An Easier Way to Update Superannuation Details

Because changing contact details with super funds should be as easy as ordering a pizza.

Contents

The digital age isn’t just about instant gratification.

It’s about simplicity, seamlessness, and service that fits effortlessly into our daily routines. We live in a world where we can order a pizza while binge-watching our favourite show. Yet, when it comes to managing our finances, we’re often left tapping our foot impatiently.

In bustling daily life, keeping contact details updated with banks, insurers, or super funds often falls through the cracks. Let’s face it; amid the whirlwind of moving boxes and address changes, notifying financial institutions isn’t usually top of the to-do list (figuring out if the internet has connected properly is usually where 90% of my brain power goes, the other 10% goes to whether the closest cafe is any good).

This lack of a ‘natural trigger’ leaves members scrambling to remember updates, turning what should be a simple task into an odyssey of login screens, customer service calls, and potential headaches.

Why is it that, when moving house, updating important details often plays out like this…

- Midway through packing the third box of vintage mugs you swear you need, it hits me. “I should probably update my address details with my bank, insurer, super fund, ATO, RMS, health insurer, gym, electoral roll… ahhh….”

- You embark on the quest to figure out how you update every single provider. You contemplate if you should break up with some just to avoid the task. Would it be THAT bad if you still voted in your old district? The democracy sausages were always on point!

- Successfully update 3 of the 15 providers on the list. Now super… Log in to your super fund’s website. Or was it a mobile app? Attempt to remember the password. Was it related to that holiday in ’09? Or the name of your first cat? Cue three failed attempts and a password reset.

- Aha! Found the update section. But do you live on a ‘Way’, ‘Drive’, or ‘Avenue’? What’s the postcode? Back to your inbox to find your real estate confirmation email.

- Squint at the minuscule boxes and type in your new address. Get distracted by the lounge which is stuck halfway in the door…

- Focus! Hit ‘Save’ on the super fund website. Experience a rush of achievement, akin to summiting Everest. Wait for the confirmation email. Don’t see it? Check the junk mail. Still not there? Realise you never updated your email address. Facepalm.

- Ok done. Now to the bank… Actually, it’s already 7pm and time to test out the new local pizzerias…

Thankfully, there’s a way to avoid this hectic scramble.

What is embedded super?

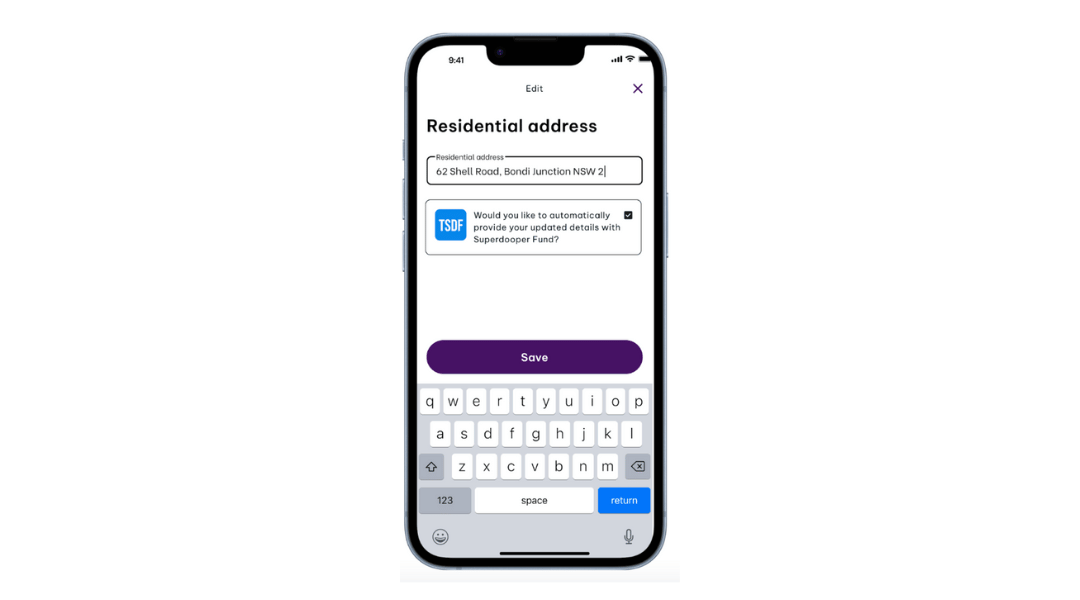

Picture a world where members effortlessly update their details on platforms they already use daily, seamlessly sharing the news of their latest move or contact change with employers and, by extension, their super funds, banks, and insurers. We call it embedded super. The new era of seamless integration, where updating your address is as intuitive and straightforward as liking a post on social media.

