Payroll software for NZ businesses

Employment Hero’s AI Employment Operating System automates, orchestrates, and runs payroll for you – freeing your team from repetitive admin and compliance uncertainty. Not just payroll software. A payroll system of action that helps you get pay runs done accurately and on time, every time.

Payroll that just works, without the busywork

Instead of managing data across disconnected systems, Employment OS takes action for you – built specifically for the complexities of New Zealand employment law. We automate Holidays Act calculations (including AWE/RDP), manage KiwiSaver contributions, and as an IRD-recognised intermediary, we handle your Payday Filing for you.

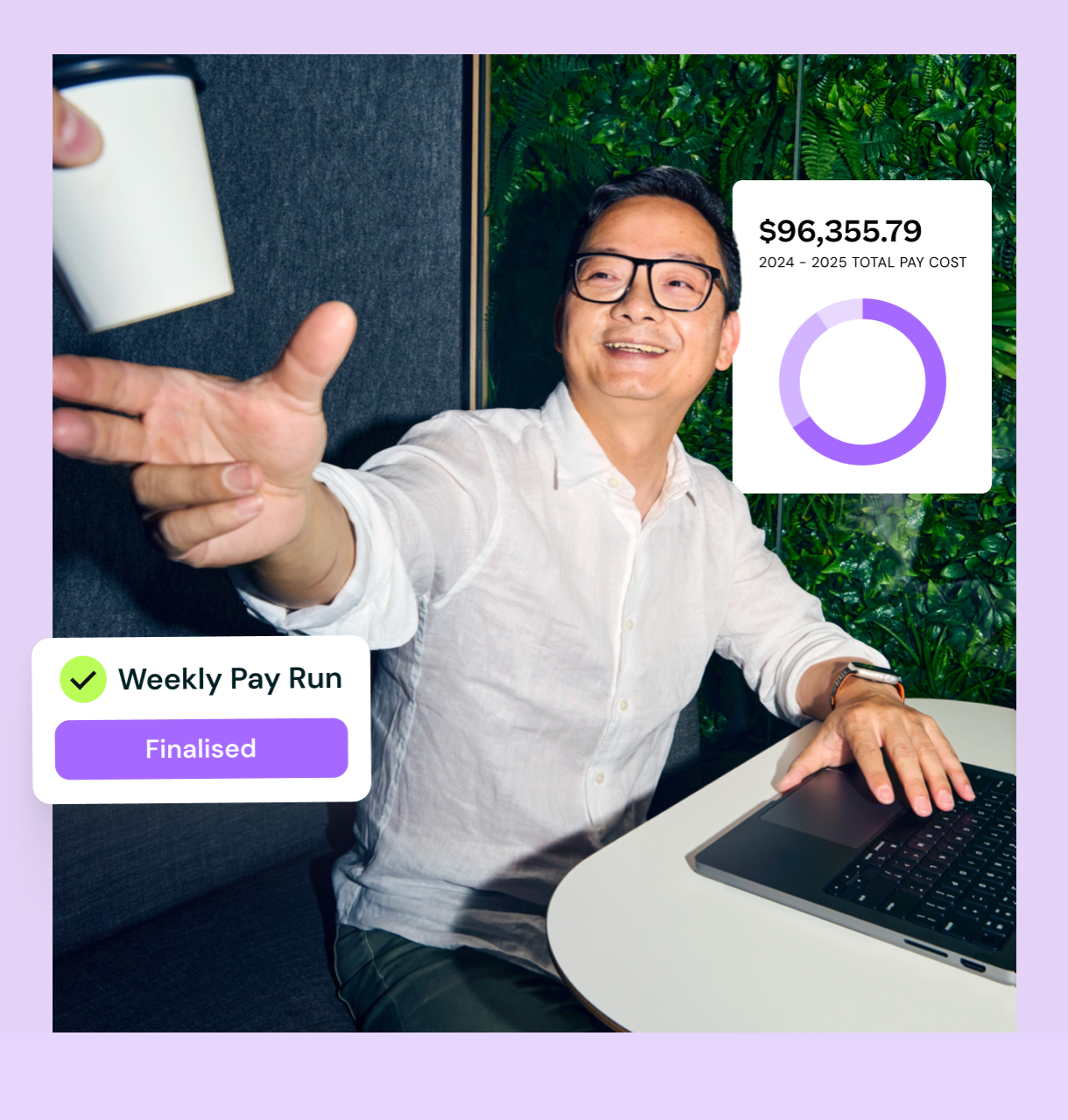

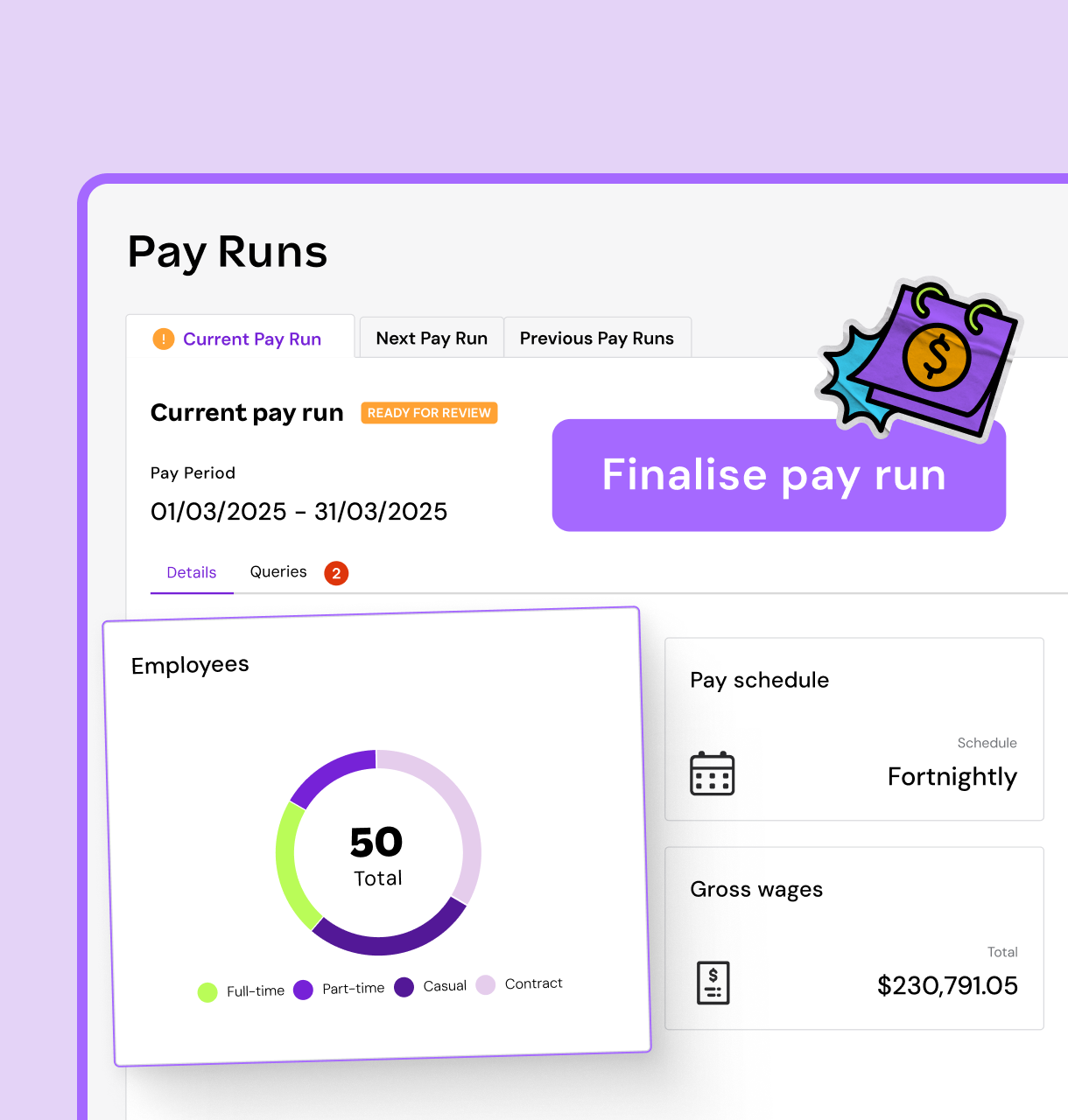

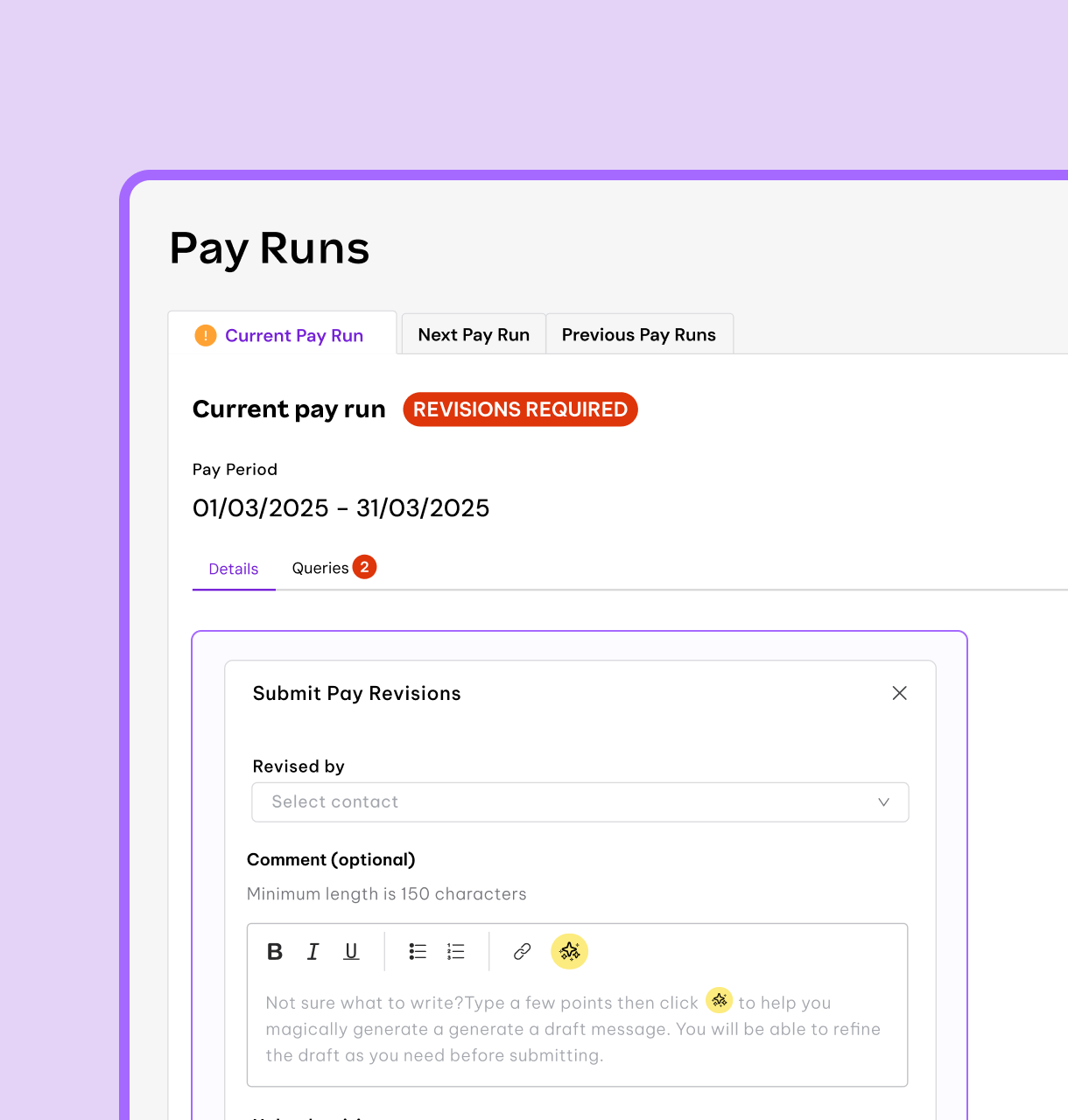

Smarter pay runs with automated payroll

AI-assisted workflows pull in the right data, calculate earnings and deductions, and help you finalise pay runs with confidence — with far fewer clicks and errors than traditional systems.

