Important Dates for NZ Businesses in 2025 [Free Calendar Download]

Published

Important Dates for NZ Businesses in 2025 [Free Calendar Download]

1 min read

From public holidays to tax deadlines and more, throughout the year there are several key dates business owners need to be across. That’s why we’ve created the Important dates calendar for 2025, ideal for popping up in the office for easy planning whenever you need a refresher.

Download the calendar today and keep across the key business dates and deadlines for 2025.

What is included in this free business calendar?

There are several public holidays in 2025, including the easily overlooked regional anniversaries. There’s also several tax dates and deadlines to remember.

Here’s the full list of this year’s public holidays marked on our calendar:

National public holidays

- New Year’s Day

- Day after New Year’s Day

- Waitangi Day

- Good Friday

- Easter Monday

- Anzac Day

- King’s Birthday

- Matariki

- Labour Day

- Christmas Day

- Boxing Day

Regional public holidays

- Wellington Anniversary Day

- Auckland Anniversary Day

- Nelson Anniversary Day

- Northland Anniversary Day

- Taranaki Anniversary Day

- Otago Anniversary Day

- Southland Anniversary Day

- South Canterbury Anniversary Day

- Hawke’s Bay Anniversary Day

- Marlborough Anniversary Day

- Canterbury Anniversary Day

- Chatham Islands Anniversary Day

- Westland Anniversary Day

Why are public holidays important for small business owners?

Public holidays come with their own employment requirements around pay and time worked. There are a few conditions that have to be adhered to by employers to ensure compliance with the Ministry of Business, Innovation and Employment (MBIE):

- Employees get a paid day off on public holidays if it’s an otherwise working day

- Each employee is entitled to a maximum of 12 public holidays a year

- If the employee has to work on a public holiday, it should be on a day when they would have otherwise worked, and it should be stated in their employment agreement

- Any employee working a public holiday should be paid time and a half, and should get an alternative day off

For employers, following these conditions will mean that pay may have to be adjusted, as well as leave records for each pay period. If you’re concerned about whether your current processes around public holidays are compliant, make sure to contact a legal advisor for advice.

Aside form public holiday’s, there’s several key dates and deadlines business owners should be aware of when it comes to taxes. We’ve covered all you’ll need to know in the calendar.

Keep your business on track with our HR and payroll software

There’s an easy way to manage employment when it comes to public holidays and key tax deadlines. Employment Hero already has all New Zealand public holidays built into its HR and payroll platform, so any leave requests and pay runs automatically factor in what’s required for legal compliance.

Using the software can be a huge asset to your business and your HR processes, helping you save time, supporting your compliance and providing peace of mind.

Disclaimer: The information in this calendar and its associated article is current as at 28 January 2025 and has been prepared by Employment Hero Pty Ltd (ABN 11 160 047 709) and its related bodies corporate (Employment Hero). The views expressed in this calendar are general information only, are provided in good faith to assist employers and their employees, and should not be relied on as professional advice. The Information is based on data supplied by third parties. While such data is believed to be accurate, it has not been independently verified and no warranties are given that it is complete, accurate, up to date or fit for the purpose for which it is required. Employment Hero does not accept responsibility for any inaccuracy in such data and is not liable for any loss or damages arising either directly or indirectly as a result of reliance on, use of or inability to use any information provided in this calendar. You should undertake your own research and to seek professional advice before making any decisions or relying on the information in this calendar

Find out how Employment Hero can support your business in 2025 – reach out to our team today.

