What to include in casual employment agreements

Published

What to include in casual employment agreements

Published

Casual employment agreements offer valuable flexibility for many New Zealand businesses, allowing you to scale your workforce up or down as needed. But this flexibility comes with specific legal obligations. Misunderstanding or mismanaging these agreements can lead to significant risks, including disputes and financial penalties.

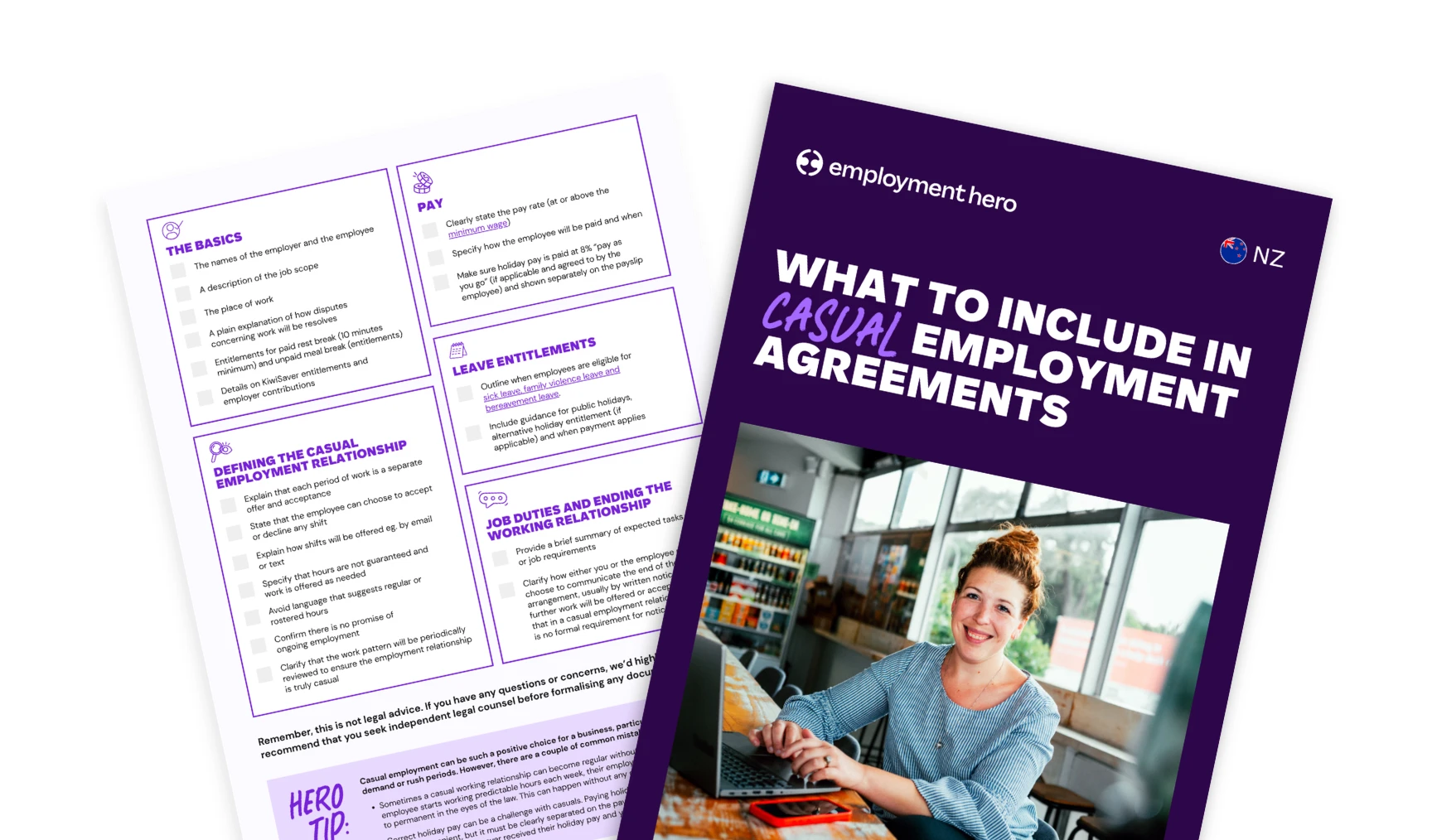

Getting casual contracts right from the start protects your business and ensures you treat your team members fairly. That’s why we’ve created a checklist, so you can understand what’s required in a standard casual employment agreement.

Download the checklist by filling in the form on the right.

A casual employment contract is an agreement for work that is irregular and intermittent. Unlike permanent or fixed-term roles, there’s no ongoing commitment from either the employer to offer work or the employee to accept it. Each offer of work is treated as a separate period of employment.

Correctly defining this relationship is important. If a work pattern becomes regular and ongoing, an employee might be legally considered permanent, regardless of what their agreement says. This could lead to back-claims for leave entitlements and other benefits.