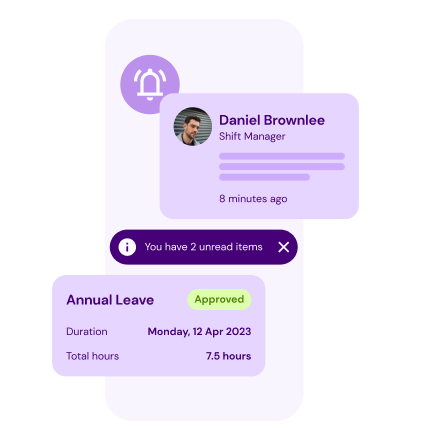

Cut down your admin with employee self-service

Empower your team and win back your time. Through the Employment Hero Work app, employees can securely access their own payslips, manage leave, and submit timesheets from their phone. That means fewer emails in your inbox and more time in your day.

Go beyond payroll with one seamless platform

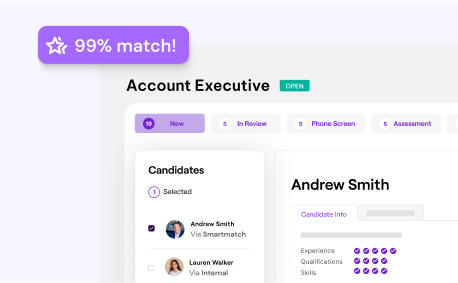

Why juggle multiple systems? Unlike standalone tools, our payroll is fully integrated with our all-in-one Employment Hero OS across hiring, payroll, HR management, and employee experience.

Connect leave management, timesheets, employee data and onboarding in a single source of truth, and say goodbye to double-handling for good.

TRUSTED BY 300k+ HAPPY CUSTOMERS

Payroll that just works without the busywork.

Rather than a static interface for data entry, Employment OS continuously coordinates the work that payroll requires.

