Key dates for small businesses in 2024 [Malaysia]

Published

Key dates for small businesses in 2024 [Malaysia]

Planning ahead is one of the most important parts of running a business. And as the year draws to a close, it’s best to get a headstart on your 2024 plans by first identifying the most important dates for your business.

As a small business owner or HR professional in Malaysia, you are constantly working on different tasks and projects, which can make it hard to keep track of key upcoming dates when you already have a long list of priorities.

We want to see Malaysian businesses grow and thrive. Ever heard of the saying, “when you fail to plan, you plan to fail”? As a small business, it’s imperative for you to gear up for the busy seasons and be prepared with the resources you need to achieve your best sales yet.

We’re here to help make things easier for you, so you can focus more on strategic plans for 2024. That’s why we’ve put together this comprehensive list of important dates for your business, so go ahead — download it, bookmark it, or print it out — whichever you prefer for easy reference when needed.

In this downloadable calendar, we cover:

- Tax return dates

- Dates of upcoming legislation changes

- Dates with increased consumer spending

- Public holiday dates

- School holiday dates

- Other important dates small business owners should know

Tax return dates in 2024

The Return Form (RF) Filing Programme dates for 2024 have not been released by the Inland Revenue Board of Malaysia (IRBM/LHDN) yet. Stay tuned.

Self-assessment tax return deadlines

30th April 2024: Form BE, the individual income tax return form, must be submitted to the LHDN. The e-filing deadline is estimated to be 2 weeks later, on 15th May 2024.

30th June 2024: Form B, the income tax return form for individuals with a business income, must be submitted to the LHDN. The e-filing deadline is estimated to be 2 weeks later, on 15th July 2024.

Corporate tax filing deadlines

29th February 2024: Form EA must be submitted to your employees by 28th February 2023, following the end of financial year (31st December 2022). This is their individual statement of remuneration from the financial year, and allows them to put together their individual tax returns. It does not need to be submitted to LHDN.

29th February 2024: Form PCB2 is a letter confirming that the employer has made all of the tax withholdings for a given period. This form is to be given to employees, who will submit it to LHDN.

29th February 2024: Form CP58, a commission statement, must be submitted to agents, dealers and distributors from companies.

31st March 2024: Form E must be submitted to LHDN by 31st March 2024 following the end of financial year. This is a statement of payments made to a business’ employees, plus MTD/PCB deductions from the year. The e-filing deadline for this form is usually one month later, on 30th April 2024.

30th June 2024: Form P, the income tax return form for partnerships, must be submitted to the LHDN. The e-filing deadline is estimated to be 2 weeks later, on 15th July 2024.

Depending on the dates of your company’s financial year, Form C, the income tax return form for companies, and Form PT, the income tax return form for LLPs, will need to be submitted to the LHDN 7 months after the financial year end. The e-filing deadline is estimated to be one month later, 8 months after the financial year end.

