Managed Payroll. Make payroll effortless.

Choose EmploymentOS for Businesses to automate and do the payroll for you.

Reporting & Compliance Made Easy

Managed tax reporting and compliance including State Pension

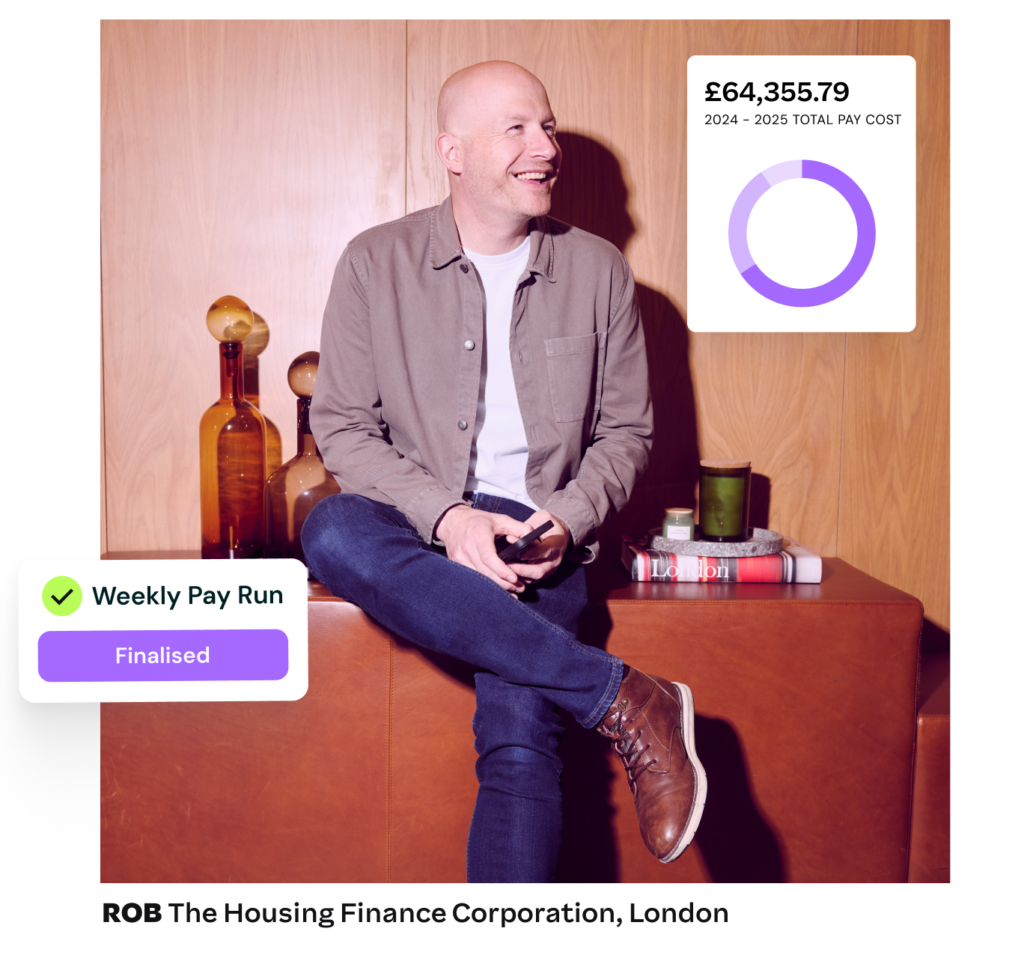

Cloud Based Pay Runs

End-to-end managed pay runs while you have full visibility with our best-in-class cloud software

Time & Attendance Tracking

Integrated time and attendance tools for employee time tracking

Do it all with Employment Hero – and save up to 75% of your payroll overhead costs.

