Free Payroll Software for UK businesses

Ditch the fees, not the features. Pay your people accurately and efficiently with comprehensive payroll software: 100% free.

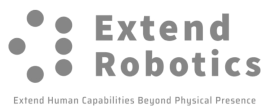

Take payroll off your plate. Run payroll in just a click, support compliance and manage important tasks in one easy workflow.

Free payroll software for UK businesses like yours

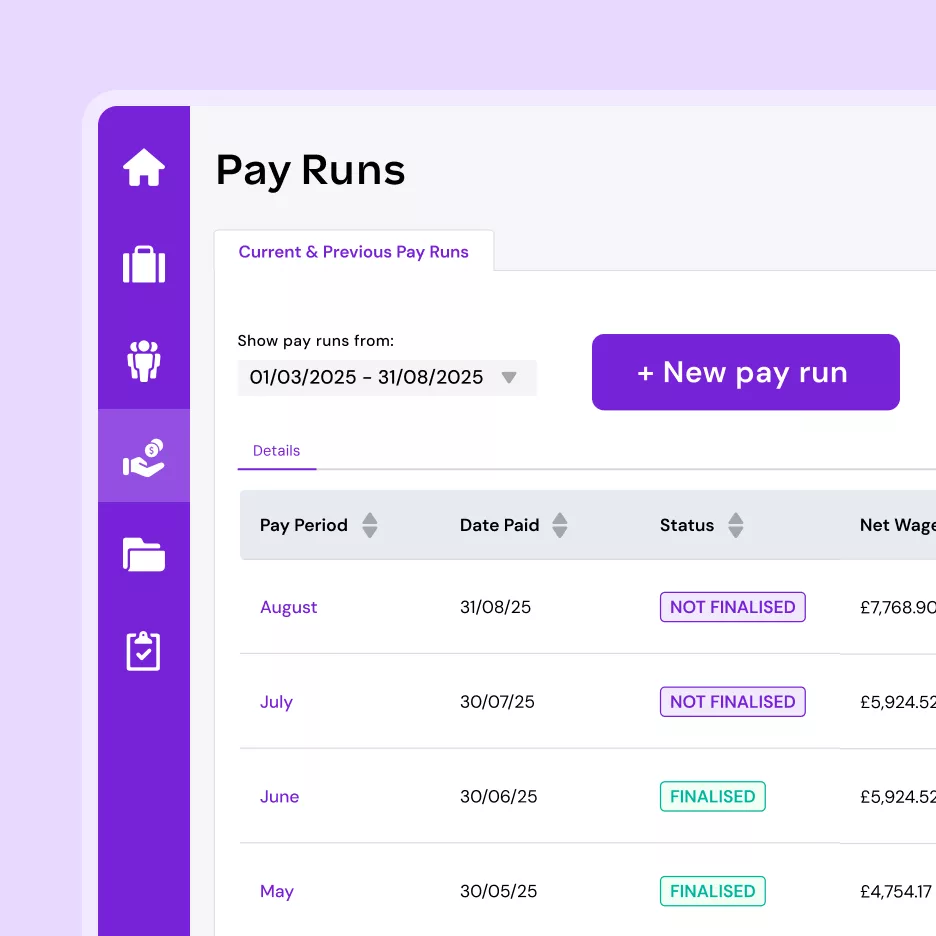

Configure your payroll process once, then sit back as smart automations run everything for you. Just review and approve.

Set and forget

Get a heads-up if something’s missing, with warning triggers and contingency pauses so nothing slips through the cracks.

Compliant. Not complex.

We’ll handle HMRC and pension submissions for you, so you’re always covered. No late-night scrambling.

Loop in your team

Payslips are sent out automatically, so your team always knows when and what they’re getting paid.

Prevent costly errors with built-in compliance guardrails and workflows:

- Auto-enrol

New hires? We’ll check eligibility and enrol them into a pension scheme automatically. - Automatic pension contributions

We calculate and submit returns, so you save time and reduce risk. - Accurate pay, every time

We handle 52-week averaging, minimum wage checks, and leave calculations. No manual work, no mistakes. - Smarter benefits

Customise your benefits and automate payrolled benefit calculations.

