Wage Theft in New Zealand – Factsheet

Published

Wage Theft in New Zealand – Factsheet

Published

Since April 2023, Parliament has debated whether intentionally underpaying an employee should be considered wage theft.

After several months of discussion, in March 2025, the Crimes (Theft by Employer) Amendment Act was officially enacted into law. The new law means employers may be subject to criminal penalties if they deliberately underpay staff.

Download the Wage Theft Factsheet to find out the details of the new law, what it means for you – and check whether your payroll processes are at risk.

What is the definition of wage theft?

Wage theft occurs when employers fail to pay employees their full legal entitlements. This can include unpaid wages, unpaid overtime, failure to provide holiday pay, and underpayment of minimum wage requirements.

Intentional versus unintentional breaches

An important factor to note is that the law relates to intentional underpayments, not unintentional mistakes or administrative errors. That means, for example, if an employer accidentally underpays an employee (and can prove that it was a mistake) it will not be subject to the Crimes Act.

However, the employer may still be subject to fines and other consequences through the Employment Relations Authority and the employment courts. Each case will be different, and for that reason it’s important you seek professional advice where necessary.

Higher penalties, including prison time for wage theft

The law introduces strict penalties for businesses found guilty of wage theft. The maximum (criminal) penalties for wage theft are below:

- If the employer is an individual, the maximum penalty is 1 year’s imprisonment, a fine of $5,000, or both.

- In any other case, the maximum penalty is a fine of $30,000.

Real world cases of wage underpayment

“[the respondents] incomplete and inconsistent approach to record-keeping undermined their ability to effectively enforce employment standards and placed employees at a disadvantage.”

That was the view of one Employment Relations Authority labour inspectorate, who enforced a $30,000 fine on a South Waikato dairy farmer for underpaying their employees, among other breaches of employment law.

Breaches like this have been dealt with by the Employment Relations Authority and employment courts for a long time. But under the Wage Theft Bill, may now result in additional criminal sanctions.

The Waikato farmer case is just one example of how wage underpayments can occur, and the massive impact they can have. But wage underpayment penalties don’t discriminate – whether you’re in agriculture, hospitality, retail or another industry, the cases below show just how easy it can be to end up in hot water.

Case 1: Kiwifruit company hit with $100K fine for underpaying workers

A labour supply company in the Bay of Plenty and its sole director was slapped with a $100,000 penalty after the Employment Relations Authority found they had underpaid three employees for years.

Case 2: Restaurant owner owes $40K in unpaid wages

A restaurant owner in Taupō learned the hard way that wage arrears don’t just disappear when a business closes. Despite the restaurant being liquidated, the sole director was still ordered to pay a former employee over $40,000 in unpaid wages.

Case 3: Dairy owners penalised $16K

A dairy in Piopio, along with its owners, faced $16,000 in penalties after the Employment Relations Authority found 21 breaches of minimum employment standards, many of which affected migrant workers.

These cases make one thing clear – the consequences for underpaying or failing to pay employees comes with serious consequences for Kiwi businesses.

Read more: Employee wellbeing in the agriculture industry

Are your payroll processes at risk?

The thing is, most employers have the right intentions when it comes to paying employees – and yet, mistakes can happen. That’s especially true if you’re manually calculating wages and salary, and running day to day operations at the same time.

So, how can you check whether your payroll processes are up to scratch, and what steps should you take to address any risks?

You’ll find a super handy self-assessment tool in our factsheet – plus key steps to get your payroll processes on track.

Compliance stealing all your time? Employment Hero has you covered.

We know laws like this can make it feel like you’re navigating a minefield. That’s why we designed the Employment Operating System – an all in one system to manage all things employment for Kiwi SMEs.

With an Employment Operating System, everything employment is covered: intelligent payroll software, time and attendance, leave management, performance reviews, recruitment and so much more. The Employment Operating System even includes an on-demand HR Advisory service so you can get practical advice when you need it.

If you’re ready to take control of all things employment, talk to one of our specialists today.

Disclaimer: The information in this article is current as at 24 February 2025, and has been prepared by Employment Hero Pty Ltd (ABN 11 160 047 709) and its related bodies corporate (Employment Hero). The views expressed in this article are general information only, are provided in good faith to assist employers and their employees, and should not be relied on as professional advice. The Information is based on data supplied by third parties. While such data is believed to be accurate, it has not been independently verified and no warranties are given that it is complete, accurate, up to date or fit for the purpose for which it is required. Employment Hero does not accept responsibility for any inaccuracy in such data and is not liable for any loss or damages arising either directly or indirectly as a result of reliance on, use of or inability to use any information provided in this article. You should undertake your own research and to seek professional advice before making any decisions or relying on the information in this article.

