Automated payroll system

Leave payroll tasks in the background and free yourself from manual admin. Smarter payroll from start to finish.

Save time on payroll processing

Save up to 90% of time spent on payroll admin. Automate payroll processing tasks such as payroll reports and timesheets, downloading and applying tax codes, super deductions, applying leave calculations and more.

Stay in control

Implement payroll automation and free yourself from day-to-day manual admin while still allowing complete control of the pay run. You determine what components of the pay run to automate and process manually.

Quality assurance

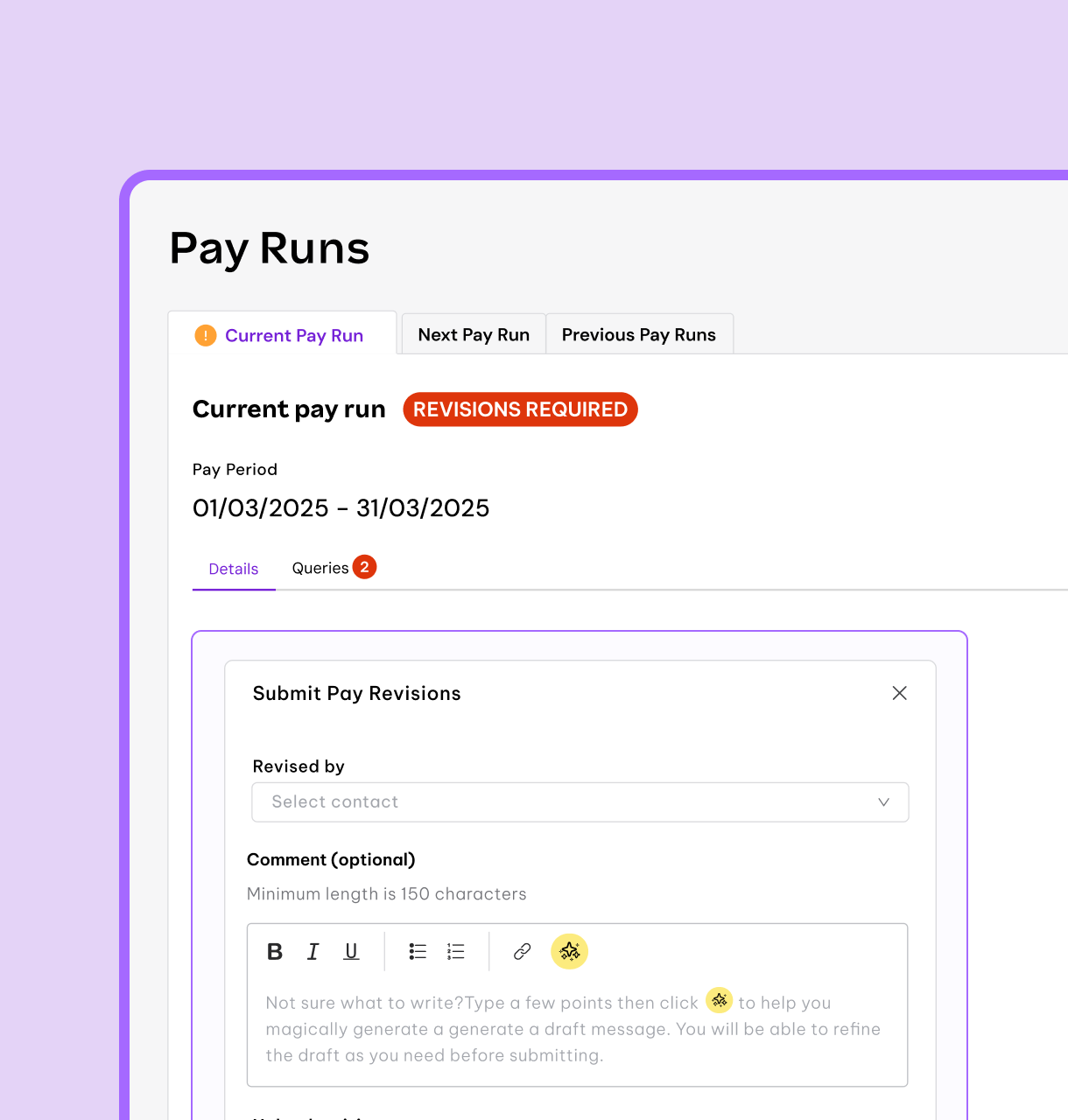

Ensure employee wages are always accurate. Our payroll automation software utilises built-in warnings that users can pre-select to pause the payroll automation process if an action is required prior to finalising the pay run.

What can you automate?