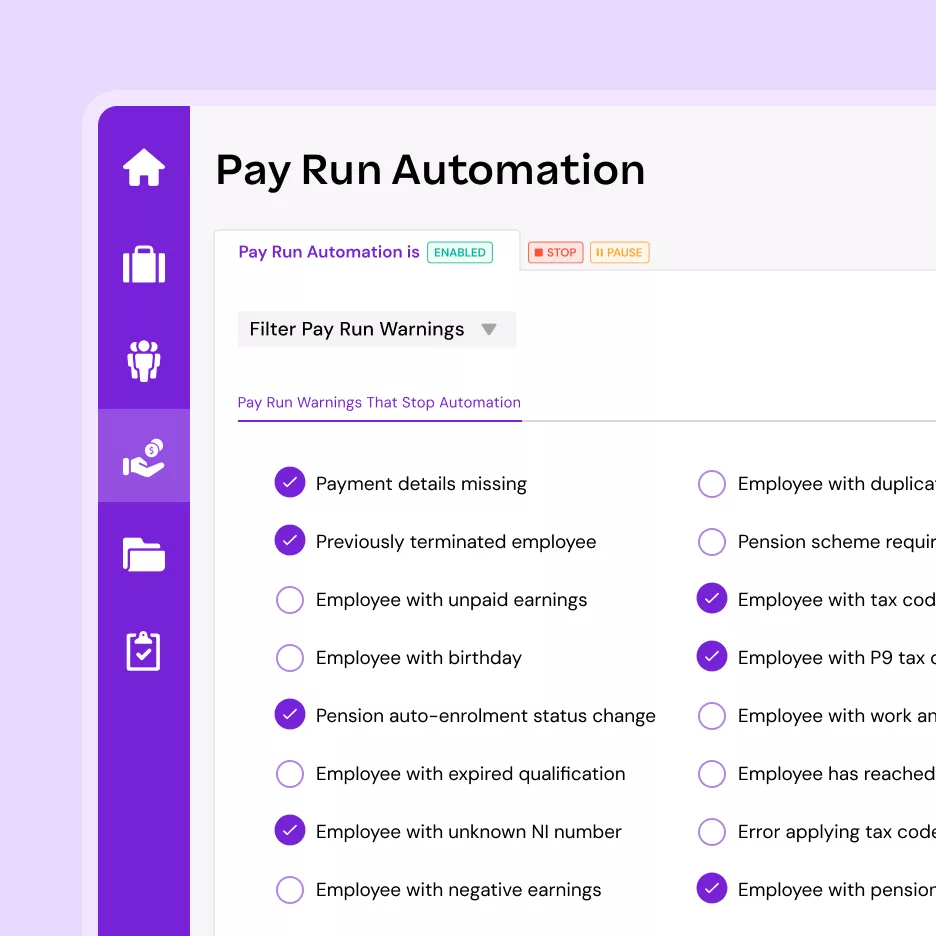

Get real-time workforce insights with intuitive reports for making smarter decisions.

- Understand profitability drivers and make the right calls with reports like gross-to-net, pay run variance and pension contributions.

- Identify discrepancies and maintain accurate employee records with reports like employee audits, unpaid employee lists, and qualification tracking.

- Navigate complex legal requirements and ensure accurate submissions with reports like FPS submissions, EPS, and P60 generation.

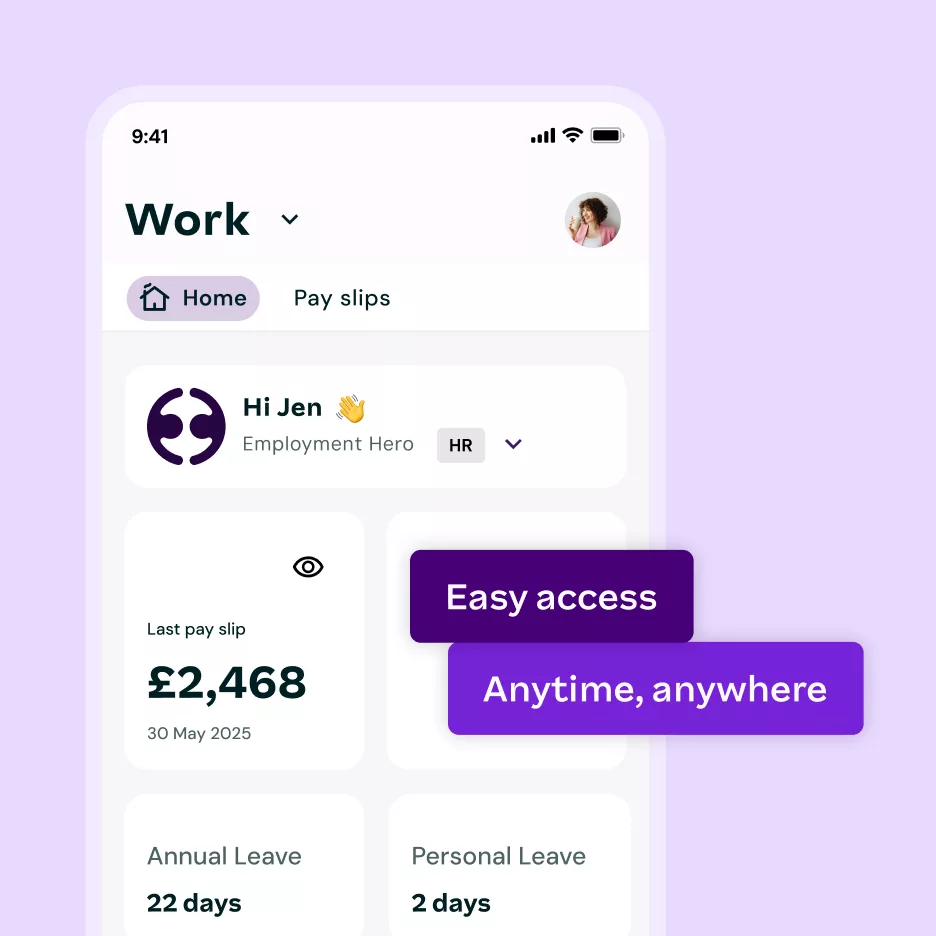

Tired of chasing up leave requests, sharing payslips and repeating the same HR policies? Let employees manage everything employment in one easy app.

