Payroll budgeting guide for New Zealand employers

Published

Payroll budgeting guide for New Zealand employers

Published

Between minimum wage increases, public holiday compliance and the rising cost of living, managing payroll can feel like trying to hit a moving target. When your biggest expense is also your most complex, a simple spreadsheet isn’t enough. You need to ensure your numbers are as accurate as your ambitions.

Plan your payroll with confidence. Our comprehensive guide gives you the tools and techniques to create an accurate and strategic payroll budget. We’ve also included a usable checklist, so you can check off all the right steps in your own budget.

Download the payroll budgeting guide by filling in the form on the right.

Why payroll budgeting is essential

Creating a payroll budget is more than a simple accounting task. It’s a strategic process that underpins your company’s financial health and growth potential. In a climate of rising costs and fierce competition for talent, a well-planned budget helps you navigate challenges and seize opportunities. It transforms payroll from a reactive expense into a proactive tool for business success.

Managing rising employment costs

The economic environment is constantly changing. With inflation and wage growth affecting businesses across New Zealand, controlling costs is a priority for every leader. A detailed payroll budget gives you a clear view of your total employment costs, not just base salaries. By forecasting expenses accurately, you can identify areas for efficiency, manage wage expectations and make informed decisions that protect your bottom line. It allows you to stay competitive in the talent market without compromising your financial stability.

Supporting strategic workforce planning

Your people are your greatest asset and your biggest investment. An accurate payroll budget is the foundation of strategic workforce planning. It ensures your hiring plans, retention strategies and organisational structure are financially viable. Whether you’re scaling your team, restructuring departments or investing in talent development, your budget provides the financial roadmap. It aligns your people strategy with your business objectives, ensuring you have the right team in place to achieve your goals.

Key components of a payroll budget

An effective payroll budget accounts for every cost associated with your employees. Overlooking even small expenses can lead to significant variances that disrupt your financial plans. A thorough approach requires breaking down your payroll into direct, indirect and statutory costs to build a complete picture.

Salaries, wages and variable pay

This is the most significant part of your payroll. It includes the fixed salaries for your permanent employees and the hourly wages for your part-time or casual team members.

You also need to account for variable pay components. This includes potential overtime payments, performance bonuses, sales commissions and any special allowances you provide. Forecasting these elements requires looking at historical data and future business plans, such as seasonal peaks or new projects.

Statutory contributions and taxes

Meeting your legal obligations is a critical part of payroll management. These costs are mandatory and must be calculated precisely.

- KiwiSaver: You must contribute a minimum of 3% of your employee’s gross pay to their KiwiSaver fund if they are enrolled in the scheme.

- PAYE: As an employer, you are responsible for deducting Pay As You Earn tax from your employees’ wages and remitting it to Inland Revenue (IR).

- ACC levies: You pay levies to the Accident Compensation Corporation (ACC) to cover work-related injuries. The rate depends on your industry classification unit (CU).

- Leave entitlements: All employees are entitled to paid time off. This includes a minimum of four weeks of annual leave, ten days of sick leave after six months and paid time off for public holidays. These entitlements represent a significant liability that must be accrued and budgeted for.

Benefits and other costs

To attract and retain top talent many businesses offer benefits beyond the statutory minimums. These can include health insurance, life insurance, wellness allowances or professional development budgets. Other costs to consider are the expenses associated with recruitment, such as advertising fees or agency costs, and the cost of onboarding and training new hires. These indirect costs are vital for building a strong and capable team.

New hires and attrition forecasting

Your workforce is not static. Your budget needs to account for planned growth and natural employee turnover. This involves forecasting the costs for new roles you plan to create, including their salary, benefits and recruitment expenses. You also need to estimate the financial impact of attrition. This includes the cost of temporary cover during a vacancy period and the cost of hiring and training a replacement.

How to create a payroll budget

Building a payroll budget is a structured process that combines historical data with future planning. Following these steps will help you create a detailed and realistic budget.

1. Gather accurate payroll and workforce data

Start with what you know. Collect comprehensive data from your payroll system for the last 12 months. This should include gross wages paid, hours worked, overtime, bonuses, leave taken and all employer contributions. This historical information provides a baseline for your forecasts.

2. Identify cost drivers and trends

Analyse your data to understand what drives your payroll costs. Are there seasonal peaks in overtime? Have certain departments grown faster than others? Identifying these trends will help you make more accurate predictions for the year ahead.

3. Factor in statutory and non-wage costs

Calculate all your on-costs. This includes your mandatory KiwiSaver contributions and ACC levies. Estimate the cost of accrued leave based on historical patterns and known staff plans. Don’t forget to budget for all other employment-related expenses like training, benefits and recruitment.

4. Forecast hiring, promotions and legislative changes

Look to the future. Incorporate any planned new hires, promotions or salary increases into your forecast. Stay informed about any upcoming changes to employment law, such as minimum wage increases or alterations to leave entitlements, that could impact your costs.

5. Allocate budgets across teams or functions

For greater control and accountability, break down your overall payroll budget by department or team. This allows managers to take ownership of their staffing costs and helps you track performance more effectively across the business.

