What is the Singapore Child Development Co-Savings Act (CDCA)?

Published

What is the Singapore Child Development Co-Savings Act (CDCA)?

Raising a newborn isn’t easy, and it certainly isn’t cheap either. Singapore has long struggled with a declining population, and resident fertility rates even hit a historic low of 1.1 in 2020.

Coupled with GST hikes, rising inflation rates and the increased cost of living – it’s no wonder there’s a growing proportion of singles, married couples having fewer children, or married couples choosing to go childless.

The Child Development Co-Savings Act (CDCA) was first introduced in 2001, in a bid to encourage married couples to have more children. It was aimed at facilitating the provision of cash grants and other financial support for working parents with children.

In this factsheet, you’ll find:

- What is the CDCA and what does it cover?

- Amendments made to the CDCA thus far

- How does this affect employers and employees?

Download the factsheet to find out the latest amendments made to the Act and what changes you should be across.

What is the Child Development Co-Savings Act (CDCSA)?

The CDCA essentially refers to the establishment of a Child Development Co-Savings Scheme, which provides financial assistance to working parents for the development of their children.

This co-savings arrangement means that the Singapore government will match contributions made by any parent to the child’s bank account.

The act outlines the following leave, benefits and eligibility criteria available to all working parents. Including:

- Government-Paid Maternity Leave;

- Government-Paid Maternity Benefit;

- Government-Paid Paternity Leave;

- Government-Paid Paternity Benefit;

- Adoption Leave For Mothers;

- Government-Paid Adoption Benefit;

- Childcare Leave and Extended Childcare Leave;

- Unpaid Infant Care Leave;

- Government-Paid Shared Parental Leave.

What are the latest amendments to the CDCA?

The Act was previously amended in 2017, to make it mandatory for employers to grant two weeks of paternity leave, and also increased shared parental leave from one week to four weeks.

In addition, on 2nd Aug 2021, the Child Development Co-Savings (Amendment) Bill was passed to enable more working parents — especially those not in full-time employment or are newly employed, to benefit from pro-family policies in the workplace.

Here’s an overview of the key changes:

- Introduction of Government-Paid Paternity Benefits (GPPB) and Government-Paid Adoption Benefits (GPAB);

- Support for parents who have been retrenched or contracts have expired;

- Support for parents with stillborn children;

- Government reimbursement for pro-family employers; and

- Disqualification of married and unwed fathers from paid childcare leave and unpaid infant care leave, for children born from extramarital affairs.

Download the factsheet to find out more.

Who is eligible for financial support from CDCA?

The eligibility requirements differ for each scheme under the CDCA. However, the main similarity across all schemes is that the child must be a Singapore citizen at birth, or become a Singapore citizen within 12 months from their date of birth (inclusive of date of birth).

Working parents who are birth parents or adoptive parents can refer to the Government-Paid Leave Portal to check if they fulfil the eligibility requirements. Self-employed parents are also covered under the CDCA.

What other parental support schemes are there in Singapore?

For working parents or self-employed parents who do not qualify for government-paid maternity leave or government-paid paternity leave under the CDCA, don’t fret! You may qualify for maternity or paternity leave under the Employment Act instead.

Baby Bonus Scheme

The Baby Bonus Scheme was introduced to help parents manage the costs involved in raising a child. It comprises the Baby Bonus Cash Gift and a Child Development Account – a special co-savings scheme for your child.

The Baby Bonus Cash Gift is given out in 5 instalments over 18 months after your child is born. You’ll receive a total of $8,000 for your first and second child, and $10,000 for your third child onwards. You are eligible for the cash gift only if you are lawfully married to your spouse, and your child is a Singapore citizen.