- Let your team access payslips and key payroll info available anytime, from anywhere.

- Let employees manage their own details and documents with a self-serve portal.

- Built-in GDPR compliance ensures appropriate levels of access to safeguard sensitive information.

TRUSTED BY 300k+ HAPPY CUSTOMERS

Payroll made simple

Automate pay runs, ensure compliance and handle post-payroll tasks with the confidence you’re getting it right—every time.

We flex with your business.

Drive value where it matters most: automate the busy, repetitive tasks and stay hands-on where it matters most.

Powerful payroll in your corner.

Have peace of mind with a GDPR and RTI-compliant, HMRC-recognised solution that meets all UK regulations and requirements.

Payroll without the boring bits.

Put repetitive tasks like auto-enrolment, pension submissions and payslip generation on auto-pilot. Enjoy hours back in the day.

Don’t just take our word for it

Employment Hero Work rolls work admin, wages, savings, and exclusive benefits into one superapp for your employees.

Accounting and payroll integration

Connect Employment Hero’s free payroll tools with all leading UK accounting software solutions for advanced workflow automation and an even more seamless experience.

Sage Intacct

Quickbooks

Xero

Frequently Asked Questions

Everything you need to know about cutting edge hiring software

Employment Hero’s free payroll software is for UK businesses looking to manage and automate core payroll and post-payroll tasks like calculations, payslip generation and RTI submissions.

Yes, Employment Hero’s payroll software is HMRC-recognised. Payroll software that is HMRC recognised has been rigorously tested and approved by HM Revenue & Customs (HMRC). This ensures the software can accurately report PAYE information online in real-time (RTI), enabling businesses to meet their tax obligations and comply with HMRC regulations.

Yes, our free payroll solution is fully cloud based. This means that you’ll experience our continuous efforts to enhance and expand our capabilities as they go live. No need to wait for future version releases.

Employment Hero’s payroll solution is RTI-compliant, HMRC-recognised, GDPR-compliant and holds a triple ISO certification (27001, 27017, 27018). Our system is also kept up-to-date with the latest compliance and legislation requirements and changes such as National Minimum Wage and National Insurance Contribution rates to ensure automation is accurate and compliant.

No, Employment Hero’s free payroll does not have a limit when it comes to how many employees you can pay, unlike most free payroll software solutions in the market.

Employment Hero’s payroll solutions support all common pay frequencies in the UK, including weekly, fortnightly, 4-weekly, monthly, quarterly and annually.

Yes, multiple users can access the same payroll account. There are no limits on the number of users you can add to your account.

Yes, the system is designed to automatically calculate and report Tax (PAYE) and National Insurance (NI) deductions to HM Revenue & Customs (HMRC) via the Full Payment Submission (FPS) and Employer Payment Summary (EPS).

Furthermore, the software accommodates other statutory payments and deductions, including Pensions, Attachment of Earnings Orders, Salary Sacrifice Schemes, Statutory Sick Pay (SSP), and various forms of Parental Pay, such as Statutory Maternity Pay (SMP)

Yes. Switch payroll solutions easily by importing employee time worked, leave taken and other employee details from your current payroll provider or accounting software into Employment Hero.

Employment Hero’s free payroll solution offers AI-powered tools to help you find the right answer to your queries. You also have access to an extended resource library with articles and videos with step-by-step instructions. Finally, you can raise queries with our expert customer support and they’ll get back to you with the best possible answers.

It’s free. All you need to do is to fill out the signup form here and set up your account by completing all the important information that helps the system to be configured in line with how you normally pay your people.

Payroll insights for you

-

Read more: AI in HR: How to keep the human in Human Resources and payroll with AI

Read more: AI in HR: How to keep the human in Human Resources and payroll with AIAI in HR: How to keep the human in Human Resources and payroll with AI

Discover how AI can complement human efforts in HR and enable teams to focus on the bigger picture.

-

Read more: In-house payroll vs outsourcing: Which is best for SMEs?

Read more: In-house payroll vs outsourcing: Which is best for SMEs?In-house payroll vs outsourcing: Which is best for SMEs?

Using a payroll platform to bring payroll in-house can be transformational for your business.

-

Read more: 12 Critical Questions to Ask Your Payroll Provider

Read more: 12 Critical Questions to Ask Your Payroll Provider12 Critical Questions to Ask Your Payroll Provider

Make sure to ask these 12 questions before you select your payroll provider.

Run payroll, don’t let it run you.

Free payroll. Sorted.