Product Update March 2023

Follow our March 2023 product update as we share all of the latest and greatest features we’ve released over the last month. Read more here.

Contents

A big hello and welcome back to the Employment Hero monthly product update! This month we’ve been hard at work on some exciting new features – all designed to streamline your work day. From improvements to our payroll system, through to enhancements to exit interviews, we know you’re going to love these new product releases. With that said, there’s lots to cover so let’s get straight to it! The team when a new product release goes live ?

The team when a new product release goes live ?

We’ve made improvements to Net to Gross Calculator in pay runs

We’ve introduced a feature that expands on the existing Net to Gross Calculator at an employee level. The new feature allows users to easily import multiple employees’ net earnings into a pay run, in just one step.

The bulk net to gross import is available as a pay run action using the existing pay run import.

Learn more about the Net to Gross Calculator.

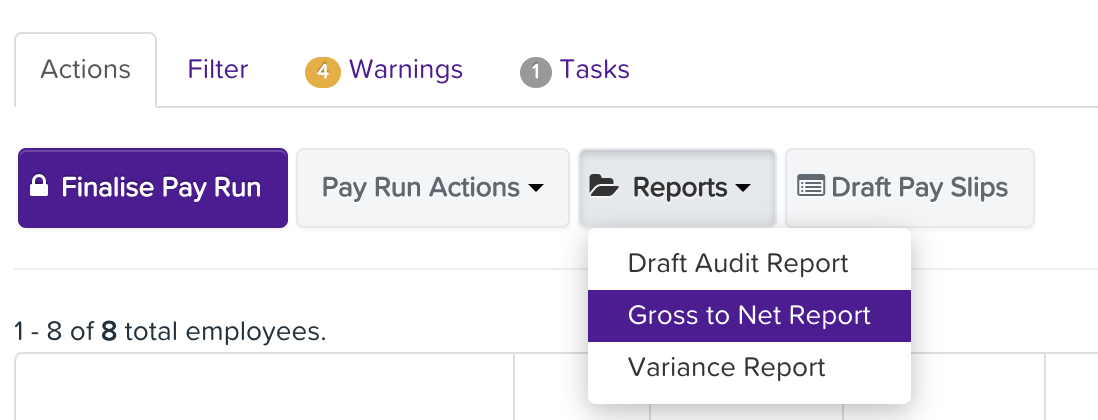

Gross to Net Report is now available in unfinalised pay runs

Users already have the ability to access the Pay Run Audit and Variance Reports within an unfinalised pay run, but now we’ve also made the Gross to Net Report accessible in unfinalised pay runs. This will allow users to get a more granular view of employee earnings as the report can be generated to display a breakdown of earnings by pay category.

Pay run approvers will also have access to this report when they are sent a pay run to approve.

Learn more about the Gross to Net Report.

You can now split earnings by dimension values

We’re making it easier to split employee earnings. Now, you can split employee earnings by dimensions as a default setting for auto-pay salaried employees.

This means that you don’t have to manually assign dimension values individually for every pay run created. Within the pay run, the system will create separate earning lines in order to calculate the earnings split per dimension value. The earnings splits will then flow through to the payroll journals (depending on the journal service you have selected).

Learn more about splitting earnings.