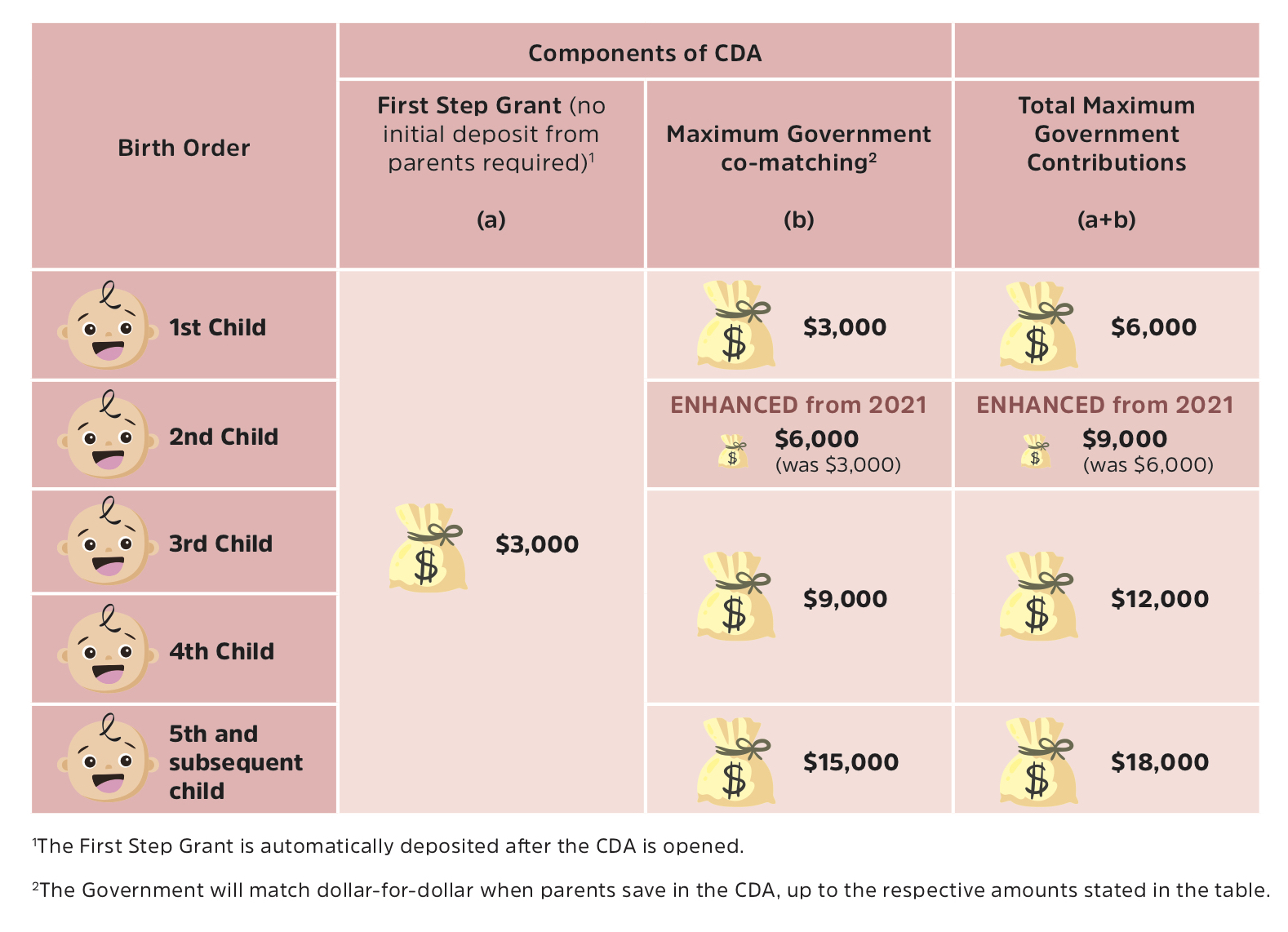

The second part of the Baby Bonus Scheme is the Child Development Account (CDA) which has two components — the First Step Grant, and government co-matching of the parents’ savings.

The CDA is a special savings account for your child — if your child is eligible, they will receive a First Step Grant of $3,000. It will be automatically deposited into the account when you open it for your child at any of the banks: DBS/POSB, OCBC, or UOB.

The subsequent savings you put in however, will be matched by the government dollar-for-dollar, up to the maximum co-matching amount which differs according to the birth order of each child.

Apart from the Baby Bonus Scheme, there’s also additional governmental support available such as:

Employment Hero makes people management easy

If the pandemic has taught us anything, it’s that work-life balance has become everyone’s top priority – especially for working parents. Thanks to hybrid and remote work styles, working parents can have a better balance between their personal and professional lives, but more support still needs to be given.

For growing Singaporean businesses looking to ensure that your employees get the best support as working parents, why not do it seamlessly with Employment Hero? Our all-in-one payroll and HR software allows you to manage your people easily with built-in policies, contracts and templates ready to go when you need them.

Enjoy fuss-free paperless onboarding with new hires quickly and compliantly by having virtual contracts, policy acknowledgements, and employee files completed electronically, especially with all things pertaining to parental leave and benefits in the workplace. You can also easily update your internal policies and get employees to re-acknowledge or sign them again to make sure they are across the changes.

Leave management has also never been easier — electronic leave requests can be submitted and approved through the mobile app, enabling fuss-free employee self-service. Every employee’s available leave is displayed in real time, and the leave calendar also provides an overview of everyone’s leave dates.

Download this guide now.

Related Resources

-

Read more: Everything You Need to Know About the Start Digital Grant Under the NCSS TechAndGO! Initiative

Read more: Everything You Need to Know About the Start Digital Grant Under the NCSS TechAndGO! InitiativeEverything You Need to Know About the Start Digital Grant Under the NCSS TechAndGO! Initiative

Discover the Start Digital Grant under NCSS’s TechAndGO! initiative.

-

Read more: 10 point HR and payroll compliance checklist

Read more: 10 point HR and payroll compliance checklist10 point HR and payroll compliance checklist

Get peace of mind with our 10 point HR and payroll compliance checklist.

-

Read more: From Hi to Hired: Hire Faster, Hire Smarter.

Read more: From Hi to Hired: Hire Faster, Hire Smarter.From Hi to Hired: Hire Faster, Hire Smarter.

This session will equip you with techniques to streamline hiring, enhance candidate experience.