Payday filing made simple

Take the stress out of payday filing with Employment Hero’s smart payroll software. PAYE and employee details are sent to Inland Revenue automatically after every pay run: accurate, compliant, and on time. It’s all built-in as part of our exclusive Employment Operating System for businesses.

Payday filing essentials for NZ employers

Your payday filing obligations

Payday filing in NZ is mandatory. Each payday, employers must send employee pay, tax, and deduction details to Inland Revenue through payroll software or online.

The risks of manual filing

Filing payday information yourself takes time and leaves room for mistakes. Errors or missed deadlines can lead to compliance issues and penalties.

How Employment Hero can help

With Employment Hero, payday filing is built into payroll. PAYE and deductions are filed automatically to IRD with every pay run: no manual uploads, no stress.

Easy IRD payday filing

Automatic, seamless filing

Every pay run is filed directly with Inland Revenue. No manual uploads, no missed deadlines. Stay fully IRD-compliant with PAYE, KiwiSaver and deductions filed with automated payroll, so you never risk penalties.

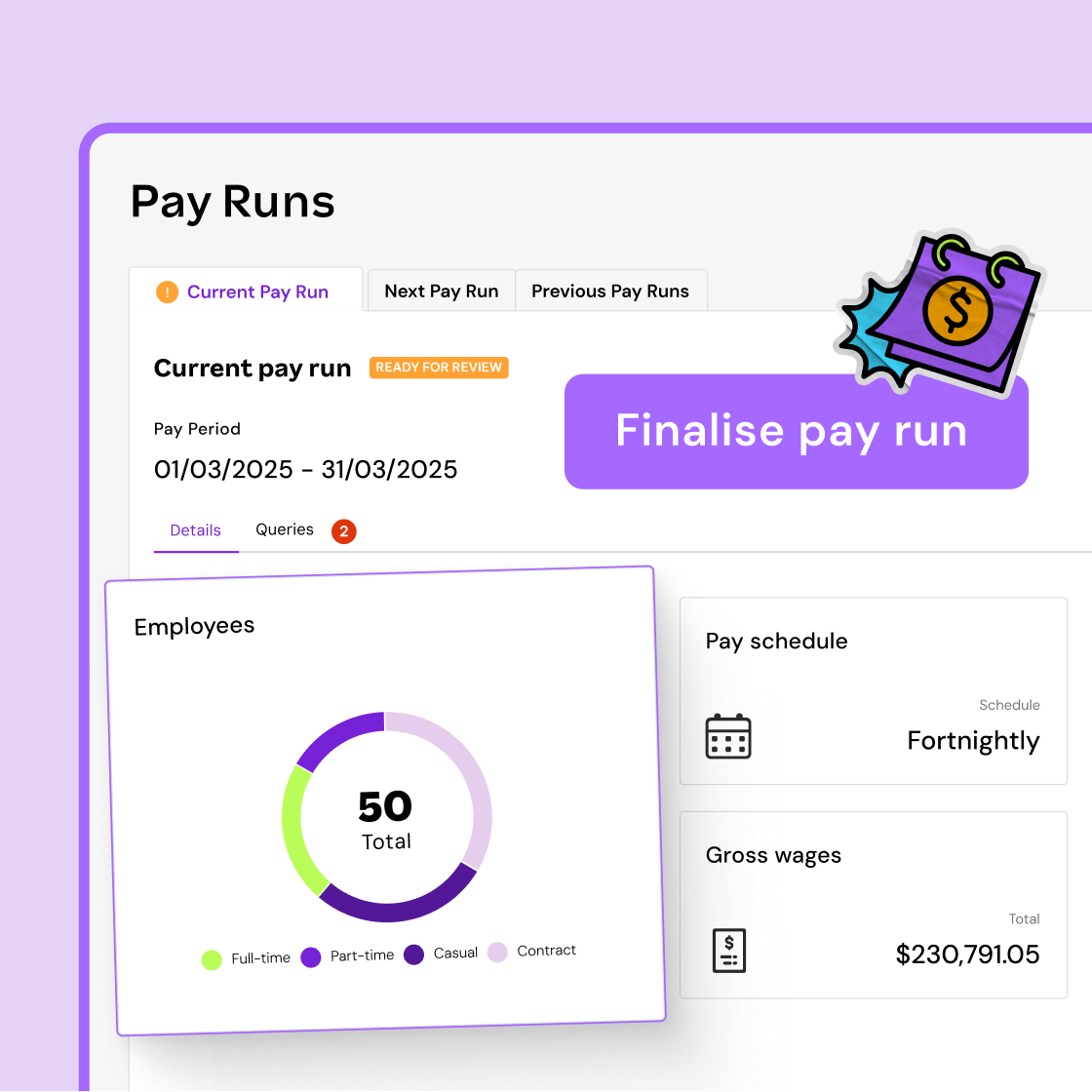

Effortless employee record management

Easily manage employee details in one place. Track changes with a full history and export in Excel, CSV, or PDF when you need it. Everything is organised and ready for audits, employee queries, or end-of-year reviews.

