Autumn Budget 2025 – Key Takeaways for SMEs

Published

Autumn Budget 2025 – Key Takeaways for SMEs

Published

The UK’s Autumn Budget was delivered on the 26th of November 2025. The announcement landed at a time when small business confidence is already fragile. Recent Employment Hero research shows that 86%1 of small businesses are worried about the impact of the Budget, while 59%1 feel that Budget decisions do not adequately consider SMEs.

The Budget introduced a series of financial, payroll and employment law changes that business leaders and HR teams will need to prepare for. To help make sense of the updates, Employment Hero has broken down the key changes and what they mean for your organisation, partnering with Ryan Pearcy from Digital Transformers for additional expert analysis.

Download our factsheet on 4 practical actions SMEs can take after the Budget.

Here’s what’s covered in the factsheet:

- National Minimum Wage increases.

- Salary Sacrifice changes.

- Electric Vehicle Tax.

- Apprenticeships.

What the budget means for HR, payroll and business owners

The Budget doesn’t just affect business owners — it also introduces a wave of changes that HR and payroll teams must navigate. In this section, we’ll break down the key compliance and employment law updates that will impact both HR and payroll professionals as well as employers.

Salary sacrifice

The Budget confirmed that from April 2029, salary sacrifice pension contributions above £2,000 per year will no longer receive National Insurance exemptions. NI contributions will apply to both employers and employees on any amount above this threshold.

This change increases the cost of offering salary sacrifice schemes, particularly following recent NI contribution rises in April 2025. It will also add administrative complexity, as payroll teams will need to calculate and deduct the relevant NI contributions.

For employees, the added cost may discourage voluntary pension savings at a time when many people already struggle to contribute enough towards retirement.

Ryan Pearcy comments:

“The £2,000 limit for pension contributions through salary sacrifice equates to an annual salary of £25,000 if calculated on full earnings or £31,000 when based on qualifying earnings, assuming pension contributions are the basic 3% employer’s pension and 5% employee’s pension under auto enrolment, which is the minimum that is allowed.

National Minimum Wage increases

From April 2026:

- Over 21s: increases by 4.1% to £12.71 per hour

- 18 to 20 year olds: increases by 8.5% to £10.85 per hour

- 16 to 17 year olds and apprentices: increases by 6% to £8 per hour

Employers must review pay rates ahead of the changes and budget for higher wage costs. The sharpest rise affects 18 to 20-year-olds, which may place added pressure on sectors with younger workforces. Employment Hero’s latest data shows that, while wage increases benefit employees, they also influence hiring decisions. In fact, 1 in 31 UK businesses may delay hiring as costs rise and almost 1 in 41 will consider redundancies.

Pearcy adds:

“The change in minimum wage for over 21s to £12.71 will mean a full time salary based on a 37.5 hour working week is now just under £25,000. This means that anyone over 21 working full time will likely be caught by the new salary sacrifice cap.

“The result will be that for most employers salary sacrifice will only be worthwhile for part time or the youngest team members. Due to the additional admin burden of salary sacrifice, consideration should be made as to whether it is removed entirely from business policy.

Income tax and NI threshold freeze

The Budget outlined that the rate of income tax will remain frozen, but so will the freeze on income tax and employer national insurance thresholds, for a further three years.

Whilst a freeze on income tax will be welcomed by employees, the fact that the tax and NI thresholds also remain frozen will mean that, as salaries rise over time, more employees will gradually move into higher tax bands as wages increase.

Pearcy also comments:

“The income and NI tax threshold changes will push more people over the £50,270 and £100,000 thresholds into higher taxes. The £100,000 threshold, also known as a cliff edge is generally an area most employees aim to avoid bridging and with less flexibility to avoid the impact through pension contributions business owners will likely see a demand for a much higher salary increase around this level to make a tangible impact in net pay for the employee.”

Youth guarantee

The government had previously announced plans for a Youth Guarantee scheme that would offer a guaranteed paid six-month work placement to every eligible young person aged between 18 and 21 years old who had been unemployed for at least 18 months and in receipt of Universal Credit.

