Payroll software that makes compliance simple

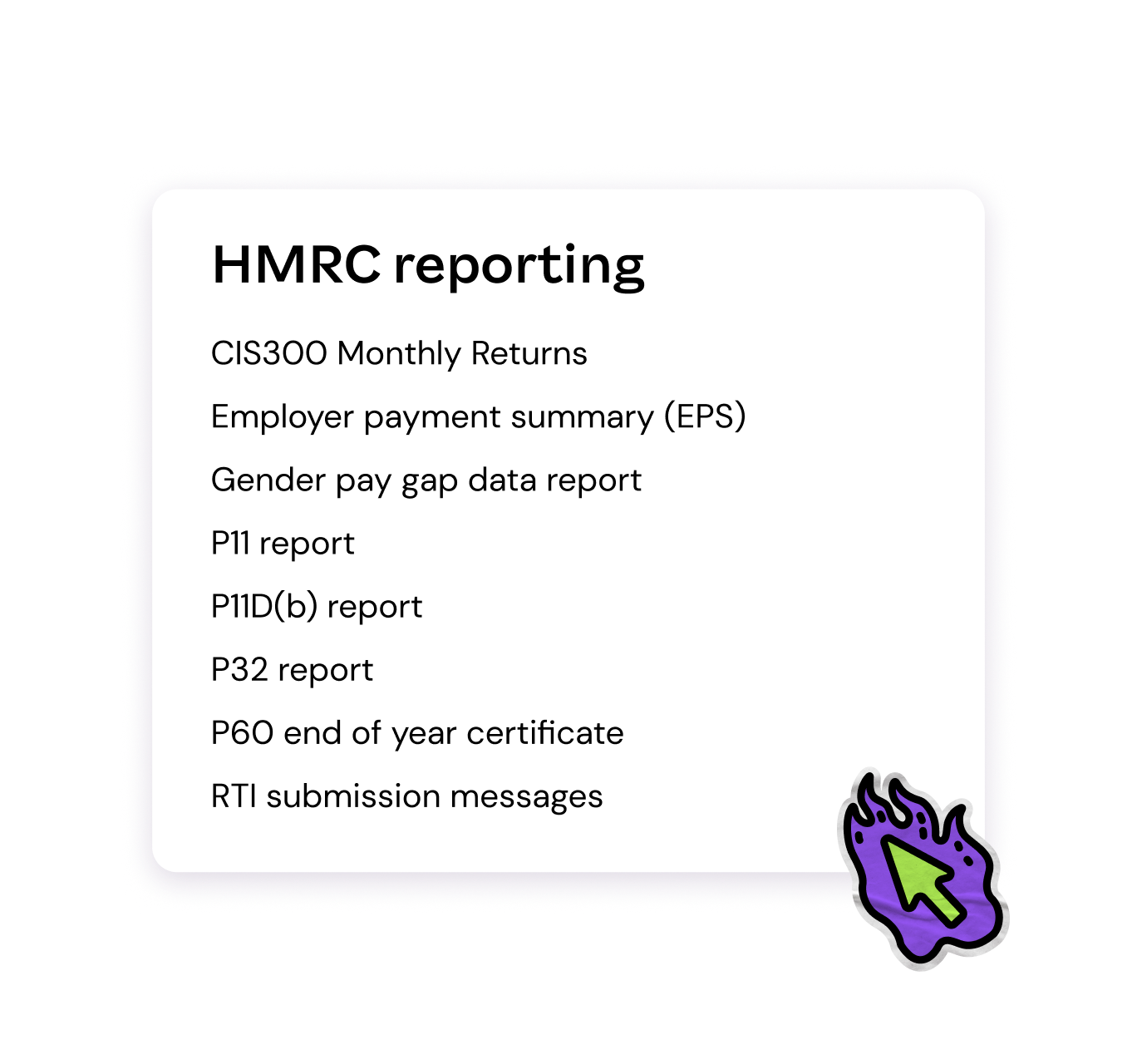

While others make payroll complicated, we make it invisible. Employment Hero syncs with HMRC, handles tax obligations, and keeps you compliant. Smart payroll that adapts – whether you’re doing it solo or scaling up. Real-time filing, zero stress.