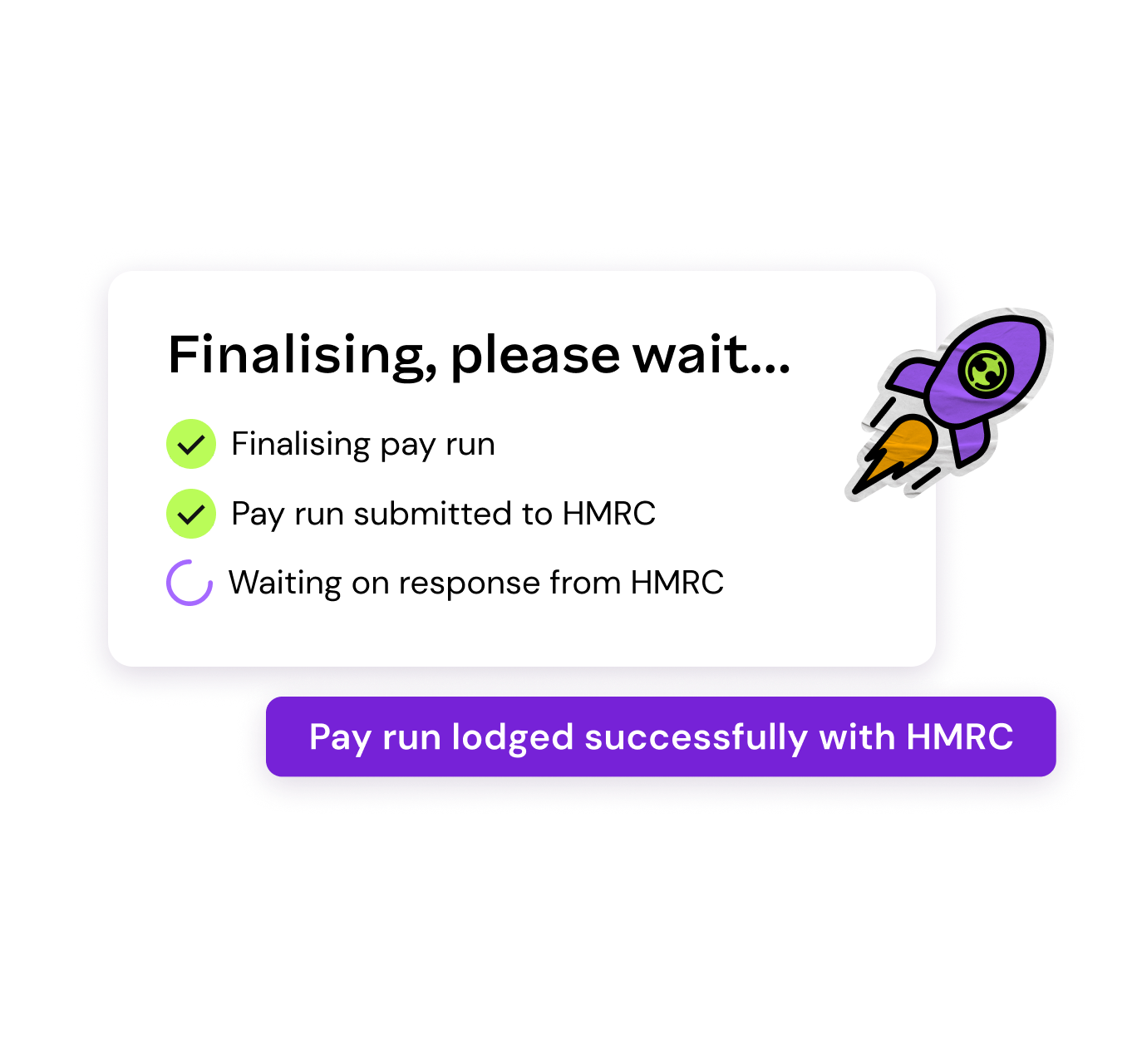

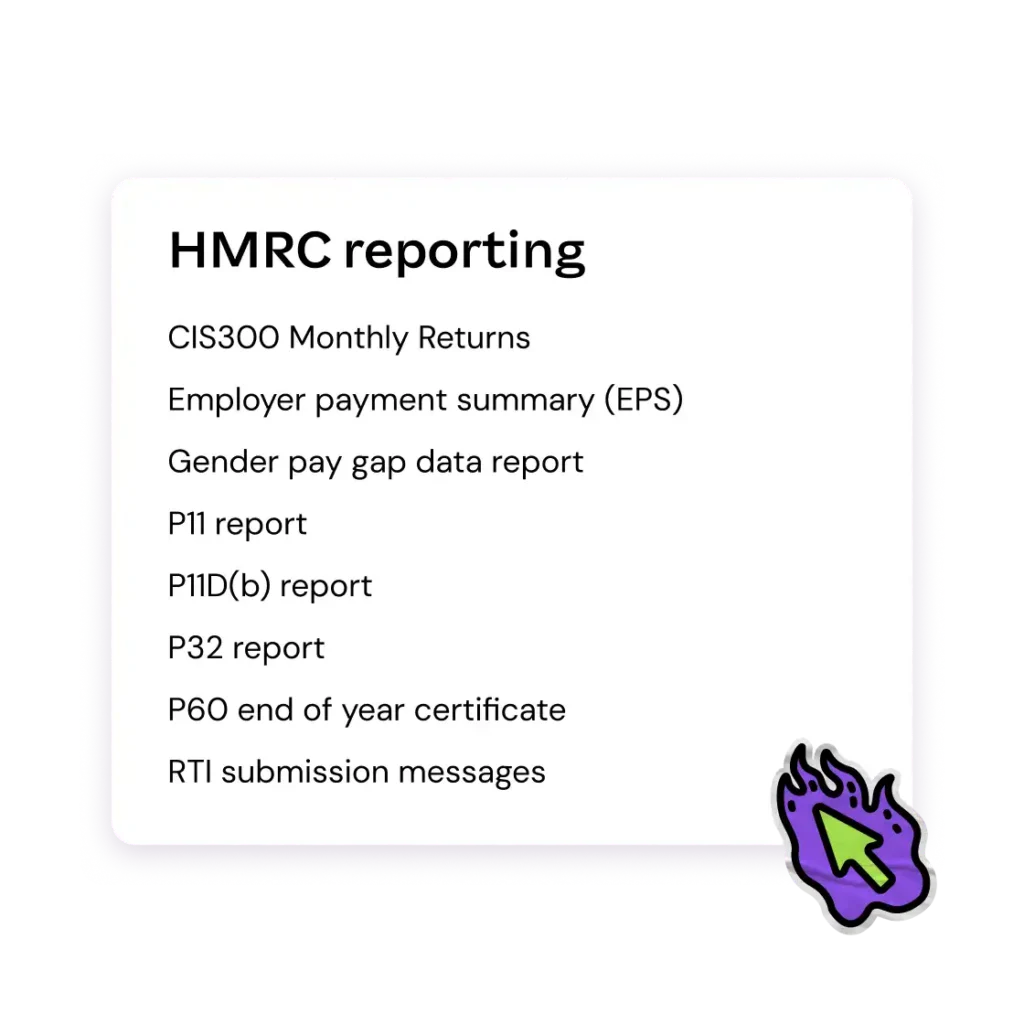

Automated Real Time Information (RTI) reporting

Automatically submit all required RTI reporting directly with HMRC after a pay run. Submit your National Insurance data and PAYE to HMRC in just one click.

