December has long been a safe bet for retail and hospitality hiring and growth, yet fresh data shows that streak has faded as small businesses face more uncertainty.

Rather than the usual seasonal boost these sectors enjoy, Employment Hero’s latest Jobs Report, based on real-time data from over 115,000 anonymised and aggregated employee records within small businesses, reveals that employment in retail and hospitality contracted by -2% in December. Year-on-year (YoY) growth in the sector also dropped sharply, down from 13.5% in December 2024 to just 0.5%.

The trend raises questions about confidence levels, cost pressures and the broader health of the labour market as the UK heads into 2026. But it also points to a lack of confidence across the market, with businesses clearly facing pressures to either retain their headcounts or scale down.

1. Fewer Seasonal Openings for Young Workers

Age groups like Gen-Z, who previously have made up significant shares of festive roles, only saw 0.4% month-on-month (MoM) employment growth in December – coming in at just below the 0.5% average and far behind the 10.4% figure compared to the previous year.

That’s a concern for the wider economy because seasonal retail and hospitality roles act as an onboarding mechanism for young talent. With fewer entry points for casual work available, Gen Z may take longer to gain the sort of experience that could prime them for more permanent roles in future.

2. Slower Hiring Across the Board

While retail and hospitality experienced the starkest MoM contraction, the slowdown wasn’t confined to one corner of the economy. In fact, Employment Hero’s figures show that all sectors saw some degree of hiring deceleration in 2025.

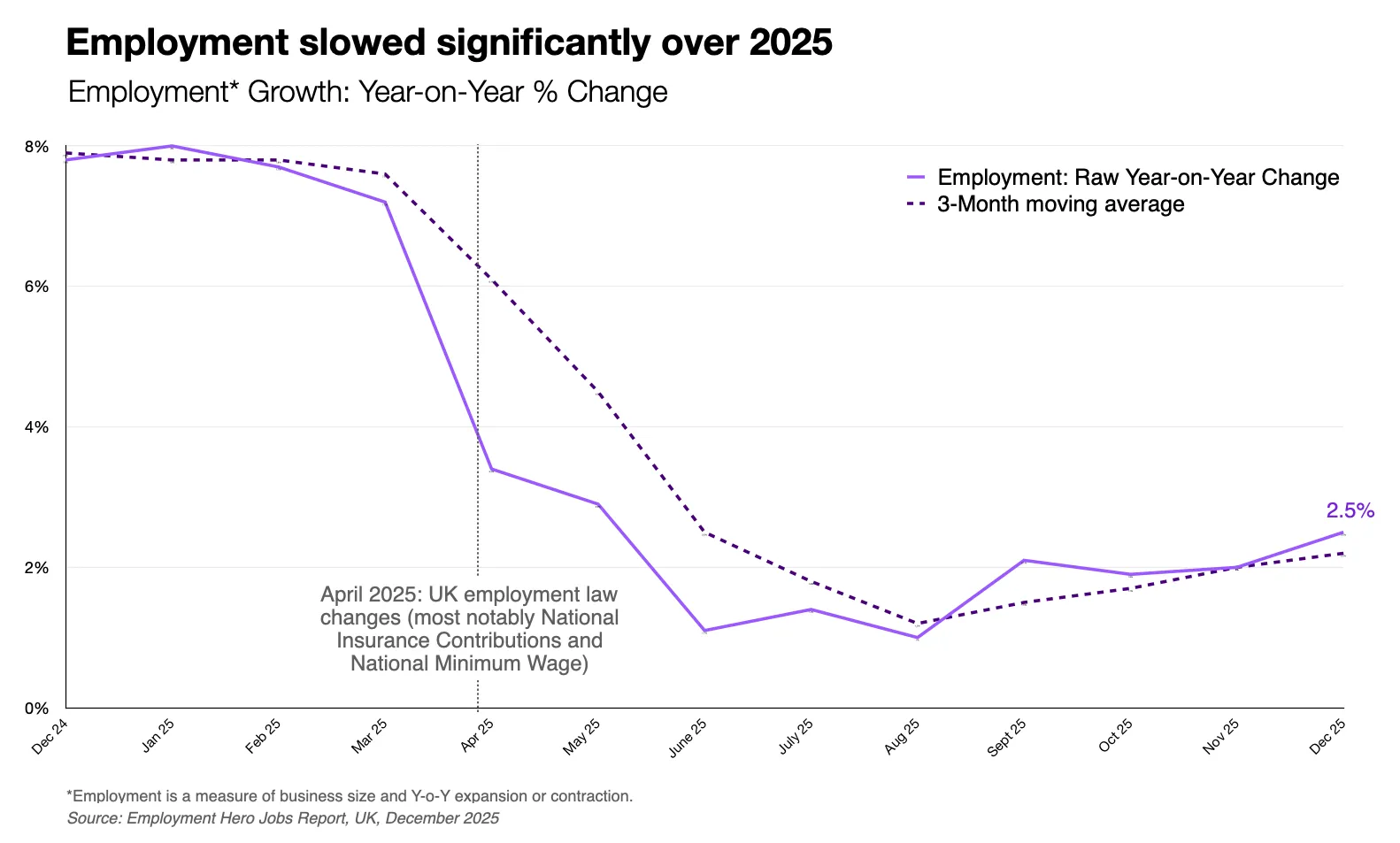

The data points to April 2025 as an inflection point, coinciding with the introduction of employment law changes that made labour more expensive, thus shaping the year that followed.

By December, total employment among UK small businesses still grew 0.5% MoM – but that short-term gain sits against a pronounced shift: year-on-year growth fell from 7.8% in December 2024 to 2.5% in December 2025.

The numbers show that while small businesses haven’t stopped hiring altogether, they have become more risk-averse, weighing decisions more heavily and taking fewer risks, especially when heading into peak trading periods.

Regardless of the significant shift from previous years, the data doesn’t quite point to collapse, but rather, sustained caution. Small to medium enterprises (SMEs) employ the majority of the UK workforce, and their hiring behaviour is usually a helpful temperature check of the broader economy.

3. Risk-Averse SMEs Put Growth on Hold

The 2025 slowdown and the December slump in particular suggest that uncertainty hasn’t yet cleared. Higher labour costs, additional reporting and compliance changes, rising operating expenses, and the lingering impact of the disruptive 2024 Autumn Budget have all combined to usher in a more conservative approach.

Kevin Fitzgerald, UK Managing Director at Employment Hero, explains what this trajectory means for SMEs.

“Retail and hospitality are usually the engine rooms of the festive jobs boom, so seeing that lift fail is a real concern. It’s clear that SMEs are exercising caution in response to ongoing uncertainty, a position which threatens to have a ripple effect across the economy.

“It’s a sign that there are still structural issues holding back the labour market, and that more needs to be done to give employers the confidence to invest and hire.”

4. Caution Rolls Into Early 2026 With Wider Economic Effects

The December dataset in itself doesn’t point to a full-blown crisis. Small businesses are still hiring, wages are still moving, and January typically brings a recalibration phase for both workers and employers. But the picture it paints is one of caution – particularly in sectors that usually rely on seasonal momentum.

For retail and hospitality, that’s especially true. The missed December boost matters because seasonal hiring is more than temporary staffing, it’s a signal of forward demand, consumer behaviour and business confidence. Without it, the ripple effects could show up in scheduling, retention, spending and investment decisions through early 2026.

For policymakers, the report reinforces a familiar message: structural frictions are still slowing hiring, and clarity, stability and support remain priorities if the labour market is to regain pace.

As 2026 begins, the question isn’t whether UK SMEs will hire, it’s how quickly they’ll be willing or able to accelerate.