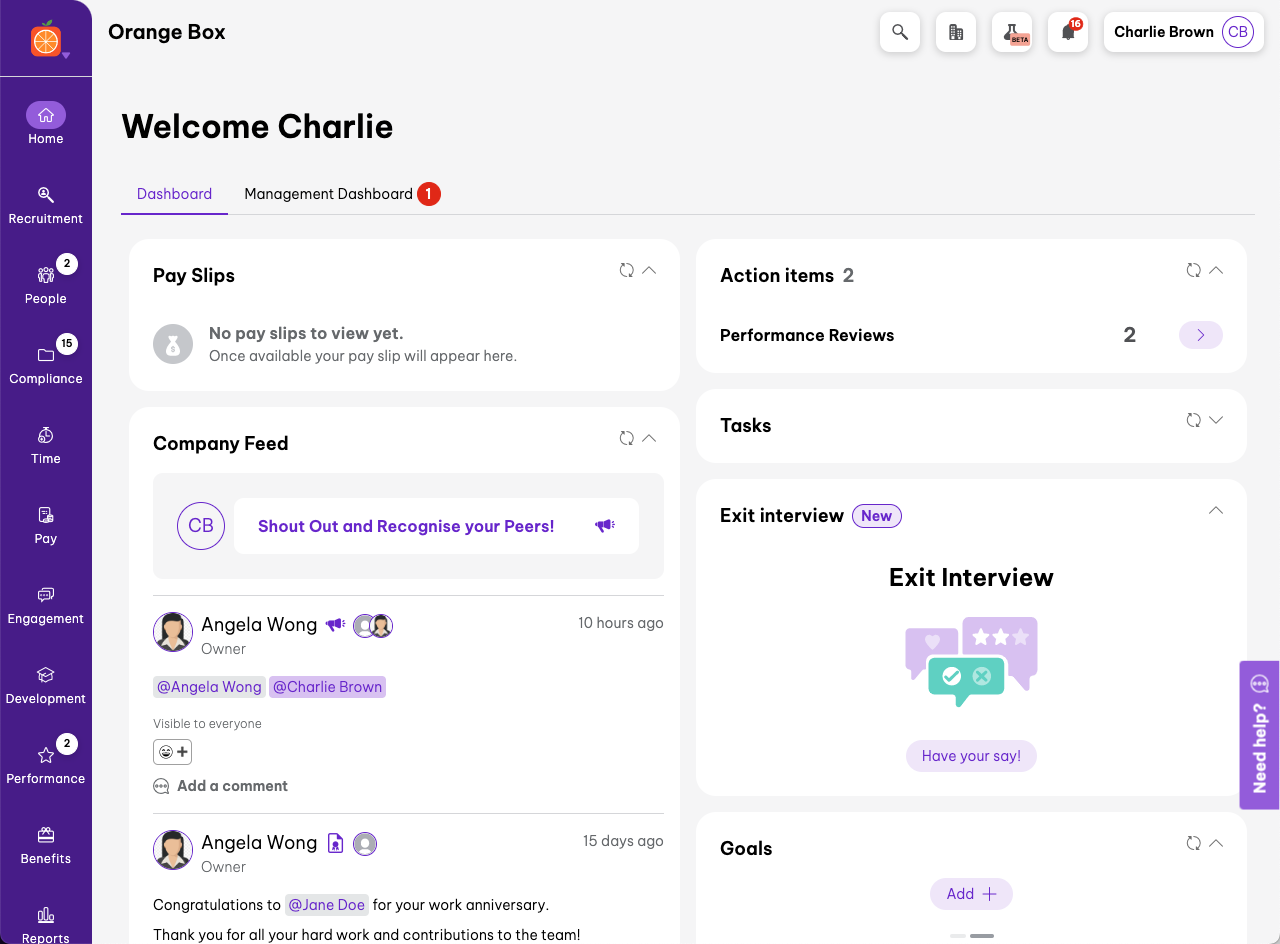

We’ve made improvements to Exit Interviews

Knowing why an employee leaves your organisation provides great insight into the overall employee experience. That’s why we’ve made it easier to find out this information.

The Exit Interview feature allows you to create a one-off exit interview survey, choose the intended audience, and then send it to the specific employee. You can also edit the question, publish any draft versions and delete an entry you no longer need.

Once you publish an exit interview, your employees can access it from their dashboard. For easy reporting, you also have the ability to download the responses as a csv file.

Learn more about exit interviews.

