UPDATE: Since this article was published, the ATO has announced that mandatory STP Phase 2 reporting will commence from 1 January 2022—six months extension from the previously proposed 1 July 2021 start date. The article has been updated to reflect these changes. Who could forget the initial rollout of single touch payroll (STP)? For those not using Employment Hero Payroll, another phase of STP reporting requirements may trigger some unpleasant memories. But there’s no need to panic. As long as you’re using the right payroll platform, Phase 2 reporting won’t look too different from your current STP reporting.

What will STP Phase 2 achieve?

The aim of STP Phase 2 is to reduce the reporting burden for employers who are required to submit information about their employees to multiple government agencies.

Why do we need STP Phase 2?

STP Phase 1 gave the ATO better visibility over how and what businesses paid their employees. By requiring businesses to report their employees’ salary and tax data every time they ran payroll, the data was more likely to be accurate (instead of once a year at EOFY time).

In order to make this transition as easy as possible, more complex aspects of payroll weren’t included in the initial phase and therefore needed to be reported manually. Now that everyone’s made the switch, it’s time to start capturing this data in STP.

What are the benefits of STP Phase 2?

- STP Phase 2 can reduce the number of duplicate information employers provide to the Government.

- It removes the need to send the tax file number declaration to the ATO. When STP Phase 2 comes into effect, this information will be captured within the STP pay event, which means you have met the obligations to send the TFND details to the ATO.

- It allows the components that make up gross income to be better defined. This makes it easier for businesses to understand their employer obligations, whilst ensuring consistency of reporting across different income types. It also aligns with requirements set out by Services Australia should different government agencies treat gross payments differently.

- Employee payments can now be reported by income type or streams, such as salary and wages, foreign employment income, closely-held payees or working holiday maker. Please note: these changes to backend data will be configured by your payroll provider.

Source: ATO.gov.au

What’s not changing in STP Phase 2?

From 1 January 2022, you’ll have to report the additional data points above. However, there are many things that aren’t changing including:

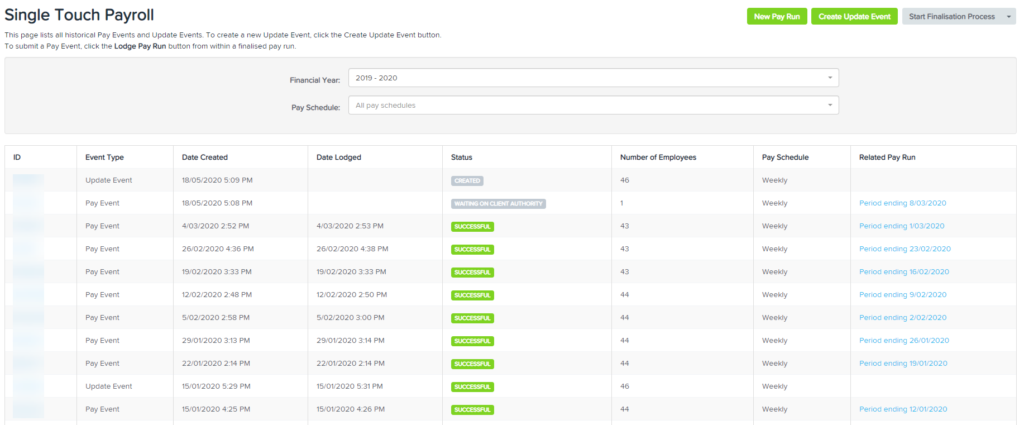

- The way you submit your STP report

- Your STP report’s due date. They are still due either on or before your payday unless you qualify for a reporting concession

- The types of payments for STP reporting

- Tax and super obligations

- End of year finalisation requirements

Guide to Payroll in Australia

What additional data points do we have to provide?

Below are the new data points that need to be included, along with a brief summary of how including these data points in STP will affect your existing processes:

1. Termination reason

You will no longer need to issue an employment separation certificate.

2. Child support garnishee/deduction amount

Payroll admins can choose to deduct these amounts via pay events, to reduce the need to submit a separate deduction report to the relevant child support agency on a monthly basis.

3. Income stream collection

Employers will now need to specify the type of payment made to an employee under a new field called income stream collection (e.g income type, payment type and/or country code).

4. Tax file number declaration

No more tax file number declarations (or updates). This data will be included in STP reporting instead. If an employee’s tax situation has changed, the ATO will be able to identify this from their TFN details (reported via STP).

5. Tax treatment codes

In your STP-compliant payroll software, like Employment Hero Payroll, you will need to apply tax treatment codes to explain how the PAYG withholding amount was determined (read: you don’t have to do anything differently).

6. Lump sum E letters

Employers will no longer be required to provide lump sum E letters.

7. Transitioning employees from another payroll system

The ATO will be able to link the BMS ID/payee ID from a previous payroll platform to the BMS ID/payee ID generated by a new payroll platform.

8. Paid leave*

Paid leave will now need to be assigned a specific leave type code (i.e paid parental leave would have a different code to annual leave).

9. Negative YTD reporting

The ATO will allow negative YTD amounts to be submitted in the STP report.

10. New allowance items*

To help employees complete their own individual income tax returns, additional allowance codes will be available to choose from in pay events.

* Please note: New allowance items and paid leave falls under the Disaggregation of gross. This requires different components that make up the gross amount to be itemised separately (including paid leave and different allowances).

11. Salary Sacrifice

From 1 January 2020, salary sacrifice contributions can no longer be used to reduce ordinary time earnings or count towards your minimum superannuation obligations. You will need to report salary sacrificed amounts in your STP report from Phase 2.

When can we start including Phase 2 data in our pay events?

STP Phase 2 reporting will be mandatory for all businesses from 1 January 2022. As one of the first payroll platforms to be certified by the ATO as STP-compliant, you can rest assured that Employment Hero Payroll will be ready. We’ll let you know more as these features are released.

Not using Employment Hero Payroll?

How well did your payroll platform manage the initial rollout of STP Phase 1? If you’re having heart palpitations just thinking about it, let’s talk. If you’re not an existing customer, get in touch with one of our small business specialists who can help.

You’ll want to get up and running ASAP to save yourself the stress of not being ready come 1 January 2022.

Want more?

The essential guide to HR compliance