What is an employer reference number (ERN)?

Find out what an Employer Reference Number is, and if you need one for your business.

Are you a new business owner or employer trying to get to grips with payroll and taxes? If so, don’t worry – you’re not alone! Understanding the ins and outs of payroll and taxes can be daunting, but we’re here to help you out. You may have heard the term ’employer reference number’, or ERN – they are an important part of the payroll process you’ll need to know about. But what is an employer reference number and why is it important?

In this blog, we’ll break down what an ERN is, how it works, and why it’s essential for your business. Whether you’re just starting out or you’re looking to brush up on your payroll knowledge, this post will provide you with all the information you need to understand and manage your employer reference number.

What is an ERN?

In the UK, an employer reference number (ERN) is a unique identifier assigned to an employer by HM Revenue and Customs (HMRC) for the purposes of administering payroll and tax. You might also see ERNs referred to as an employer Pay As You Earn (PAYE) reference number on tax forms.

The ERN is made up of two parts: the first is a three-digit reference number that identifies the HMRC office dealing with your business’s Pay As You Earn (PAYE) tax. The second is a reference number unique to you as an employer.

For businesses that registered as an employer prior to 2001, the employer reference number will be in the form 135 A56789. In 2001 an additional alphanumeric letter was added to the second part of the ERN, so any ERNs registered after 2001 will take the form 135/AB56789.

The ERN is used to identify the employer’s payroll records and to ensure that the correct amount of National Insurance contributions and income tax are paid to HMRC. It is used in all RTI filing with HMRC so they can identify who the employer is, and use the employee data filed against the correct employer. If the PAYE reference number isn’t entered, as an employer you will not be able to file anything to HMRC.

Employers are required to include their ERN on various documents, including payslips, P45 forms, and P60 forms. If as an employer you have more than one PAYE scheme, you will get a separate ERN for each scheme.

You can find your ERN in the yellow booklet supplied by HMRC when you first registered as an employer, on any payslip, P45, P60 or P11D issued to past or present employees, and on any other correspondence from HMRC relating to PAYE.

Who issues an ERN in the UK?

ERNs are issued by HMRC, the government department responsible for collecting taxes and administering the tax system. When a new employer registers with HMRC for PAYE, HMRC assigns them a unique ERN.

A new employer will need to enrol as a new business account holder and select ‘Add a tax to your account’ on the ‘Business tax summary’ page. They will then be able to add PAYE for employers.

Employers should keep their ERN safe and use it whenever they submit payroll-related paperwork, including employee payslips, P45s, and P60s.

How are employer reference numbers used?

Employer reference numbers are used by HMRC and employers in different ways.

How HMRC uses ERNs

Tax collection

Employer reference numbers are used by HMRC in the UK to administer and collect taxes through payroll, including National Insurance contributions and income tax. The ERN is used to link an employer’s payroll records to the specific PAYE scheme that they are registered under, which ensures that the correct amounts of tax and National Insurance contributions are paid to HMRC.

Linking PAYE schemes

If an employer has more than one PAYE scheme, each scheme will have a separate ERN. This ensures that the correct tax and National Insurance contributions are paid to HMRC for each scheme.

Compliance monitoring

HMRC uses ERNs to monitor compliance with payroll and tax laws, and to track the payment history of an employer. If an employer fails to pay the correct amount of tax or National Insurance contributions, or fails to submit payroll-related paperwork on time, HMRC may take enforcement action, which can include financial penalties and legal action.

How employers use ERNs

Payroll administration

Employers must include their ERN on all payroll-related paperwork, including employee payslips, P45s, and P60s. Employees might also ask for the ERN if they are applying for tax credits.

ERNs are mainly used for end of year PAYE returns – missing or invalid ERNs are the most common reasons for HMRC rejecting end-of-year returns.

Employment history

An individual’s employment history may include their employer’s ERN, which can be useful for verification purposes, such as when applying for a mortgage or a loan.

Employers’ Liability Insurance

An ERN is also required when purchasing or renewing employers’ liability insurance, which is a legal requirement for any business with more than one employee. Without a registered ERN, your employers’ liability insurance could be cancelled, and if you ever need to make a claim, the Employers’ Liability Tracing Office (ELTO) will need the ERN to begin the claim process.

Why are employer reference numbers important?