Have confidence in compliance

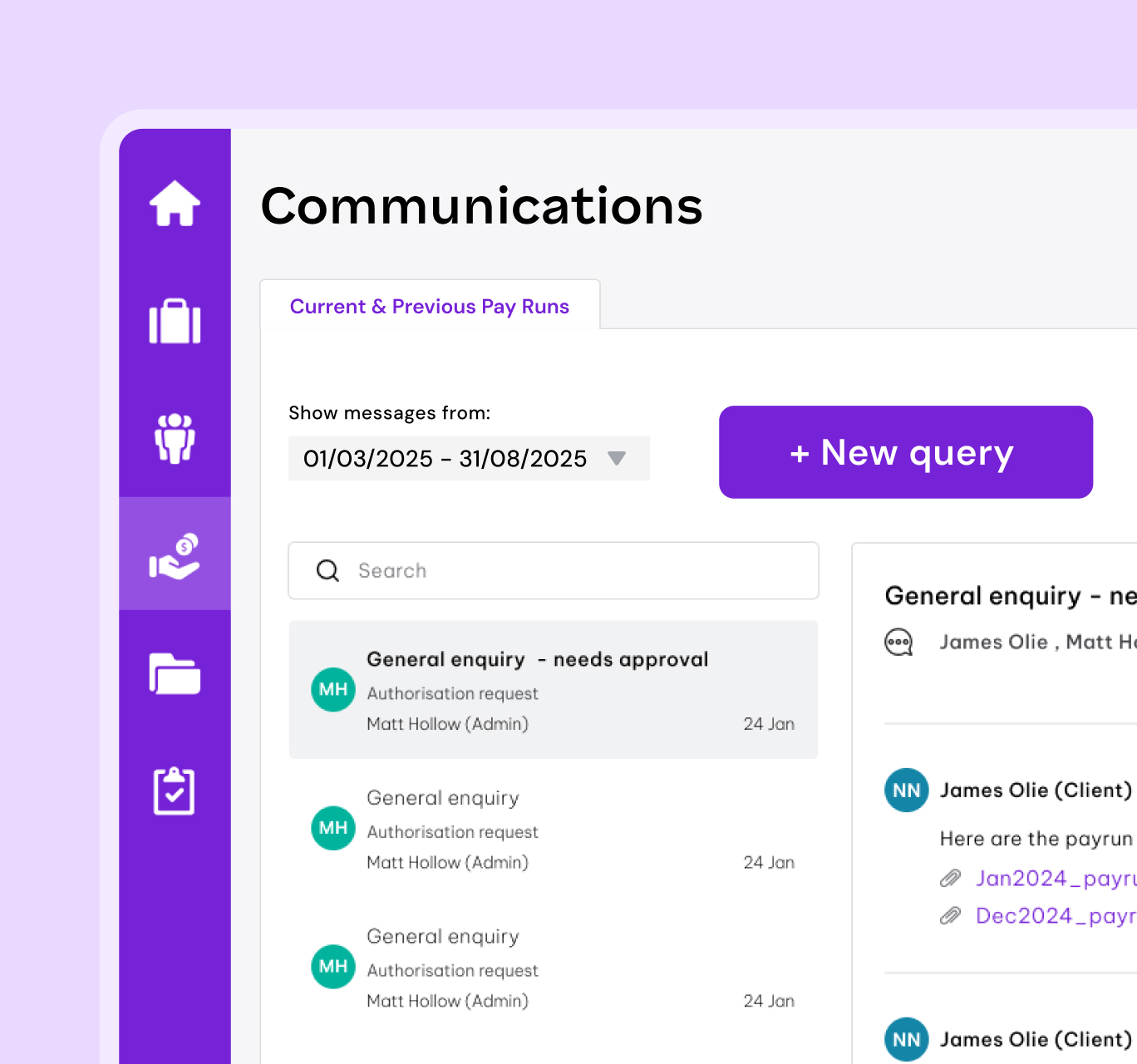

From built-in GDPR compliance to automatically submitting RTI to HMRC, Employment Hero provides HR advisory and support to help take the guesswork out of payroll compliance.

Payroll that fits into the big picture

Employment Hero’s payroll integrates with our HR tools. That means leave management, timesheets, RTI-payroll and reports, salaries and employee data flow seamlessly together, eliminating double-handling, spreadsheets and siloes.

Payroll processes anyone can master

Whether you’re in HR, ops or finance, payroll might not be your job title: but it’s on your plate. Employment Hero Payroll is built to be intuitive, reliable and stress-free. Non-specialists can run compliant payroll with confidence, and experts can go further, faster.

