How to save time on payroll through automated bulk bank payments

Tired of time-consuming and tedious payroll tasks? Discover how automated bank payments can save you valuable time and bring ease to your pay runs.

We know running payroll isn’t always easy at the best of times, but it can get particularly challenging when you’re juggling multiple bank accounts and payments. Every month can arrive in a swirl of bank files and time-consuming admin, just to complete some basic tasks.

Luckily, today’s technology can handle that work for you. Savvy payrollers and administrators are automating all the necessary bank payments involved in pay runs, and reaping the benefits as a result.

Why should busy payrollers automate bulk bank payments?

Automation is all about making work that little bit easier and in this case, it can make payroll much easier too. Here’s why automating bulk bank payments could make a huge difference for you and your organisation.

Admin time is significantly reduced when processing payroll

There’s no getting around it – there’s always a fair bit of work involved in payroll processing. However, automating bulk bank payments can reduce time spent organising bank files, setting up account payments or liaising with providers. When the bank and your payroll software are linked up together, there’s no need to do all those middleman tasks to make them work together. That’s a lot of time you’ll get back.

There’s no double-handling of data

Reduce the risk of human error by letting your different tools communicate with each other directly. There’s no need to manually enter all the key data across different software or bank accounts, or to make manual calculations for those final payments. Technology does all that admin for you, which means less risk of miscalculations or typos in the process.

Your data security will improve

We know just how important data security is these days, with the potential risk of hackers and phishing attacks always on the horizon. By storing confidential bank information on cloud-based software, any critical data will be kept safe, protected by a number of verified security measures that are in turn managed by professionals. It’s much more secure than storing information on paper or on staff desktops.

Introducing open finance

If you’re looking to automate bulk payments for payroll, using an open finance provider is the best way to achieve your goal. Open finance is a way to seamlessly share crucial information from banks and other financial institutions with software applications. Most importantly in our digital age, it’s designed to be secure as well.

On a practical level, there’s a good chance that as a business owner or payroll professional, you’ve encountered open finance before. For example, if you have used accounting software like Xero, you’ve probably linked your bank account with the software. That bridge of information is powered by open finance companies.

How can open finance help with payroll and bank payments?

Open finance providers like Akahu have utilised API capabilities to build an automated payments solution – providing ongoing connectivity to initiate payments from a connected bank account.

Those automated payments can come in handy when it comes to a business’s payroll and making payments. If you want to pay employees fast and without any admin, then open finance is going to make things much, much easier for you by providing another option to make payments.

The same goes if you’re a payroll professional who is managing a lot of clients – imagine if you could automate a lot of your client’s payments in a way that is secure and quick.

That’s why Employment Hero Payroll has partnered with Akahu, offering a new integration that is going to change the game for busy payroll professionals, business owners and administrators. It’s a match made in payroll heaven.

What are the benefits that come from automating payments through Akahu and Employment Hero Payroll?

It’s easy to see the benefits of automating bulk bank payments, but not all open finance providers are made equally. Employment Hero Payroll’s integration with Akahu comes with some additional features that won’t just offer you the automated payments we’ve already mentioned, but will transform a host of other payroll processes in the meantime…

Bank files can be set automatically

There’s no need to manually upload bank files individually for each payment. With this integration, all those files can be done in bulk and set automatically. Whether you’re an employer or a payroll professional running payroll for clients, this is a massive time saver.

IRD payments are automated as well

Pay runs aren’t just about getting the employee’s wage packet in their account, it’s also about filing the correct contributions and deductions for IRD. Employment Hero Payroll and Akahu can completely automate all IRD payments, making it effortless to get all those crucial payments done in one go.

Everything is managed in one platform

With all payments managed in one platform, you won’t have to constantly log out and log in to different apps. Instead, you can organise everything from a single central location, making payments super easy and secure.

There’s no need for multiple integrations

Akahu is a super flexible platform that can facilitate connections to all major New Zealand banks, including ANZ, ASB, Westpac, BNZ, Kiwibank, TSB and Heartland. For most users, this means that your bank accounts are already covered without setting up any further manual integrations with different banks.

Use different accounts for different payments

We know how tricky it can be to manage cash flow. With Akahu, you can use different bank accounts for different pay schedules, and set them all up to run independently. Also, if a payment fails from one account you can easily retry with another in just a few clicks.

