Flexible payslips. Create, customise, circulate.

Automatically send compliant payslips to employees as soon as they get paid.

Paperless

Don’t waste time printing off and posting payslips. Send digital copies instead. It’s simple, secure and confidential.

Save time and money

Automate payslips and tax calculations. Spend more time focusing on what matters most.

Accessible

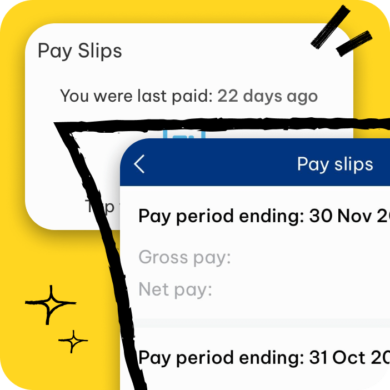

Employees can easily access and download payslips from the cloud anytime, anywhere.

Payslips. Made easy.

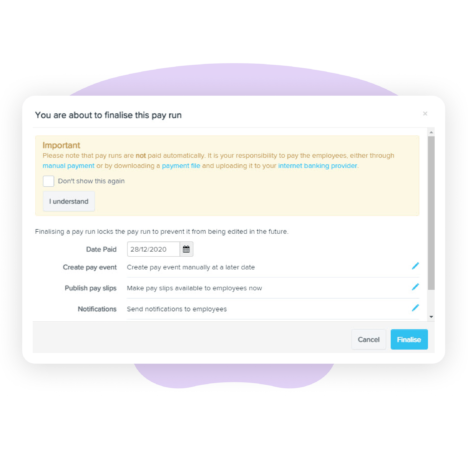

Easy to create and send

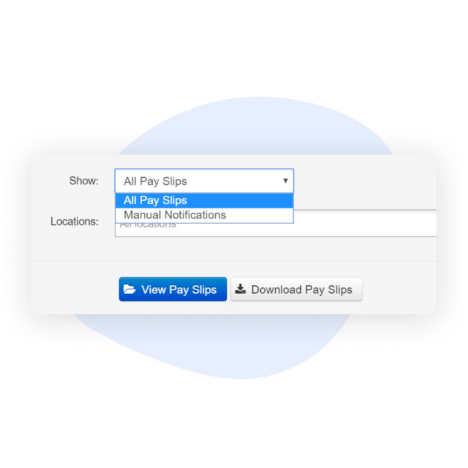

Once a pay run is finalised, payslips can be automated, manually published or scheduled live to be viewed by employees.

Customisable

Payslips can be tailored to your needs, with the option to add a business logo and choose what information is relevant to display or disclose. Custom notes and messages can also be added to payslips and payslip communications if desired.

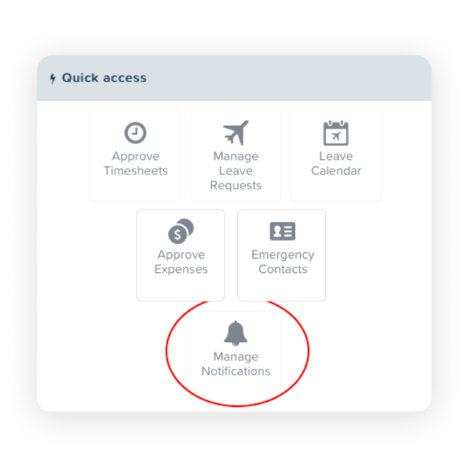

Automatic payslip notifications

Send notifications to employees automatically after a payslip is published. Notifications can be sent by email or SMS to give employees instant payslip access.

Easy access in the cloud

No more searching for payslips or managing requests. Multiple payslips can be bulk downloaded for any given date range, saving you from unnecessary admin frustrations.

Refer your clients or business network to us and get rewarded for every successful referral.

Let us solve your clients HR & Payroll problems, making you look like the hero.

Innovation, reliability, customer service. A tick, gold medal, five stars.

Resources. All for you.

Payroll Guide: The Basics of Payroll In Australia

How can you ensure that you are running payroll correctly? Get the basics in our guide.

The essential guide to HR compliance in Australia

Tick HR compliance tasks off your to-do list with our HR compliance guide

Payroll Metrics and Analytics: Leveraging Data for Business Insights

Learn how to engage your employees and improve business outcomes with our free whitepaper

Work easy.

Employment Hero is an all-in-one HR and payroll platform for Aussie businesses.