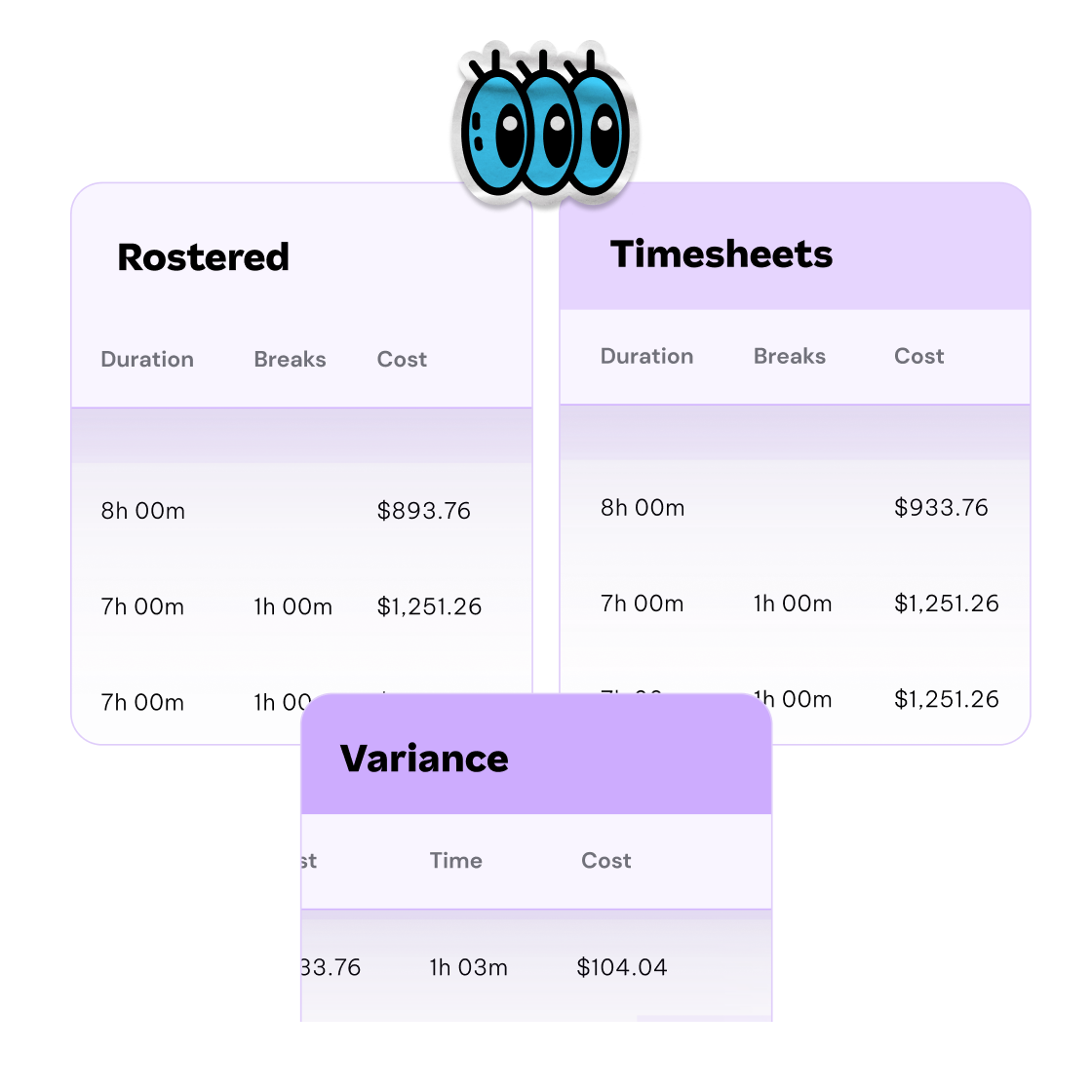

Automated timesheets & rostering

Say goodbye to manual timesheets and data entry errors. Our payroll software automatically syncs your employee time and attendance with payroll to calculate pay accurately. It effortlessly handles different pay rates, allowances, and overtime for your full-time, part-time, and casual workers across New Zealand.

End-to-end leave management

Remove the administrative burden of managing leave. Our fully integrated leave management software is designed for the complexities of the Holidays Act. Employees can apply for leave via their self-service portal, and the system automatically calculates and updates leave balances correctly.

Effortless onboarding & offboarding

Our platform streamlines the entire employee journey. Simplify new employee onboarding by automatically capturing their payroll details, tax information, and KiwiSaver status. When an employee leaves, we ensure all final payments and documentation are handled correctly.

Total compliance, backed by Kiwi payroll experts

Master the Holidays Act

Stop worrying about complex leave calculations. Our payroll software includes built-in tools that automatically calculate entitlements like Relevant Daily Pay (RDP) and Average Weekly Earnings (AWE). Our system stays up-to-date with legislative changes, so your payroll is always fair and compliant.

Automated Payday Filing with IRD

Our platform is an IRD-recognised software that automatically handles all aspects of Payday Filing. This ensures your business meets its legislative requirements without the hassle of manual data transfers to Inland Revenue.

Local expert support & managed payroll

Get dedicated support from a local team that truly understands New Zealand small business. If you need a more hands-off approach, our team of payroll experts is here to help. Our Managed Payroll Services can handle your entire payroll process, from start to finish, giving you complete peace of mind.

Secure, smart & accessible payroll

Actionable financial insights

Don’t run your business in the dark. Our payroll software goes beyond simple reporting to give you valuable financial insights. You can easily access reports on pay run variances, budgets, and salary distribution to drive better, data-backed decisions.

Your payroll data is always safe

Your employees’ sensitive data is our top priority. Our platform is built with security at its core, with all data encrypted and stored on secure cloud servers. We have access controls, password protection, and disaster recovery plans to ensure your data is always safe.

The Employment Hero Work App

Empower your team and reduce administrative work with our mobile app – Employment Hero Work. Your employees can access their payslips, manage personal details, and apply for leave directly from their phones. It’s a central hub for all their employment needs, giving your team control and convenience.