Run payroll the smart way.

Run payroll in minutes, not days with smart payroll automation. Our tech flags discrepancies and missing information before they become big issues, and cuts out busy work and manual handling.

TRUSTED BY 300k+ HAPPY CUSTOMERS

Payroll like you didn’t think was possible

Pre-payroll done for you

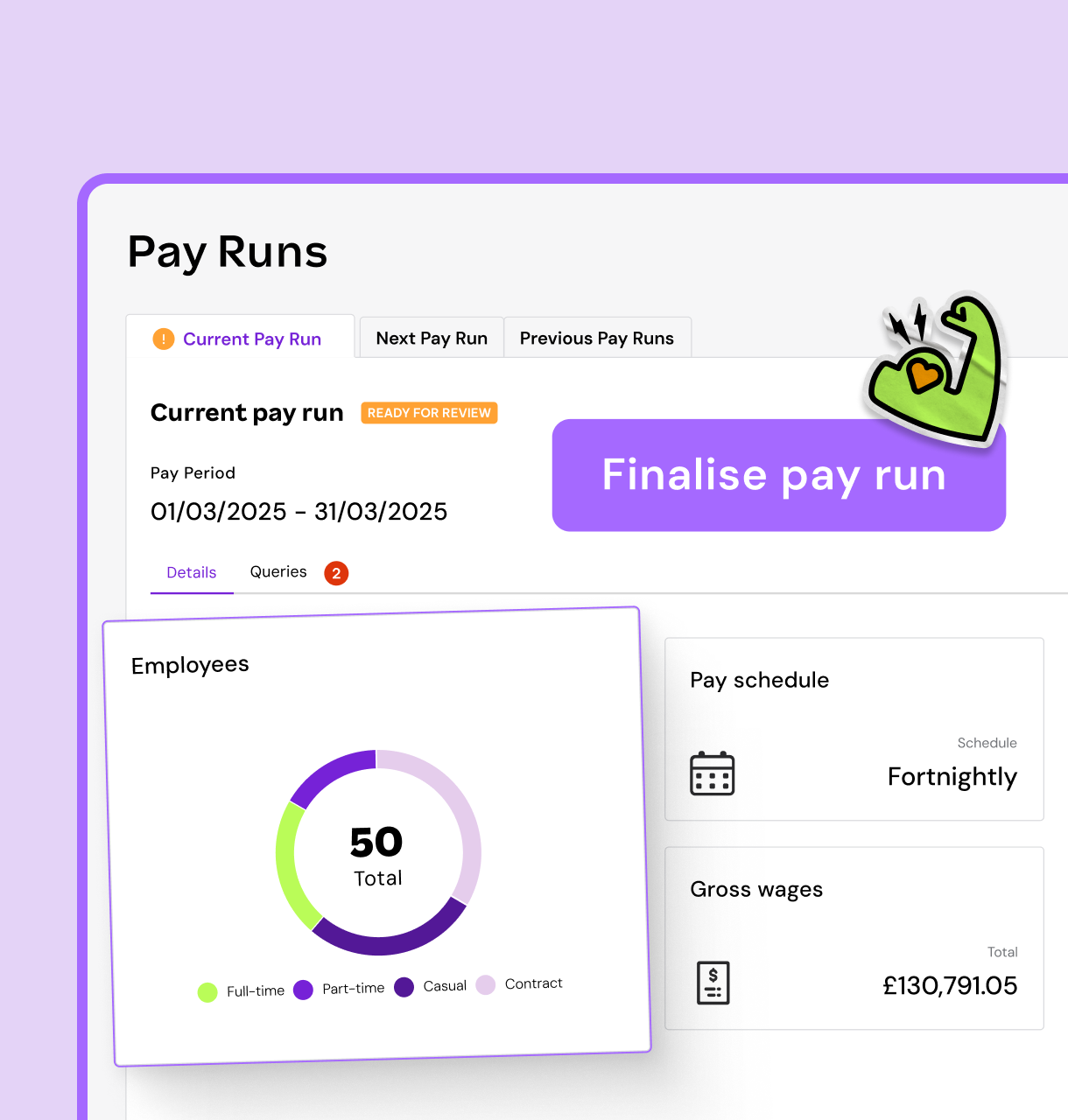