6. Build scenarios and contingency buffers

The future is uncertain. It’s wise to model different scenarios. What if revenue is lower than expected? What if a key employee resigns? Creating best-case, worst-case and expected-case budgets helps you prepare for different outcomes. Include a contingency buffer, typically 3–5% of total payroll, to cover unexpected costs.

7. Review, refine and communicate the budget

A budget is a collaborative tool. Share your draft with key leaders in finance, HR and operations to get their input. Their insights will help refine the budget and ensure it aligns with the company’s strategic goals. Once finalised, communicate the relevant parts of the budget to department heads.

Payroll budgeting techniques to consider

There are several methods for creating a payroll budget. The best one for your business depends on its size, complexity and strategic objectives.

Zero-based budgeting

With zero-based budgeting (ZBB), you start from scratch every year. Every single role and its associated cost must be justified based on its contribution to the company’s goals for the upcoming period. It’s a rigorous, time-consuming method but it forces a critical evaluation of all payroll spending. ZBB is excellent for optimising costs and ensuring your workforce structure is perfectly aligned with your strategy.

Incremental budgeting

This is the most common and straightforward technique. You take the previous year’s budget or actual spend and apply a percentage increase to account for factors like inflation, planned hires and annual salary reviews. Incremental budgeting is fast and simple, making it suitable for stable businesses with predictable growth. Its weakness is that it can carry over past inefficiencies.

Rolling forecasts

Instead of a fixed annual budget, a rolling forecast is continuously updated. For example, at the end of each quarter you might add a new forecast for the quarter 12 months ahead. This makes your budget a living document that adapts to changing business conditions. It provides a more current and relevant financial outlook, enabling more agile decision-making.

Scenario planning

Scenario planning involves creating multiple budget versions based on different potential future states. You might create an optimistic scenario with high revenue growth and a pessimistic one with an economic downturn. This technique helps you understand the potential impact of external factors on your payroll and prepares you to respond effectively whatever happens.

Common payroll budgeting mistakes to avoid

A few common pitfalls can undermine the accuracy and usefulness of your payroll budget. Being aware of them is the first step to avoiding them.

Underestimating statutory costs

Employer contributions like KiwiSaver and ACC levies are significant costs. Similarly, the liability of accrued annual leave can be substantial. Underestimating these or calculating them incorrectly can lead to a budget that is unrealistic from the start and may create compliance issues.

Ignoring seasonal or irregular payroll events

Many businesses experience fluctuations in staffing needs throughout the year. Forgetting to budget for seasonal temps, annual bonus payouts or the payroll costs of a major project can cause significant budget variances that put pressure on your cash flow.

Treating budgeting as a one-off task

An effective budget is not something you create in January and forget about until December. Your business and the market are constantly evolving. You must regularly compare your actual spending to your budget, analyse any variances and adjust your forecasts as needed.

Not aligning payroll with business strategy

Your payroll budget should be a financial expression of your business strategy. A budget created in isolation from your company’s goals for growth, innovation or market expansion is just a numbers exercise. It misses the opportunity to be a powerful tool that drives strategic execution.

Best practices for New Zealand payroll managers

Adopting best practices will elevate your budgeting from a necessary task to a strategic function that adds real value to the business.

Collaborate across finance and HR

Payroll sits at the intersection of finance and human resources. Close collaboration between these two departments is essential. HR provides the insights on workforce planning, talent strategy and compensation, while finance provides the overall financial framework and rigour. Working together ensures the payroll budget is both strategically aligned and financially sound.

Use payroll software and automation wisely

Modern payroll software is an indispensable tool for budgeting. It can automate complex calculations, provide detailed historical data and generate custom reports for analysis. Using these tools reduces the risk of manual error and frees up your time to focus on more strategic aspects of budget management, like forecasting and scenario planning.

Stay up to date with legislation

New Zealand’s employment landscape changes frequently. The Government regularly reviews and updates laws related to minimum wage, leave entitlements, and taxes. It’s so important to stay informed about these changes and factor them into your budget. This not only keeps you on the right side of the law but also prevents unexpected costs from derailing your budget.

Report clearly to leadership

Your budget reports should tell a clear story to the leadership team. Don’t just present numbers; provide context and analysis. Explain the key assumptions behind your forecast, highlight potential risks and opportunities and clearly show how the payroll budget supports the company’s strategic objectives. Clear reporting builds confidence and facilitates better decision-making.

How Employment Hero supports smarter payroll budgeting

Creating and managing a payroll budget is a complex process but you don’t have to do it alone. Employment Hero’s all-in-one platform is designed to simplify HR and payroll for New Zealand businesses.

Our payroll software automates complex calculations for PAYE, KiwiSaver and leave entitlements, reducing the risk of errors and saving you valuable time. With integrated reporting you can easily access real-time and historical data to build accurate forecasts. Track your spending against your budget, generate custom reports for leadership and manage your largest expense with confidence.

By streamlining your payroll processes, Employment Hero empowers you to move beyond administration and focus on strategy. Make smarter decisions, plan for the future and turn your payroll budget into a powerful tool for growth.