Register for the factsheet

Related Resources

-

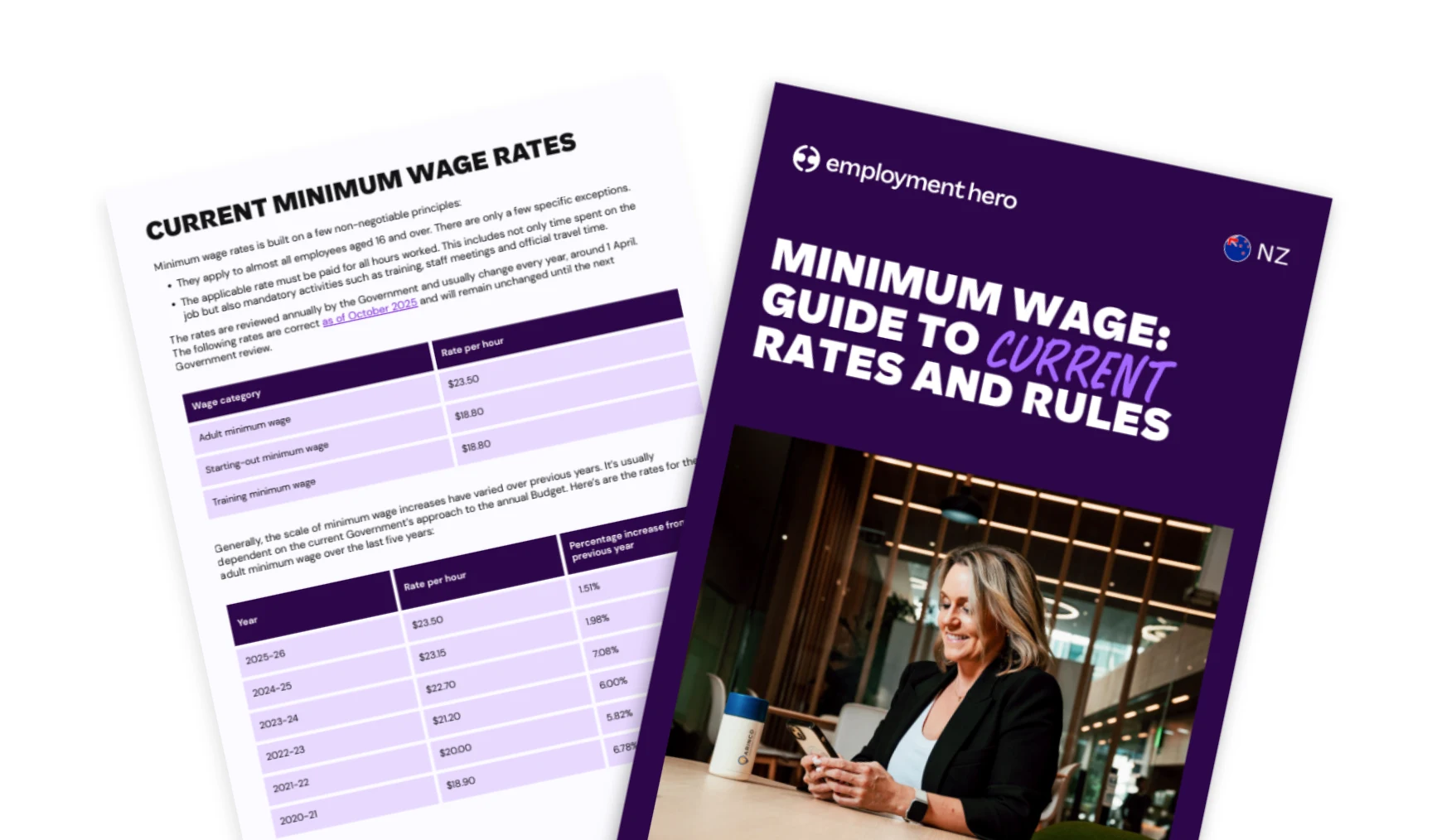

Read more: Minimum wage: Guide for New Zealand employers and payroll teams

Read more: Minimum wage: Guide for New Zealand employers and payroll teamsMinimum wage: Guide for New Zealand employers and payroll teams

Understand NZ’s minimum wage rates, training wage rules, and 2025 updates. Learn how Employment Hero NZ automates wage compliance.