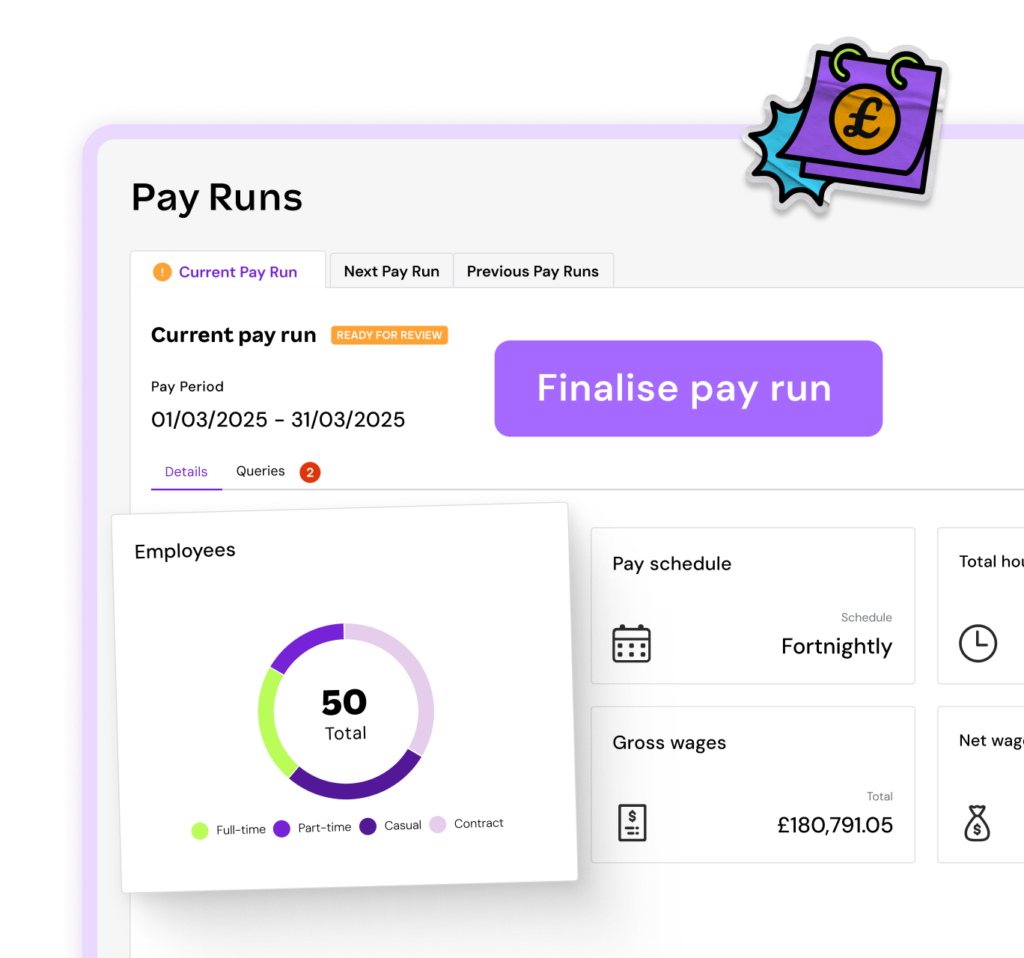

Say goodbye to missed information and last minute chasing. Pay run is automatically compiled from different data points in the platform. You can easily run checks, make final approvals or declines, upload amendments, and action any pending tasks—all from one place. Once ready, submit it with just a click.

