Payroll built for Canada

Run payroll with confidence everywhere in Canada. From payroll taxes to RL-1 slips, we handle the details so you can focus on your people.

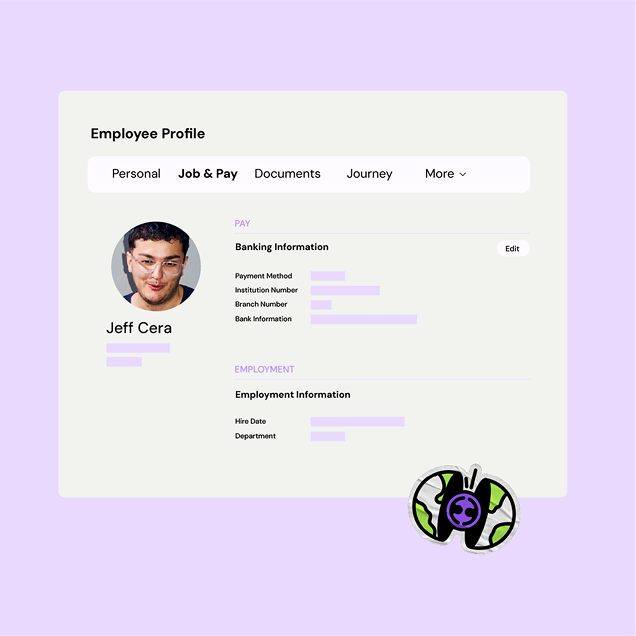

One login, zero hassle

HR and payroll work better together — manage everything from a single, secure platform.

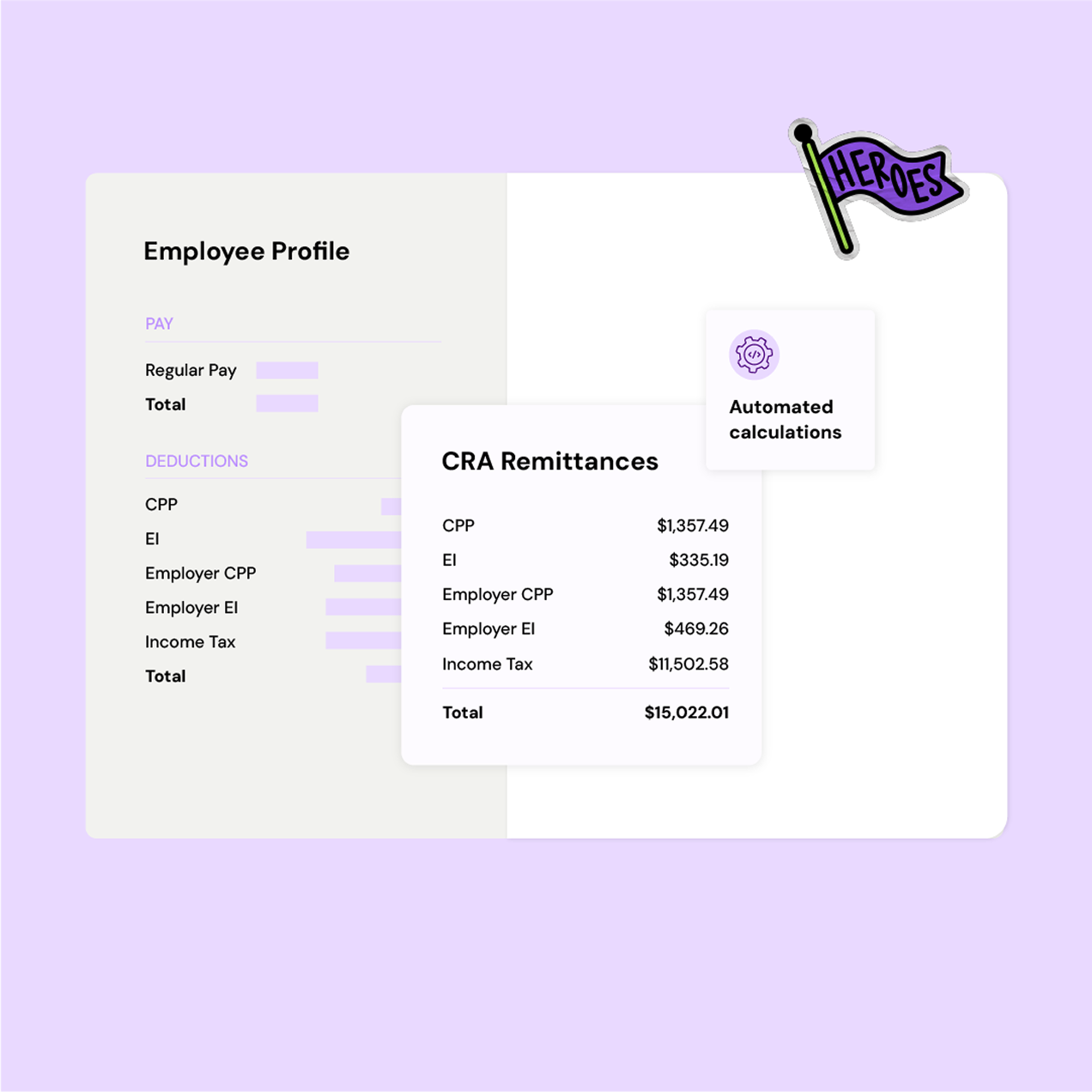

Accuracy on autopilot

With data flowing seamlessly across the system, calculations stay precise and paydays stay stress-free.

