Hire Employees in the Philippines

Looking to hire employees in the Philippines? Employment Hero’s global teams is your Employer of Record of choice for your hiring needs.

Key Facts

| Employment Terms | |

|---|---|

| Timezone | GMT +8 |

| Currency | Philippine Pesos (PHP) |

| Capital city | Manila |

| Official language(s) | Filipino and English |

| Ease of doing business | Friendly to business but challenging (#90 out of 190) |

| Minimum wage | 537 PHP per day |

| Estimated employer cost | 11.75% + provident fund |

| Employer retirement contribution: Mandatory Provident Fund (MPF) | Mandatory Provident Fund (MPF) For employees earning over PHP 20,000 per month, the employer is required to contribute from PHP 42.50 to PHP 425 per month. Employers contribute slightly more than 8.5%, with monthly caps at a total of PHP 2,155. As an employer, you are required to contribute to the Social Security System (SSS) & Mandatory Provident Fund (MPF) for your employees. |

About the Philippines

The Philippines is a Southeast Asian nation formed of an archipelago of approximately 7,641 islands. With a population of 111 million, and 88% of its inhabitants being proficient in English, this makes it the fourth highest English speaking population in the world.

With English as a widely spoken second language and a highly educated remote-ready workforce, it is no secret that the Philippines’ virtual economy is thriving. Post-Covid, the number of Filipinos opting for remote work with overseas companies has grown exponentially.

Employment in the Philippines

Working Hours

- The regulated standard working hours are a maximum of 8 hours per day and therefore 40 hours maximum per week for a 5-day week.

Overtime

- If an employee has to work on weekends, they are entitled to an additional 30% of their regular daily rate wages, unless stated otherwise in the employment contract.

- If an employee has to work over 8 hours a day, the employer must pay an additional 25% of the hourly rate in excess.

- Senior managers are excluded from overtime pay.

Probationary Period

- Probation period is not mandatory for indefinite contracts, but it is in practice 6 months.

Payroll Cycle

- Salaries are usually paid bi-monthly on the 15th and the 30th of each month.

Main Types of Leave in the Philippines

Annual Leave

After one year of service, an employee is entitled to 5 days of “Service Incentive Leave” (SIL). These days can be taken as holiday or sick leave. However, it is customary to provide at least 12 days to 20 days of annual leave per year.

Sick Leave

There is no minimum entitlement for sick leave. Annual leave is usually inclusive of sick leave. However, an employer can decide to provide extra days of sick leave.

Parental Leave

Maternity Leave

Paid Maternity Leave comprises of 105 days, increased to 120 days for single mothers. Female employees of at least one year of service are entitled to a yearly service incentive of 5 days paid leave which can be used towards maternity leave. The maternity benefit is paid to the employee at the rate of 100% of the regular pay by the employer and is reimbursed to them via social security.

Paternity Leave

Paid Paternity Leave entitlement is 7 days from the child’s date of birth.

Other Leave

Solo Parent Leave – Certified solo parents are entitled to up to seven days leave for parental activities.

Violence Against Women and Children (VAWC) Leave – Victims are entitled to 10 days of leave for medical treatment and legal obligations. The employee must provide a certification.

Special Leave for women – Eligible employees can take up to 2 months leave following surgery for gynaecological issues.

Employment Termination

Notice Period

The notice period for termination is 30 days.

Written notice to the employee is required and the employee needs to have the opportunity to explain themselves.

For authorized causes (refer to “Termination” below), a copy of the notice needs to be sent to the Regional Office of the Department of Labor and Employment (DOLE) where the employer is located.

For just causes (refer to “”Termination”” below), a hearing needs to be organized to allow the employee to respond to charges, present evidence or rebut the evidence.

A notice of the final decision indicating the justification for termination and the sanctions will then need to be issued.

Termination

An authorized cause or justified cause is required for termination.

- Authorized causes include business and health reasons such as redundancy, retrenchment, installation of labor-saving devices or closing/cessation of operation.

- Just Causes include gross and habitual neglect of duties, fraud, commission of a crime, serious misconduct, wilful breach of trust, wilful disobedience and other similar causes.

*We recommend that you seek professional advice before taking any action on termination. Global Teams can assist you.

Severance

For authorized causes, the employee is entitled to a severance pay equal to one month of basic pay, or one month of basic pay multiplied by the number of years of service, whichever is higher.

For Just Causes, no severance pay is required.

