When it comes to managed payroll, it pays to be picky.

From consultations, audits and best practices, to setting up and running your payroll, you’ll have everything you need to pay your employees easily. We make pay runs as joyful as pay days.

Reporting & compliance made easy

Stay on top of tax reporting and record keeping without the paperwork pile-up.

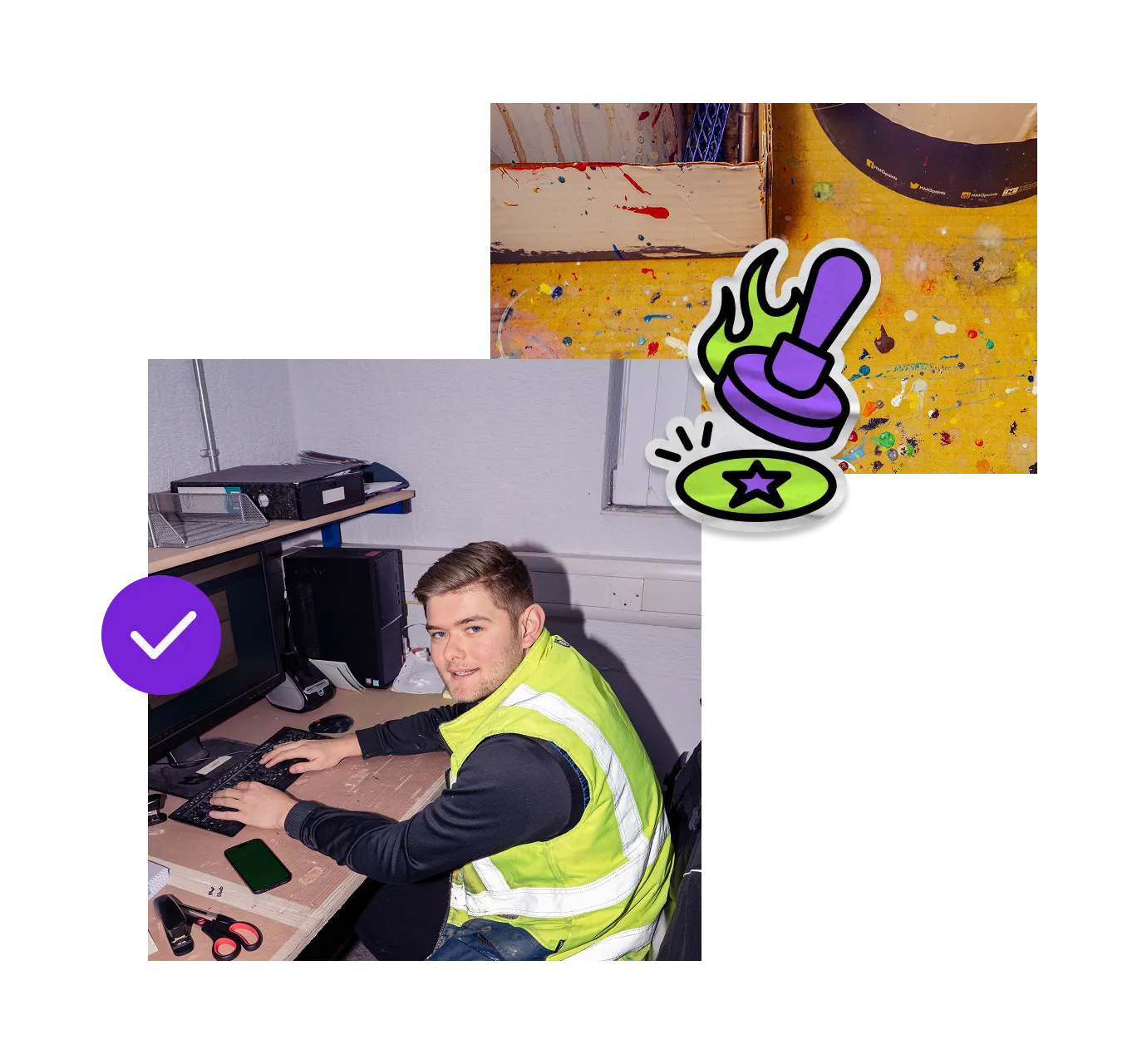

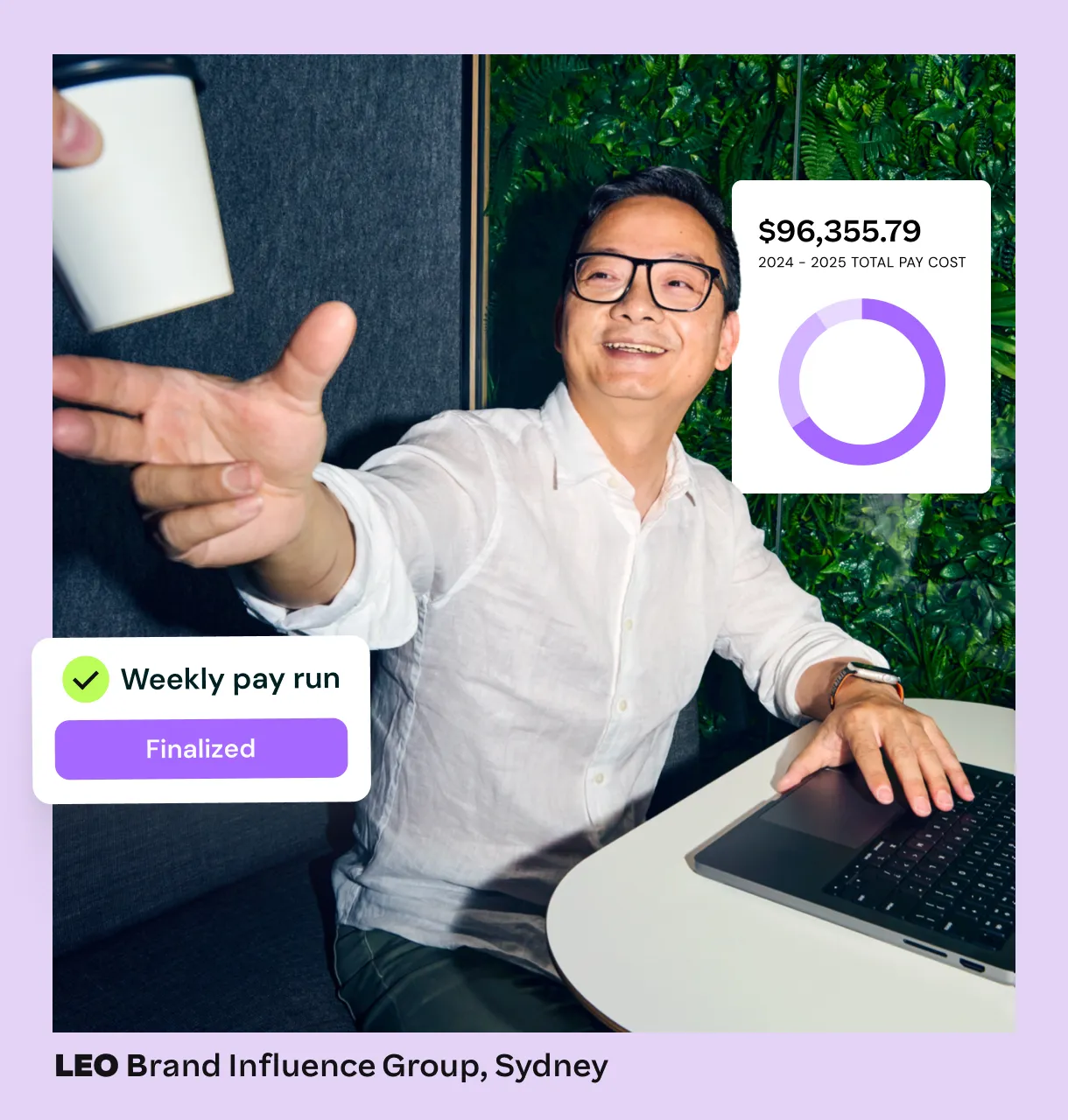

Cloud-based pay runs

Run payroll end-to-end in the cloud. You’ll have full visibility and control, with powerful software doing the heavy lifting.

Time & attendance tracking

Track employee hours with integrated time and attendance tools that keep pay accurate and fair.

We run your payroll so you don’t have to

Pricing that makes sense

No hidden costs, no guesswork. Get payroll that’s precise and predictable, so you can budget with clarity and confidence.

Canadian payroll, local expertise

Our Managed Payroll service is run by a team of PCP-certified specialists who have a deep understanding of Canadian regulations. You get payroll that’s accurate and on time, supported by local experts you can count on.

Driving compliance and efficiency

Feel confident that your payroll processing always meets compliance requirements thanks to our local implementation teams, dedicated support services and end-to-end Employment Hero payroll platform.