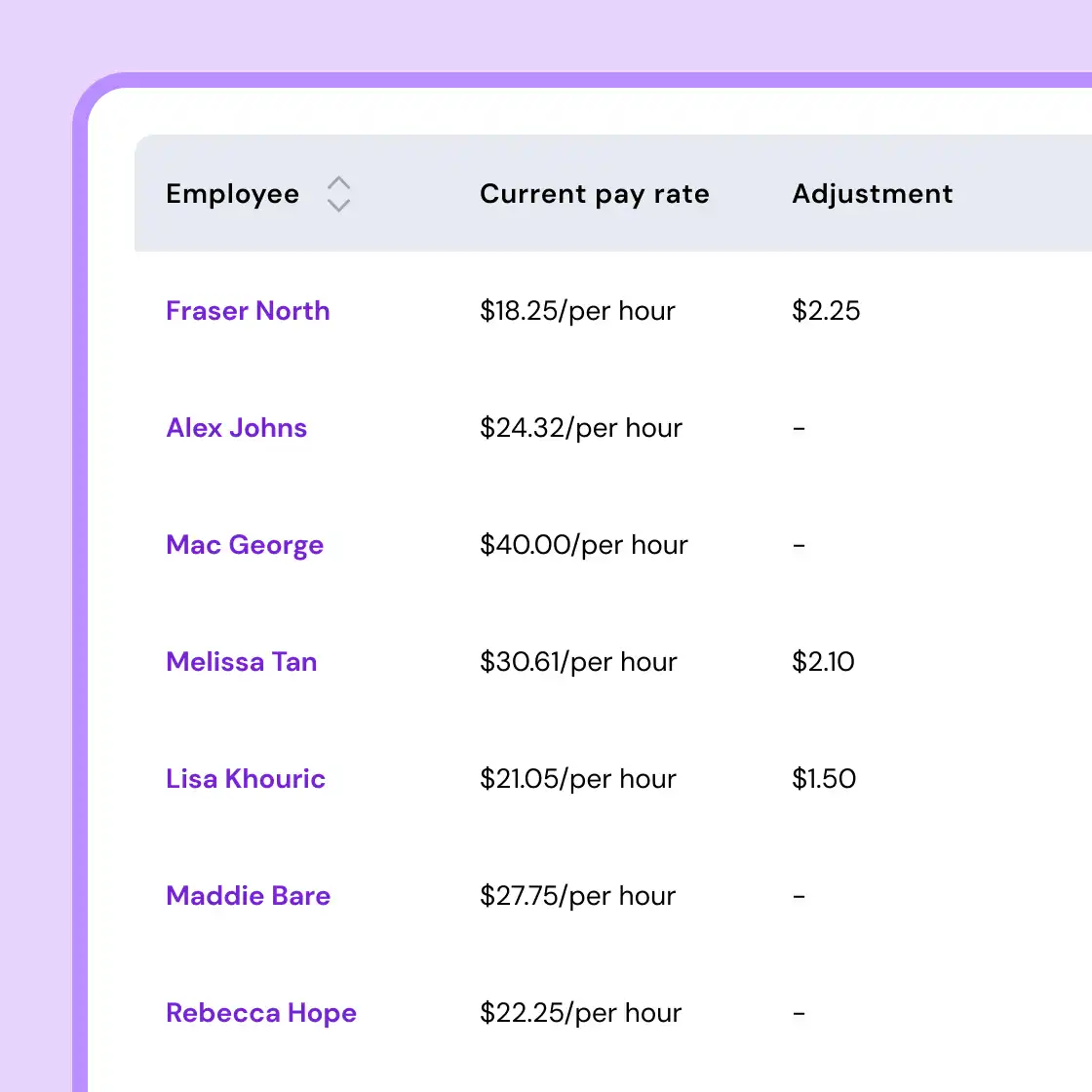

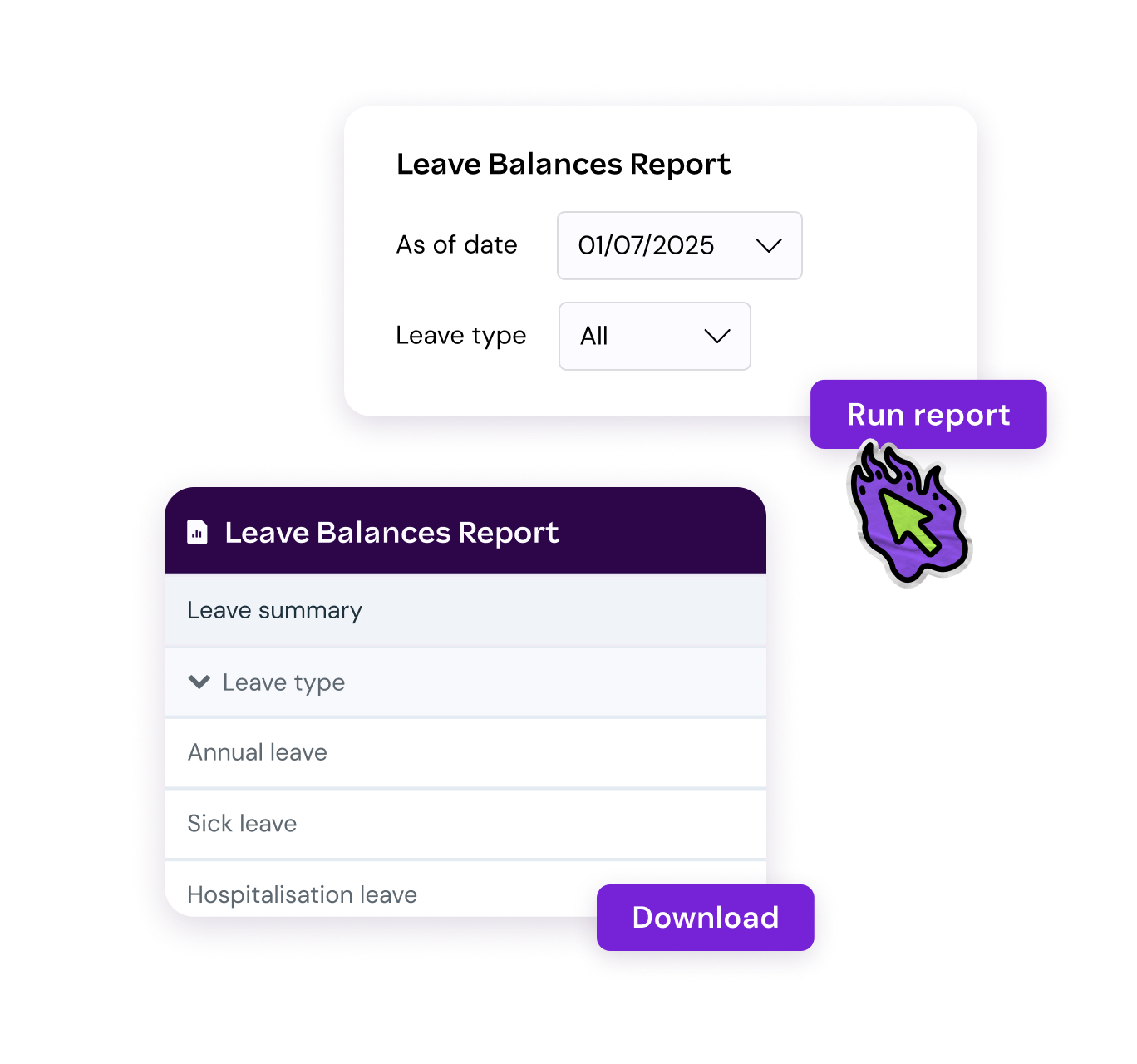

Leave made simple

Generate leave reports in seconds with built-in leave management software. Get visibility of leave taken, approved and remaining, with holiday pay and liabilities calculated automatically.