As Ray Jaramis discusses in the History of Super in Australia, the evolution of superannuation is heading towards more integrated solutions like embedded super.

Essentially, embedded super refers to placing a superannuation product within a non-super platform, service or digital customer experience that members already use. It allows members to manage their superannuation seamlessly alongside their other activities, enhancing member context, engagement and streamlining interactions with super.

For more on how we’re engaging super members in their daily routines, check out our detailed blog on modern engagement.

Read more: Engaging Super Members in their Daily Routine

A transformative member experience

In a world where sophisticated algorithms suggest your next favourite song and one-click purchases are the norm, we believe streamlining our superannuation is going to be transformative in improving member engagement, and ultimately satisfaction.

We believe in creating a digital world where our day-to-day conveniences are seamlessly integrated. Where a single update resonates across the platforms you choose, simplifying the way to make sure you’re always in sync with your super funds, banks, and insurers.

To explore the insights from the recent fintech discussions, take a look at our wrap-up of the 10th annual Fintech Summit.

If you’d like to learn more about Employment Hero Hero Super, reach out to Ray and the partnerships team at embeddedsuper@employmenthero.com.

Alternately, you can learn more about Hero Super here or download our whitepaper.

Read more: The History of Super in Australia

About Employment Hero

Employment Hero manages the employment of more than 1 million employees, roughly 15% of Australia’s private sector workforce and is forecast to continue growing exponentially.

Our mission is to make employment easier and more valuable, for everyone.

Employment Hero offers a suite of digital super services to help employees engage with and manage their super selection, all while making employment simpler and more automated for small-medium business owners.

The information provided on this page has been prepared by Employment Hero Pty Ltd (ABN 11 160 047 709) and its related bodies corporate (Employment Hero). The content provided on this page is only general information about Employment Hero’s products and services, and is provided in good faith without taking into account your personal circumstances, financial situation or needs. Before acting on any information, you should consider whether it is appropriate for you and Employment Hero recommends that you seek independent financial, legal and taxation advice. Certain information given is based on data supplied by third parties. While such data is believed to be accurate, it has not been independently verified and no warranties are given that it is complete, accurate, up to date or fit for the purpose for which it is required. Employment Hero does not accept responsibility for any inaccuracy in such data and is not liable for any loss or damages arising either directly or indirectly as a result of reliance on, use of, or inability to use any information provided on this page.

Related Resources

-

Read more: Guide to long service leave entitlements in Australia

Read more: Guide to long service leave entitlements in AustraliaGuide to long service leave entitlements in Australia

Understanding long service leave entitlements can be challenging. We share everything employers need to know about managing it.

-

Read more: The $124,000 Cashflow Crunch: Small and Medium Businesses (SMBs) at risk under proposed Payday Super Requirements

Read more: The $124,000 Cashflow Crunch: Small and Medium Businesses (SMBs) at risk under proposed Payday Super RequirementsThe $124,000 Cashflow Crunch: Small and Medium Businesses (SMBs) at risk under proposed Payday Super Requirements

New Employment Hero modelling and research shows businesses will need an extra $124,000 in working capital on average to meet…

-

Read more: From hiring mismatch to SmartMatch: 5 critical things your recruitment strategy is missing

Read more: From hiring mismatch to SmartMatch: 5 critical things your recruitment strategy is missingFrom hiring mismatch to SmartMatch: 5 critical things your recruitment strategy is missing

We’ve wrapped up five critical things your recruitment strategy might be missing so you can feel confident in your hiring…