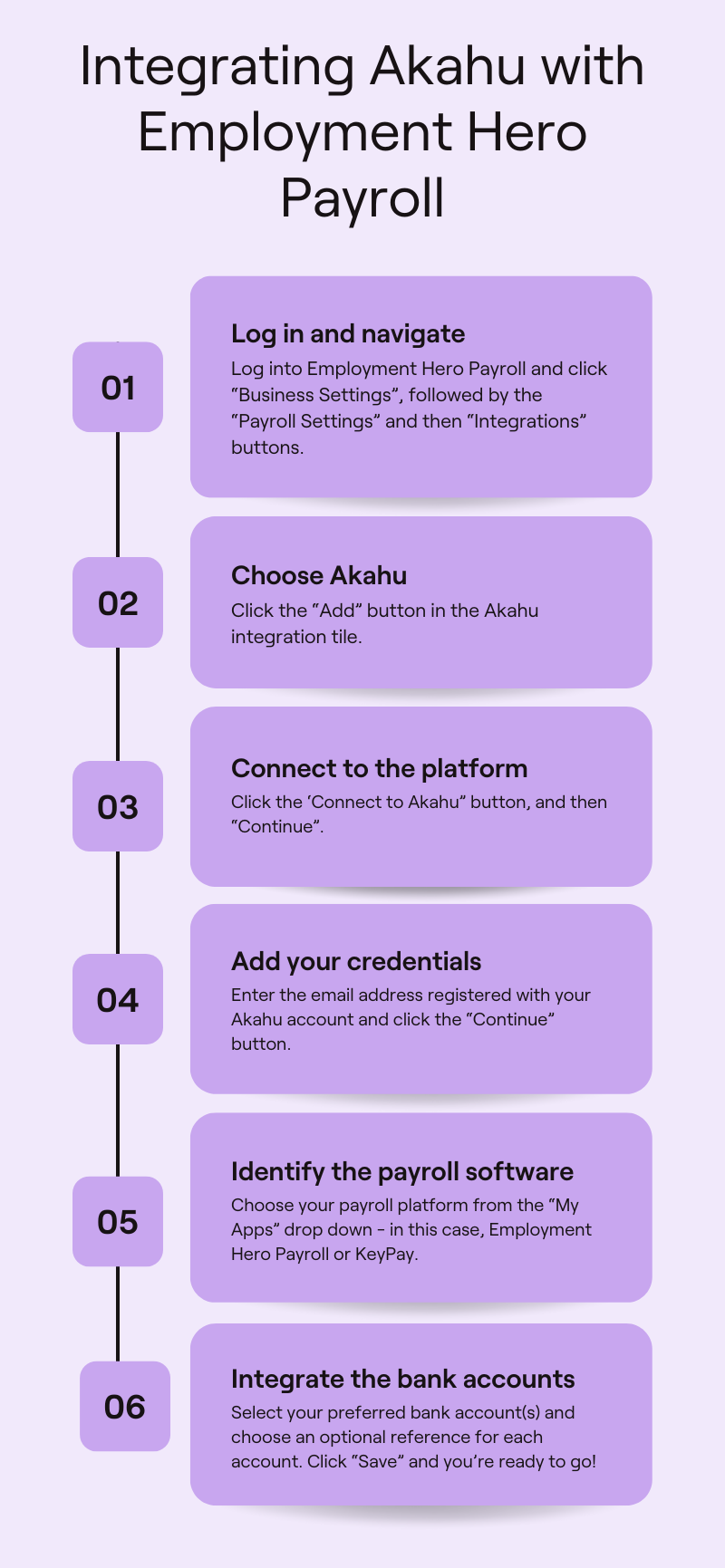

How to set up Akahu in Employment Hero Payroll

If you’re new to Employment Hero Payroll, reach out to our team today to find out why the platform (and this integration) could be your next best move.

If you’re already with us as an Employment Hero Payroll user in New Zealand, and on the Standard or Premium plan, you will have access to this integration with an additional monthly charge of just $5 NZD per month. The platform will notify you of this fee as you set up the integration. This fee is regardless of the amount of employees or pay schedules/payment files sent per month.

Once that’s organised, integrating the two platforms is super easy. Check out our infographic on the left for a step-by-step breakdown, or visit our support pages for either employers or payroll professionals for help.

Related Resources

-

Read more: Employment Hero Named Among Best Australian & New Zealand Companies by G2

Read more: Employment Hero Named Among Best Australian & New Zealand Companies by G2Employment Hero Named Among Best Australian & New Zealand Companies by G2

Ranked #6 on G2’s 2026 Best Software Awards, officially a Top 10 software company in ANZ

-

Read more: Employment Hero Named Among Best Australian & New Zealand Companies By G2

Read more: Employment Hero Named Among Best Australian & New Zealand Companies By G2Employment Hero Named Among Best Australian & New Zealand Companies By G2

Employment Hero has been ranked #6 on G2’s 2026 list of the Best Australian and New Zealand Companies.

-

Read more: Product Update: January 2026

Read more: Product Update: January 2026Product Update: January 2026

Welcome to the January 2026 product update from the Employment Hero team. We’ve got lots to share around Custom Forms,…