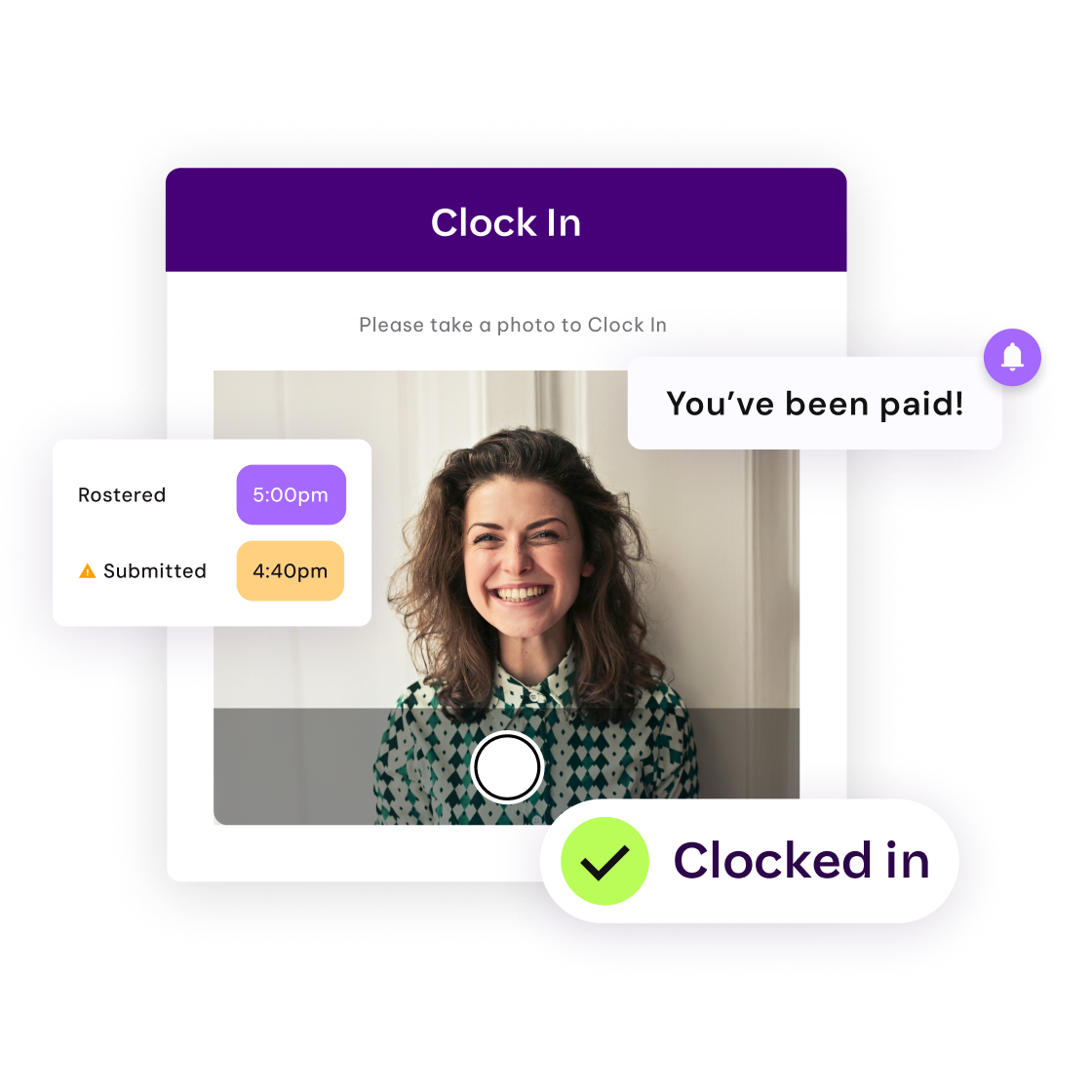

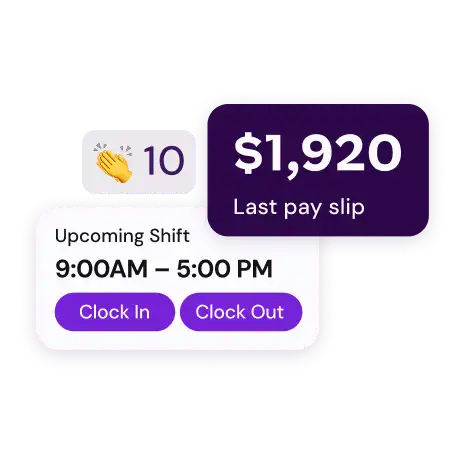

Real-time attendance

Track clock-ins and clock-outs with time, location and photo verification with our time and attendance system. Sync with rosters and timesheets to clear up any shift queries quickly.

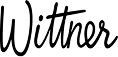

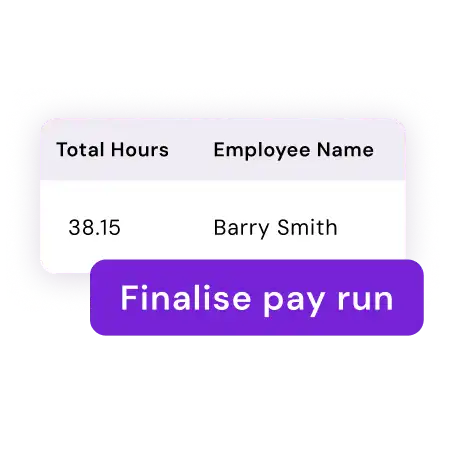

Pay run audits

Review pay runs at a glance: earnings, KiwiSaver, deductions, bank payments and leave. Schedule reports to be sent automatically so you’re always up to date. Quickly spot errors before they become problems, with a clear audit trail to back you up.

TRUSTED BY 300k+ HAPPY CUSTOMERS

Payroll that’s easy to set up and manage

Quick setup and migration

We help you import employee data, configure pay rules and get IRD filing live without disrupting your pay cycle.

Works with your accounting software

Seamlessly connect payroll to tools like Xero and MYOB: no double handling or re-entry. See all of our payroll integrations here.

Flexible pay cycles and secure records

Pay staff weekly, fortnightly or monthly. All payday filing records, PAYE history and KiwiSaver contributions are stored securely and available whenever you need them.

Pricing that grows with your business

Start small and scale when you’re ready. With flexible plans, you only pay for the payroll features you need now: and add HR, hiring and more as you expand.

Stress-free payday filing

Take payroll off your plate with smart automation, all backed by our team of experts. Just review and approve in a few clicks.

Compliance you can count on

Employment Hero is IRD-approved. We handle PAYE, KiwiSaver and payday filing automatically, supporting compliance with every pay run.

Payslips your staff can trust

Build confidence with payroll that gets it right, every time. Employees always know their KiwiSaver, PAYE and deductions are correct. H3: Reports that keep you in control

Reports that keep you in control

From pay run summaries to leave balances, generate reports in seconds. Stay across payroll data without relying on spreadsheets.

Don’t just take our word for it

Join thousands of New Zealand businesses already using Employment Hero to simplify payroll and payday filing. From saving hours each week to supporting IRD compliance , business owners trust us to take the stress out of payday.

Frequently Asked Questions

Everything you need to know about cutting edge hiring software

Payday filing is a system implemented by the New Zealand government to make it easier for employers to submit their employment information to the Inland Revenue Department (IRD).

This information includes the details of each employee, including their employee earnings, deductions, and KiwiSaver contributions for the pay cycle.

