Employer’s guide to hiring employees in Singapore

Not sure how to hire an employee? This step-by-step guide will walk you through the recruitment process while complying with local legislation.

Are you a new business owner in Singapore looking to hire your first employee? Or a business owner looking to triple check your knowledge of Singapore’s employment law?

If your business is currently growing, and you require additional help in running the day-to-day operations or expanding the business, we’re here to help ease you through the entire process.

Employment can be a confusing and complex topic for new business owners, especially when it comes to hiring employees. Whether you’re looking for the right person to hire, or taking on the hiring process for the first time, we’ve got you covered with this handy guide to hiring employees in Singapore.

What is the Singapore Employment Act?

Enacted in 1968, the Employment Act is the most important piece of legislation you should be familiar with as a business owner. It is the main labour law in Singapore, and acts as a source of truth for all things related to employment in Singapore. It essentially dictates the basic terms and conditions for employment under a contract of service, with some exceptions included.

Key points for hiring employees in Singapore

- The Employment Act 1968 is the main labour law of Singapore for both local and foreign employees.

- Employers must apply for a CPF Submission Number (CSN) to hire Singaporean or Singapore permanent resident employees.

- Employers should adhere to fair and non-discriminatory hiring practices as stipulated in the Fair Consideration Framework and Tripartite Guidelines on Fair Employment Practices.

- Employment contracts must include Key Employment Terms (KETs) and other essential clauses.

- Buy work injury compensation insurance for eligible employees through designated insurers that comply with Ministry of Manpower (MOM) terms.

- Employers must pay all employees the Skills Development Levy (SDL), supporting workforce training and development. The levy is a percentage of the monthly wage.

- Employers must issue payslips along with salary or within three days of payment.

- Employers must keep employee payslip records for at least two years.

- Employers must comply with the Employment of Foreign Manpower Act (EFMA) when hiring foreign employees. Additional requirements apply.

Who is covered by the Singapore Employment Act?

Both local and foreign employees are covered by the Employment Act, as long as you are an employee working under a contract of service with an employer. Employees can be employed on a full-time, part-time, temporary and contract basis, and be paid hourly, daily, monthly, or by piece-rate.

Individuals employed as the following are not covered under the Employment Act:

- Seafarers;

- Domestic workers; and

- Statutory board employees or civil servants.

For those not covered by the Employment Act, the terms and conditions of their employment will be according to their employment contract instead.

Managers and executives with a basic monthly salary of more than $4,500 were previously not covered by the Employment Act. However, after amendments were made to the act in 2019, all employees in Singapore with the exception of the aforementioned, are covered for core provisions such as:

- Minimum days of annual leave;

- Paid public holidays and sick leave;

- Timely payment of salary; and

- Statutory protection against wrongful dismissal.

Employer obligations when hiring employees

1. Central Provident Fund (CPF) contributions

To hire a Singaporean or a Singapore permanent resident (PR) employee, you need to apply for a CPF Submission Number (CSN) to make CPF contributions as an employer.

It is a unique identifier that you will use to transact with the CPF Board, such as making CPF payments or making requests relating to employer matters. Each CSN consists of an Unique Entity Number (UEN) or NRIC/FIN (if you’re trading under your own name) and your CPF Payment Code.

You’re required to make two contributions to your employees’ CPF accounts every month:

- Employee’s contribution: deducted from their salary; and

- Employer’s contribution: a fixed percentage of the employee’s wage, provided on top of their existing salary.

If your employee is earning more than $750 per month, you’re permitted to deduct the employee’s share of mandatory CPF contributions from their wages. The CPF contribution rates are not fixed for everyone, but rather are dependent on an employee’s age, and their permanent resident status.

These are the existing CPF rates:

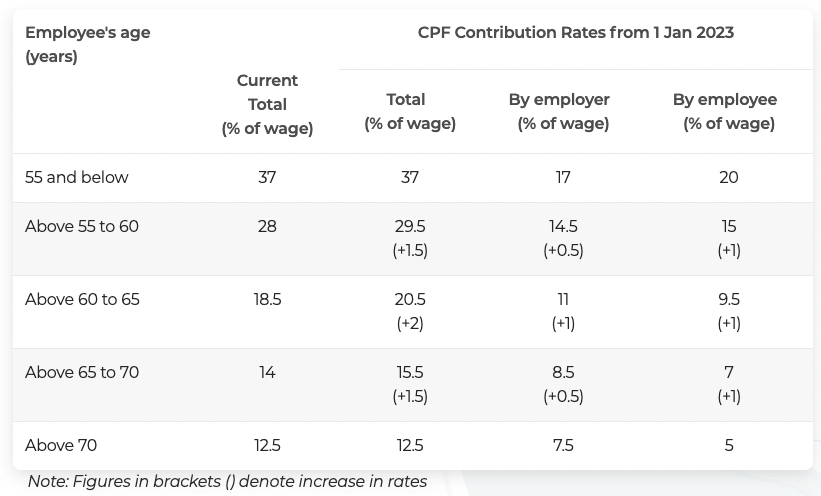

Take note however, that the CPF contribution rates for employees aged above 55 to 70 will be increased from 1 January 2023, to strengthen retirement adequacy. These will be the new rates:

