NZ public holidays: Your obligations as an employer or payroll professional

We’re here to break down exactly what is required from business leaders and payroll professionals when it comes to public holidays.

Here in New Zealand, there are plenty of public holidays that business leaders have to be across. While for many Kiwis, they’re a great opportunity to get out the BBQ or take a trip across the country, for businesses, public holidays can be a payroll minefield. We’re here to break down exactly what is required from business leaders and payroll professionals, so you can navigate the long weekends with confidence.

New Zealand’s public holidays

The public holidays that occur annually are:

- New Year’s Day (1 January)

- Day after New Year’s Day (2 January)

- Waitangi Day (6 February)

- Good Friday (dates vary)

- Easter Monday (dates vary)

- ANZAC Day (25 April)

- King’s Birthday (first Monday in June)

- Matariki (dates vary)

- Labour Day (fourth Monday in October)

- Christmas Day (25 December)

- Boxing Day (26 December)

- Regional Anniversary Day (date decided locally)

An easy way to keep track is to download our public holiday calendar, designed for easy printing so you can hang it somewhere visible.

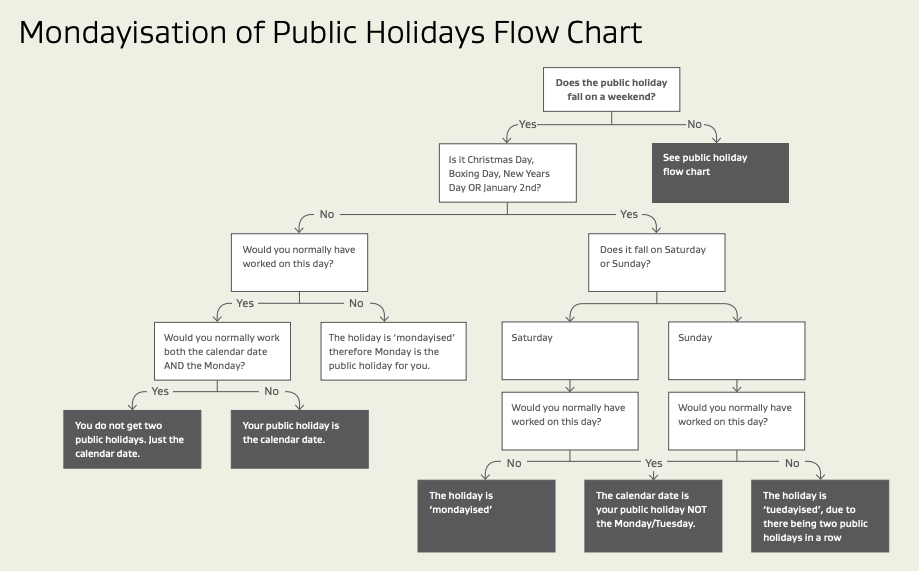

One important rule to note in determining public holiday dates is Mondayisation. This rule means that if any of these public holidays happen to fall on a Saturday and Sunday, and the day would not be an otherwise working day for an employee, the holiday is transferred to the following Monday (or Tuesday, in the case of Boxing Day or the day after New Year’s Day).

If the employee would be working on that original Saturday or Sunday date however, the public holiday remains on that day and they’re entitled to a day off on pay.

It can get a little complicated: here’s a helpful flow chart provided by Employment New Zealand.

Employee leave entitlements

All employees are entitled to 12 public holidays a year. They also cannot use more than four public holidays over the Christmas and New Year period, and should only take one Regional Anniversary Day a year. The assigned Anniversary Day is generally decided by where their work is based. The only exception is if the employee is temporarily in another region – in that case, they must reach an agreement with their employer as to which Anniversary Day to take.

Public holidays should be paid days off, providing they’re on an otherwise working day for the employee. Employees can only be compelled to work on a public holiday under the following circumstances:

- The holiday is on a day that they would have otherwise worked, and

- Their employment agreement states that they have to work on the public holiday(s).

Defining an ‘otherwise working day’

The exact definition of an ‘otherwise working day’ can sometimes be tricky to pin down. In its simplest form, an otherwise working day is one that an employee would have been working, had there not been a public holiday or any leave taken.

This can be fairly easy to define in the case of set working hours or consistent rotas. However, it’s less clear when an employee works varying shifts or on call. In that instance, it’s up to the employer and employee to come to an agreement. The decision in the end should be fair and not simply announced by an employer.