As you can see, employer reference numbers (ERNs) are important in the UK for several reasons:

- Tax compliance

- Payroll administration

- Business insurance

- Employee verification

ERNs are essential for tax compliance, payroll administration, verification and accessing online services. Employers who fail to comply with payroll and tax laws may face penalties and legal action, making it important to understand and manage your employer reference number correctly.

Do all businesses require an ERN?

Not all businesses require an ERN. But if your business has employees, you must register with HMRC for PAYE and you will be issued an ERN.

All employers who are registered for the PAYE system are required to have an employer reference number. This includes businesses that employ one or more employees, as well as limited companies, partnerships, and sole traders who pay themselves a salary or wages.

However, there are some exceptions. For example, if you only employ people for domestic work, such as a cleaner, gardener or nanny, you may not need an ERN. In these cases, the individuals you employ may need to register as self-employed and pay their own National Insurance and tax contributions.

Similarly, if you only employ casual workers for short periods of time, you may not need an ERN. However, if you expect to employ them for longer than a few weeks, or you hire them to replace permanent employees, you will need to register for PAYE and obtain an ERN.

If your business does not have any employees, you may not need to register for PAYE and therefore you won’t need an ERN.

What are the impacts of not having an ERN?

Because an ERN is used to identify an employer for tax and national insurance purposes, there are impacts for not having one. It is a legal requirement for all employers in the UK to have an ERN. If an employer does not have an ERN, they could face legal consequences, such as fines and penalties.

How does having an employer reference number impact tax filing?

Having an ERN is a crucial part of tax filing for employers. The ERN serves as a unique identifier for an employer, which is necessary for tax purposes when operating PAYE.

As an employer, when you file taxes, you must include your ERN on all relevant forms and documents. This means that you must deduct income tax and National Insurance contributions from your employees’ pay and report the deductions to HMRC on a regular basis, either through a Full Payment Submission (FPS) when you pay your employees using the Real Time Information (RTI) system, quarterly or annually. You can use your payroll software to do this, and it should automatically include your ERN.

Remember, failure to have an ERN or to include it on relevant forms and documents can result in penalties from HMRC. HMRC carries out audits and inspections, and if HMRC discovers an error, they will take into consideration the behaviours that led to the error being made. If a penalty is charged because a taxpayer failed to take reasonable care, the penalty may be suspended by HMRC for up to 2 years.

How can you keep employer reference numbers current and secure?

