End of Financial Year HR and Payroll Checklist NZ [2026]

Published

End of Financial Year HR and Payroll Checklist NZ [2026]

Last Updated

For HR and payroll professionals, the end of the financial year (EOFY) can be a hectic time. Whether it’s balancing the books, taking stock of your employee data or running crucial reports, there’s always plenty to do before the end of March.

If you’re the type that enjoys ticking off a to-do list, we’ve got something to make your busy period more rewarding. Our EOFY HR and payroll checklists for 2026 lists all the tasks you’ll need to complete in one handy place, plus some useful FAQs.

Our checklists also include:

- Key Inland Revenue (IRD) submission dates for 2026

- Tasks to finalise payroll

- Data checks to complete

- Culture and goals review

- HR policies checks

- Workforce planning

- Key Inland Revenue (IRD) submission dates for 2026

- EOFY FAQs

When is the 2026 EOFY in New Zealand?

For most businesses in New Zealand, the end of the financial year is 31 March 2026; the 2025-2026 financial year being 1 April 2025 to 31 March 2026.

There are some exceptions for industries whose peak season falls during March. Those industries are often given an alternative EOFY date (called a ‘recognised balance date’) by the IRD. Eligible businesses can apply to the IRD for a ‘recognised balance date’ instead of 31 March.

If they don’t apply, their end of financial year remains 31 March.

*Note: For employees, the financial year is always 1 April to 31 March. That means, for example, any payments they owe such as PAYE, student loan repayments, and any KiwiSaver contributions are based on their income within this period.

Eligible industries are as follows:

- Beekeeping: 30 November or 31 December

- Childcare or education services: 31 December

- Cattle farming: 31 May

- Dairy farming: 31 May, 30 June or 31 July

- Sheep farming: 30 June

- Fishing: 30 September

- Horse breeding: 31 July

- Kiwifruit growing: 31 January or 28 February

- Meat processing or exporting: 31 August or 30 September

- Pip fruit growing: 30 June or 31 December

- Seed dressing: 30 November

- Tobacco growing: 31 July

What are the main legal obligations for businesses at EOFY?

If your business is active and a New Zealand resident for tax purposes, your two main tasks in terms of financial reporting are 1) filing an income tax return and 2) completing a financial statement. Once you’ve completed these, the IRD will let you know what tax you owe.

For the 2025-2026 tax year, these must be completed and submitted to IRD before 7 July 2026. The penalty for filing late can be up to $500 NZD, so it pays to get it in on time.

Here’s how to get started with each one.

File a company’s income tax return

The IR4 form is the main way to submit an income tax return, which you can do through myIR online. The information you’ll need to complete the form includes:

- The company address, name, IRD number and Business Industry Classification Code (BIC).

- Any income received over the last year e.g. dividends, business activities, interest.

- Total revenue over the year (or net loss, if applicable).

- Total tax payable – the form will guide you through calculating this.

- Bank details for any potential tax refunds.

- Eligible tax credits.

- The details of any business shareholders.

Once submitted to the IRD, you can then choose how you wish to pay your tax bill over the coming year:

- Small business owners in their first year of business have to pay the full amount by the following 7 February. That allows almost 11 months from the end of the financial year to pay the full amount.

- Businesses in their second year and beyond can choose to pay in installments over the year ahead, known as provisional tax.

Complete a financial statements summary

As well as the IR4 form, IRD requires a copy of your financial records for the tax year.

One way to speed up this process is to complete a financial statements summary, also known as an IR10 form.

This form acts as a balance sheet, showing all your total income, expenses, assets and liabilities. This way, IRD can get a clear picture of your business finances to ensure that you’re paying the correct tax and are making compliant financial decisions.

What documents do employers need for EOFY tasks?

Employers will need to have access to up-to-date documentation from the entire financial year. That includes employee info, bank statements, business expenses, payslips, pay run submissions and more.

Legally, all businesses must keep comprehensive financial records for at least seven years, including all PAYE transactions, pay runs and KiwiSaver contributions. Employee details should also be kept for at least six years.

As a business owner, you must keep the following records:

- Transaction records: cashbooks, lists of people who owe you money, list of people you owe money to.

- Income: invoices, credit card sales, debit and credit card notes.

- Business expenses: invoices for purchases, receipts for credit card purchases.

