If there’s one word that sums up how small to medium enterprises and their employees closed out the year, it’s “cautiously”.

With the usual seasonal hiring spike failing to appear and employment growth barely moving, Employment Hero’s latest jobs report shows just how quiet December was compared to the usual end of year boost.

According to the figures, drawn from aggregated and anonymised employee records, total employment rose just 0.5% month-on-month (MoM) in December, the slowest monthly increase since April.

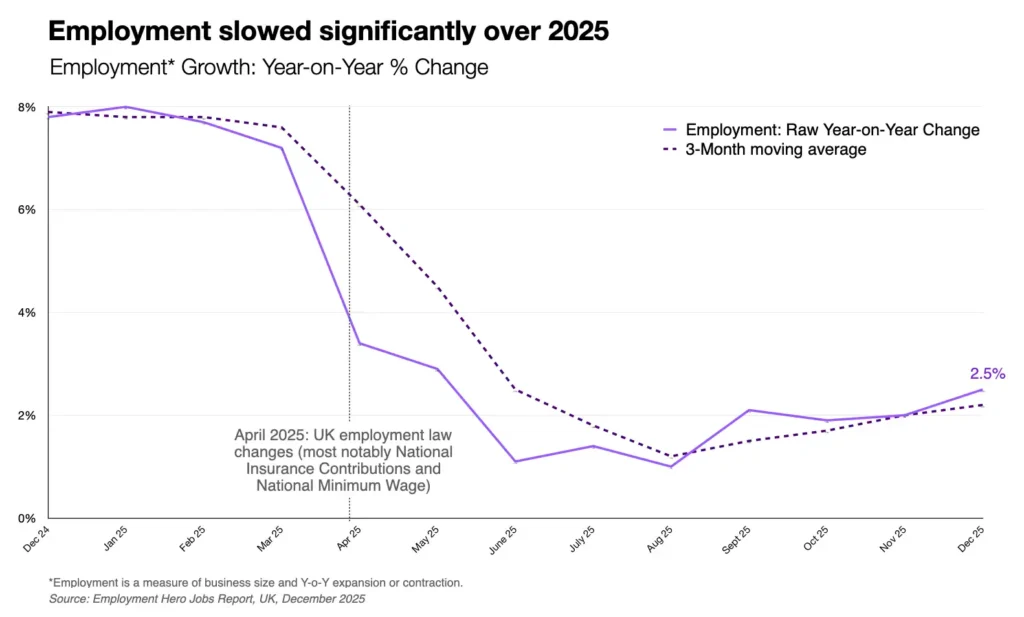

Over the past three months, employment was up 3.1%, suggesting the market is still expanding but lost pace in winter. And while year-on-year (YoY) growth reached 2.5% in December, the highest annual reading since May, it was still well below the 7.8% recorded in December 2024.

Seasonal Surge Fails to Materialise

That wariness appeared to take hold in the wake of October’s Autumn Budget, which many SMEs argued provided limited support and added uncertainty at a time when labour costs were already rising.

The absence of a seasonal uplift suggests SMEs are still cautious, even when short-term consumer demand would typically justify additional staffing.

Two Turning Points Defined SME Hiring in 2025

Zooming out, 2025 had two big turning points. April brought a sharp slowdown in hiring, coinciding with increases to the National Living Wage, the National Minimum Wage and changes to National Insurance contributions. And September marked a temporary peak, with MoM employment growth hitting 2.6% before cooling again into winter.

The Autumn Budget that followed the next month did little to loosen the brakes. With no significant relief for hiring costs or regulatory pressure, SMEs entered the final quarter in wait-and-see mode.

From there, gains decelerated steadily, landing at a 0.5% increase MoM in December. While the long-term story is slightly more positive at 2.5% YoY, the pace has noticeably slowed compared to previous years.

These patterns reflect just how much policy and rising costs shaped SME decisions in 2025. Kevin Fitzgerald, UK Managing Director at Employment Hero points out that “while small businesses remain resilient, they are cautious, with employment growth slowing and the usual seasonal surge failing to materialise.”

He adds: “Many are still adjusting to changes from last year’s Autumn Budget and structural barriers continue to hold back investment and growth.”

Full-Time Roles Drive Growth as SMEs Prioritise Stability

Beneath the headline numbers, the makeup of jobs also continued to shift. Full-time roles increased 1% MoM and 7.1% YoY, while part-time and casual roles rose 1.1% MoM and 4.5% YoY. The faster pace of full-time growth suggests SMEs are adding permanent staff even as labour becomes more expensive.

Generational patterns diverged too. Gen Z employment was up 0.4% MoM and 8.3% YoY, making it the fastest growing age group and continuing an ongoing trend of job market resilience among this cohort. Gen Y, meanwhile, posted 0.4% MoM and 0.3% YoY growth, Gen X rose 0.5% MoM and 1.1% YoY, and Boomers declined 0.2% MoM and 5.3% YoY.

Wage Growth Accelerates Despite Hiring Slowdown

If hiring slowed, pay went the other way. Wages increased 1.1% MoM in December and 4.4% over the past three months. YoY, wages were up 3.1%, the strongest annual figure in four months and roughly in line with inflation. For comparison, December 2024 recorded -4.1% YoY wage growth.

In terms of age groups, Gen Z again saw the fastest wage increases at 1.8% MoM and 5.0% YoY, Gen Y came in at 1.1% MoM and 2.8% YoY and Gen X saw a 0.3% MoM and 4.2% YoY increase. Boomers, on the other hand, saw a decline of -0.1% MoM and 4.4% YoY, compared to -4.7% in December 2024.

Regions Split Between Jobs Growth and Wage Growth

Regionally, only two locations saw meaningful MoM employment increases, with the South growing 4.7% MoM and 8.5% YoY and London growing 1.1% MoM and 2.1% YoY.

Meanwhile, every other region experienced declines in December. Figures for the East came in -2.1% MoM, the Midlands at -0.3%, the North at -0.4%, Scotland at -0.3% and Wales at -1.6%.

Wages, however, ran in the opposite direction. The North surged 8.2% MoM and 8.8% YoY, the strongest wage growth in the country. The East recorded 0.3% MoM and 8.9% YoY. And in the Capital and the South more broadly, there were slight declines of 0.5% and 0.4% MoM respectively.

In short, the regions gaining jobs were not the regions seeing pay growth, and vice versa.

SMEs Head Into 2026 Balancing Confidence With Caution

December’s data doesn’t necessarily signal a long term downturn. SMEs are still hiring, wages are improving and full-time roles are expanding. But it does show the market continuing to move at a slower, more careful pace.

“Looking ahead, the Employment Rights Bill will be front of mind for many small business leaders, who will be considering how best to navigate the changes coming into force in April 2026,” Kevin Fitzgerald adds.

“This is a real opportunity for the government to provide clear guidance and work collaboratively with small businesses, helping them plan and grow.”

The main themes heading into 2026 are clear: Seasonal hiring has not fully returned, wage growth is recovering faster than headcount growth, Full-time work is outpacing part-time and casual and Regions are drifting in different directions.

With further employment reforms due in April 2026 under the Employment Rights Bill, SMEs are likely to continue balancing confidence with caution.