Is your organisation on the list of businesses being affected by the spread of COVID-19?

How do you use this unpaid leave employee agreement template?

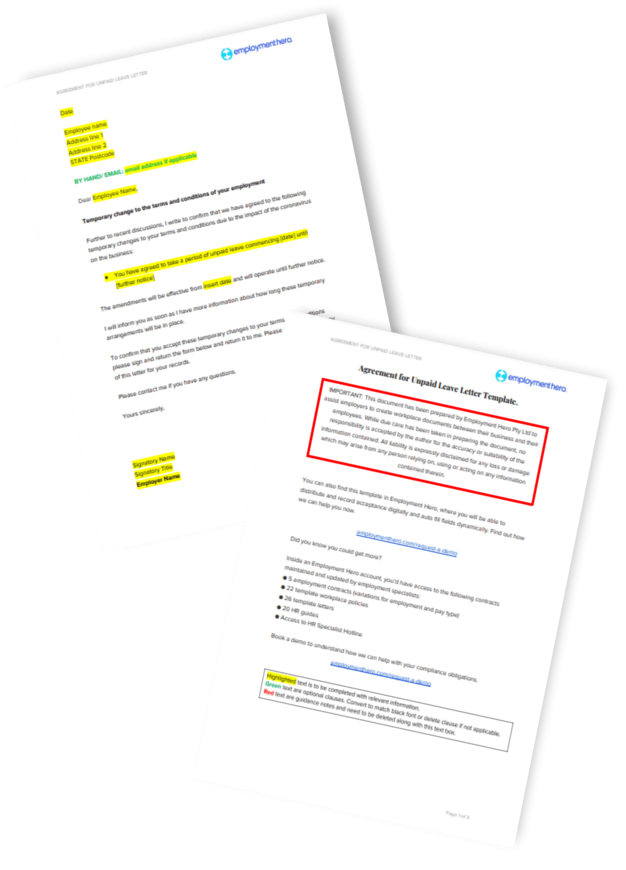

If you find yourself in a position where you need to ask employees to take a leave of absence, unpaid leave, or an employee wants to stay at home to self-isolate and cannot work remotely, this template, written and approved by Employment Law experts is fully customisable to your businesses situation.

Download this free Unpaid Leave Employee Agreement Template now.

Stay safe!

COVID-19: What are your employees’ rights to leave and pay?

With everything going on, it’s normal to feel unsure about what your obligations are as an employer. This is especially applicable to handing employees rights to leave and pay in these unsettling times.

Many of our clients have been asking for clarification and support on this topic, so we’ve worked with our sister company, EI Legal to bring you this handy guide relating to your employees’ rights to leave and pay.

This article will cover:

- Sick leave

- Pandemic Leave Disaster Payment

- Leave without pay (LWOP)

- Ordinary pay

- Special leave

- Stand down (no pay)

- Redundancy

If you’re looking at getting your team set up for remote working, download the COVID-19 employer response pack here.

Disclaimer: All information is intended for general use only and is current as of 31 August 2020.

When does sick leave (personal/carers leave) apply?

According to FairWork, Sick and carer’s leave (also known as personal leave or personal/carer’s leave) allows an employee to take time off work to help them deal with personal illness, caring responsibilities or family emergencies.

An employer can offer annual leave or unpaid leave (or long service leave (LSL) if applicable) if the employee has not accrued any paid sick leave (personal/carers leave).

Situations where sick leave might apply; if an employee:

- tests positive for COVID-19

- is in Government directed OR optional self-isolation and is sick

- is sick with any illness or injury

- has to care for or support a member of their immediate family or household who is sick, injured or has an unexpected emergency including, but not limited to:

- any illness

- COVID-19

- school closure due to COVID-19

- Government-directed isolation of child/dependant due to COVID-19 (NB does not include general coverage for own Government directed isolation. This leave is offered for the unexpected care required for the child, not for the isolation itself – see below)

When does Pandemic Leave Disaster Payment apply?

In response to the COVID-19 pandemic, the Australian Government has introduced a special Pandemic Leave Disaster Payment for some workers during coronavirus. This payment is available to eligible workers who don’t have paid sick leave and who live in Victoria or Tasmania.

For more information about the payment and how to claim it, you can visit Services Australia.

Some states and territories have similar schemes (QLD, SA and ACT) that don’t fall under the federal government, you can find more information on your state or territory government website.

When does leave without pay (LWOP) apply?

First let’s clarify: what is leave without pay?

Leave without pay (LWOP), or unpaid leave is an absence from employment that is authorised or approved by an employer. It’s sometimes called a leave of absence.

It is rare for LWOP to be covered under a modern award or an enterprise agreement, and is not a statutory entitlement in Australia.

Can I take leave without pay?