- Banking: bank and credit card statements, interest statements.

- Worksheets: tax return calculations, GST tax invoices, tax deductions.

- Asset register: list of assets and liabilities, depreciation schedule and calculations.

- Financial accounts: balance sheets, final profit and loss statements, dividend statements.

- Legal documents: sale and purchase agreements, lease agreements, credit agreements.

- Employee details: wage records for all PAYE, KiwiSaver, student loans and child support deductions, employment agreements.

- Benefits: full records of any benefits e.g. entertainment expenses, health insurance discounts etc.

What are some common payroll deductions for NZ businesses?

The EOFY is often a time when you’ll review the deductions you’ve made through payroll – both for reporting and to ensure you’ve made the correct deductions throughout 2025-2026.

There are several payroll deductions that New Zealand businesses will commonly make, although they vary by employee. These include:

- KiwiSaver employee and employer contributions;

- Student loan deductions;

- Child support payments;

- PAYE; and

- Employee superannuation contribution tax (ESCT).

How can NZ employers better prepare for the next financial year?

Preparing for the next financial year doesn’t have to be hard. Here’s a few extra tips to help you feel prepared for the 2026-2027 financial year.

Review your record-keeping processes and systems

How are you currently storing your employee leave, pay and KiwiSaver data? Do you have a centralised, secure place for it all you can easily sort through when needed?

If not, the 2026/2027 financial year-end could quickly become overwhelming. Save yourself the stress by reviewing your processes as soon as possible – so that when March 2027 is hot on your heels, you’ll stay cool and collected.

Stay on top of deadlines

There are plenty of dates to be aware of when it comes to running a business, from public holidays to IRD submission dates. Don’t forget that all income tax returns should be filed for 2025-2026 by 7 July 2026, and your income tax bill is due by 7 February 2027. This isn’t just crucial as a legal compliance issue, but ensures your cash flow for the next year is correct and going to the right places.

Complete your last payday filing

Completing your last payday filing for the 2025-2026 tax year is a key task before you start working on the big tax return. Make sure your final pay run is complete and accurate so that you’re free to take stock of the last year without anything outstanding.

You’ll also need to reconcile your payroll data for the year with what has been reported to IRD, to ensure that it all balances. That includes reviewing employer superannuation contribution tax (ESCT) rates for all employees.

Ensure your employee data is up to date

Part of your end of financial year filing will include employee records, so make sure that all the information you have on file about your team is correct. This might require some time checking in individually with your employees, so it’s crucial to factor in some time for them to respond and check themselves.

See a new tax year as an opportunity

For many people, getting through the end of a tax year can seem like a whole lot of admin. However, just as spring cleaning leads to a sparkling home, think of a new tax year as an opportunity to do things better.

Here’s your chance to try new things, refresh how you organise employment and payroll, and see how your business can flourish.

Transform your business at the EOFY and beyond with Employment Hero

Just one of the many built-in features of our Employment Operating System, our automated payroll software is designed to ensure you can tackle the EOFY with confidence.

Easily calculate pay, taxes, KiwiSaver contributions, public holiday pay rates and so much more. Get notifications in the lead up to the EOFY so that you’re never caught off guard – from reminders about increases to the minimum wage, to alerts about employees’ KiwiSaver contribution status and more.

And that’s not all – our Employment OS syncs up with all your HR needs too. Get notifications when employee certifications are about to expire, request digital acknowledgment of essential workplace policies, and auto-schedule 1:1s and performance reviews to keep your team on track to meet their KPIs.

For more information on how we can help transform your business at EOFY and beyond, book a demo today.

The information in this article is current as at 22 January 2026, and has been prepared by Employment Hero Pty Ltd (ABN 11 160 047 709) and its related bodies corporate (Employment Hero). The views expressed in this article are general information only, are provided in good faith to assist employers and their employees, and should not be relied on as professional advice. Some information is based on data supplied by third parties. While such data is believed to be accurate, it has not been independently verified and no warranties are given that it is complete, accurate, up to date or fit for the purpose for which it is required. Employment Hero does not accept responsibility for any inaccuracy in such data and is not liable for any loss or damages arising directly or indirectly as a result of reliance on, use of or inability to use any information provided in this article. You should undertake your own research and seek professional advice before making any decisions or relying on the information in this article.