Register for the calendar

Related Resources

-

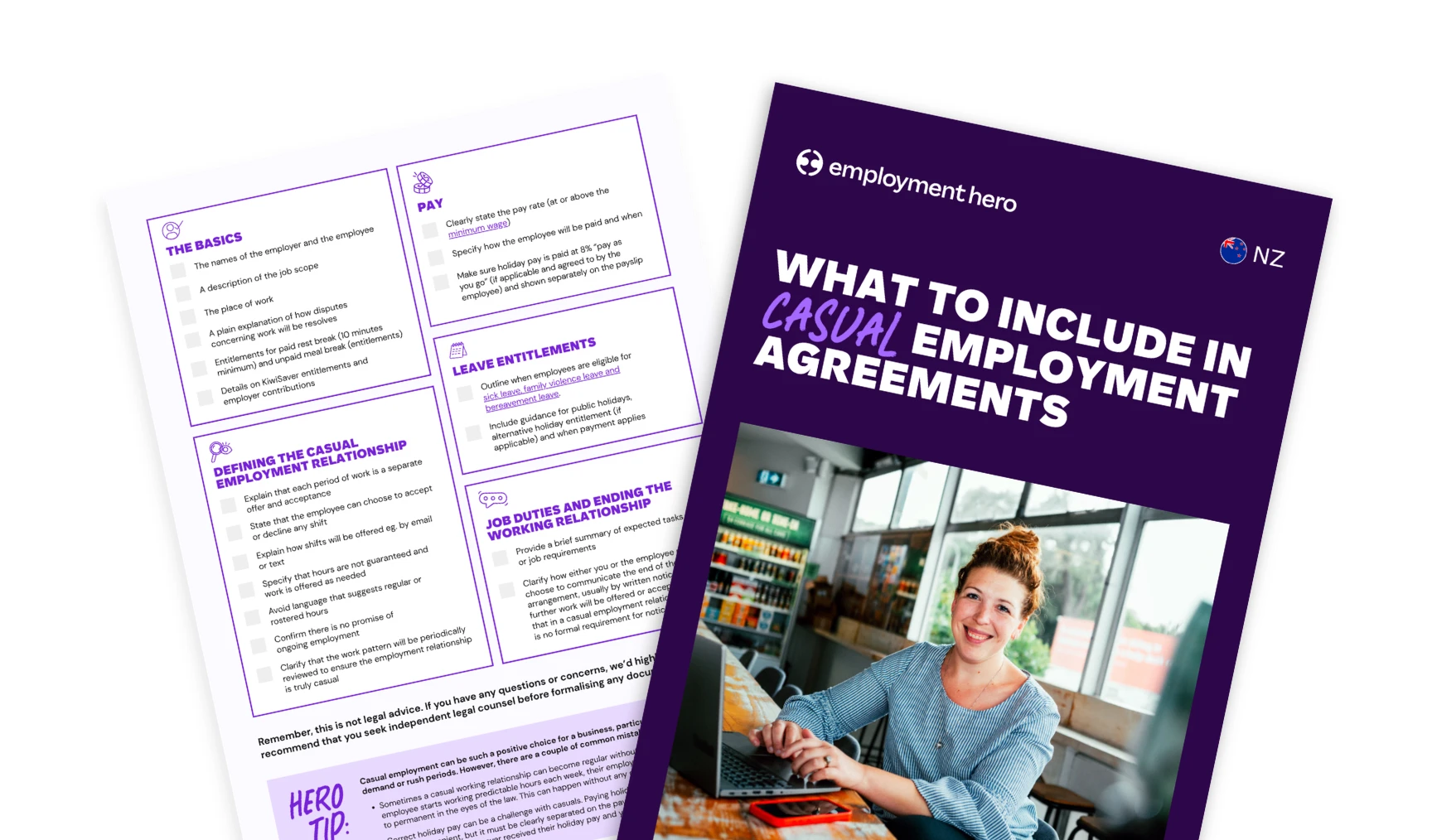

Read more: What to include in casual employment agreements

Read more: What to include in casual employment agreementsWhat to include in casual employment agreements

Use our NZ casual contract checklist to vet your current employment agreements. Free, practical and designed for HR teams and…

-

Read more: Payroll budgeting guide for New Zealand employers

Read more: Payroll budgeting guide for New Zealand employersPayroll budgeting guide for New Zealand employers

Learn how to create a payroll budget with our clear NZ guide. Explore techniques, and tips to plan with confidence.…

-

Read more: Guide: How to run an effective End of Financial Year review

Read more: Guide: How to run an effective End of Financial Year reviewGuide: How to run an effective End of Financial Year review

Get ready for the end of financial year with this guide to running an effective EOFY review.