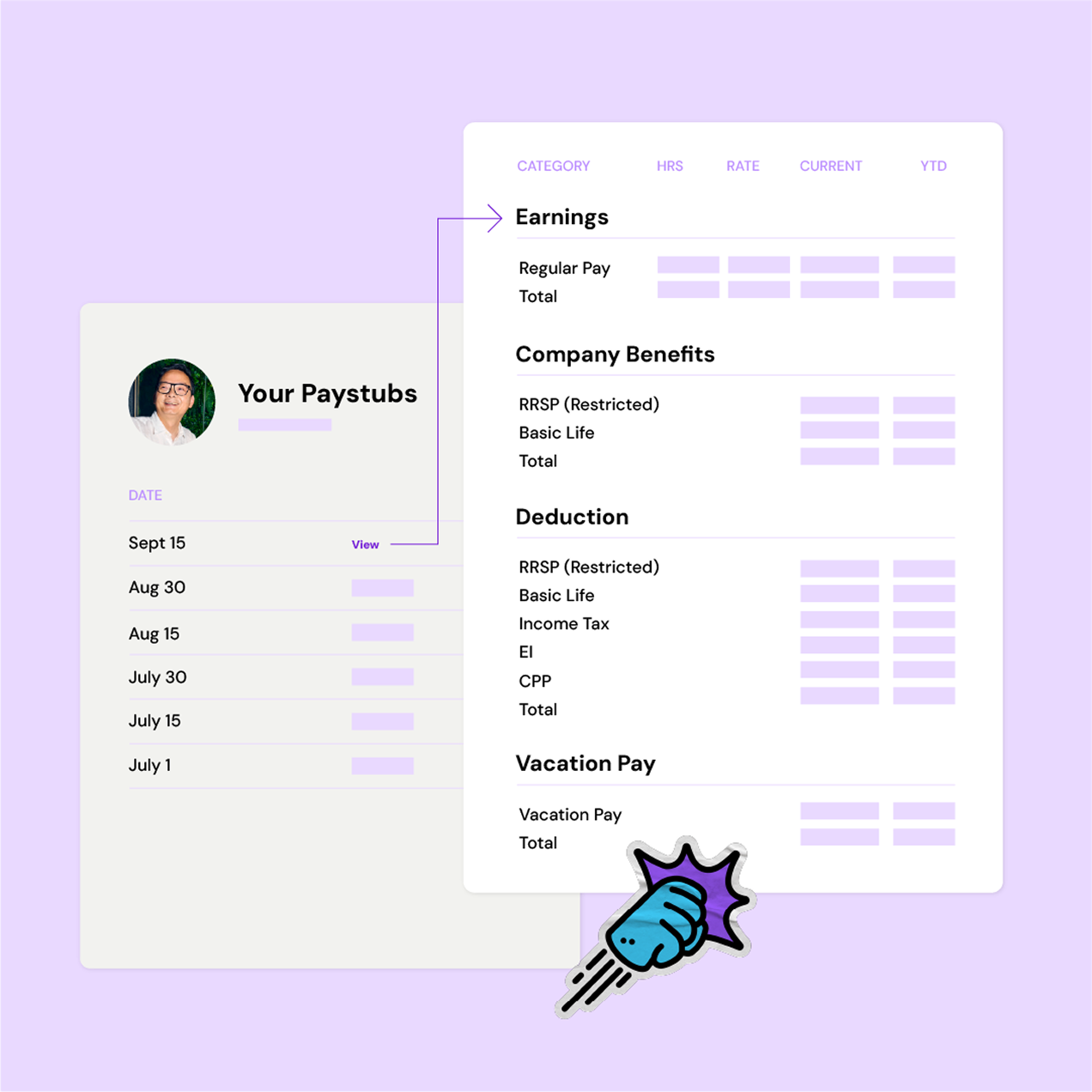

Transparent for employees

Employees get easy, transparent access to their pay information whenever they need it.