Don’t just take it from us…

Future-Ready Payroll

Employment Hero isn’t just a tool; it’s the intelligent, all-in-one platform built for modern Kiwi businesses. You’ve seen how our seamless integration, smart automation, and uncompromising compliance take the stress out of payroll. We give you back time, protect your business from errors, and provide a partner who truly understands your needs. It’s time to find a smarter way to manage payroll.

Payroll in one smart system

Our powerful payroll is built into an all-in-one Employment Operating System, combining HR management, employee experience, and hiring in a single platform.

Less admin, more time

Our platform includes a mobile app where employees can access payslips and apply for leave, reducing your admin burden.

Compliant, not complex

We keep you compliant with New Zealand laws and automatically update for complex pay rates and Holidays Act requirements.

Support when you need it

We give you local support and a team that truly gets small business, so you have real people to help when you need them.

Smart payroll integrations

Connect Employment Hero Payroll directly with leading accounting software in New Zealand like Xero, MYOB and Netsuite. Your payroll journal data flows seamlessly to your general ledger after each pay run, eliminating the need for manual exports and ensuring complete accuracy.

Payroll software FAQs

Payroll software helps New Zealand businesses run pay cycles with confidence. It automates tasks like wage calculations, PAYE deductions, KiwiSaver contributions, IRD payday filing, and leave management – so you can stay compliant and focus on growing your team.

In New Zealand, payroll compliance means getting the details right, every time. Great payroll software will:

- Automatically handle PAYE and submit payday filing to the IRD

- Track and manage KiwiSaver contributions accurately

- Apply Holidays Act entitlements and leave calculations (including Average Weekly and Relevant Daily Pay)

- Keep secure records ready for audits or reporting.

Kiwi payroll rules can be complex, and spreadsheets leave room for error. Payroll software automates calculations, files directly with IRD, and ensures you’re always using the latest compliance rules. That means less time on admin, and fewer compliance headaches.

You’ve got options. You can use payroll software directly to manage payroll in-house and file straight with IRD, or choose a PAYE intermediary, like Employment Hero’s Managed Payroll service, to take care of it all on your behalf.

Here’s what matters most:

- Direct IRD integration for seamless payday filing

- Built-in KiwiSaver and tax compliance

- Leave management that aligns with the Holidays Act

- Employee self-service including on mobile, and secure cloud storage

- Local support, plus payroll integrations with your HR and accounting tools.

Definitely. Employment Hero payroll integrates with popular accounting platforms like Xero and MYOB, as well as rostering and HR tools – keeping everything in sync, from hours worked to final pays.

We believe in simple, transparent pricing with no surprises. Our plans are billed on a straightforward per-employee, per-month basis, so you only pay for what you need as your team grows. Because our payroll is part of an all-in-one platform, many of our plans also include our powerful HR software, giving you much more value than a standalone payroll tool. You can see a full breakdown on our pricing page.

Employment OS doesn’t just store payroll data — it runs pay cycles for you. Intelligent automation coordinates your employee data, calculates entitlements and helps guide your team through compliance checks and pay runs.

Security and privacy are core to the platform. We use enterprise-grade encryption, role-based access and compliance protocols to protect your payroll data.

Payroll tools, tips, templates.

-

Read more: How will AI change the payroll industry?

Read more: How will AI change the payroll industry?How will AI change the payroll industry?

Learn how AI is being used in payroll – and how you can make the most of it in your…

-

Read more: Payroll guide: The basics of payroll in New Zealand

Read more: Payroll guide: The basics of payroll in New ZealandPayroll guide: The basics of payroll in New Zealand

How can you ensure that you are running payroll correctly? Get the basics in our guide.

-

Read more: Template: Building a business case for payroll software

Read more: Template: Building a business case for payroll softwareTemplate: Building a business case for payroll software

If payroll is a monthly HR headache at your organisation, it’s time to consider new payroll software

The real MVPs?

The payroll heroes.

Power them with the only payroll built into an end to end Employment Operating System.