Automated report submission

Automatically submit required reports such as FPS, EPS, P11, P11D, P32 and P60s directly with HMRC.

Automated pension submissions

Our system integrates with UK pension schemes, removing the hassle of duplicating efforts. Whether you’re setting up a new pension scheme or connecting to an existing pension, it’s easy to manage pensions seamlessly using our PensionSync feature.

Auto pay schedule

Run multiple pay runs in the background at the same time. Choose which pay run processes to automate and enjoy greater control by choosing specific dates and times to automate certain tasks.

Warnings and notifications

Run payroll on your terms. Choose what you want to get notified about to stop the automation, and who needs to be informed.

Pay run finalisation

Choose how to finalise the pay run, and automatically build and send RTI reports on a recurring basis based on the schedule set.

TRUSTED BY 300k+ HAPPY CUSTOMERS

Payroll processing is now fully automated. From start to finish.

GDPR compliant

GDPR doesn’t have to be a burden for your business. You can rest easy knowing that our system is kept up-to-date and GDPR compliant.

Transference of data across systems

Push data across any platform seamlessly with our industry-leading integrations. No need for Excel spreadsheets or manual imports and exports.

Payroll and leave calculations

Leave the math to us – build the rules of unique employment agreements to automate calculation of wages, overtime, CIS, allowances and more. Calculation panels allow you to understand exactly what’s been applied, providing total transparency to assist with legislative compliance.

Bank holidays tracking

Up-to-date national bank holidays are automatically entered into your system so you don’t have to worry about staying on top of dates manually.

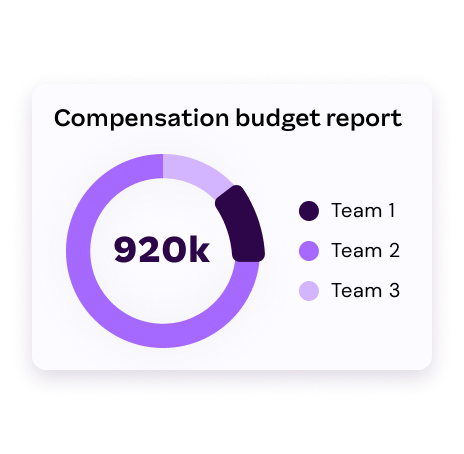

Reporting

Select specific dates and times to automate payroll reports and journals. Once configured, our automated payroll system handles everything. Say goodbye to Excel spreadsheets.

Payslips

Notify employees of payslips via email or SMS, removing the need for paper or manual data handling.

Made by payroll experts. For payroll experts.

We’re the all-in-one employment solution for businesses with big ambitions.

Automated payroll systems FAQs

An automated payroll solution uses software to help managers save time by automatically performing payroll tasks, such as payroll calculations, calculating tax withholdings, generating pay slips and paying employees in just a few clicks.

Manual payroll involves calculating employee salaries and taxes using spreadsheets, calculators, paper and other tools.

An automated payroll platform helps to eliminates the need for manual data entry and makes sure employees can easily access their payslips and get paid correctly and on time. This in turn reduces company operating costs while increasing productivity and simplifying the payroll process. Small business owners, accountants and HR teams can focus on more strategic tasks like employee engagement and business growth.

Automated payroll software collects and processes employee and payroll data from multiple platforms, such as integrated time-tracking systems, accounting software, and HR software. Once a one-off configuration is set, the software then uses this data to calculate employee salaries, wage deductions, and payroll taxes based on local payroll legislation changes, unique employee scenarios and the company’s payroll policies and regulations. Finally, employees are paid straight into their bank accounts, by pay schedule set.