The due date for CPF contributions is on the last day of the calendar month. Employers who fail to pay by the 14th of the following month (or the next working day if the 14th falls on a Saturday, Sunday, or public holiday) will face enforcement action, which includes late payment interest charged at 1.5% per month, commencing from the first day after the due date.

2. Ensure fair and anti-discriminatory hiring practices

To ensure fair hiring and employment practices, employers in Singapore must adhere to the requirements outlined in the Fair Consideration Framework (FCF) and the Tripartite Guidelines on Fair Employment Practices.

Singapore is a meritocratic society, and prides itself on ensuring that fair and merit-based employment practices are implemented. Employers must seek to recruit and select employees based on their skills, experience, or ability to perform the job, regardless of age, race, gender, religion, marital status, family responsibilities, or disability.

With such a diverse workforce in multiracial and multicultural Singapore, it’s important for employers to treat jobseekers fairly and with respect. This not only widens the pool of potential candidates, it also increases the chances of finding the right person for the role you’re hiring for. The selection criteria and recruitment process for each role should be consistent and made known to all applicants.

Employers are also actively encouraged to hire and develop Singaporeans as the core of their workforce, while foreigners play a valuable role in complementing the existing workforce.

The Ministry of Manpower (MOM) takes cases of discriminatory hiring practices seriously — it proactively identifies employers with indications of such practices and places them on a watchlist for closer scrutiny.

3. Create employment contracts compliant with the Employment Act

As an employer, you must have a written contract of service that defines the employer-employee relationship, including the terms and conditions of employment.

The contract must include key employment terms (KETs) and essential clauses, such as:

- Full name of employer and employee;

- Job title, main duties and responsibilities;

- Commencement date of employment;

- Duration of employment (if employee is on fixed term contract);

- Working arrangements such as daily hours of work, number of working days per week, rest days;

- Remuneration (salary period, basic salary or basic rate of pay for those paid by hour, day, or by piece);

- Fixed allowances/deductions;

- Overtime payment period and overtime rate of pay;

- Bonuses and incentives;

- Type of leave (annual leave, sick leave, hospitalisation leave, maternity leave, childcare leave);

- Insurance, medical benefits and dental benefits;

- Probation period (if any);

- Termination of contract, notice period; and

- Place of work (optional).

4. Purchase work injury compensation insurance

Employers are required to buy work injury compensation insurance for both local and foreign employees, if they are:

- Doing manual work, regardless of salary level; or

- Doing non-manual work and earning a salary of $2,600 or less a month, excluding any overtime payment, bonus payment, annual wage supplement, productivity incentive payment and any allowance.

If your employee doesn’t fall under any of the above categories, you have the flexibility to decide whether you want to purchase insurance for them. If your employees make a valid claim however, you will have to compensate them regardless of whether they are insured.

It’s also important to note that you must buy or renew your insurance policy from the list of designated insurers, and your policies must comply with MOM’s compulsory terms.

This helps to ensure that the policy coverage is adequate for any Work Injury Compensation Act (WICA) claims.

5. Skills Development Levy (SDL) contributions

In addition to CPF contributions, you will also have to pay a compulsory levy — the Skills Development Levy (SDL) for all your employees, regardless of whether they are Singapore citizens or foreign nationals. The CPF Board collects the SDL on behalf of the SkillsFuture Singapore Agency.

If you’re wondering what it’s used for, the SDL amount collected is actually channelled to the Skills Development Fund, which is used to support workforce upgrading programmes and provide training grants to you, when you send your employees for training under the National Continuing Education Training system.

The levy payable for each employee is 0.25% of their total monthly wage — the minimum payable is $2 for employees earning less than $800 a month, and the maximum payable is $11.25 for employees earning more than $4,500 a month. You can use the SDL calculator for easy calculations, or the auto-computation feature under CPF EZPay when you pay for SDL together with your CPF contributions.

6. Issue itemised payslips

It is compulsory for employers to issue itemised payslips to employees in Singapore if they are covered under the Employment Act. You must issue the payslips together with the payment of salary to your employee. If you are unable to issue both together, then you have to provide the payslip within 3 working days of the salary payment.