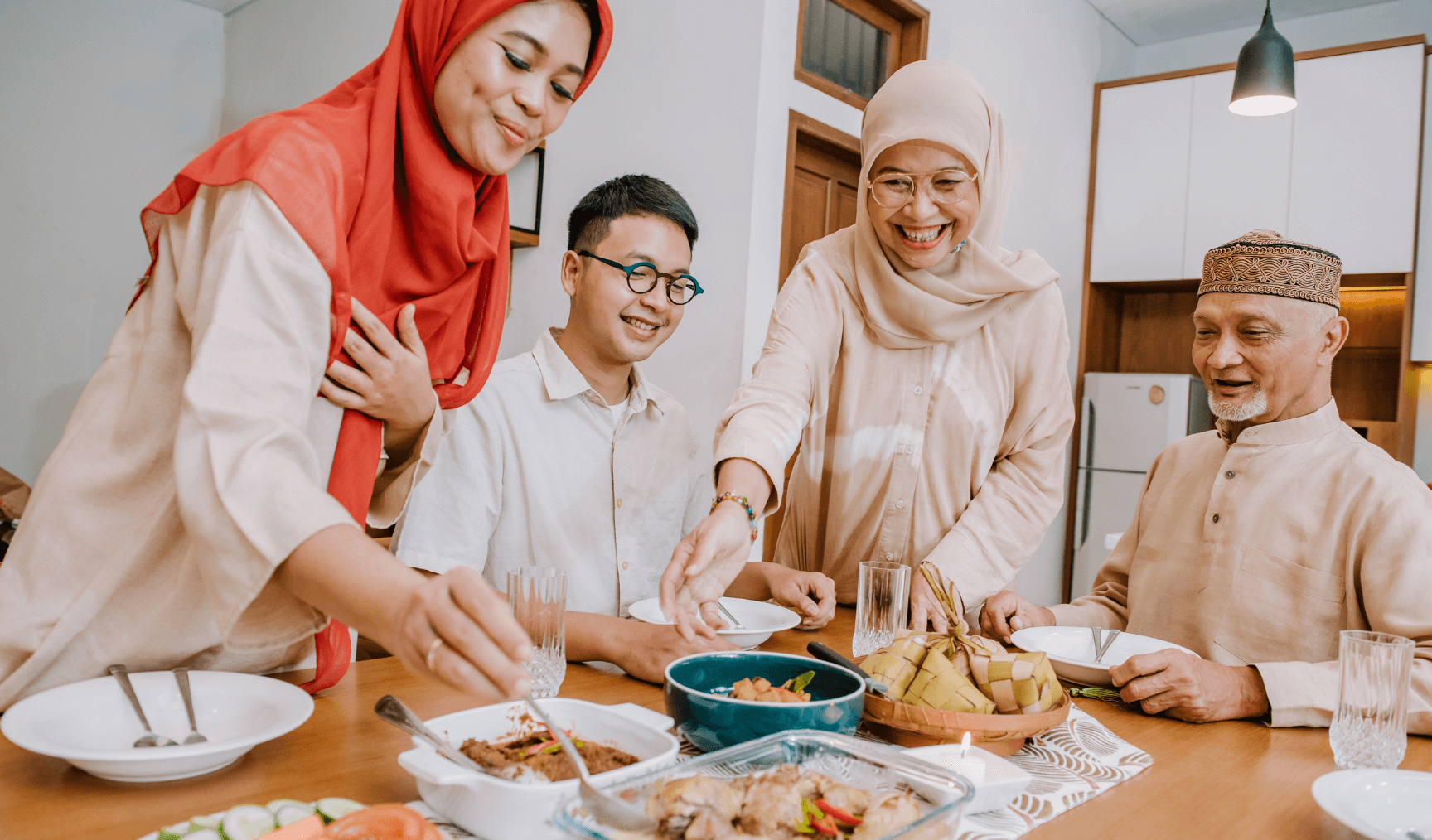

Dates with increased consumer spending

January: Chinese New Year sales

April to May: Ramadan/Hari Raya sales

August: Hari Merdeka sales

November: Singles Day, Black Friday, and Cyber Monday sales

December: Christmas sales

Double digit sale days have also been trending — for example 9.9, 10.10, 11.11, 12.12 and more.

Public holiday dates in Malaysia

For a complete list of public holidays across all states in Malaysia, refer to our handy factsheet here.

School holiday dates in Malaysia

The Malaysia Ministry of Education (KPM) recently confirmed the 2024/2025 school term dates. Malaysian states are split into two groups — group A and group B, which start the school term one day apart respectively.

Group A comprises of Johor, Kedah, Kelantan and Terengganu while Group B comprises Melaka, Negeri Sembilan, Pahang, Perak, Perlis, Penang, Sabah, Sarawak, Selangor, Kuala Lumpur, Labuan and Putrajaya.

These are the holiday dates for each respective group.

| Group A | Holiday starts | Holiday ends |

| Term 1 holidays | 13 March 2024 | 21 March 2024 |

| Mid Year holidays | 22 May 2024 | 6 June 2024 |

| Term 2 holidays | 24 July 2024 | 1 Aug 2024 |

| End of year holidays | 20 Nov 2024 | 31 Dec 2024 |

| Group B | Holiday starts | Holiday ends |

| Term 1 holidays | 14 March 2024 | 22 March 2024 |

| Mid Year holidays | 23 May 2024 | 7 June 2024 |

| Term 2 holidays | 25 July 2024 | 2 August 2024 |

| End of year holidays | 21 November 2024 | 31 December 2024 |

Other important dates small business owners should know

These dates are notable international days, observances and events that can be relevant to your business.

14th February 2024: Valentine’s Day

8th March 2024: International Women’s Day

10th March to 9th April 2024: Ramadan

1st April 2024: April Fool’s Day

22nd April 2024: Earth Day

12th May 2024: Mother’s Day

16th June 2023: Father’s Day

27th June 2024: Micro, Small and Medium Enterprises Day

17th September 2024: Mid-Autumn Festival

10th October 2024: World Mental Health Day

31st October 2024: Halloween

24th December 2024: Christmas Eve

31st December 2024: New Year’s Eve

Download our small business key dates poster

Running a small business is no easy feat. There are so many important dates to remember throughout the year!

When it comes to public holidays and leave management, working out accurate leave entitlements and pay rates can be challenging. That’s where Employment Hero payroll can help — our system automatically includes all Malaysian public holidays and factors that into any calculations. It’s an important way to support compliance in the long term.

Understanding the critical dates on the tax calendar and having access to an automated payroll system helps make managing your small business easier. Not to mention the fact that tax reporting to LHDN is also so much easier and fuss-free with automated software — it provides compliance confidence whilst reducing the chances of human error.

Looking for more helpful resources? Check out our guide to payroll in Malaysia.

The smarter way to manage your payroll, people and productivity. For Malaysian small and medium businesses on the up.

Related Resources

-

Read more: 10 point HR and payroll compliance checklist

Read more: 10 point HR and payroll compliance checklist10 point HR and payroll compliance checklist

Get peace of mind with our 10 point HR and payroll compliance checklist.

-

Read more: Business Owner’s Guide to Applying for the HRD Corp Grant

Read more: Business Owner’s Guide to Applying for the HRD Corp GrantBusiness Owner’s Guide to Applying for the HRD Corp Grant

Find out if you are eligible for the HRD Corp Grant and how to apply for it here.