Core payroll tasks such as importing timesheets, calculating pay or sharing payslips can be automated with the help of using cloud-based technology. Cloud-based payroll software like Employment Hero Payroll keeps all employee data in one centralised location and updates in real time. A payroll software with employee self-service also reduces the workload associated with payroll administration. By empowering employees to access and enter their own data and even view their wages, deductions, and benefits, managers will no longer have to chase for data. When using the right cloud payroll system, small business owners, managers and payroll and HR teams can fully automate payroll, as long as one-off configurations have been set.

When looking for an automated payroll service provider, it is important to make sure it is cloud based and has features such as shift management, local compliance with regulations, integration with existing software, employee self-service capability and scalability. Additionally, you should evaluate the security of the provider’s systems and the support they provide, to ensure that your data is secure and all issues can be addressed quickly.

Refer your clients or business network to us and get rewarded for every successful referral.

Let us solve your clients HR & Payroll problems, making you look like the hero.

Tools, tips & insights

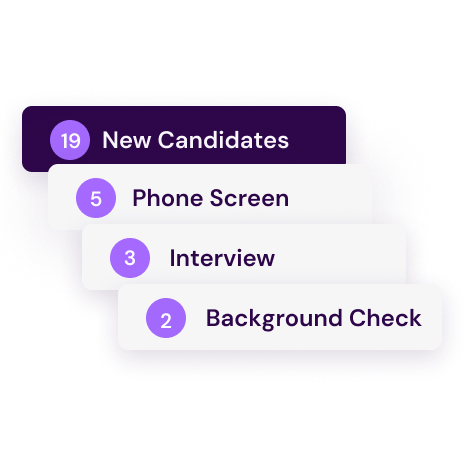

Hiring on autopilot.

Take people from “Hi” to Hired without switching tabs.

Get instant access to talent. Save time and cut costs

Curated talent shortlists, automation, and more

Manage open roles, interviews, and onboarding from one place

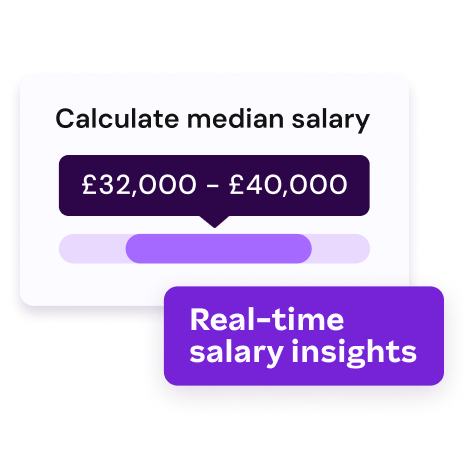

Hire smarter with salary insights and candidate matches for every role

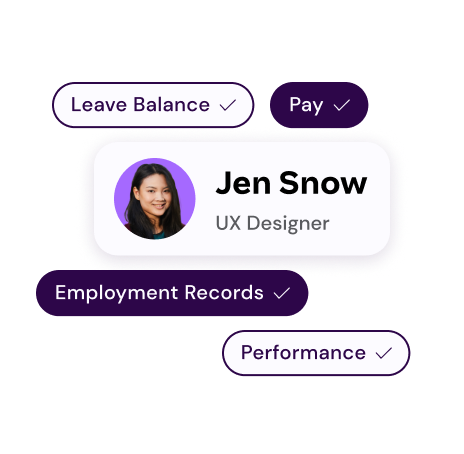

Make work feel less like work.

We’ve made work admin a breeze. Forget paper-based processes and lost leave requests: give your team self-service access to all their important HR and payroll tasks. From onboarding to HR advisory, we provide end-to-end value.

All employee data is housed in a single, secure platform

Automate leave requests, performance reviews, and onboarding.

Centralise and share company policies and essential documents

Workforce analytics and reports to help leaders make data-driven decisions.