You are also legally required to provide the following details in the payslip:

- Employer’s full name;

- Employee’s full name;

- Start and end date of salary period;

- Date of payment;

- Mode of payment;

- Basic salary (for hourly, daily or piece-rate workers, indicate the basic rate of pay and the total number of hours or days worked or pieces produced);

- Total allowances with a breakdown shown;

- Any other additional payments with a breakdown shown;

- Fixed deductions (e.g. employee’s CPF contribution);

- Ad-hoc deductions (e.g. deductions for no-pay leave, absence from work);

- Overtime hours worked;

- Overtime pay;

- Start and end date of overtime payment period;

- Net salary paid in total; and

- Employer’s CPF contributions.

You’re also required to keep records of your current employee’s payslips for the last 2 years, and if they are former employees, you’ll have to keep the last 2 years of records for at least 1 year after their last day of employment.

Additional requirements for hiring foreign employees

1. Be compliant with the Employment of Foreign Manpower Act (EFMA)

Apart from areas such as salary, hours of work, overtime and rest days, public holidays, annual leave and sick leave for foreign employees which are covered by the Employment Act, the Employment of Foreign Manpower Act (EFMA) covers regulations of work passes and enforcement for any offences or infringements.

Work passes include the Employment Pass, S Pass and Work Permit — and the EFMA covers employers of foreign employees and any person issued a work pass by the Ministry of Manpower. It outlines the responsibilities employers need to fulfil relating to applications, medical insurance, levy, cancellation and repatriation.

2. Set up a work pass account to obtain a valid work visa for employees

To hire a foreign employee in Singapore, you need to first set up a work pass account, which allows you to do the following:

- Register for an Employment Pass Online account;

- Register for a Work Permit Online account;

- Declare your business activity (formerly known as industrial classification); and

- Check the status of your registration.

Under the Employment Act, all foreigners require a valid work visa to work in Singapore, and employers are required to apply for it on their behalf. This has to be completed before the employee can start work with the employer.

There are many different work passes available for foreigners, which are largely dependent on their skills, wages, and family ties. The three main types of work passes are the work permit, S Pass, or Employment Pass (EP), and you will have to assess which one your employee requires and fulfils the criteria needed, before applying for it online via your work pass account.

You should also take note of the changes made to the minimum qualifying salaries of EP and S Pass holders from Budget 2022.

3. Be compliant with the Fair Consideration Framework (FCF) for job advertisements

Before you can even apply for a valid EP or S Pass, you’re required to advertise the job opening on MyCareersFuture and consider all candidates fairly. The job posting must also be open for at least 28 consecutive days, to provide sufficient time for jobseekers to view and apply for the vacancy.

If you make any changes to the job posting (e.g. job title, salary or number of vacancies), you’re required to keep it open for at least another 28 consecutive days before you can submit the EP or S Pass application. This is to ensure that job seekers are aware of the changes, and continue having a chance to apply for the role.

Take note that if your job advertisements have expired or closed for more than 3 months, they cannot be used for EP or S Pass applications. You must advertise the job vacancy again, to reach out to other jobseekers.

There are exemptions however — if you meet any of the following requirements, you will not need to advertise your job availability on MyCareersFuture.

- Your company has fewer than 10 employees;

- The fixed monthly salary for the vacancy is $20,000 and above;

- The role is short-term, i.e. not more than 1 month;

- The role is to be filled by a local transferee, i.e. an existing employee from your company in Singapore transferring to another related branch, subsidiary, or affiliate in Singapore; or

- The role is to be filled by a candidate choosing to apply as an overseas intra-corporate transferee under the World Trade Organisation’s General Agreement on Trade in Services or an applicable Free Trade Agreement that Singapore is party to.

4. Foreign Worker Levy (FWL) & dependency ratio ceiling (DRC)

All companies in Singapore are required to pay foreign worker levy for their work permit and S Pass holders — this levy was introduced by the government to help regulate the number of foreign workers in the country.

The amount of FWL to be paid for each worker generally depends on the worker’s qualifications, the number of S Pass and work permit holders hired in the company, and the sector the employer belongs to.

Upgrading your workers to a higher skilled status also benefits your company, as you pay a lower levy. This is known as the higher-skilled worker levy, and the rates are different for each sector.

There’s also a dependency ratio ceiling or quota implemented in each company, which is the maximum ratio of foreign employees to the total workforce that a company in a given sector can employ. For example, if the quota for the manufacturing sector is 60%, then only 60% of a manufacturing company’s total workforce can comprise of S Pass and Work Permit holders. It won’t be applicable to you if you’re hiring your first employee, but for bigger companies, it is crucial to stick to the quota provided.

Other annual requirements for hiring employees

Reporting employee earnings (IR8A, IR8S)

As an employer, you are required to complete Form IR8A, Appendix 8A, Appendix 8B, and Form IR8S (where applicable) for all your employees who are employed in Singapore by 1st March every year.