Payday filing became mandatory in New Zealand on the 1st of April 2019. From this date, all employers are required to submit employment information through the Payday Filing system after every pay period.

You can log into myIR and manually upload payroll information: but this takes time and leaves room for errors. With Employment Hero, payday filing is automated. Every pay run you process files PAYE and deductions directly with IRD, no manual steps required.

Payday filing must be completed within two working days of paying staff. Employment Hero takes care of this automatically by sending the information to IRD as soon as your pay run is approved.

Late or missing payday filings may result in IRD penalties. If you make a mistake, you must correct the record and resubmit. Employment Hero makes this easier —simply adjust in the software and the corrected filing is sent to IRD.

Yes. Our payroll software automatically calculates PAYE, KiwiSaver, student loans and other deductions. These are included in your payday filing and reported to IRD every pay run.

Absolutely. Our team helps you migrate employee details and set up your payday filing rules, so you can switch quickly and start filing with IRD without disruption.

Payday filing tips & advice

-

Read more: Do’s and don’ts for the end of financial year

Read more: Do’s and don’ts for the end of financial yearDo’s and don’ts for the end of financial year

From the mammoth task of gathering up a year’s worth of records, to filing the company tax return, the end…

-

Read more: How to set up payroll for small businesses in NZ

Read more: How to set up payroll for small businesses in NZHow to set up payroll for small businesses in NZ

Learn how to set up your payroll system in New Zealand as a new business.

Never run another pay run again. We handle it all: you simply approve

Manage all payroll tasks from one place with automated data flows and error alerts., Make paying your people faster and worry-free.

AI-powered automation and expert oversight for accuracy and compliance.

Manage your employees annual & sick leave with ease

A dedicated payroll partner to handle everyday tasks like payslips to the more complex, from legislation changes, payday filing, to payroll anomalies.

Automated bank transfers, compliance reporting, and more.

Hiring on autopilot.

Put your hiring on autopilot

Get instant access to talent. Save time and cut costs

Curated talent shortlists, automation, and more

Manage open roles, interviews, and onboarding from one place

Your employees work hard, so we’ve made work admin easy

Free up your team to do great work with every critical HR process streamlined, consolidated and automated behind the scenes

All employee data is housed in a single, secure platform

Automate leave requests, performance reviews, and onboarding.

Centralise and share company policies and essential documents

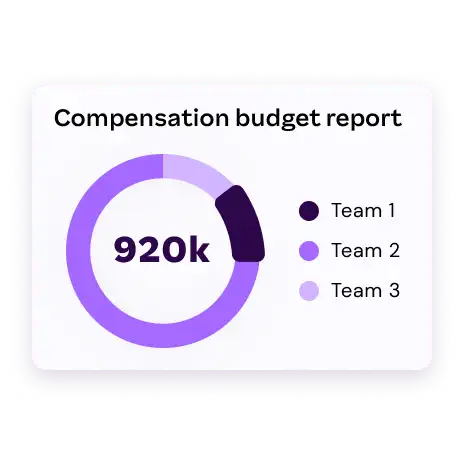

Workforce analytics and reports to help leaders make data-driven decisions.

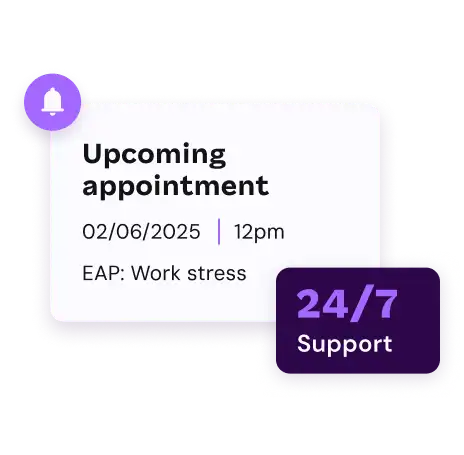

Be the best employer you can be

When you offer employment – we’ll bring the benefits

Employees can access everything they need through an intuitive self-service portal

Increase morale, productivity, and loyalty with an employee assistance program.

Jump into

Employment OS

Employment doesn’t have to be hard. Streamline every step of the employment lifecycle so you and your team can run ahead