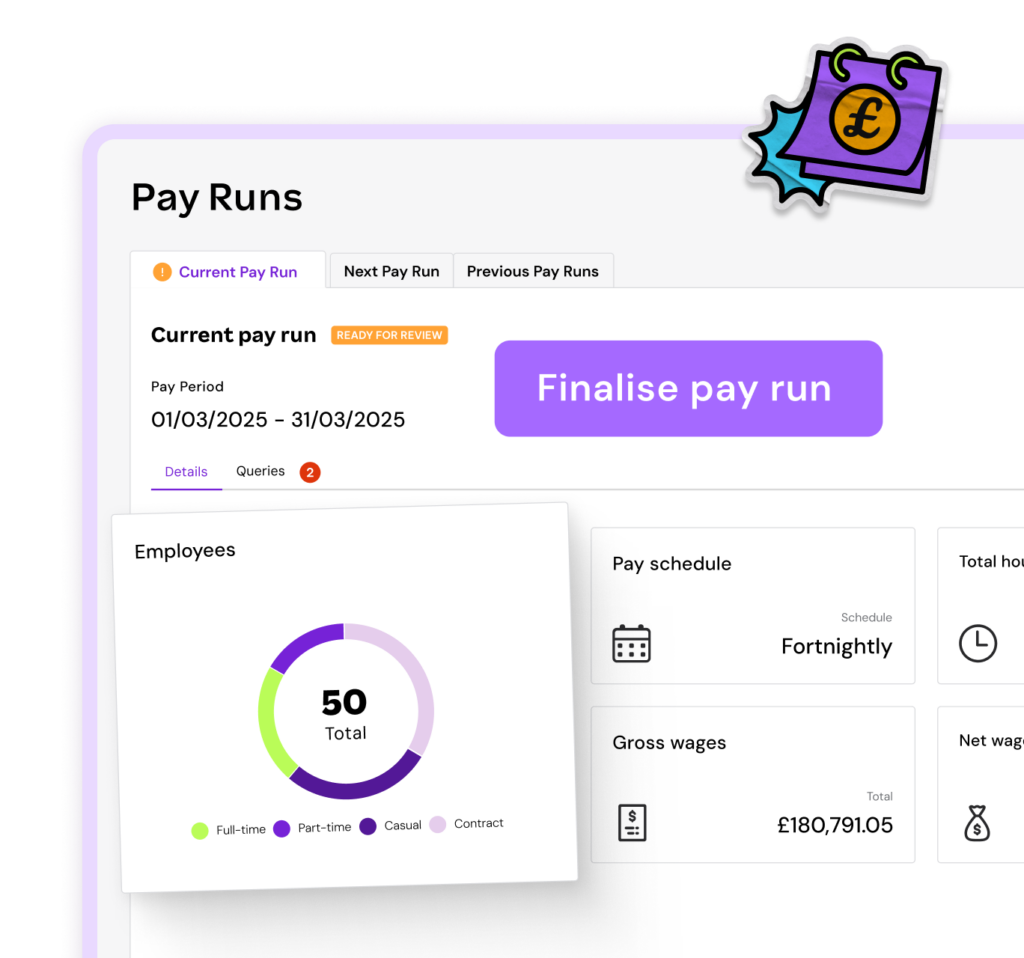

Run payroll your way, every time.

Whether you want to run manual diligence, automate pay runs or outsource the bulk of work to our specialists, Employment Hero has a payroll solution that flexes with your ways of working.

Automate core payroll and post-payroll tasks at no cost. Really.

Run advanced payroll with pay conditions, app integrations and multiple PAYE schemes.

Centralise access to pre-payroll data like timesheets and holidays. The HR module keeps your workflow smooth and simple.

A dedicated payroll partner to handle complex tasks, from legislation changes to payroll anomalies.

Be the employer everyone wants to work for.

You offer the employment – we’ll bring the benefits

Employees can access everything they need through an intuitive self-service portal

Keep your team engaged and motivated with recognition and perks

Give your team flexible, on-demand access to their earned wages

Increase morale, productivity, and loyalty with an employee assistance programme.

Work made easy

Take the stress out of payroll admin and take control of your pay runs with Employment Hero.