Find out more about Employment Hero and book a call with one of our team today.

The information in this article is current as at 30 December 2025, and has been prepared by Employment Hero Pty Ltd (ABN 11 160 047 709) and its related bodies corporate (Employment Hero). The views expressed in this article are general information only, are provided in good faith to assist employers and their employees, and should not be relied on as professional advice. Some information is based on data supplied by third parties. While such data is believed to be accurate, it has not been independently verified and no warranties are given that it is complete, accurate, up to date or fit for the purpose for which it is required. Employment Hero does not accept responsibility for any inaccuracy in such data and is not liable for any loss or damages arising directly or indirectly as a result of reliance on, use of or inability to use any information provided in this article. You should undertake your own research and seek professional advice before making any decisions or relying on the information in this article

Register for the guide

Related Resources

-

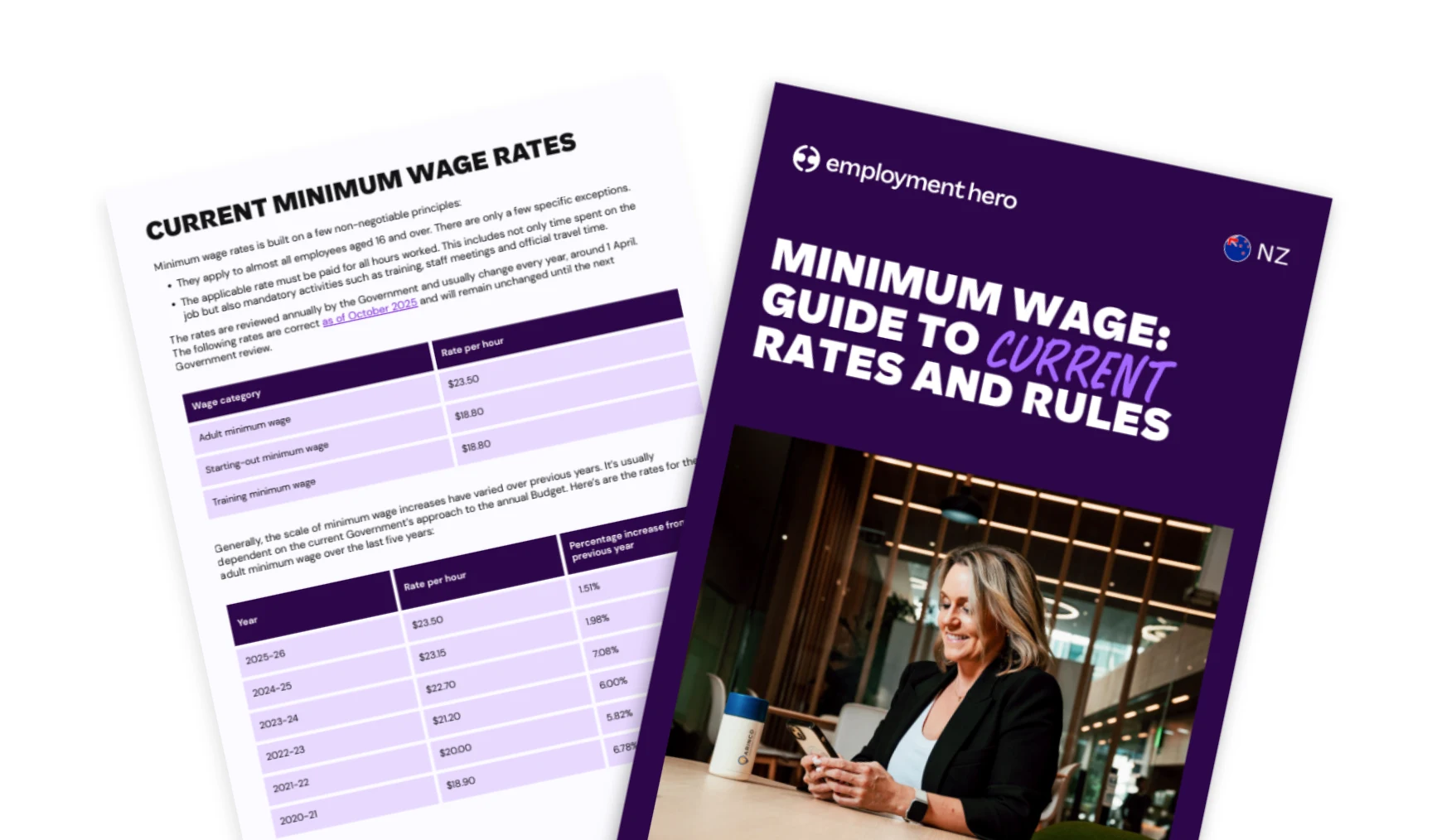

Read more: Minimum wage: Guide for New Zealand employers and payroll teams

Read more: Minimum wage: Guide for New Zealand employers and payroll teamsMinimum wage: Guide for New Zealand employers and payroll teams

Understand NZ’s minimum wage rates, training wage rules, and 2025 updates. Learn how Employment Hero NZ automates wage compliance.