Generating ABA files in Employment Hero Payroll

The most common way for your clients to pay employees in Employment Hero Payroll is via an ABA file which is automatically generated by their payroll software. Learn how.

An ABA file is a file that is used by all major Australian financial institutions to specify payments to be made from one bank account to one or more bank accounts.

As a accountancy/bookkeeping firm or bureau, the most common way for your clients to pay employees in Employment Hero Payroll is via an ABA file which is automatically generated by their payroll software. Once you have your ABA file, it’s usually a simple matter of uploading it to their business internet banking portal and authorising the payments.

For a comprehensive understanding of Australian payroll legislation, especially for accountants and bookkeepers, check out this free guide.

Setting up Employment Hero Payroll to generate an ABA file

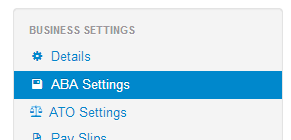

Before managers can generate an ABA file in Employment Hero Payroll, the ABA settings need to be first setup using the following steps:

1. From the “Business –> Settings” menu, select “ABA Settings”

2. Click “Add” to create a new set of ABA settings. Employment Hero Payroll can set up multiple bank accounts to pay employees from, but only one account needs to be set up.

3. Once the ABA details have been filled in, click “Save”. ABA files can now be generated from pay runs.

To understand how cloud payroll can benefit your accounting firm and streamline payroll processes, read this article.

What are each of the ABA settings for?

The table below provides more information on the purpose of each of the ABA settings:

| Setting | Required | Description |

| BSB Number | YES | The BSB number of the account that payroll payments will be made from |

| Account Number | YES | The Account number of the account that payroll payments will be made from |

| Account Name | YES | The Account Name of the account that payroll payments will be made from |

| Financial Institution Code | YES | The official 3 letter abbreviation of the financial institution that the bank account that payroll payments will be made from is registered with. e.g. the official Westpac code is WBC. You may refer to the BSB numbers site to look up your institution code |

| Lodgement Reference | YES | The description of the payroll payment that will appear on the employees bank statement. e.g. “Payroll” or “Weekly wages” |

| Name Of User Supplying File | YES | This is the name of the user or business that is creating the ABA file. The most common value is the business name. |

| Name Of User Supplying File | YES | This is a 6 digit number provided by your bank. If you’re not sure what this number is, you’ll need to contact your bank. It’s often listed on their website and for some banks such as the ANZ you can provide any 6 digit number (such as 000000) |

| Include Self Balancing Transaction | NO | Selecting this option adds an additional “Self balancing” transaction to the end of the ABA file which is required by some financial institutions when generating the ABA files. You’ll need to check with your financial institution to determine if you’ll need to select this option (it’s often available on their website). |

For insights into how advancements in technology are changing the role of accountants, read the State of Accounting Report.

Generating ABA files

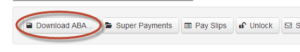

ABA files can be generated within Employment Hero Payroll using the following steps:

- After a pay run has be finalised, click the “Download ABA” button from the pay run actions bar

- If there is one set of ABA setting, the ABA file will download automatically

- If there are multiple ABA settings, the appropriate ABA setting needs to be selected

- Once the correct ABA settings has been selected, click “Generate ABA”.

- Employment Hero Payroll will remember which ABA settings that was last used to generate an ABA file and will automatically select it for next time.

To learn more about ABA files, take a look at our support article here.

If you’re experiencing issues with your current payroll software, it might be time for a change. Here are five simple steps to help you switch to a new payroll software.

Disclaimer: The information in this article is current as at 1 June 2022, and has been prepared by Employment Hero Pty Ltd (ABN 11 160 047 709) and its related bodies corporate (Employment Hero). The views expressed in this article are general information only, are provided in good faith to assist employers and their employees, and should not be relied on as professional advice. The Information is based on data supplied by third parties. While such data is believed to be accurate, it has not been independently verified and no warranties are given that it is complete, accurate, up to date or fit for the purpose for which it is required. Employment Hero does not accept responsibility for any inaccuracy in such data and is not liable for any loss or damages arising directly or indirectly as a result of reliance on, use of or inability to use any information provided in this article. You should undertake your own research and seek professional advice before making any decisions or relying on the information in this article.

Related Resources

-

Read more: Superannuation payment due dates for Payday Super

Read more: Superannuation payment due dates for Payday SuperSuperannuation payment due dates for Payday Super

Payday Super is changing the rules on when to pay superannuation. Learn about the 7-business-day deadline and QE Day. Read…

-

Read more: OKR examples for Australian workplaces

Read more: OKR examples for Australian workplacesOKR examples for Australian workplaces

Discover practical OKR examples for Australian businesses. Learn how to set effective objectives and key results to boost alignment and…

-

Read more: Cash flow management: The guide to financial health for Australian businesses

Read more: Cash flow management: The guide to financial health for Australian businessesCash flow management: The guide to financial health for Australian businesses

Discover effective cash flow management strategies for employers. Learn how to forecast cash flows, manage inflows and outflows, and ensure…