An employer’s guide to the 1 April KiwiSaver changes

Published

An employer’s guide to the 1 April KiwiSaver changes

Published

A big change to KiwiSaver is on the horizon for New Zealand employers. Following the initial government changes in mid-2025, the next phase of the legislation is set to take effect on 1 April 2026, directly impacting payroll, employer contributions and employee take-home pay.

The big headline is the jump in the default contribution rate. For both employers and employees, the rate is climbing from 3% to 3.5%.

But that’s not all. New rules around temporary rate reductions and contributions for younger workers are also kicking in. It’s a win for employees’ future savings, but it does mean a bit of heavy lifting for you as employers.

We’re here to help. This guide breaks down everything you need to know about the 1 April 2026 changes. It includes:

This guide covers:

- All the changes to KiwiSaver in detail

- The practical implications for your business

- A checklist of everything you need to do to prepare

- A standardised email template to keep your team informed

The information in this article is current as at 22 January 2026, and has been prepared by Employment Hero Pty Ltd (ABN 11 160 047 709) and its related bodies corporate (Employment Hero). The views expressed in this article are general information only, are provided in good faith to assist employers and their employees, and should not be relied on as professional advice. Some information is based on data supplied by third parties. While such data is believed to be accurate, it has not been independently verified and no warranties are given that it is complete, accurate, up to date or fit for the purpose for which it is required. Employment Hero does not accept responsibility for any inaccuracy in such data and is not liable for any loss or damages arising directly or indirectly as a result of reliance on, use of or inability to use any information provided in this article. You should undertake your own research and seek professional advice before making any decisions or relying on the information in this article.

Register for the guide

Related Resources

-

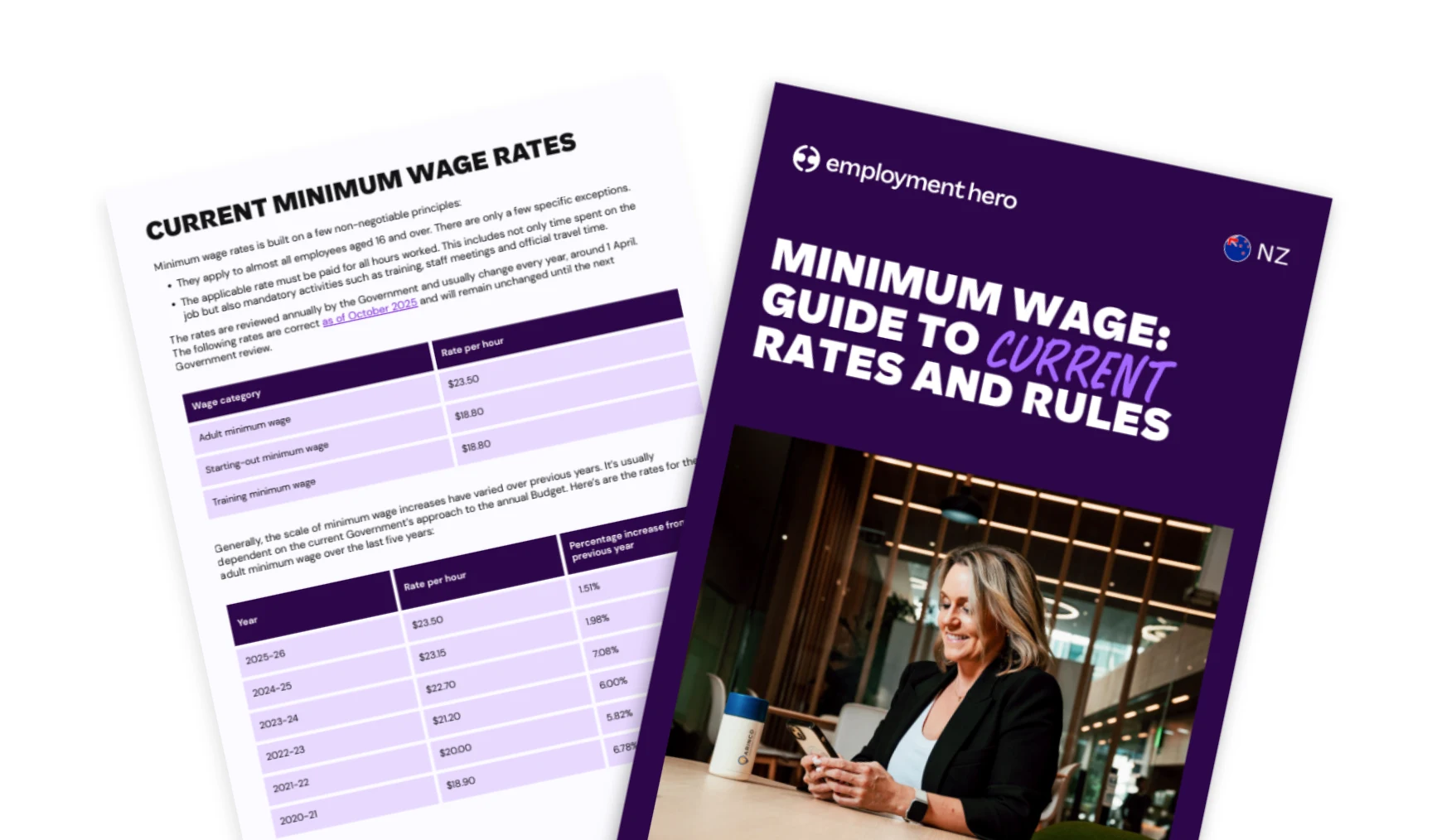

Read more: Minimum wage: Guide for New Zealand employers and payroll teams

Read more: Minimum wage: Guide for New Zealand employers and payroll teamsMinimum wage: Guide for New Zealand employers and payroll teams

Understand NZ’s minimum wage rates, training wage rules, and 2025 updates. Learn how Employment Hero NZ automates wage compliance.