How to maximise profits and market payroll as a service

Published

How to maximise profits and market payroll as a service

We all know how hard it can be to grow your business in today’s competitive environment. For any business, the primary goal is to maximise their profits — but how? Where do you even start?

What if we told you that the key to maximising profits is expanding your suite of services to include advisory as well, in addition to compliance services?

By optimising and streamlining compliance tasks like payroll, you could increase your revenue significantly. That’s right — leverage the power of automation to get repetitive, time-consuming tasks done in just a few clicks. That frees up precious time for you to work on advisory services, which are more lucrative.

In this guide, we cover;

- Why is it essential for accountants to shift towards a more advisory role?

- How can you maximise the profitability of payroll?

- How to market payroll as a service to clients

- How to maximise profitability with the Employment Hero Partner Network

By following these tips and strategies, you can position your payroll services as a valuable solution for businesses, and increase your profit margins in the process.

Regardless of whether you’re a small business looking for new revenue streams, or an established organisation looking for cost-effective solutions, we’ve got what you need.

Download the guide now to discover valuable tips on how to reduce your business costs and increase profits.

Visit our Employment Hero Partner Network page to find out more.

Register for the guide

Related Resources

-

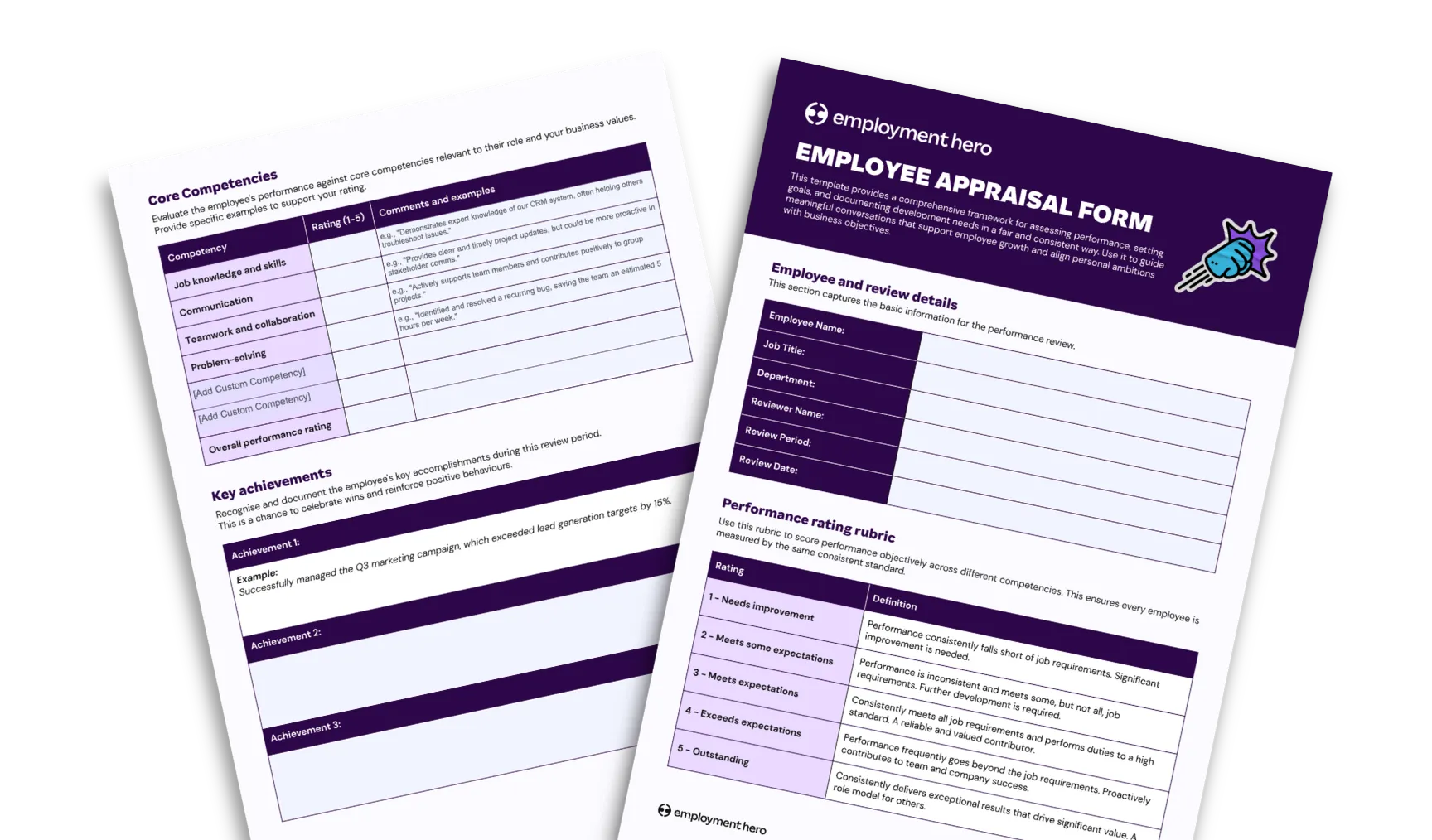

Read more: Performance appraisal form template and guide

Read more: Performance appraisal form template and guidePerformance appraisal form template and guide

Download our appraisal form template to enhance employee performance reviews. Improve feedback processes and growth.