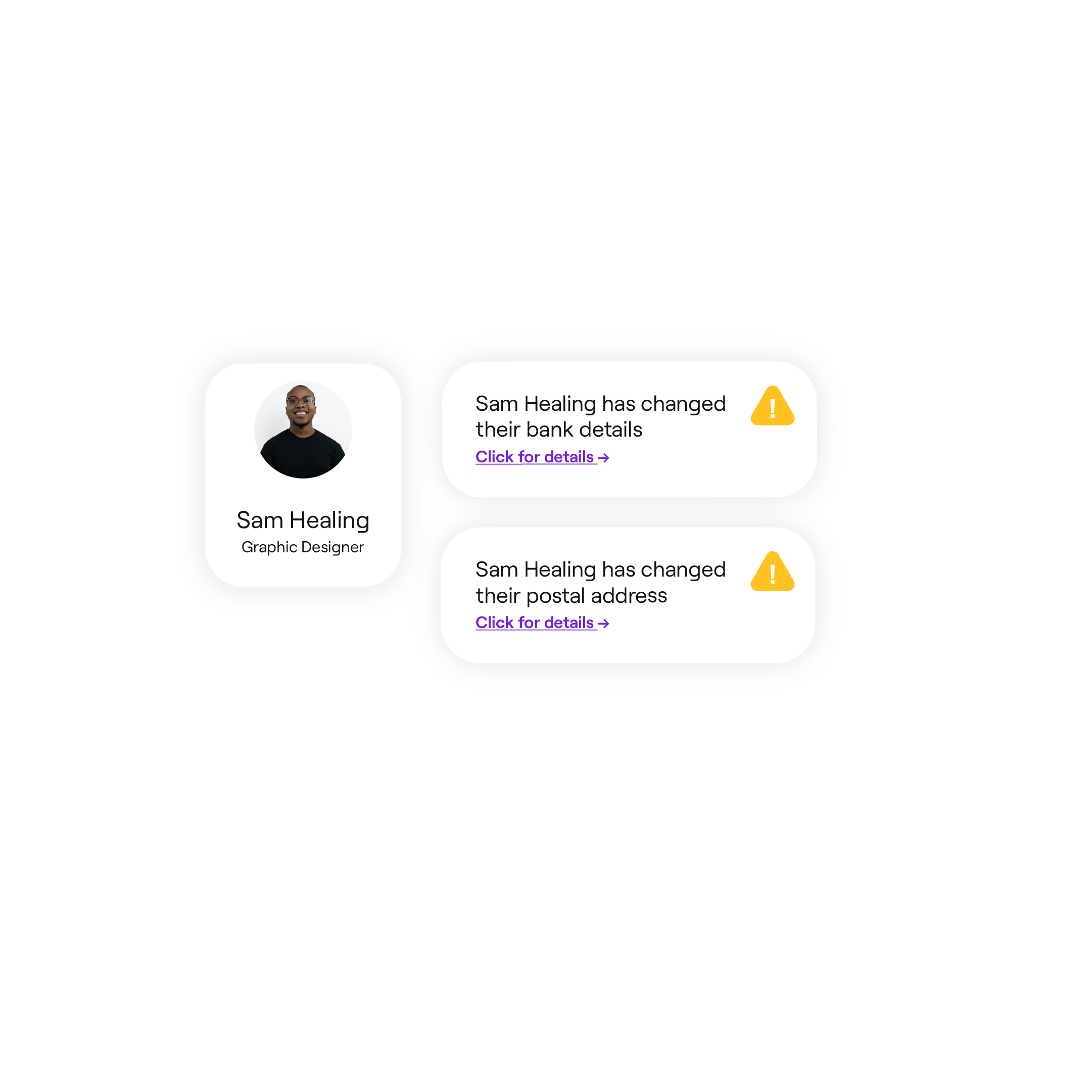

To keep your Employer Reference Number (ERN) current and secure, there are a few things to bear in mind. Your ERN is a valuable piece of information that should be protected from theft or misuse. This could include taking steps to secure your physical premises, such as locking filing cabinets if you’re using a paper system, and using strong passwords and two-factor authentication for online accounts. Using software to bring payroll in-house can be transformational for your business and employees, giving you greater control over your data and its security.

If any of your business details change, such as your name or address, or your employee details, you must inform HMRC as soon as possible. This will ensure that your ERN details are up to date.

It’s good practice to review your tax filings regularly to ensure that your ERN has been included correctly and that all tax payments have been made on time.

By following these steps, you can ensure that your ERN is kept current and secure, which can help to avoid any penalties or issues with your tax filings.

If you have any concerns or questions about your ERN, seek professional advice from a tax specialist, payroll provider or your accountant. They can provide guidance on the steps you need to take to ensure that your ERN remains current and secure.

If you’re considering bringing your payroll in-house, it has thankfully never been easier. This small investment can save you time and money as your payroll processes become automated and streamlined.

How Employment Hero can help you go digital

Most businesses, especially small businesses, would never intentionally make a payroll mistake, but errors can and do happen. That’s why digital payroll software can be a massive help to employers.

Employment Hero is designed to handle some of the most complex payroll systems in the world, keeping up to date with ever-changing legislation and automating frustrating compliance admin so you don’t have to. There’s never been a better time to take payroll digital!

Want more payroll tips and insights? Check out our handy payroll guide.

Related Resources

-

Read more: Zero-hours contract template and employment guide

Read more: Zero-hours contract template and employment guideZero-hours contract template and employment guide

Discover essential features and guidelines for creating a zero hours contract template.

-

Read more: Ask the Experts: Time and Attendance Software with Mobile Apps That Actually Work for Teams

Read more: Ask the Experts: Time and Attendance Software with Mobile Apps That Actually Work for TeamsAsk the Experts: Time and Attendance Software with Mobile Apps That Actually Work for Teams

Discover why Employment Hero is the best time and attendance software for shift-based teams. Manage shifts, automate overtime, and integrate…

-

Read more: Is there a “Right to Switch Off” for UK Employees?

Read more: Is there a “Right to Switch Off” for UK Employees?Is there a “Right to Switch Off” for UK Employees?

Learn how to create a Right to Switch Off policy. Support employee wellbeing, compliance, and productivity with this free UK-focused…