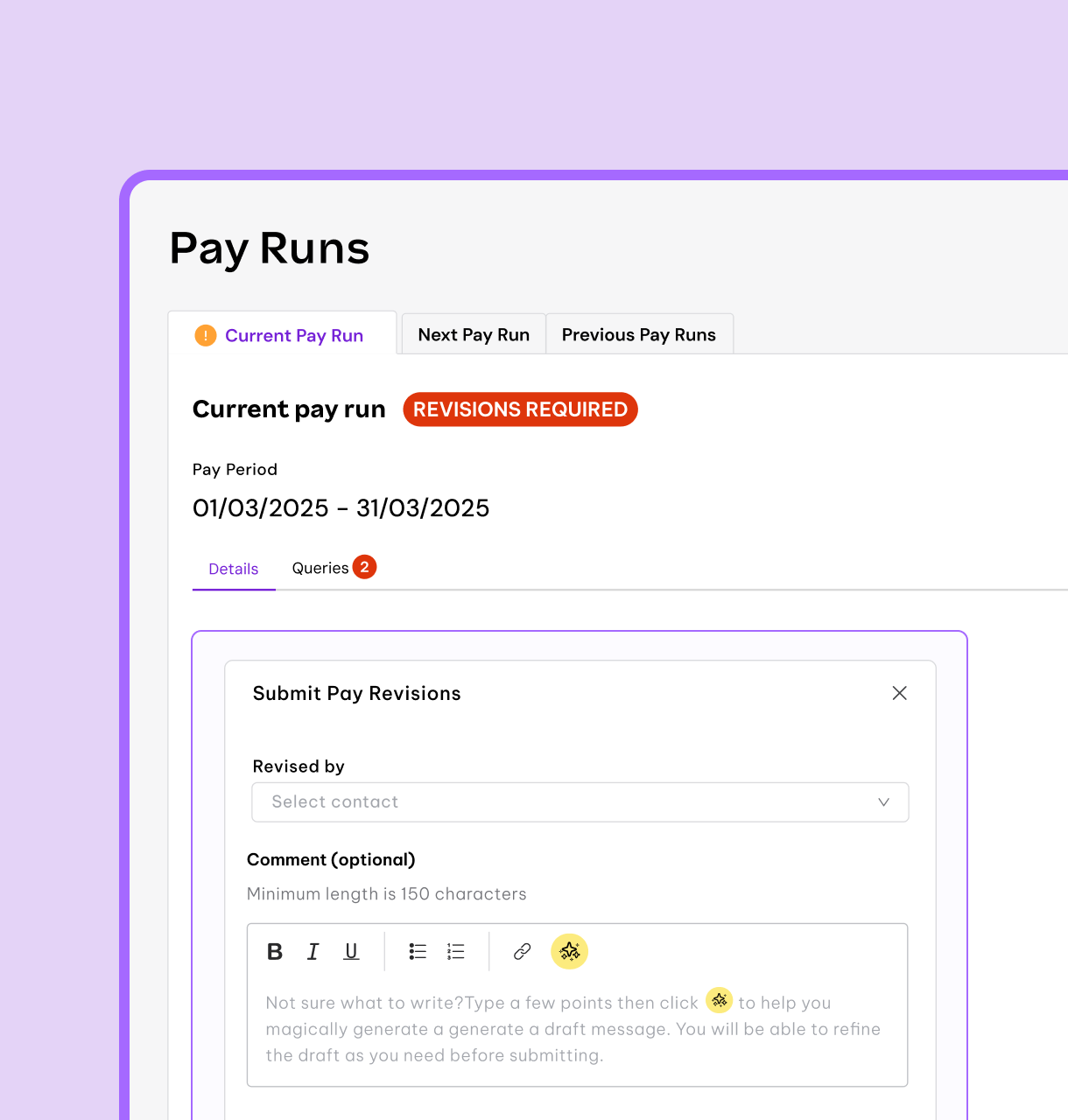

Complex pay run processing made easy

Employment Hero reviews, calculates, and processes your payroll. Once ready, you get notified for a final check with a simple visual dashboard with key information and warned of any errors or discrepancies. Easily submit any revisions or approve the pay run with just a click.

Make post-payroll tasks effortless

Save time on those same recurring tasks to focus on running a tight ship. Automatically calculate and sync pension payments, get payslips created and posted to your employees, and send salary journals to the general ledger.

Expert support you can count on

Work with an allocated payroll partner to tailor the service to your needs. Get complex calculations like back pay, 52-week averages, pay condition rules, and redundancy models done for you. Consult on auto-enrolment compliance. Action delayed changes. This and more with the support of a UK professional that becomes an extension of your organisation.

Shield your payroll with waterproof compliance

Automatically submit all required RTI reporting directly with HMRC after a pay run. Submit your National Insurance data and PAYE to HMRC in just one click.

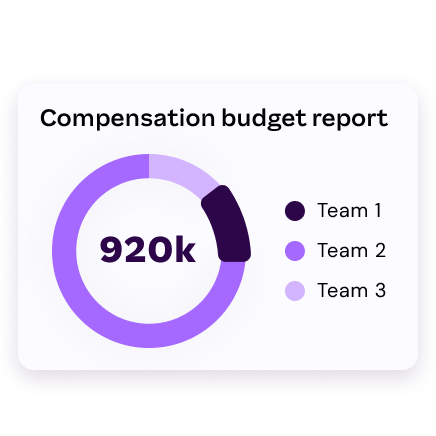

Drive better decisions with powerful insights

No more complex spreadsheet formulas or running blind. Make data-driven decisions with a variety of payroll reports. Access pay run variance, run audits, calculate gross-to-net, and more. Payroll data also allows you to uncover important financial metrics like budget, salary distribution, and payment cycle reports.