Disclaimer: The information on this webpage is current as at 19 September 2022, and has been prepared by Employment Hero Pty Ltd (ABN 11 160 047 709) and its related bodies corporate (Employment Hero). The views expressed on this webpage are general information only, are provided in good faith to assist employers and their employees, and should not be relied on as professional advice. The information is based on data supplied by third parties. While such data is believed to be accurate, it has not been independently verified and no warranties are given that it is complete, accurate, up to date or fit for the purpose for which it is required. Employment Hero does not accept responsibility for any inaccuracy in such data and is not liable for any loss or damages arising either directly or indirectly as a result of reliance on, use of or inability to use any information provided on this webpage. You should undertake your own research and to seek professional advice before making any decisions or relying on the information displayed here.

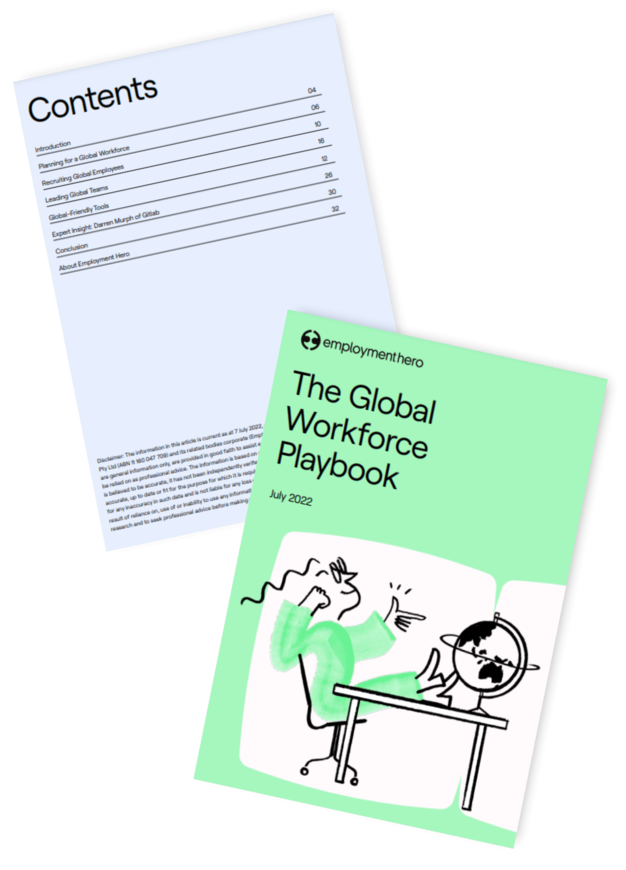

Download the International Hiring Guide

*Information here is current as at 16/09/2022, for full details download the guide.

Hiring Process in the Philippines Sorted

Hiring an employee in the Philippines is no easy task. Especially, if you are overseas, and lack the knowledge of employment law and regulations relating to international HR compliance, payroll, benefits and taxes.

Employment Hero has a local entity in the Philippines and we fully understand all the ins and outs of hiring in the local market, so we can help you throughout the whole process.

The Philippines Employment Law Decoded.

The Philippines has laws that help keep workplaces fair. You should be aware of the rules and what your employer’s rights and responsibilities are. Under the labor code of the Philippines, employers and employees both have rights and responsibilities. Do you know your responsibilities?

Employ anyone, anywhere. Easily.

Employment Hero’s Global Teams service takes care of the complex admin; international employment legislation, local tax and pension minimums, insurance obligations and more. Hiring incredible talent from anywhere in the world has never been easier.

Try our Applicant Tracking System

Employment Hero’s ATS makes hiring and managing new staff easier than ever.

“The good thing about Employment Hero is that they’re on this journey with you… We’ve got a kind of partnership helping us understand local employment and ensure we’re hiring legally.”

Ariane Sarabia, Global Talent Acquisition Specialist

Related Resources

The Global Workforce Playbook For Employers

Are you ready to go global? We explore how SMBs can establish dynamic and effective global teams.

Interview Questions To Ask Remote Workers

We’ve compiled 101 questions to help you find the best talent for your remote role.

How global teams can transform your business

Global teams are changing the workplace. Find out how this team structure can benefit your business

Employer of Record.

Hire Remotely

Global Teams is the best-in-class global (EOR) Employer of Record that enables you to hire based on skill, not location. Whether you’re expanding into new markets or struggling to fill open roles, we connect the best talent with the best employers, legally and ethically.