Register for the checklist

Related Resources

-

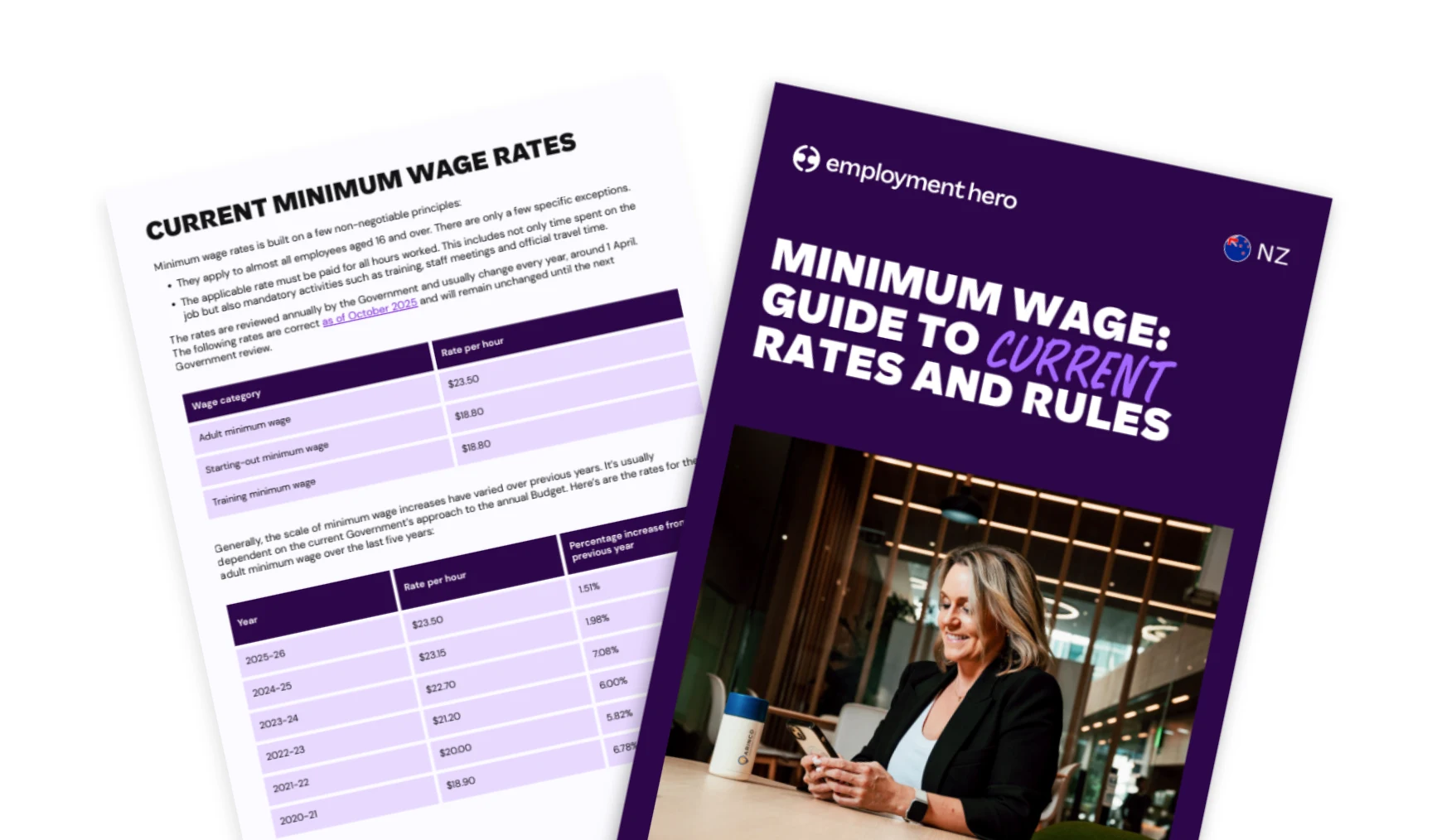

Read more: Minimum wage: Guide for New Zealand employers and payroll teams

Read more: Minimum wage: Guide for New Zealand employers and payroll teamsMinimum wage: Guide for New Zealand employers and payroll teams

Understand NZ’s minimum wage rates, training wage rules, and 2025 updates. Learn how Employment Hero NZ automates wage compliance.