Those who refuse to participate in the scheme without reasonable excuse will risk losing their entitlement to benefits. The Budget confirmed that £820m will be spent on the scheme over the next three years.

Full details of the scheme are due to be announced shortly, but it is not yet clear which sorts of employers will be eligible to participate. If SMEs are included, the scheme could offer funded entry-level support and create a route into long-term employment.

Apprenticeships

The Budget outlined that apprenticeship funding for under-25s will be free for small and medium-sized businesses. Currently apprenticeships are only fully funded for individuals who are under 22 years of age.

Widening the pool of individuals who can have an apprenticeship fully-funded is undoubtedly good news for employers and employees alike, and is designed to encourage SMEs to offer apprenticeships to young people, at a time when the number of employees working as apprentices has declined.

It is not yet clear exactly when these changes will be made – but we should have further information on this soon.

Download our factsheet on 4 practical actions SMEs can take after the Budget.

Electric vehicle tax

From April 2028, the UK government will introduce a new mileage-based road-tax charge for electric and plug-in hybrid vehicles, raising the costs of running an EV.

- Battery-electric vehicles: 3p per mile

- Plug-in hybrids: 1.5p per mile

Alongside this, the government has raised the threshold for “luxury” EV tax and has maintained a number of grants and incentives for EV drivers, meaning EVs will remain an attractive option for many drivers.

With mileage-based EV taxes on the horizon, businesses who provide company cars or mileage reimbursement will need to revise their policies, update pay processes and ensure rates remain HMRC-compliant.

Pearcy comments:

“The excise duty on electric cars based on miles travelled has a significant impact on the benefit of buying an electric fleet for the business. The nature of this change makes comparing and contrasting the cost and tax impact of purchasing electric against petrol/diesel vehicles far more difficult.

“Combine this with the changes to the capital allowance writing down allowance from 18% to 14% and impact for cars is exacerbated further. Now more than ever is the time to start planning with your accountant for any acquisitions in this area.”

Employee Ownership Trust (EOT) relief reduction

Selling shares into an Employee Ownership Trust (EOT) now provides 50% Capital Gains Tax relief, down from 100%. While this may not reduce EOT popularity overall, it will affect the cash value business owners receive and may influence exit planning.

Pearcy comments:

“If you are considering exiting your business in the near future it is worth taking note of the changes to tax breaks for Employee Ownership Trusts. Share disposals into an EOT now only benefit from a 50% relief for CGT rather than 100%.”

“Most professionals do not believe this will impact the volume of business owners using this process, but it will impact the cash you receive as an owner and require you to consider whether the valuation will now be sufficient for the lifestyle you want on exit.”

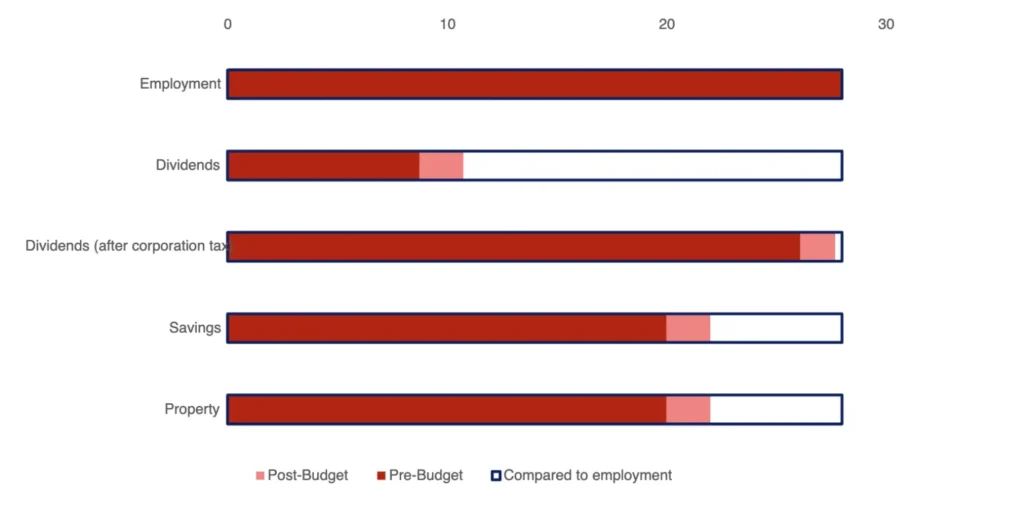

Dividend tax increase

Dividend tax will increase by 2% for both basic and higher rate taxpayers. The financial benefit of dividend extraction over salary is now marginal, meaning many business owners may prefer salary for greater protection and predictability.

