Payslips explained: Tips to help your employees

We bet you didn’t know that 58% of employers don’t use any tools to help their employees understand their payslips. We know no one wants to be in the 58%, so here’s how you can avoid it.

We bet you didn’t know that 58% of employers don’t use any tools to help their employees understand their payslips. We know no one wants to be in the 58%, so here’s how you can avoid it.

The reality is, helping your employees understand their salary statement is really important, but payslips explained is challenging without having a solid understanding yourself. Whilst we all know what should be included on a salary statement, having a deeper understanding of what that means is a rarity.

Here we’re going to take a deep dive into UK payslips explained, to help you empower your employees to understand their pay.

UK Payslips explained: What is a payslip?

We’ve all received one, and for business owners or HR professionals, you’ve probably created a few. So we get that this sounds like a simple question, but for the sake of making sure we are all on the same page, we thought it would be wise to identify what a salary statement actually is.

Lets break it down – a payslip is a written statement that shows an employee’s earnings and deductions for a specific pay period. Although employers can opt to either provide them electronically or in print (we recommend electronically!), they must be made available to employees on or before their payday.

Why are salary statements important?

For businessesAlthough statements of earnings are given to employees, they are also important records for businesses. Here are some of the key reasons why:

- Legal compliance – By law (Employment Rights Act 1996), employers must give all their employees and workers salary statements from their first payday. Therefore, to remain compliant, all businesses must be providing written proof of earnings to all employees and workers.

- Tax reporting – Salary statements include important information that is needed for filing tax returns and ensuring accurate tax reporting.

- Dispute resolution – While all business owners hope they will never encounter a dispute, they do occasionally happen. Salary statements can help to protect your business and serve as evidence to help resolve issues.

- Financial auditing – Proof of pay serves as documentation for internal financial audits. This allows businesses to track payroll expenses and to identify any discrepancies.

For employeesEveryone loves getting paid, so there’s a certain satisfaction to receiving your salary statement. But they’re helpful for far more than just admiring your earnings!

- Proof of income and employment – When applying for loans, mortgages, or renting a property, you will often need to provide salary statements as proof of your earnings and employment.

- Tax filling – Salary statements provide the information you’ll need to complete your tax return.

- Dispute resolution – If there is a discrepancy with your pay, your salary statement can serve as evidence to support your claim.

- Checking accuracy – You can review your documents to ensure your hours worked, pay rate, and deductions are all calculated correctly.

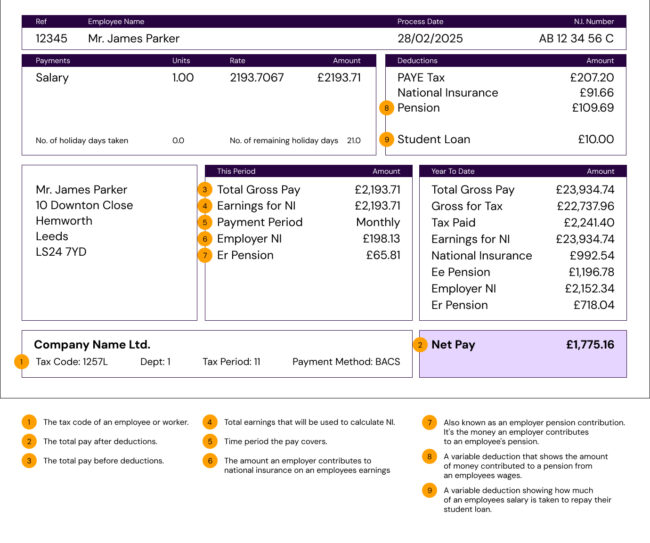

What should be on my payslip in the UK?

In order to comply with UK law, a payslip must include:

- Gross amount – this is the total pay before deductions.

- Net amount – this is the total pay after deductions.

- Variable deductions – this is where the amounts depend on the amount of pay, for example tax, National Insurance, student loan repayments and pension contributions.

- Amounts of any fixed deductions – for example trade union subscriptions.

- A breakdown of how the wages will be paid if more than one payment method is used – for example bank transfer and cash.

Although not a requirement, salary statements might also include:

- Time period the pay covers.

- Tax code of the employee or worker.

Fixed deductions can be given in a separate statement, known as a ‘standing statement of fixed deductions’. It should include:

- What the deduction is for.

- How much it is.

- How often it’s paid.

If the standing statement is separate from the main payslip, it’s only valid for 12 months. It must be reissued every year, or earlier if the fixed deductions change.

What are deductions?

If you want to help your employees understand their salary statement, you need to make sure they understand what deductions are.

Deductions are amounts withheld from an employee’s pay. They are taken out of a salary to cover taxes, benefits and garnishments. It’s important to keep in mind that deductions can be mandatory or voluntary.