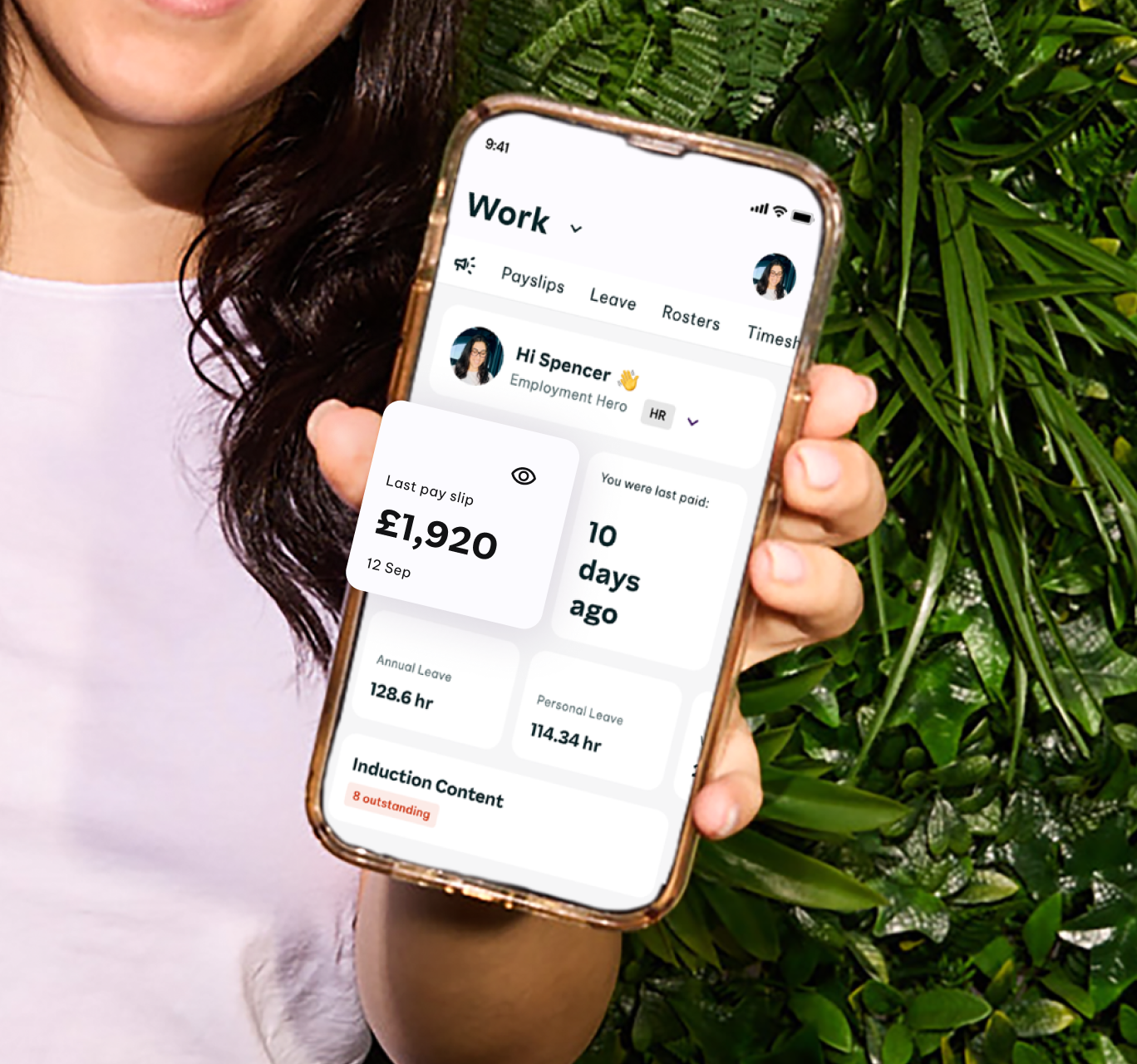

Empower your employees to access what they need

Everyone in your company can access important HR and payroll documents like payslips and employment contracts via Employment Hero work, our employee app, or via their Employment Hero account. Past employees can also self-serve important information and documents like payslips, pay details, and employment history via their Hero Passport.