Backed by the best

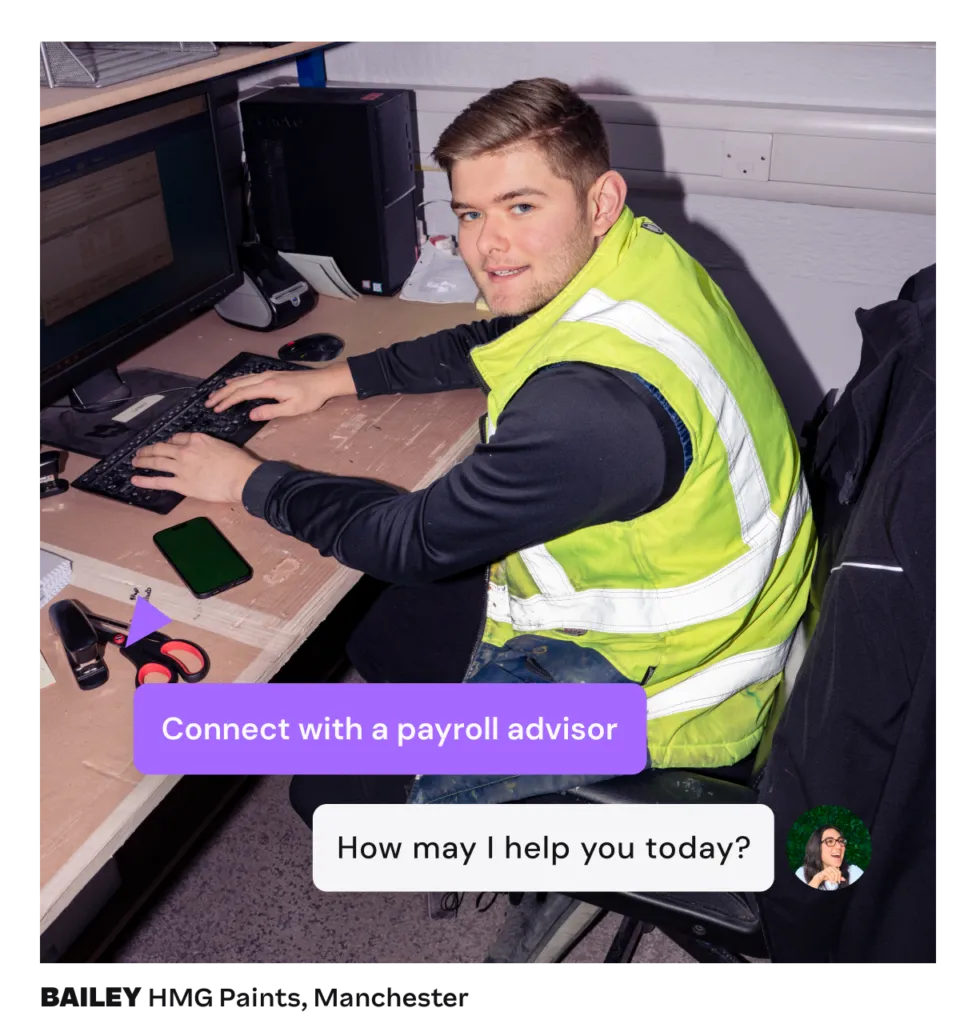

Your payroll partner handles your payroll processing with precision. They give you the support to get every pay run right, helping you stay in line with the latest legislative requirements and best practices.

Our promise to you

With our managed Payroll Partner service, you have access to dedicated Payroll professionals who always put you first and offer our services with your needs in mind. We use technology to drive the most efficient managed payroll solutions, constantly striving to improve your experience with our expertise.

What do you get with Managed Payroll?

Guaranteed data entry

We ensure all your payroll information is entered into the system on time for accurate processing within the agreed pay cycle.

Pre-payroll verification

We run a full audit before every pay run and send you a detailed report, so you can spot and fix any discrepancies before payroll is finalized. Smooth, accurate and right —every time.

Timely processing & reports

We follow a strict process to ensure your payroll is accurate, compliant and always completed on time. Along with handling your payroll calculations, we produce standard reports — and we take care of your Employer Health Tax (EHT) reporting, too.

Year – end reconciliation for T4s

Say goodbye to spreadsheets. Our experts handle your reconciliation, so you can close out the year knowing your T4s are good to go.

Dedicated payroll help desk

Count on our payroll support team for expert guidance and quick, reliable answers — giving your designated contacts a seamless experience whenever they need it.

Don’t just take it from us…

Managed payroll insights for you

-

Read more: Best farewell gift ideas for colleagues (thoughtful & practical)

Read more: Best farewell gift ideas for colleagues (thoughtful & practical)Best farewell gift ideas for colleagues (thoughtful & practical)

Explore creative, practical and budget‑friendly farewell gift ideas for colleagues leaving the team, with inspiration to suit every personality and…

-

Read more: Scaling a restaurant business: Why manual employee onboarding is costing you hires

Read more: Scaling a restaurant business: Why manual employee onboarding is costing you hiresScaling a restaurant business: Why manual employee onboarding is costing you hires

Contents In a high-turnover industry like hospitality, the clock starts ticking the moment a new hire walks through the door.…

-

Read more: Alberta’s expanded job-protected sick leave and what it means for employers in 2026

Read more: Alberta’s expanded job-protected sick leave and what it means for employers in 2026Alberta’s expanded job-protected sick leave and what it means for employers in 2026

Alberta has expanded job-protected leave entitlements to 27 weeks. Learn what’s changed, who is eligible and how employers should respond.