on how to export a template to capture your data and also how to import the completed data template into your payroll.

Core 4B: Employee opening balances / Other income and benefits

Importing your opening balances and benefits in kind could be an initial configuration activity for your employee’s financial year end tax filing. This workshop will provide you with the knowledge on how to export a template to capture your data and also how to import the completed relevant data template into your payroll.

Core 6: Running a Pay Run (SG)

This workshop will provide you with an overview of the process to run a payroll, from creating a pay run to finalising a pay run. In this training, you will also be exposed to adding in your shared help group (SHG) deductions, additional earnings & deductions should you need to do so.

Core 7: Completion of Payroll Settings (SG)

In this workshop you will be guided through the process of finalising your pay run within the platform, downloading your CPF files and Bank files and importing year to date opening balances and leave balances for your employees before you go live and transit to our Payroll platform!