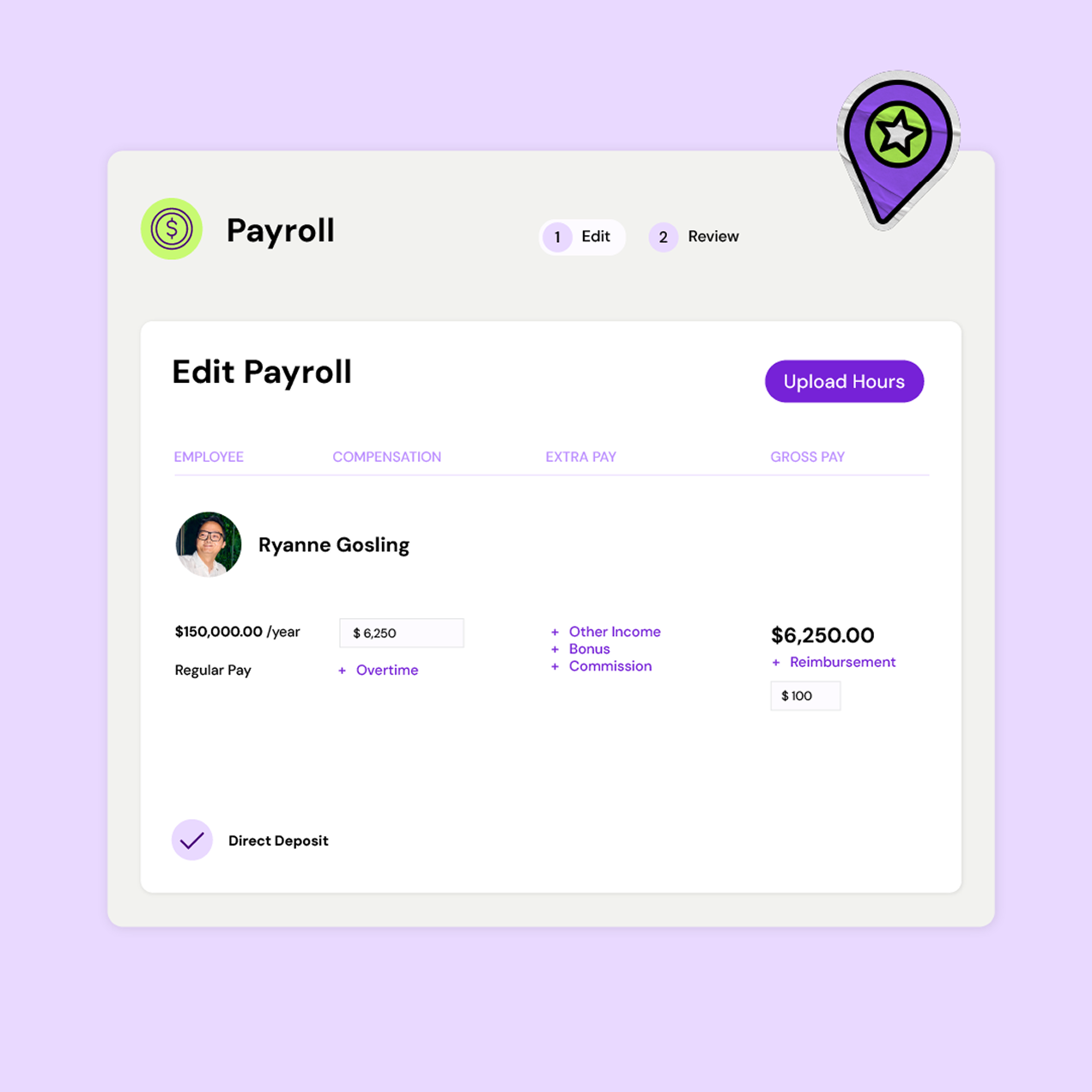

Time back in your day

Automate the busywork and spend more energy on the people and projects that matter most.

TRUSTED BY FORWARD THINKING COMPANIES

Payroll that speaks Canadian

Humi by Employment Hero’s payroll system is designed for Canadian businesses — coast to coast. From compliance to accuracy, everything you need is built right in.

Automatic CRA & RQ remittances

Stay compliant without the stress: remittances are handled accurately and on time.

T4 and RL-1 generation

Create year-end tax slips quickly and confidently, with built-in accuracy and compliance.

Multi-province calculations

Conquer regional differences from coast-to-coast with confidence.

Fully-compliant with Canadian regulations

Always up to date with federal and provincial payroll requirements, so your business never misses a step.

Real results from real Canadian businesses

Frequently Asked Questions

Everything you need to know about cutting-edge HR software

No, we offer a flat monthly rate. Run payroll as often as needed without extra fees.

We typically start with four business days and can reduce to three after a review period.

Not at all. Start with Core HR and Payroll, then add more modules as your needs evolve. We’re here to support your growth.

Payroll tools, tips, templates.

-

Read more: Canada’s Leading All-In-One HR, Payroll, and Benefits Solution Launches Business Insurance

Read more: Canada’s Leading All-In-One HR, Payroll, and Benefits Solution Launches Business InsuranceCanada’s Leading All-In-One HR, Payroll, and Benefits Solution Launches Business Insurance

Published Updated Contents TORONTO, March 4, 2021 – Humi, the Canadian leader for HR, payroll, and benefits software has announced its newest…

-

Read more: Calculating payroll deductions in Canada

Read more: Calculating payroll deductions in CanadaCalculating payroll deductions in Canada

What steps do Canadian employers need to take when processing payroll? Here is a guide to help you to calculate…

Ready to make payroll a breeze?

Solve the employment puzzle with just one click. Navigate every phase of the lifecycle and connect your team to outpace the competition.