Hire Employees in the Netherlands

Looking to hire employees in the Netherlands? HeroForce is your Employer of Record, helping you find and hire the skills you need.

Key Facts

| Employment Terms | |

|---|---|

| Timezone | Central European Time (CET) during standard time (late October to late March) and Central European Summer Time (CEST) during daylight saving time (late March to late October). |

| Currency | Euro (€) |

| Capital city | Amsterdam |

| Official language(s) | Dutch |

| Ease of doing business | Very friendly to business (#42 out of 190) |

| Minimum wage | € 11.16 – 12.40 (as per 1st January 2023) |

| Estimated employer cost | Approx. 20% |

| Employer retirement contribution: Algemene Ouderdomswet (AOW) | The retirement plan is called the Algemene Ouderdomswet (AOW). It is a state pension that provides a basic income for individuals who have reached retirement age, which is currently 66 years and 9 months. Additionally, individuals can choose to supplement their AOW income with private pensions or other forms of retirement savings. The amount of the AOW pension depends on the number of years an individual has lived or worked in the Netherlands. |

About the Netherlands

The Netherlands is a developed country with a population of approximately 17.5 million people, and its gross domestic product (GDP) ranks as the world’s sixteenth largest. The country’s education system is highly regarded, with a significant percentage of individuals having attained a university education. The Netherlands has also implemented a comprehensive set of employment regulations that cover various areas such as employment terms, working conditions, and minimum wage requirements that are specific to certain industries.

Employment in the Netherlands

Working Hours

- The standard full-time working week is between 38-40 hours. Variations are common, but must be agreed in writing.

Overtime

- Overtime hours and pay in the Netherlands are not regulated by national standards, but are typically agreed upon in individual employment contracts or collective agreements.

Probationary (Trial Period)

- A probationary period of up to two months is allowed for permanent contracts, while fixed-term contracts have a maximum probationary period of one month. Probation can only be included in contracts that last over six months.

Payroll Cycle

- The standard payroll cycle is monthly, although some employers may pay their employees weekly or every four weeks. Employers must provide employees with a payslip that shows their gross salary, deductions, and net salary, and deduct taxes and social security contributions from the employee’s salary.

Main Types of Leave in the Netherlands

Annual Leave

Employees are entitled to a minimum of four times their weekly working hours in paid leave per year. For example, someone working 40 hours a week is entitled to 160 hours of leave. Part-time employees are entitled to a proportional amount of leave hours based on their weekly working hours.

Sick Leave

Pay sick employees at least 70% of their last salary and holiday allowance, or a higher percentage as specified in their contract or CAO. Payment can last up to 104 weeks. If their contract ends, register them as sick with UWV on their last day. Payment ends, and they receive sickness benefits from UWV.

Parental Leave (Employment Insurance maternity and parental benefits)

Parents with children under 8 can take up to 26 times their weekly working hours as parental leave. They’re paid for the first 9 weeks through a benefit from the UWV, equal to 70% of their daily wage. This paid leave must be taken during the child’s first year, and can be taken as soon as they start working for you. Although you’re required to allow this leave, you’re not legally obliged to pay their salary during it, unless your contract or CAO stipulates otherwise.

Other Leave

- Adoption and foster leave: Six weeks of leave for parents who adopt or foster a child, with an adoption allowance or foster care benefit. Can be taken spread out over a longer period.

- Short-term and long-term care leave: Short-term care leave for essential care for an ill or needy child, partner, parent, friend, etc. The employer pays 70% of salary or minimum wage. Long-term care leave for seriously ill child, partner, or parent, with no pay from employer.

- Emergency and short absence leave: Emergency leave for unforeseen personal circumstances with paid salary, such as sick family member or death. Short absence leave is unpaid and for other urgent matters.

- Special or extraordinary leave: Provided in the collective labor agreement, company scheme, or employment contract for events such as marriage, funeral, moving house, taking an exam, etc. Leave duration depends on mutual or contract agreement.