It is usually granted at the discretion of the employer. An employer can offer annual leave (or LSL if applicable) if the employee requests this and has an adequate annual leave balance.

Situations where leave without pay might apply; if an employee:

- is in Government directed OR optional self-isolation and is not sick (i.e. has returned from overseas and feels well) *

- has come in to contact with a known case of COVID-19 and is in Government directed OR optional self-isolation and is not sick

- has come in to contact with a suspected case of COVID-19 and is in Government directed OR optional self-isolation and is not sick

- is stuck overseas (on a cruise ship etc) due to COVID-19

Note: Casual employees are not entitled to paid sick (personal/carer’s) leave. A casual employee who has to self-isolate or has contracted COVID-19 must not attend the workplace without additional payments.

If you’re an employer and find yourself in a position where you need to ask your employees to take an unpaid leave of absence, or an employee wants to self-isolate and cannot work remotely, you can download our free Unpaid Leave Employee Agreement Template.

This template has been written and approved by Employment Law experts and is fully customisable to your business situation.

When does ordinary pay apply?

Ordinary pay is as the name suggests. Ordinary pay usually applies to normal hours worked during the normal span of working hours prescribed. Ordinary pay is usually required if an employee:

- is requested to not come to work/isolate which is not in line with Government direction

- is working from home (and the employer has approved this)

- is getting an assessment for fitness for work under the direction of the employer. Following the assessment, leave and pay entitlements will revert back to normal as per this guide.

And, if an employer:

- requests an employee to not come to work/isolate, not in line with Government direction

- closes the business/office/location using discretion (not Government directed) as an added precaution but the employee’s role does not allow for working from home (i.e. works in a café, cleaner, factory worker, manual labour, mechanic etc).

- closes business temporarily due to a downturn in work/business (refer to redundancy if this is a prolonged situation).

When does special leave apply?

Special leave is an arrangement granted to an employee who needs to be absent from work during working hours which does not come under other types of leave.

For instance, it might be worth considering setting up a new leave type for COVID-19, paid and/or unpaid for those affected. The University of Queensland has a good example of this in action.

The Government may need to offer special paid leave (over and above annual leave and/or sick leave) for this pandemic. This could be delivered at a later date as part of a stimulus package for businesses.

Read more on stimulus packages offered for small businesses:

When does stand down (no pay) apply?

An employer may stand down an employee during a period in which the employee cannot usefully be employed because of a number of circumstances including:

- industrial action (other than industrial action organised or engaged in by the employer).

- a breakdown of machinery or equipment if the employer cannot reasonably be held responsible for the breakdown.

- a stoppage of work for any cause for which the employer cannot reasonably be held responsible.

- A government-issued directive for closure (not at the discretion of the business). Seek further advice before actioning.

In terms of rights to leave and pay, if an employer stands down an employee during a period in accordance with the Fair Work Act, then the employer is not required to make payments to the employee for that period. For more information please reach out to our partners at Employment Innovations.

Generally, an employer would not be able to “stand down” an employee without pay just because there was a downturn in business caused by COVID-19.

However if the Government ordered a business not to open (and the employees could not be given any other meaningful work), this might well give rise to a right to stand down.

When does redundancy apply?

No one likes to hear the word ‘redundancy’. Unfortunately, you should be prepared in the unfortunate event you need to enact this.

What is it? Redundancy is a form of employment termination, but rather than being a fault-based dismissal, redundancy is usually caused by factors such as economic conditions, business efficiency, or technological development.

To make an employee’s role redundant, the employer believes that their role and duties should no longer exist within the company. When an employee’s job is made redundant their employer may have to give them redundancy pay, also known as severance pay.

Generally, businesses with less than 15 employees do not have to pay redundancy (unless a modern award, enterprise agreement or contract of employment has more generous terms).

When might redundancy apply:

- A significant downturn in work

- When a role and its duties are no longer appropriate or needed within a business

For COVID-19: Due to the impact of COVID-19, we’d advise you openly discuss ways to mitigate redundancy if possible. Consider talking with staff and seeking expressions of interest from employees who might agree to temporarily reduce hours, take annual leave or leave without pay where possible.

Unfortunately, for many businesses, we know this is not possible. If this is the case for you, then begin consultation for redundancies.

Guidance on the process to follow when considering redundancies can be found here.

A few extra tips on how to support employees

We encourage businesses to continue to support their employees by:

- Providing remote and flexible working arrangements if possible

- Paying employees even if no leave type is applicable if possible

- Sharing the following resource from Headspace or providing your employees with an EAP (What is an EAP?)

- Communicating regularly and checking in with employees

Disclaimer: The information provided in this knowledge base article is general in nature and is not intended to substitute for professional advice. If you are unsure about how this information applies to your specific situation, we recommend you contact Employment Innovations for further advice.

Download our template now.