When to use casual agreements (and when not to)

Recognising when a worker is deemed a casual employee is the first crucial step in understanding your obligations.

Good examples for using a casual contract:

- Hiring event staff to work at sporadic functions throughout the year.

- Engaging a student to cover shifts on an ad-hoc basis when permanent staff are sick.

- Bringing in extra help for unpredictable busy periods in a retail store.

Examples of when not to use a casual contract:

- An employee who works every Monday and Tuesday from 9 am to 5 pm. This regular pattern suggests part-time permanent employment.

- A worker covering a six-month period of parental leave. This is better suited to a fixed-term agreement.

- An employee who has been working a consistent 20 hours per week for over a year. Their work has become regular and expected.

Key requirements for casual employment contracts

Every casual employment agreement must be in writing and include specific clauses, according to New Zealand’s legal standards.

Employment type

The contract must clearly state that the employment is casual. It should explicitly mention that each offer of work is a separate engagement and there is no obligation to offer or accept future work.

Work expectations and offer of hours

The agreement must make it clear there are no guaranteed hours of work. It should describe how work will be offered, for example by phone or email, and confirm the employee’s right to decline any offer without reason.

Pay, holiday pay and deductions

The contract must specify the hourly wage which must be at or above the current minimum wage. For casual employees, you can pay holiday pay with their wages. This must be:

- At a rate of at least 8% of their gross earnings.

- Agreed upon in the employment agreement.

- Shown as a separate, clearly identifiable payment on their payslip.

KiwiSaver and other entitlements

Casual employees are generally eligible for KiwiSaver. If they are, you will need to make employer contributions unless they opt out or have a savings suspension. They also become entitled to sick and bereavement leave after six months if their work pattern meets certain criteria. Your agreement should mention these provisions.

Health & safety obligations

Your health and safety duties extend to all your workers, including casual employees. The contract should reference your commitment to providing a safe work environment and the employee’s responsibility to follow safety procedures.

Common casual contract mistakes that lead to non-compliance

Even with the best intentions, employers can make mistakes that create legal risks.

One of the most frequent errors is letting a casual working relationship become regular. If an employee starts working predictable hours each week, their employment status may have changed to permanent in the eyes of the law. This can happen informally, without any change to the contract.

Another common mistake is failing to pay holiday pay correctly. Paying holiday pay at 8% on a pay-as-you-go basis is convenient, but it must be clearly separated on the payslip. If it isn’t, an employee could successfully claim they never received their holiday pay and you may have to pay it again.

How to keep your casual contracts compliant over time

Managing casual employment effectively is an ongoing process, not just a one-time setup. Regular reviews are essential to make sure the working arrangement hasn’t unintentionally become permanent.

Set a reminder to review the work patterns of your casual employees every three to six months. Check their hours for regularity. If a pattern has emerged, it may be time to discuss moving them to a permanent part-time or full-time agreement.

It also helps to train managers on the nature of casual employment so they don’t accidentally create an expectation of ongoing work when offering shifts.

How Employment Hero helps you manage your team

Managing agreements, tracking hours and staying on top of legislative changes can be a heavy administrative load. Employment Hero is designed to simplify your HR and payroll processes so you can focus on your business.

Our Employment Operating System offers employment agreement templates, including for casual employees. You can create, send and store contracts digitally, creating a secure and accessible record. Our integrated payroll system makes it easy to manage pay-as-you-go holiday pay correctly, showing it as a separate line item on digital payslips. With everything in one place, you can more easily review work patterns and manage your obligations.

Find out more about Employment Hero and book a call with one of our team today.

The information in this article is current as at 30 December 2025, and has been prepared by Employment Hero Pty Ltd (ABN 11 160 047 709) and its related bodies corporate (Employment Hero). The views expressed in this article are general information only, are provided in good faith to assist employers and their employees, and should not be relied on as professional advice. Some information is based on data supplied by third parties. While such data is believed to be accurate, it has not been independently verified and no warranties are given that it is complete, accurate, up to date or fit for the purpose for which it is required. Employment Hero does not accept responsibility for any inaccuracy in such data and is not liable for any loss or damages arising directly or indirectly as a result of reliance on, use of or inability to use any information provided in this article. You should undertake your own research and seek professional advice before making any decisions or relying on the information in this article.

Register for downloadable

Related Resources

-

Read more: Product Update: January 2026

Read more: Product Update: January 2026Product Update: January 2026

Welcome to the January 2026 product update from the Employment Hero team. We’ve got lots to share around Custom Forms,…

-

Read more: What to include in casual employment agreements

Read more: What to include in casual employment agreementsWhat to include in casual employment agreements

Use our NZ casual contract checklist to vet your current employment agreements. Free, practical and designed for HR teams and…

-

Read more: Payroll budgeting guide for New Zealand employers

Read more: Payroll budgeting guide for New Zealand employersPayroll budgeting guide for New Zealand employers

Learn how to create a payroll budget with our clear NZ guide. Explore techniques, and tips to plan with confidence.…