- Unpaid leave: Full or part-time unpaid leave in consultation with employer, with no legal entitlement but possible arrangements in collective labor agreement.

Employment Termination

Notice Period

Employees have a one-month notice period by law, but this can be adjusted if agreed upon and stated in the employment contract. If an employee’s notice period is longer than one month, the employer’s notice period must be at least twice as long, and the maximum notice period for an employee is six months.

Termination

A valid reason is required to dismiss an employee. The most common reasons are below:

- Economic reasons, such as company restructuring or bankruptcy

- Disability of 2 or more years

- Frequent sickness that seriously impacts the business and no other suitable work is available

- Unsatisfactory performance, with sufficient warning and opportunity given to improve

- Wilful misconduct or culpable negligence, such as theft or coming to work drunk

- Serious conscientious objections to business activities with no alternative work available

- Impaired working relations that cannot be restored

- Other circumstances, such as being in the Netherlands illegally or imprisoned

- Non-performance of work for various reasons

- Cumulative grounds that combine the above circumstances (excluding economic reasons or long-term disability)

Severance (Compensation)

If an employer fails to provide the correct notice period, they may have to compensate their employee in the amount of at least one month’s salary, which is equivalent to what the employee would have earned during the regular notice period.

Disclaimer: The information on this webpage is current as at 19 September 2022, and has been prepared by Employment Hero Pty Ltd (ABN 11 160 047 709) and its related bodies corporate (Employment Hero). The views expressed on this webpage are general information only, are provided in good faith to assist employers and their employees, and should not be relied on as professional advice. The information is based on data supplied by third parties. While such data is believed to be accurate, it has not been independently verified and no warranties are given that it is complete, accurate, up to date or fit for the purpose for which it is required. Employment Hero does not accept responsibility for any inaccuracy in such data and is not liable for any loss or damages arising either directly or indirectly as a result of reliance on, use of or inability to use any information provided on this webpage. You should undertake your own research and to seek professional advice before making any decisions or relying on the information displayed here.

Download the International Hiring Guide

*Information here is current as at 16/09/2022, for full details download the guide.

Hiring Process in the Netherlands Sorted.

Hiring an employee in the Netherlands is no easy task. Especially, if you are overseas, and lack the knowledge of employment law and regulations relating to international HR compliance, payroll, benefits and taxes.

Employment Hero started in Australia and we fully understand all the ins and outs of hiring in the local market, so we can help you throughout the step-by-step process.

Dutch Employment

Law Decoded.

The Netherlands has laws that help keep workplaces fair. You should be aware of the rules and what your employer’s rights and responsibilities are. Under Dutch employment law, employers and employees both have rights and responsibilities. Do you know your responsibilities?

Employ anyone, anywhere. Easily.

HeroForce takes care of the complex admin; international employment legislation, local tax and pension minimums, insurance obligations and more. Hiring incredible talent from anywhere in the world has never been easier.