Our all-inclusive fee means no hidden costs

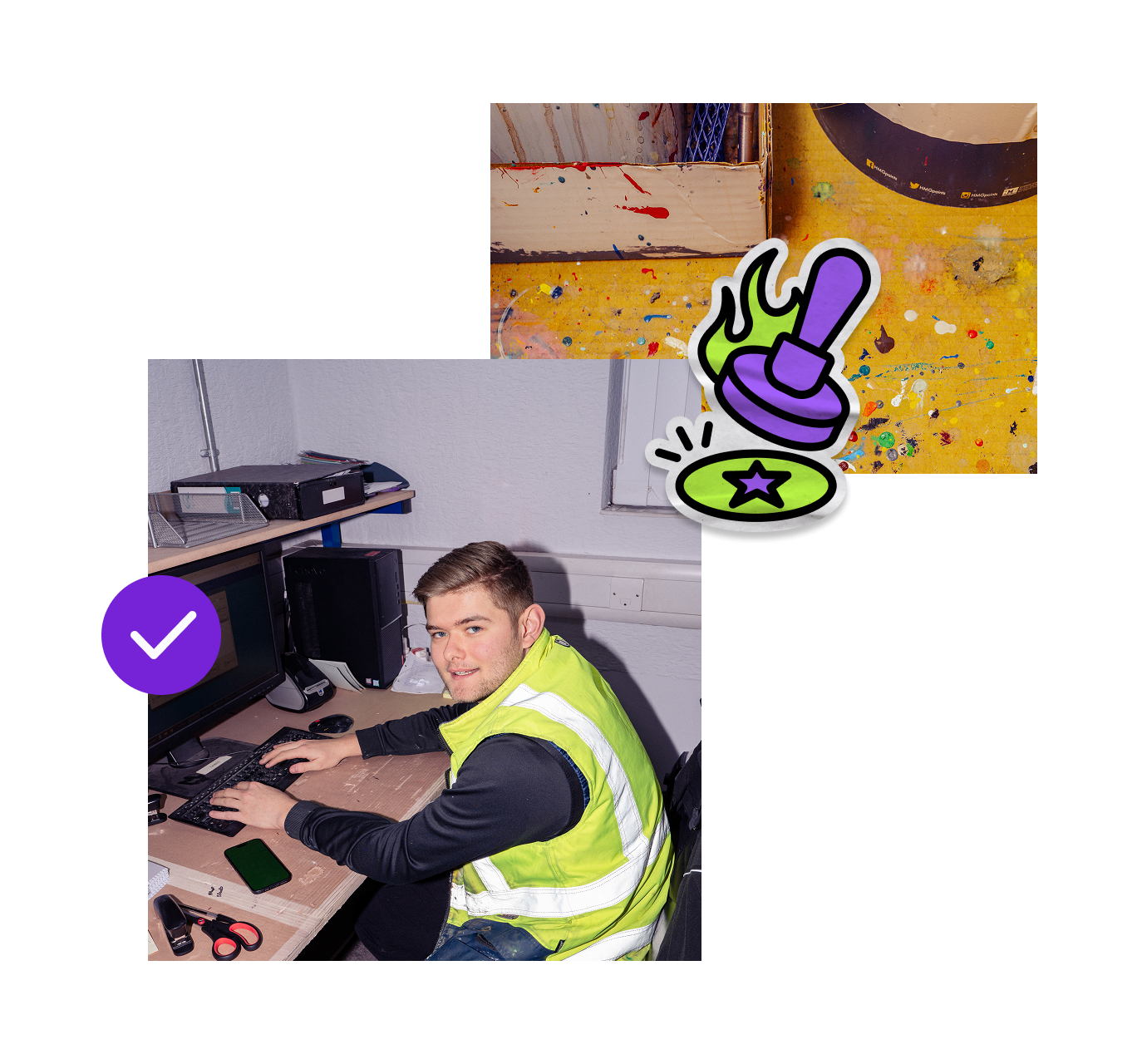

Our self-service portal enables your employees to have access to their pay information providing flexibility to update their own details and saving you from ad hoc requests.