Mandatory deductions include:

-

- Income Tax: Withheld from an employee’s paycheck to fund the UK’s infrastructure, social care, and healthcare. It’s calculated based on an employee’s annual earnings and is deducted through Pay As You Earn (PAYE). The amount of tax deducted depends on how much employees earn annually.

- National Insurance: Also deducted directly from an employee’s salary. Employers make separate payments based on the wages of their staff. Similar to income tax it also helps to support state services, like NHS and unemployment benefits.

- Pension Contributions: A statutory deduction taken directly from an employee’s salary and placed into their company pension scheme. Employers are legally required to automatically enrol all eligible employees into a workplace pension, helping them to save for their retirement. Contribution rates vary based on the employee’s contract and employment status, but there are statutory minimum rates set out by the UK government.

- Student Loans: Only applicable if an individual has borrowed from the government to pursue higher education and whose earnings exceed a certain threshold.

Voluntary deductions cover:

- Pension Plans: Employees may wish to contribute more to their pension via salary sacrifice schemes. This means a portion of an employee’s earnings are exchanged for pension contributions. This is a perk offered by some employees through private pension providers.

- Health Insurance: Some employers may wish to offer health insurance for their employees, which gives them access to private medical care. To cover the cost of the employee’s membership in these health insurance schemes, a payroll deduction is taken from their salary.

- Employee Benefits: Employers can opt to offer additional benefits in order to improve employee satisfaction. Benefits such as gym memberships, cycle to work schemes and childcare vouchers are included. The cost of these benefits is then covered by salary deductions from their salary statement.

What is the difference between gross and net pay?

As an employee, the element on a salary statement you’re likely to be most interested in is how much you’ve been paid. But as you will have noticed, there are two areas that outline pay amount, gross and net pay.

So what’s the difference?

Gross pay

Gross pay is that total amount an employee earns before any deductions are taken out. Gross pay includes salary, bonuses and overtime.

Net Pay

Net pay is the amount of money an employee receives after deductions have been taken out of their gross pay. Net pay is also often known as take-home pay.

How to help employees understand payslips

Improve clarity around payroll

One of the main challenges with payroll is a lack of clarity and understanding. And this is exactly why payslips explained UK is so important.

Employees often don’t know how their pay is calculated, or how other elements (like pensions) are documented. This can cause issues for small business owners or HR professionals, as they may get recurring questions from employees asking for elements of their payslips explained.

The best way to reduce questions about what is included on a salary statement, where information is documented, or how to read one is by being transparent. This could be achieved through adding further detail on salary statements and expanding fields to include future itemisation.

Customise payslips

A standard payslip layout may not contain enough for employees and workers to get the full picture of what they are being paid for, or what deductions have been taken. By adjusting salary statements to include more detail, HR teams running payroll, and business owners, are likely to get less queries. Instead of just using one template, HR managers of business owners should compare different layouts and details to establish what else should be included. To get further insights on what employees would value, consider conducting a survey about payslips explained and base a new template off of these findings.

Use payroll software

Arguably the most significant change in payroll over recent years is digitalisation. The ability to provide these documents via email or an online platform has benefits for both employers and employees. Payroll software enables HR teams to be flexible and update templates based on employee queries.For employees, a platform that can be accessed at any time allows for a “self-service” approach. Having the ability to easily view current and previous salary statements assists with payslips explained UK and is likely to reduce confusion and give power back to your team regarding their pay.

Understanding tax codes

Another aspect of a salary statement that both employers and employees should be aware of are tax codes. But what are they?At their core, tax codes are numbers that are issued by HMRC to everyone who is employed through PAYE in the UK. Their purpose is to ensure that employees are paying the right amount of tax for their salary. It’s important to note, though, that it’s up to individuals to check that they are on the correct tax code. Luckily, finding your tax code is pretty simple, and there are several places you can look for it:

- On a ‘Tax Code Notice’ letter from HMRC

- On a salary statement

- On the HMRC app

Breaking down tax codes

Looking at a tax code can be really confusing, and without taking a deep dive, most people don’t understand what the numbers and letters in the code mean. So as part of our mission to simplify employment, we thought we should break it down.

What do the numbers in a tax code mean?

The numbers shown in a tax code tell an employer how much tax-free pay an individual is allowed. The last digit of your tax free pay is removed to create the code (so a £12,570 personal allowance becomes the digits 1257 in the code).

As an example, if your code number is 1257, you are entitled to tax-free pay of £12,570. This means if an individual earns £1,047 or less per month (£12,570 divided by 12 months), you will not need to pay any income tax. Any earnings above this amount will be taxed at the correct rate for their salary.

As an employer, you are responsible for working out how much tax is due and taking it from an employee’s pay. The tax is paid over to HMRC.