Payroll automation done right.

Automate calculations like 52-week averaging and occupational leave, auto-create BACS files, automatically calculate and sync pension contributions, auto-pilot payslip generation, and instantly notify employees. Ditch fragmented solutions with smart payroll automation done all the way.

Built-in payroll

One system. One source of truth. One smarter way to run payroll.

Less admin, more control

Made for the unsung heroes who make payday happen.

Compliant, not complex

Running a business is stressful. Compliance shouldn’t be.

Support when you need it

Power, not paperwork. With real people to help when you need them.

Hear what our customers have to say

Smart payroll integrations.

Switch payroll solutions easily by importing employee time worked, leave taken and other employee details from your current payroll provider or accounting software into Employment Hero.

Frequently Asked Questions

Everything you need to know about our payroll software

Payroll software helps businesses automate their payroll processes. This can include tasks like payroll processing, payroll calculation, tax filing, and detailed reports.

One of the significant benefits of using payroll software is that it can help businesses avoid penalties for non-compliance with payroll tax laws. These laws can be complicated and subject to change, which can make it challenging for businesses to stay on top of their obligations.

Yes, Employment Hero’s payroll software is designed to be compliant with UK payroll laws and tax regulations. It is HMRC-recognised and RTI (Real Time Information)-compliant, automating the calculation and reporting of PAYE (Income Tax) and National Insurance (NI) deductions. It also handles other statutory payments and deductions such as pensions, Attachment of Earnings Orders, Salary Sacrifice Schemes, Statutory Sick Pay (SSP), and various forms of Parental Pay (e.g., SMP).

Yes, Employment Hero’s payroll can run payroll for both full-time and part-time employees. You can easily manage full-time equivalent (FTE) settings for employees, and the system automatically calculates part-time employees’ FTE and pro-rata salaries based on your input of pay and work hours.

Yes, Employment Hero’s payroll software, when combined with Rota Management and Time & Attendance features available with HR modules, is suitable for shift workers. It allows managers to schedule and manage rotas and shifts, configure rules for overtime and allowances, automatically notify employees of their shifts, and integrate with timesheets to ensure accurate payroll processing for shift-based work.

Yes, we provide comprehensive support for payroll system implementation. Our dedicated Implementation Consultants work closely with you to gather information, create and deliver training, and offer ongoing support. Our goal is to ensure a smooth and successful implementation, and to help you master best practices.

We offer a wide range of integrations to connect with your existing systems, particularly for accounting, payment, workforce management, and HR software. Some of our key integrations include Xero, Freshbooks, FreeAgent, Telleroo, Square, Slack, Google Workspace Account and Microsoft 365 Account. Find out more on our integrations page.

Yes, our cloud-based payroll software is incredibly well-suited for small businesses in the UK. We’ve designed it to streamline payroll management, automate compliance, and simplify HR processes, all of which are huge benefits for smaller organisations. Many find our comprehensive features and support a strong asset for small and medium-sized businesses.

Yes, our payroll solution is 100% cloud-based. This means you can access it from anywhere with an internet connection. Plus, you’ll always have the latest features and security enhancements, as updates are continuously delivered without the need for manual installations. Your data is also securely stored in the cloud.

Tools, tips, templates.

-

Read more: TUPE: An Employer’s Guide to Staff Transfers

Read more: TUPE: An Employer’s Guide to Staff TransfersTUPE: An Employer’s Guide to Staff Transfers

Learn what TUPE is, when it applies, employee rights, and how to manage staff transfers compliantly.

-

Read more: Childcare vouchers: A guide for UK employers

Read more: Childcare vouchers: A guide for UK employersChildcare vouchers: A guide for UK employers

Learn what the legacy scheme is, how it works, and how it compares with Tax-Free Childcare.

-

Read more: RTI submission guide: FPS vs EPS in UK payroll

Read more: RTI submission guide: FPS vs EPS in UK payrollRTI submission guide: FPS vs EPS in UK payroll

Learn what RTI submissions are, the difference between FPS and EPS, and how to factor in compliance with HMRC payroll…

From hired to retired, all in one place.

Jump into EmploymentOS

Employment doesn’t have to be hard. Streamline every step of the employment lifecycle so you and your team can run ahead