Considerations for the discussion should include:

- What is defined in the employment agreement;

- The employee’s usual work patterns;

- If the employee works only when work is available from the employer.

Agreeing on these definitions is why writing a clear and comprehensive employment agreement for new employees can really help further down the line.

When the holiday is during a leave period

If an employee’s period of leave overlaps with a public holiday, there are a few stipulations around their pay and leave allocations.

Annual leave, sick leave, bereavement leave or family violence leave

If the employee would have otherwise worked on that public holiday, they receive their relevant daily pay for that day, and don’t lose a day of annual leave. They don’t receive time and a half, or an additional day of paid leave.

Parental leave

Since the employee would not have normally worked on a public holiday during this period, the employer doesn’t have to pay for the public holiday. However, their standard weekly parental leave payment should not be affected by the public holiday.

Rules for operating on a public holiday

As we mentioned above, an employee can be made to work on a public holiday but it should be an otherwise working day, and already stated in their employment agreement.

There are a few additional requirements for employers when operating with staff during a public holiday. Any employee working on the holiday should receive their daily pay, multiplied by 1.5 (time and a half). This should be applied in payroll by whoever is managing it, and factored in each pay run when calculating PAYE and KiwiSaver contributions.

Employees working on a public holiday are also entitled to an alternative day of paid leave, at the usual rate. This can be taken at a date agreed by the employer and employee. If they can’t reach an agreement, the employer can decide the final date with ‘reasonable basis’ and give the employee at least 14 days of notice.

Managing pay and leave

Whether you’re a business owner who manages your own payroll, or a payroll professional working for clients, it’s critical that you are making the right choices when it comes to public holidays. There are cases where employers have been monetarily penalised for incorrectly paying their employees during public holidays.

This ranges from ensuring that any public holiday clauses are stipulated in starting employment agreements, to correctly calculating your or your client’s employees time and a half pay after working on public holidays.

How payroll software can help

Luckily, payroll software can streamline a lot of those administrative challenges and manual calculations. In Employment Hero Payroll, we’ve designed specific features with managing public holidays in mind. Here are just a few available:

- All New Zealand public holidays are already built into the Employment Hero Payroll system, and can be automatically applied to certain employees. This means that their correct pay is submitted to pay runs without any manual tweaks.

- Our Employee Self-Service system allows employees to apply for leave themselves (including their additional day of leave if applicable), with requests sent directly to their line manager.

- A shift management system makes it easy for managers and outsourced payroll providers to identify which employees are rostered on for certain days and shifts, as well as potential gaps.

If you’re ready to make the next step and power up your public holiday management with payroll software, reach out to us today. We’re a proven partner, with 81% of users agreeing that Employment Hero Payroll improves payroll efficiency.

Disclaimer: The information in this article is current as at 11 April 2023, and has been prepared by Employment Hero Pty Ltd (ABN 11 160 047 709) and its related bodies corporate (Employment Hero). The views expressed in this article are general information only, are provided in good faith to assist employers and their employees, and should not be relied on as professional advice. The Information is based on data supplied by third parties. While such data is believed to be accurate, it has not been independently verified and no warranties are given that it is complete, accurate, up to date or fit for the purpose for which it is required. Employment Hero does not accept responsibility for any inaccuracy in such data and is not liable for any loss or damages arising either directly or indirectly as a result of reliance on, use of or inability to use any information provided in this article.You should undertake your own research and to seek professional advice before making any decisions or relying on the information in this article.

Related Resources

-

Read more: Product Update: January 2026

Read more: Product Update: January 2026Product Update: January 2026

Welcome to the January 2026 product update from the Employment Hero team. We’ve got lots to share around Custom Forms,…

-

Read more: 7 Ways Employment Hero Can Help You Retain Top Talent

Read more: 7 Ways Employment Hero Can Help You Retain Top Talent7 Ways Employment Hero Can Help You Retain Top Talent

Contents Retaining top talent in 2026 is about more than providing a positive workplace culture; employees are looking for jobs…

-

Read more: Product Update: December 2025

Read more: Product Update: December 2025Product Update: December 2025

Welcome to the December 2025 product update from the Employment Hero team. We’ve got lots to share around Custom Forms,…