What the letters in a tax code mean

The second part of a tax code is a letter. Take a look at the list below to understand what the letters on a tax code stand for.

- L – Standard tax free personal allowance, under 65.

- M – Marriage allowance where you’ve received 10% of your partner’s personal allowance.

- N – Marriage allowance where you’ve transferred 10% of your personal allowance to your partner.

- T – Tax code includes other calculations to work out pension.

- 0T – Personal allowance has been used up, you’ve started a new job or your employer doesn’t have details required to issue a tax code.

- BR – Income from this job or pension is taxed at basic rate (applicable if you have more than one job or pension).

- D0 – Income from this job or pension is taxed at a higher rate (applicable if you have more than one job or pension).

- D1 – Income from this job or pension is taxed at an additional rate (applicable if you have more than one job or pension).

- NT – No tax payable on this income.

- S – Income taxed using Scotland rates.

- S0T – Personal allowance (in Scotland) has been used up, you’ve started a new job or employer doesn’t have details required to issue a tax code.

- SBR – Taxed at basic rate in Scotland.

- SD0 – Taxed at intermediate rate in Scotland.

- SD1 – Taxed at a higher rate in Scotland.

- SD2 – Taxed at top rate in Scotland.

- C – Income or pension taxed at Wales rates.

- C0T – Personal allowance (in Wales) has been used up, you’ve started a new job or employer doesn’t have details required to issue a tax code.

- CBR – Taxed at basic rate in Wales.

- CD0 – Taxed at higher rate in Wales.

- CD1 – Taxed at additional rate in Wales.

What should employers know about tax codes?

Whenever a new employee joins your company, there is plenty of admin to get through, and working out a tax code is usually part of this. Most of the time, assigning a tax code is straightforward, and you can work it out by looking at a P45.

It’s also important to remember to update employees’ tax codes at the start of a new tax year. If a tax code changes during the year, HMRC will email you with a reminder to update payroll records.

Worried about deducting the right amount of tax based on your employees tax codes? Not on our watch. Take the stress out of tax deductions by putting your employees tax codes into your payroll software, and let the software work out how much needs to be deducted throughout the year.

Common payslip queries

How do I read my UK payslip?

To read a salary statement, pay attention to details such as gross pay, net pay, your tax code and deductions. This information will give you an understanding of what you have earned throughout your pay period as well as where any deductions are going. If you have questions about particular items on your, or need your payslip explained, contact your HR department.

What is the law on payslips UK?

According to the Employment Rights Act 1996, employers must provide all of their employees and workers with payslips from their first payday. Workers can include agency workers, and people on flexible hour contracts.

Should holiday pay be shown on a salary statement?

Yes, holiday pay should be outlined on a salary statement, and our experts recommend it is noted down as a separate line item.

What is the PAYE in the UK salary slip?

PAYE stands for Pay As You Earn. Most employees in the UK pay Income Tax through PAYE. It’s the system an employer or pension provider uses to take Income Tax and National Insurance contributions before wages or pension are paid.

Tax codes determine how much should be deducted.

Improve your payroll with Employment Hero

Running payroll, sending salary statements and making sure your business is compliant with UK law is a lot of work. And who has time for all that? As a small business owner or HR professional, we know you don’t.

This is where Employment Hero can help you out. Employment Hero is the world’s first Employment Operating System (OS) that helps to launch businesses on the path to success by powering more productivity every day.

We offer everything your business needs, from finding and hiring top talent using SmartMatch to seamlessly onboarding new hires, automating complex payroll, and driving employee engagement and morale – all backed by UK-based expert support.

Supporting over 25,000 UK businesses, why not see how we can supercharge your business? Book a demo today to learn more.

One system. Everything Employment.

Related Resources

-

Read more: Yorkshire businesses show local loyalty as Employment Hero back region with Leeds United partnership

Read more: Yorkshire businesses show local loyalty as Employment Hero back region with Leeds United partnershipYorkshire businesses show local loyalty as Employment Hero back region with Leeds United partnership

5 March 2026 – New data from Employment Hero reveals strong regional confidence across Yorkshire & the Humber amid rising…

-

Read more: Payroll reporting metrics every payroll professional should track

Read more: Payroll reporting metrics every payroll professional should trackPayroll reporting metrics every payroll professional should track

Stop reactive firefighting in 2026. Discover the 9 essential payroll metrics and KPIs UK businesses need to track to improve…

-

Read more: Zero Hour Contracts in 2026: What Employers Need to Know About New Restrictions and Worker Rights

Read more: Zero Hour Contracts in 2026: What Employers Need to Know About New Restrictions and Worker RightsZero Hour Contracts in 2026: What Employers Need to Know About New Restrictions and Worker Rights

The Employment Rights Act 2025 is changing zero hour contracts. Read our 2026 guide for UK employers on guaranteed hours,…