Employers with less than 5 employees are also welcome to join the Auto Inclusion Scheme (AIS) under the Inland Revenue Authority of Singapore (IRAS) if they want to, but it is deemed compulsory for employers with more than 5 employees to participate in it.

It helps to simplify tax filing for your employees, because the income information submitted by employers will be automatically included in your employee’s tax returns. Plus, it helps to eliminate the use of hardcopy forms!

Tips to improve your hiring process

1. Consider hidden recruitment costs

Contrary to popular belief, recruiting isn’t as straightforward and simple as it seems. There are plenty of hidden recruitment costs you might not be aware of, and as a small to medium business owner, you’ll want to discover the most cost-effective ways to hire new people into your business.

Recruiting can be time-consuming and expensive when you’re stumbling your way through it — get hiring right the first time you do it, so you minimise any unnecessary costs.

2. List clear requirements in the job description

If you want to attract the best candidates for your role, you need to be nailing the job description down with as much accuracy as possible. A detailed and relevant job description should give the applicant the knowledge they need to undertake the rest of the recruitment process.

As mentioned previously, referencing the Fair Consideration Framework (FCF) and the Tripartite Guidelines on Fair Employment Practices is important when crafting your job description.

The job requirements should clearly state the required qualifications, knowledge, experience, and skills — but be careful to not mention any particularly specific attributes which may be considered discriminatory. Any phrases or words that indicate the exclusion of Singaporeans or preference towards non-Singaporeans are prohibited.

You should also be aware that you are not allowed to mention age as a requirement for the job, or even express a preference for ‘youthful workers’ — this is in support of national efforts to help boost employment opportunities for the older age groups. Language proficiency requirements also need to be justified with valid reasons.

If you’re completely lost on where to start, we have an ideal job ad template that’s free for you to download. It’s fully customisable to your business, and includes helpful tips on what to write and how to write it.

3.Accelerate your hiring process with an applicant tracking system (ATS)

An applicant tracking system (ATS) is an all-purpose software tool to solve your recruitment challenges. By accelerating the hiring process, it will become your new best friend in boosting your recruitment process.

A good ATS (like, say, Employment Hero’s) will be cloud-based and built into HR platforms, seamlessly integrated with major job boards for easy advertising. It can help you intelligently screen candidates, provide a single source of truth for easy visibility, and give you full control over each part of the recruitment process.

You’ll be able to move candidates more easily through the recruitment pipeline, and even digitally deliver policies, contracts, and training details! Needless to say, having an ATS cuts through all the tedious admin involved in hiring, making it a smooth hiring process that won’t leave you with a throbbing headache. You’ll gain precious time that can be focused on more strategic work for your business instead.

You can hire employees beyond Singapore borders too

Keen to expand your workforce even further and hire an international employee, instead of being limited by geographical boundaries?

Using an employer of record (EOR) service allows you to hire remotely based on skills and not location. Connect with the best talents legally and ethically so you can take your business to new heights.

What’s next in the hiring process?

Now that you’ve got all the information you need from this guide to hiring employees, and have successfully hired an employee, you’ll want them to have an awesome employee experience – especially during their first week at work! Here are some ideas to help guide you on how to structure and prepare for their onboarding process.

[list-item]

- Create an onboarding checklist.

- Greet them on their first day with a welcome pack.

- Pair them up with a buddy or mentor.

[/list-item]

Want more tips on how you can create a great employee onboarding process? Download our comprehensive guide to onboarding employees today.

Disclaimer: The information in this article is current as at 14 July 2022, and has been prepared by Employment Hero Pty Ltd (ABN 11 160 047 709) and its related bodies corporate (Employment Hero). The views expressed in this article are general information only, are provided in good faith to assist employers and their employees, and should not be relied on as professional advice. The information is based on data supplied by third parties. While such data is believed to be accurate, it has not been independently verified and no warranties are given that it is complete, accurate, up to date or fit for the purpose for which it is required. Employment Hero does not accept responsibility for any inaccuracy in such data and is not liable for any loss or damages arising either directly or indirectly as a result of reliance on, use of or inability to use any information provided in this article.You should undertake your own research and seek professional advice before making any decisions or relying on the information in this article.

Related Resources

-

Read more: Product Update: May 2025

Read more: Product Update: May 2025Product Update: May 2025

Follow our May 2025 product update as we share all of the latest and greatest features we’ve released over the…

-

Read more: Product Update: April 2025

Read more: Product Update: April 2025Product Update: April 2025

Follow our April 2025 product update as we share all of the latest and greatest features we’ve released over the…

-

Read more: Product Update: March 2025

Read more: Product Update: March 2025Product Update: March 2025

Follow our March 2025 product update as we share all of the latest and greatest features we’ve released over the…