-

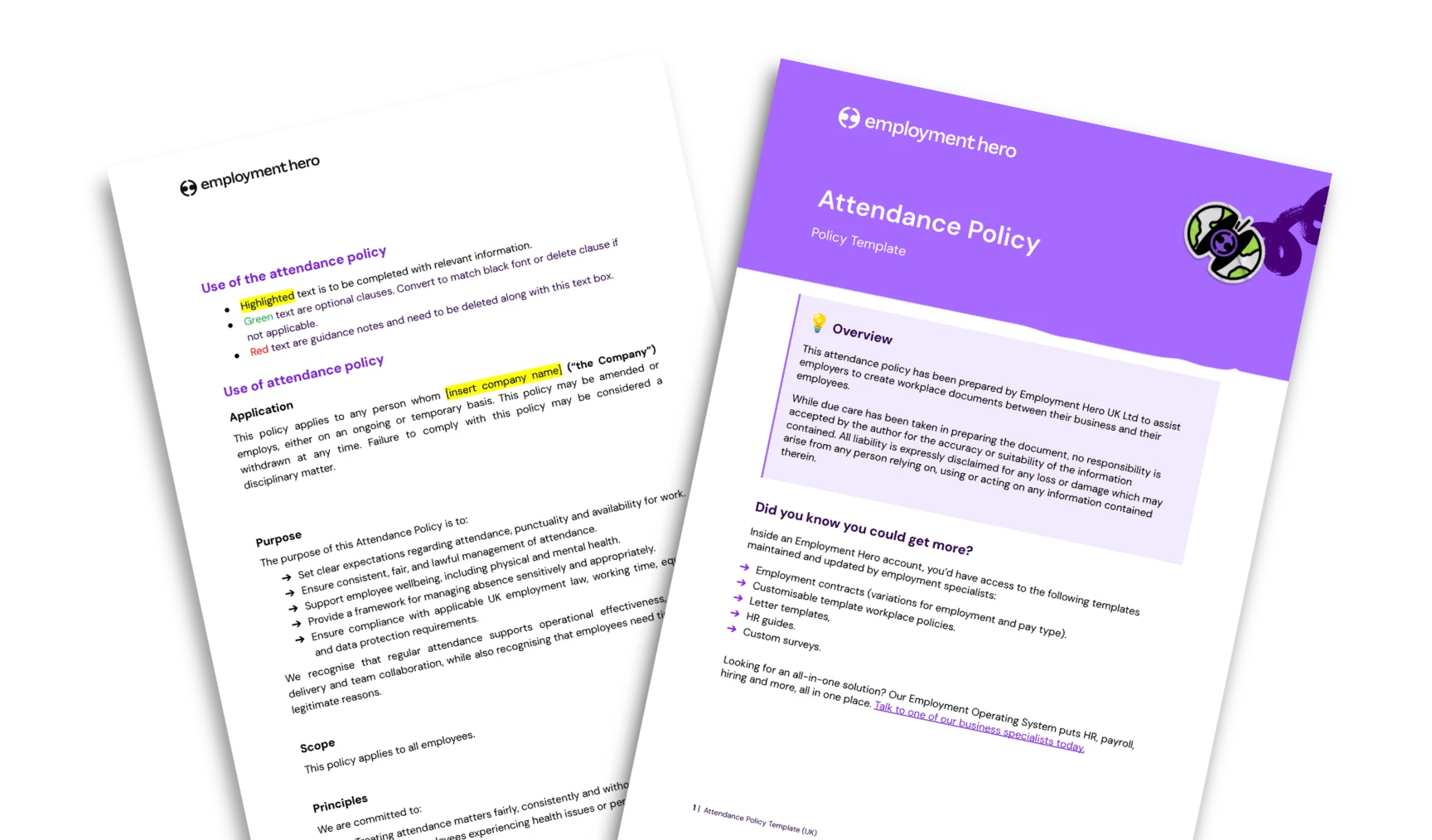

Read more: How to Build an Employee Attendance Policy in 2026

Read more: How to Build an Employee Attendance Policy in 2026How to Build an Employee Attendance Policy in 2026

Learn how to create a fair and effective employee attendance policy in 2026. Discover strategies for managing attendance policies that…