“The increase in Dividend tax by 2% for basic and higher rate earners further squeezes the benefit of dividend extraction over salary to a negligible benefit. Business owners should consider whether salary is now the better route with all the protection it offers in contrast to dividend payments.”not just shaping stronger employees, you’re building a stronger business.

Source: The Budget – what it says – Tax Policy Associates

Making Tax Digital and compliance changes

With Making Tax Digital for Income Tax now fully underway and other tax pressures mounting, you might hope the government would ease compliance requirements for small businesses. Unfortunately, that isn’t the case. The government has confirmed that electronic invoicing will become mandatory for all B2B sales from 2029, with further details on how this will be implemented expected next year.

Cut in business property tax rates

The government will introduce “permanently lower tax rates” for more than 750,000 retail, hospitality and leisure properties, Reeves tells the Commons. The move will be funded through higher rates on properties worth £500,000 or more, such as warehouses used by online retail giants.

Pearcy comments:

“This is welcome relief for the stretched retail and hospitality sector that hasn’t fully recovered from the impacts of covid. It is an area that has been spoken about for successive governments in moving tax towards out of townx§ larger commercial units and is one of the announcements that is likely to draw the least criticism. The change is a 5p reduction in the multiplier on property value, reducing it from 43p to 38.2p, with the high value properties increasing to 50.8p.”

What’s next for businesses?

While this year’s Autumn Budget gives businesses plenty to unpack, it ultimately offers little in the way of practical support for small businesses. Key pressures—rising costs, workforce challenges and tight cash flow—remain largely unanswered. This lack of targeted action means many small business owners are still searching for the clarity and relief they were hoping for.

Understanding where the budget fell short not only helps you plan for what’s next, but also highlights the importance of relying on smart operations, digital tools and agile decision-making to stay resilient in the months ahead. Find out what was missed and what it means for you.

Download our factsheet on 4 practical actions SMEs can take after the Budget.

Disclaimer: The information in this article is current as of November 2025 and has been prepared by Employment Hero UK Ltd and its related bodies corporate (Employment Hero). The views expressed in this article are general information only, are provided in good faith to assist employers and their employees, and should not be relied on as professional advice. Some information is based on data supplied by third parties. While such data is believed to be accurate, it has not been independently verified and no warranties are given that it is complete, accurate, up to date or fit for the purpose for which it is required. Employment Hero does not accept responsibility for any inaccuracy in such data and is not liable for any loss or damages arising directly or indirectly as a result of reliance on, use of or inability to use any information provided in this article. You should undertake your own research and seek professional advice before making any decisions or relying on the information in this article

1Source: Employment Hero commissioned research with One Poll, survey with senior business leaders and business owners, UK, n=1000

To download the guide, we just need a few quick details.

Related Resources

-

Read more: EOFY HR Audit: What to Review in March

Read more: EOFY HR Audit: What to Review in MarchEOFY HR Audit: What to Review in March

Complete a EOFY HR audit with our practical checklist. Review compliance, people processes and compliance to reduce risk before the…

-

Read more: How to Choose an HR System: A 2026 Buyer’s Checklist

Read more: How to Choose an HR System: A 2026 Buyer’s ChecklistHow to Choose an HR System: A 2026 Buyer’s Checklist

HR software is more than features. Discover how the right system can streamline operations, boost efficiency and future-proof workforce management.

-

Read more: How to Create an Employee Training Plan: Template & Guide

Read more: How to Create an Employee Training Plan: Template & GuideHow to Create an Employee Training Plan: Template & Guide

Ready to build a training program that drives results? Learn how to create an effective employee training outline that aligns…