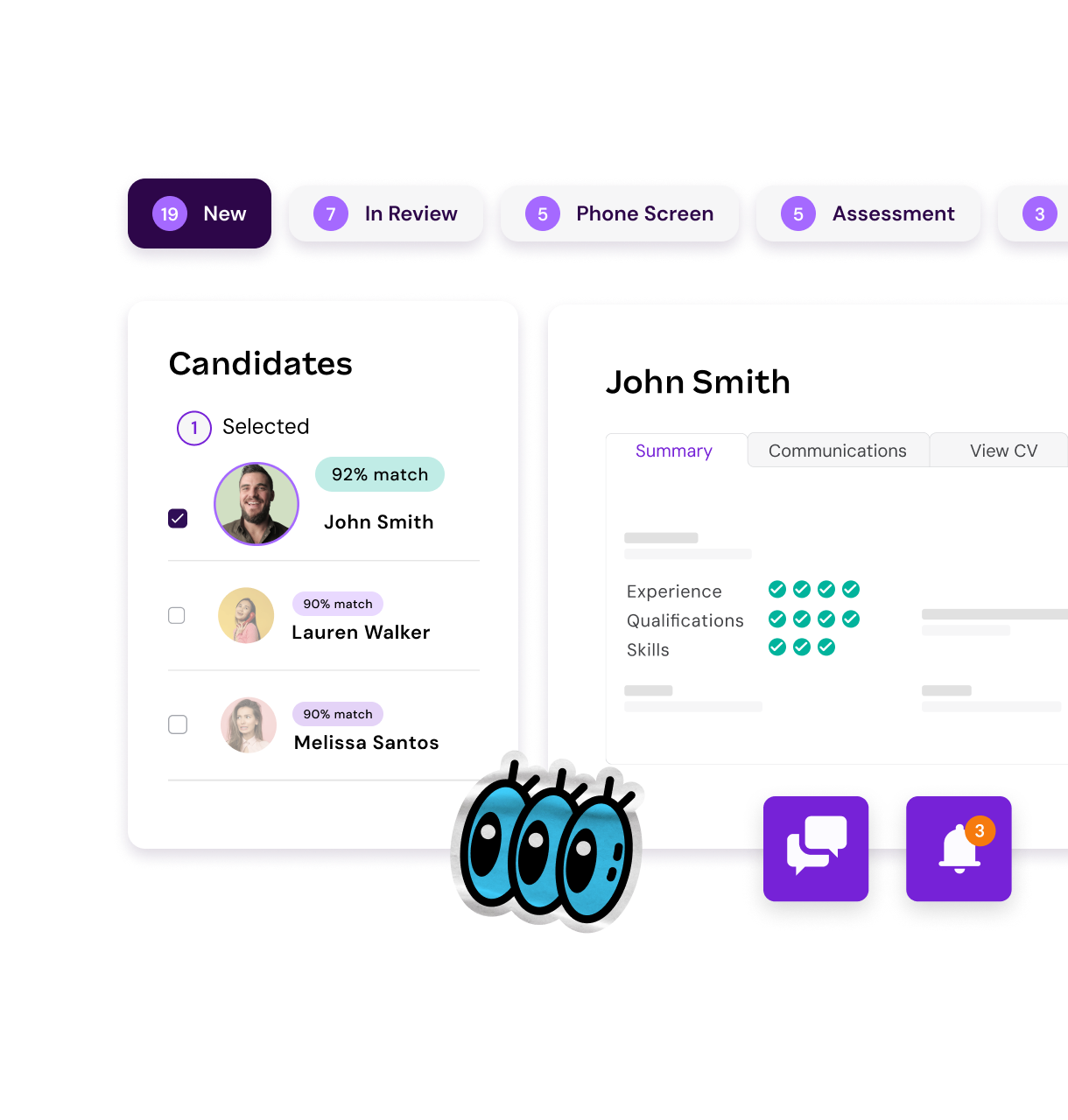

Try our Applicant Tracking System

Employment Hero’s ATS makes hiring and managing new staff easier than ever.

“The good thing about Employment Hero is that they’re on this journey with you… We’ve got a kind of partnership helping us understand local employment and ensure we’re hiring legally.”

Ariane Sarabia, Global Talent Acquisition Specialist

Related Resources

Employer of Record (EOR): The Ultimate Guide

As outsourcing is becomes more popular, an outsourced staffing agency is another avenue to explore.

The Remote First Workplace Playbook [Free Download]

As our world continues to change, we can expect to see the rise of remote-first approach to working.

End of Financial Year HR and Payroll Checklist NZ [2025]

Don’t let the end of financial year get the best of you! Download our free HR and Payroll checklist.

Employer of Record.

Hire Remotely

HeroForce is the best-in-class global (EOR) Employer of Record that enables you to hire based on skill, not location. Whether you’re expanding into new markets or struggling to fill open roles, we connect the best talent with the best employers, legally and ethically.