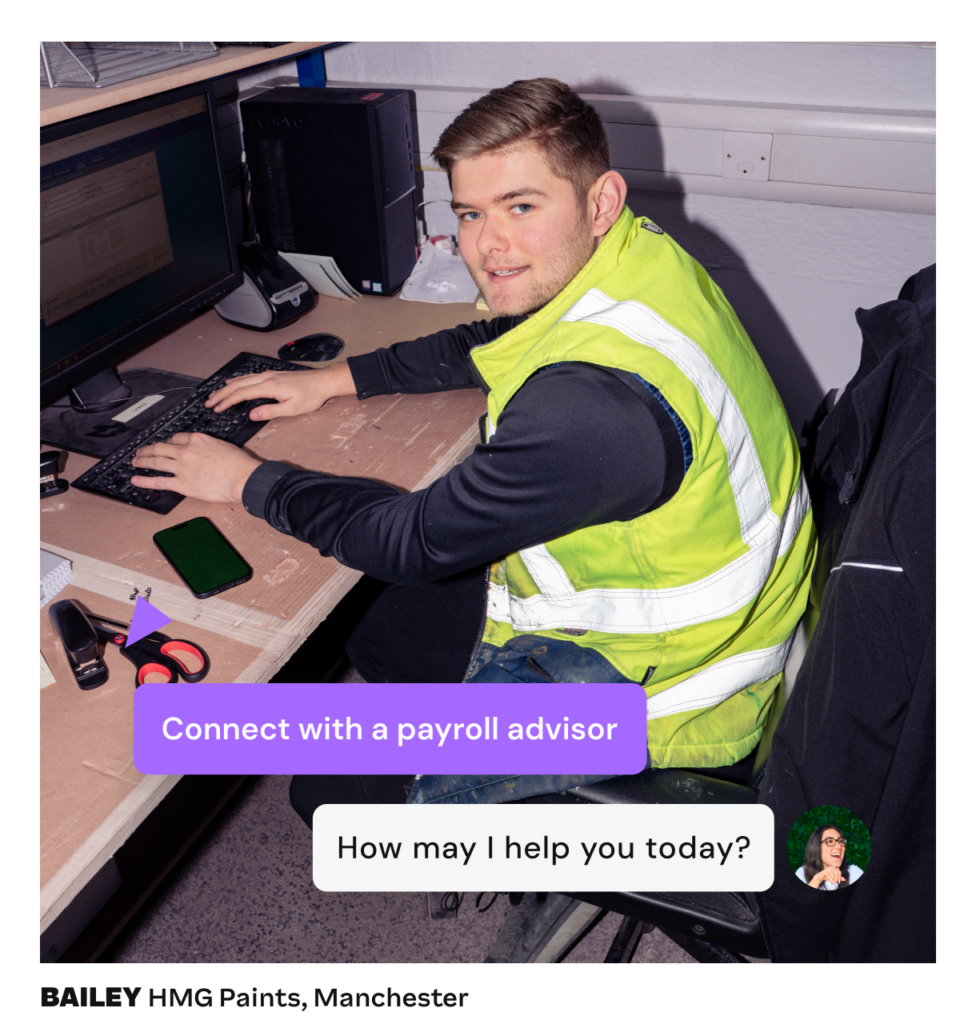

Locally processed with local support

With local offices around the UK, all our dedicated payroll partners are easily accessible and expert in their field, with experience across all industries and business sizes.

Driving compliance and efficiency

Feel confident that your payroll processing always meets compliance requirements thanks to our local implementation teams, dedicated support services and end-to-end Employment Hero payroll platform.

Backed by the best

Your dedicated payroll partner will own the payroll processing outcomes for your business. They’re also backed by a team of human resource, legal and HR software experts to ensure that important legislative and best practice changes are always adhered to.

Our promise to you

With our managed Payroll Partner service, you have access to dedicated Payroll professionals who always put you first, and offer our services with your needs in mind. We use technology to drive the most efficient managed payroll solutions, constantly striving to improve your experience with our expertise.

What do you get with Managed Payroll?

Guaranteed data entry

We ensure all your payroll information is entered into the system on time for accurate processing within the agreed pay cycle.

Pre-payroll verification

Receive a detailed report for review before finalising payroll, allowing you to catch any discrepancies.

Timely processing & reports

We handle your payroll calculations and generate standard reports.

Effortless employee payments

We provide employee Electronic Funds Transfer (EFT) data for easy processing.

State Pension

Never worry about pension schemes again, we handle State Pension payments and reports for all your employees.

Dedicated payroll help desk

Our support team is available to assist your designated contacts with payroll inquiries.

Managing payroll for all businesses

Payroll services that scale with your business

No matter your size, we have a scalable service to grow with you team. Our payroll specialists help your business stay compliant with UK tax, accounting, and processing regulations.

Payroll services for bigger businesses

Bigger business have more complex payroll needs. Our team are experienced to deal with the most complicated payroll functions, simplifying each process to save you time, money and compliance headaches.

Don’t just take it from us…

Payroll insights for you

-

Read more: AI in HR: How to keep the human in Human Resources and payroll with AI

Read more: AI in HR: How to keep the human in Human Resources and payroll with AIAI in HR: How to keep the human in Human Resources and payroll with AI

Discover how AI can complement human efforts in HR and enable teams to focus on the bigger picture.

-

Read more: In-house payroll vs outsourcing: Which is best for SMEs?

Read more: In-house payroll vs outsourcing: Which is best for SMEs?In-house payroll vs outsourcing: Which is best for SMEs?

Using a payroll platform to bring payroll in-house can be transformational for your business and team. Let’s chat through why…

-

Read more: 12 Critical Questions to Ask Your Payroll Provider

Read more: 12 Critical Questions to Ask Your Payroll Provider12 Critical Questions to Ask Your Payroll Provider

Like most services, there is no one-size-fits-all outsourced payroll provider. By doing your research and asking these important payroll questions,…