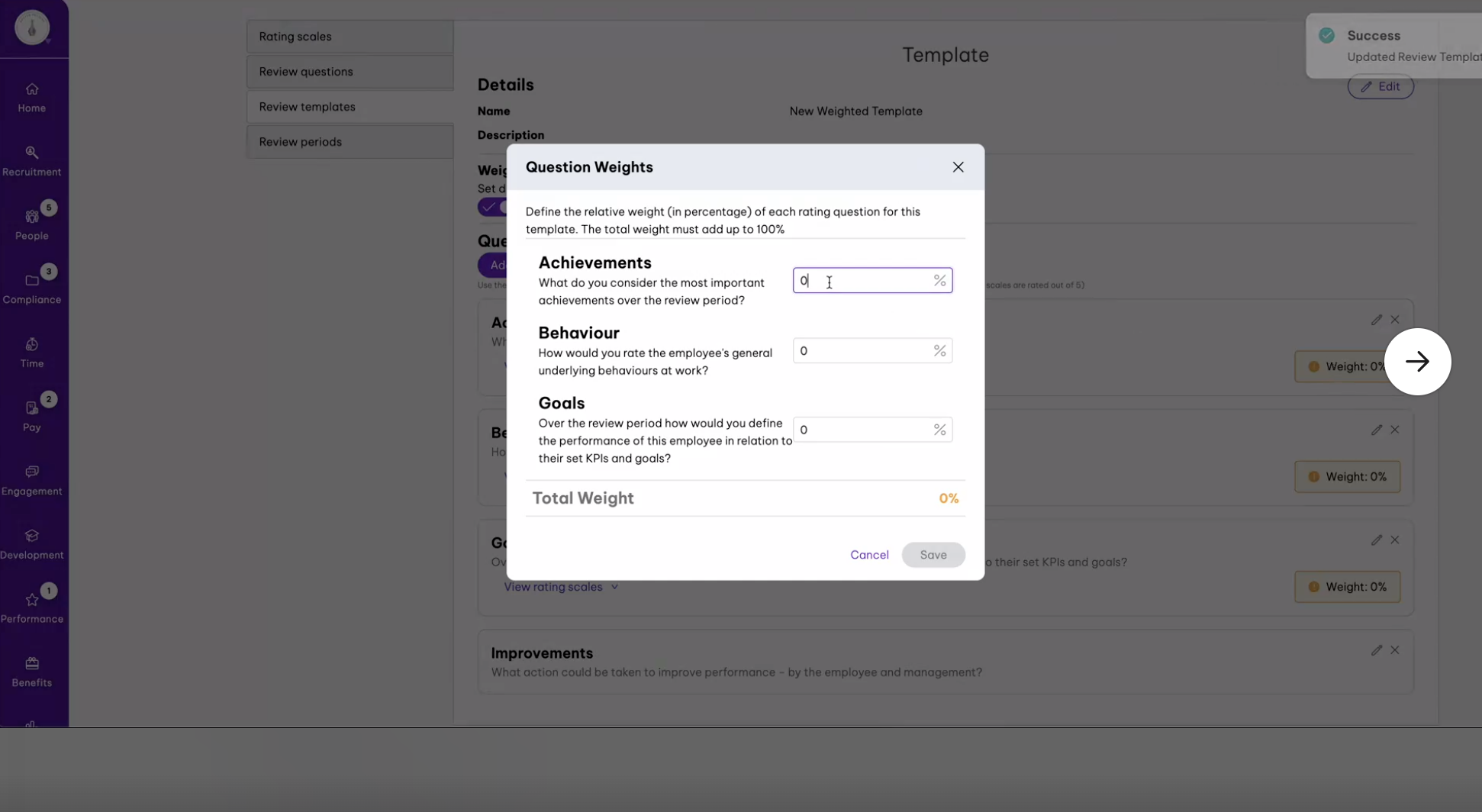

You can now add weighted questions in performance reviews

When reviewing performance, we know that some areas are more important than others. That’s why we’ve enhanced the Performance Reviews feature, allowing you to assign the importance of each question with an individual weighting.

Admins can now assign the relative importance of the rating questions in the template, and these weights will be used to calculate the weighted average (Overall Score). You can also choose to include or leave out the weights in the Overall Score calculation.

The advanced editor (build your own) is now available

Sometimes a one size fits all approach doesn’t always work. That’s why we’ve added a feature that allows for greater customisation. Our new advanced editor gives you greater flexibility to edit, issue and clone your own existing templates via Employment Hero (available on Premium subscriptions).

Learn more about basic vs. advanced editor templates.

Tax tables have been updated for end of financial year 22/23

We’ve updated the tax tables for the NZ 2023/24 tax year. This will take effect for any pay runs with a paid date of 1 April 2023 or after. The updates include:

- Earner levy increased from $1.46 to $1.53

- Earner levy threshold increased from $136,544 to $139,384

- Student loan repayment threshold increased from $21,268 to $22,828

- Weekly threshold increased from $409 to $439

- Fortnightly threshold increased from $818 to $878

- Monthly threshold increased from $1,772.33 to $1,902.33

- Twice monthly threshold increased from $886.17 to $951.17

Find out more information about NZ tax table updates and payroll processing.

Calculated annual leave accrual has been added to the leave balance report

Gaining a holistic view of employee leave might leave you scratching your head and unaware where to get started. To make it easier, we’ve added the annual holiday accrual to the Leave Balance report so users will be able to report on employee’s current entitlement as well as their estimated accrual when running that report.

Learn more about annual leave accrual.

Data extracts now available for employee liabilities

If you have employer liabilities set up in your pay run inclusions, you can now extract data for employee liabilities from within your payroll file. These can be exported as both CSV and Excel files.

To download data extracts from within your payroll file, navigate to the Payroll settings > Data extracts page. Then, select the data type you want to export.

Learn more about downloading employee data.

You can now capture work eligibility during onboarding

Work eligibility refers to your employees having the right to work in New Zealand and, as an organisation, it’s important to have an easy way to capture the right to work details. The Work Eligibility feature allows you to add residency, passport and visa details to an employee file. You can also use this feature to add, view and delete any required documents.

Find out more about worker eligibility.

Follow along every month for the latest and greatest product updates

We want our customers to get the most out of our platform. Whether it’s HR, payroll or benefits, you can expect to find new updates here – all designed to make your world at work easier. If you’d like to stay up to date with all of our content, you can visit our resource hub or follow us on LinkedIn.

Related Resources

-

Read more: Employment Hero Named Among Best Australian & New Zealand Companies by G2

Read more: Employment Hero Named Among Best Australian & New Zealand Companies by G2Employment Hero Named Among Best Australian & New Zealand Companies by G2

Ranked #6 on G2’s 2026 Best Software Awards, officially a Top 10 software company in ANZ

-

Read more: Employment Hero Named Among Best Australian & New Zealand Companies By G2

Read more: Employment Hero Named Among Best Australian & New Zealand Companies By G2Employment Hero Named Among Best Australian & New Zealand Companies By G2

Employment Hero has been ranked #6 on G2’s 2026 list of the Best Australian and New Zealand Companies.

-

Read more: Product Update: January 2026

Read more: Product Update: January 2026Product Update: January 2026

Welcome to the January 2026 product update from the Employment Hero team. We’ve got lots to share around Custom Forms,…